artiemedvedev

A Quick Take On Greenidge Generation Holdings

Greenidge Generation (NASDAQ:GREE) reported its Q2 2022 financial results on Aug. 15, 2022 and more recently published preliminary Q3 2022 results.

The company operates a power plant and has related data center operations in New York and South Carolina.

Until we learn more about the future direction of the company under new senior management and begin to see improvement in its financial results, I’m on Hold for GREE.

Greenidge Overview

Connecticut-based Greenidge was founded to develop a vertically-integrated Bitcoin mining and power generation company.

The firm is headed by Chief Executive Officer David Anderson, who joined the firm in October 2022 and previously was president and CEO of Millar Western Forest Products, an integrated forest products commodity company in Canada.

The company seeks to use low-carbon or zero-carbon energy sources to power its Bitcoin mining facilities.

GREE owns and operates a 106 megawatt power generating facility in Dresden, New York, which originally was a coal-fired plant and has since been converted to a natural gas-burning energy plant.

The plant provides energy to neighboring communities as well as to the company’s data center hosting Bitcoin mining operations.

The company also is building out its computing center at Spartanburg, South Carolina, and has plans to “develop at least 1.5 exahash of mining capacity, powered by 50 megawatts of mining and infrastructure by the first quarter of 2023.”

Greenidge’s Market and Competition

The global market for Bitcoin mining is currently in significant flux with the recent bans on mining in China having caused a large amount of that country’s hashpower to exit the network while those operators look for more suitable locations.

Manay mining concerns have relocated to the United States due to its largely predictable regulatory and legal environment and pro-business approaches in a number of states.

The market value for mining depends on the price of Bitcoin since the majority of value going to the miner is a function of the current Bitcoin reward rate of 6.25 Bitcoin per successfully mined block.

At a price of $20,000 per Bitcoin, the annual mining rewards for the entire industry would be approximately $6.6 billion.

Major industry participants include:

-

Bitfarms

-

Argo Blockchain

-

DMG Blockchain

-

Hive Blockchain

-

Hut 8 Mining

-

HashChain Technology

-

DPW Holdings

-

Layer1 Technologies

-

Riot Blockchain

-

Marathon Patent Corp.

-

Others

Greenidge’s Recent Financial Performance

-

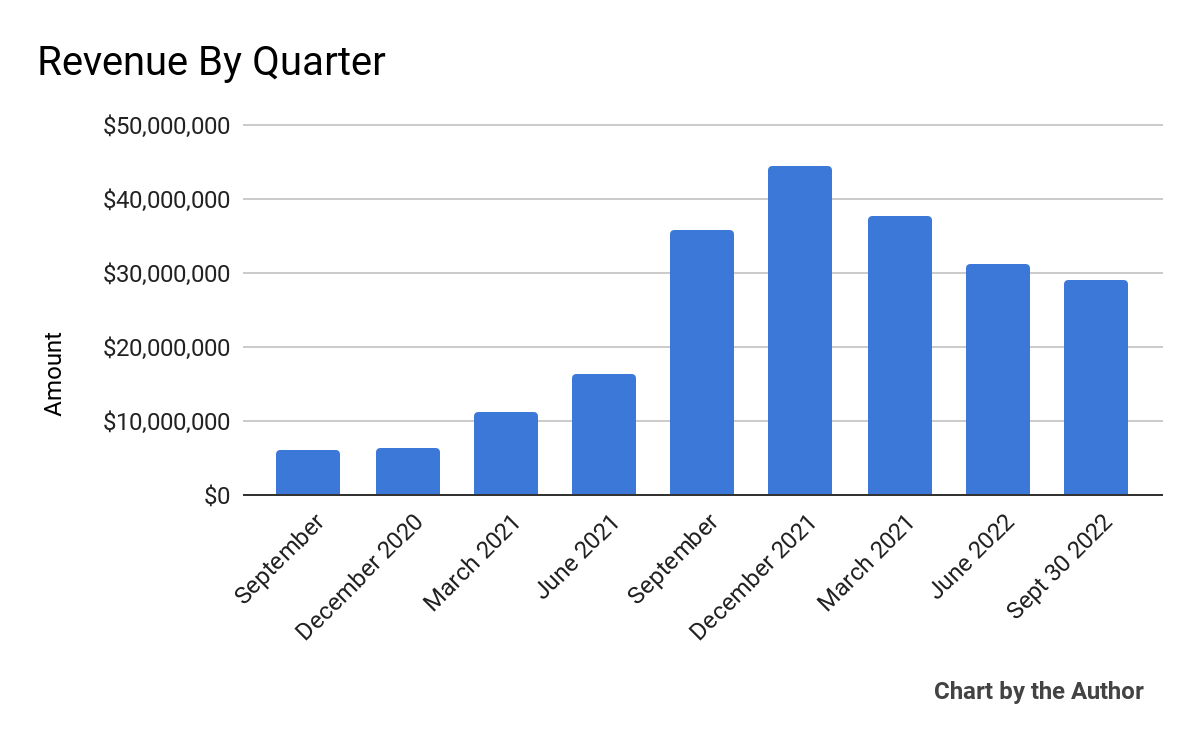

Total revenue by quarter has followed the trajectory shown below:

9 Quarter Total Revenue (Seeking Alpha)

-

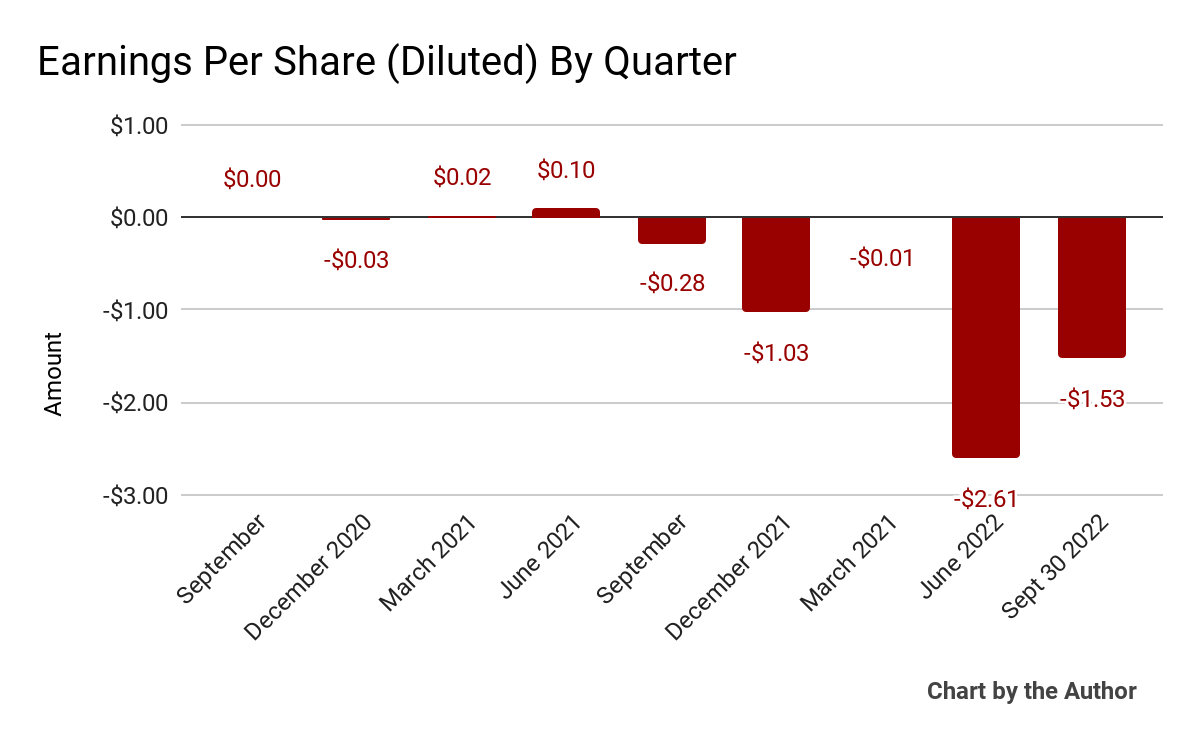

Earnings per share (diluted) have worsened dramatically in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

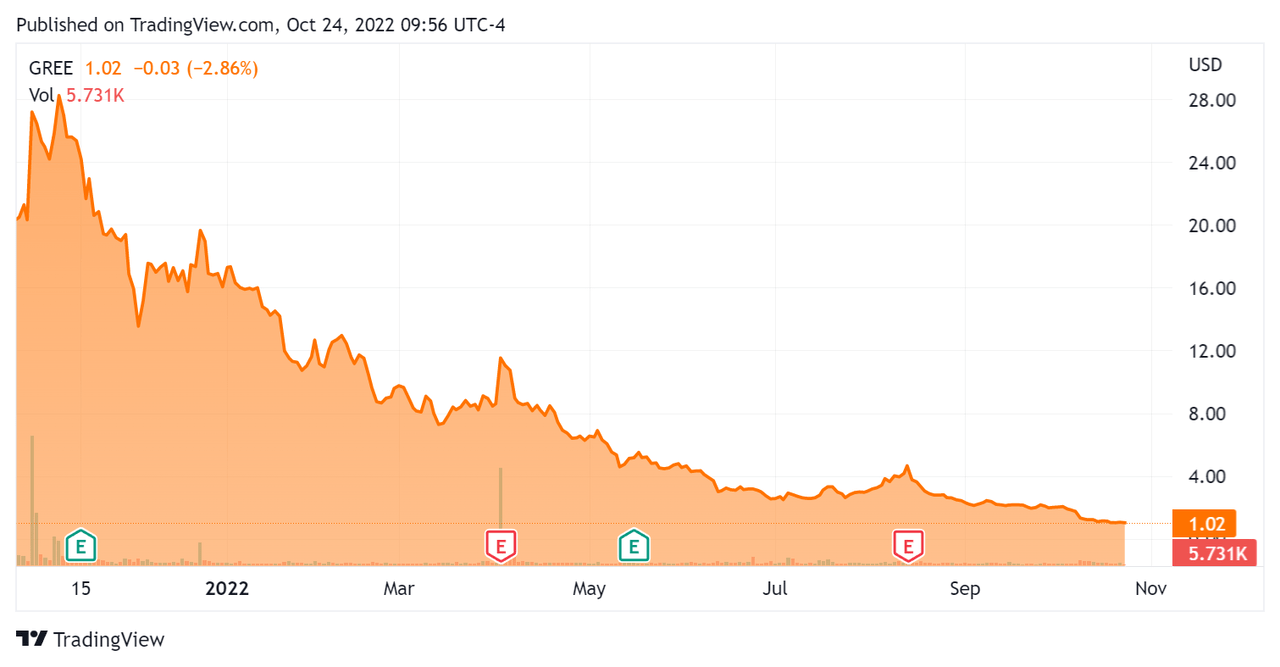

In the past 12 months, GREE’s stock price has fallen 95% vs. the U.S. S&P 500 index’ drop of around 16.7%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Greenidge

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.04 |

|

Revenue Growth Rate |

276.9% |

|

Net Income Margin |

-105.7% |

|

GAAP EBITDA % |

29.3% |

|

Market Capitalization |

$45,110,000 |

|

Enterprise Value |

$154,960,000 |

|

Operating Cash Flow |

$33,830,000 |

|

Earnings Per Share (Fully Diluted) |

-$5.18 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Hut 8 Mining (HUT). Shown below is a comparison of their primary valuation metrics:

|

Metric |

Hut 8 Mining |

Greenidge Generation |

Variance |

|

Enterprise Value / Sales |

2.32 |

1.04 |

-55.2% |

|

Revenue Growth Rate |

143.8% |

276.9% |

92.6% |

|

Net Income Margin |

-58.5% |

-105.7% |

|

|

Operating Cash Flow |

-$81,320,000 |

$33,830,000 |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On Greenidge

In its last earnings call (Source – Seeking Alpha) covering Q2 2022’s results, management highlighted its changing strategy toward focusing on liquidity rather than its previous strategy of aggressive growth.

With the price of Bitcoin having dropped significantly from its previous highs coupled with a rising hashrate and related difficulty adjustment, the economics of mining Bitcoin have become much tougher and management seeks to leverage its existing infrastructure for the time being.

Management has “received strong lender support, which has provided us with additional liquidity by flattening our amortization curve…”

As to its financial results, cryptocurrency mining revenue rose 43% year-over-year as the company produced 621 bitcoins during the second quarter, nearly double that of the prior year’s same quarter.

However, sequentially, operating profit turned to loss for the quarter and negative earnings were substantial.

For the balance sheet, the company finished the quarter with $67 million of cash and fair value of Bitcoin held in its treasury. Debt was $176 million.

Over the trailing twelve months, free cash used was ($205.6 million), with $239.4 million in capital expenditure during the period.

Since the end of the second quarter, the firm has announced preliminary results for its third quarter, with revenue expected to be approximately $29 million, sequentially slightly lower than Q2.

Earnings per share is forecast to be negative ($1.53), a sequential improvement over Q2’s dismal results.

The company also announced the resignation of CEO Jeff Kirt and his replacement with David Anderson as new CEO and Scott MacKenzie as Chief Strategy Officer.

Looking ahead, management provided little guidance about the firm’s future. Its New York power generating and Bitcoin mining facility has been the subject of negative regulatory actions which the firm is contesting in court and which could take up to several years to resolve.

It is unclear what the “changing of the guard” at the top of the company will pursue. Other mining operators have begun to transition their fleets or incoming hashpower to “high performance computing” markets that promise to provide more predictable and diversified revenue streams.

The primary risks to the company’s outlook include the uncertain direction until new management makes its approach known and the price of Bitcoin in the face of rising hashpower and difficulty adjustments.

Until we learn more about the future direction of the company and begin to see improvement in its financial results, I’m on hold for GREE.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment