payphoto/iStock via Getty Images

Investment Thesis

Signature Bank (NASDAQ:SBNY) is a full-service commercial bank headquartered in New York, United States. In this thesis, I will primarily be analyzing the Q2 2022 results of SBNY and the future growth prospects of the bank. I will also analyze the gross loan growth of SBNY. I believe SBNY is trading at an attractive valuation with significant growth prospects. I assign a buy rating for SBNY after analyzing all these factors.

Q2 2022 Results

SBNY posted solid second quarter 2022 results, beating the EPS estimates by 4%. The revenue was in-line with the expectations. SBNY reported one of its strongest quarters in terms of loan growth. I believe the company is effectively improving its loan growth while maintaining the credit quality of the loans.

SBNY reported net interest income (before provisions for credit losses) at $649.1 million, compared to $457.2 million in Q2 2021, a significant 42% increase. This increase was primarily driven by growth in interest-earning assets and higher interest rates. The non-interest income jumped 61%, from $23.4 million in Q2 2021 to $37.7 million in Q2 2022. This increase was majorly due to a hike in the service charges and fees. SBNY reported a net income of $339.2 million, a 58% increase compared to $214.5 million in the year-ago period. The increase was driven by strong loan growth coupled with higher interest rates. SBNY reported diluted EPS of $5.26, compared to $3.57 in the corresponding quarter last year, an effective increase of 47%. SBNY declared a dividend of $0.56 per share payable on August 12, 2022.

Joseph J. DePaolo, Signature Bank President and Chief Executive Officer, commented,

This quarter we once again delivered record earnings of $339.2 million, realizing our strongest growth in pre-provision net revenue of 54 percent, compared with same period last year. We credit this meaningful growth in earnings to all of our business lines, collectively, as there is no single one which has brought us to this point. As we look ahead, we will continue to take advantage of the abundant team onboarding opportunities which exist across our entire footprint and rely upon our proven approach to organic growth to continue to drive earnings, despite some unsettling times.

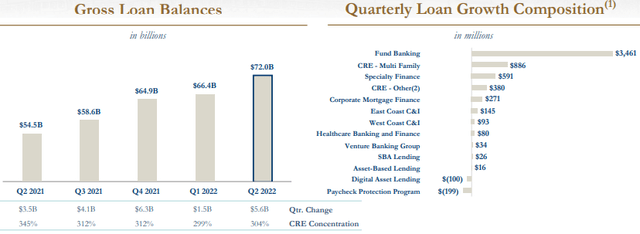

Let us have a look at the gross loan development of SBNY. This is the second-biggest increase in SBNY’s history in terms of loan amount growth. The gross loans grew $5.6 billion q-o-q, from $66.4 billion in Q1 2022 to $72 billion. And, when compared to Q2 2022, the gross loan balance increased by $17.5 billion. This increase is very significant when compared to the industry standards. I believe SBNY is on a growth track with consistent improvement in loan growth.

Overall, SBNY posted robust results with improvement across interest and non-interest incomes. SBNY launched New National Banking Practice, the Healthcare Banking and Finance Team, in Q2 2022 to expand its operations and increase deposits and loan balances. It onboarded 11 private client banking teams to execute this expansion plan. I believe this will help SBNY maintain its growth trajectory in the future. Overall, SBNY posted strong Q2 2022 results with positive future growth prospects.

Key Risk Factor

Credit Risk: SBNY is involved in the banking business, and credit risk is the most significant risk for any bank. The timely repayment and value of the collateral which supports the loan get affected by the credit rating and strength of the borrower’s business. The delay in loan repayment and early payment of the loan can adversely affect the earning estimate of the company.

Currently, the economy is facing a high inflationary environment which can put pressure on a client’s margin and profitability. The economic slowdown and decreased client earnings can impact the company’s performance adversely. The company has been able to mitigate this risk by following a balanced loan portfolio, but it is a risk that should be considered before taking any position the company.

Valuation

SBNY is currently trading at $175.89 with a market cap of $11.07 billion, which is a P/E multiple of 10.30x. SBNY has reported strong growth in the last quarter, and I believe SBNY will continue the growth in the future. The SA quant rating of SBNY also confirms the strong growth in the future, as it has an A factor grade in growth. I estimate the EPS for FY22 of SBNY to be $22.30, which gives the leading P/E multiple of 7.89x. After considering SBNY’s growth prospect, a P/E multiple of the 7.89x is inexpensive.

I think SBNY will trade at a higher P/E multiple to justify the high growth scenario. I estimate SBNY to trade at a P/E multiple of 11.2x, which gives us a target price of $249.76. This is a 42% upside from the current levels.

Conclusion

SBNY has reported a strong quarterly result and has solid growth prospects in the coming period. SBNY has shown significant loan growth with an efficient loan credit profile, which is very attractive for investors in the current economic scenario. SBNY is the perfect combination of a robust growth stock trading at an inexpensive valuation. Thus, I assign a buy rating for SBNY.

Be the first to comment