gesrey

Active ESG Managers: Evangelists or Hypocrites?

The United Nations Principles for Responsible Investment (PRI) was initiated by investors worldwide in 2006 and called for fund managers to incorporate ESG (environmental, social and governance) issues into their investment decisions and to actively engage in the companies in which they invest. When the PRI was launched, signatories’ total assets under management (AUM) was just a few hundred billion dollars, but by 2020 this number had grown to roughly $120 trillion and the number of signatories had grown to more than 2,300.

Soohun Kim and Aaron S. Yoon contribute to the sustainable investing literature with their December 2021 study “Analyzing Active Fund Managers’ Commitment to ESG: Evidence from the United Nations Principles for Responsible Investment” in which they analyzed what happens after active U.S. mutual funds sign the PRI in order to assess whether they actually exhibit ESG implementation. Using firm-level ESG scores from MSCI, Sustainalytics and TruValue Labs, they created a value-weighted average ESG score at the fund-quarter level and compared the six quarters before and after signing the PRI. Their data sample included 448 active funds from 86 investment management firms. Following is a summary of their findings:

Comparing fund flows during the six quarters pre- and post-signing, PRI signatories exhibited a spike in flows post-signing (4.9% average increase per quarter for the subsequent six quarters and well distributed over the next six quarters)-suggesting that asset allocators consider PRI an important signal. There was not an observable notable improvement in ESG scores post-signing. This was robust to considering various subscores related to environment, social or governance separately, or to financial materiality. The results remained valid when they identified a matched group of non-PRI funds and used a difference-in-differences specification. They examined whether PRI signatory funds bought (sold) high- (low-) ESG performers, whether they unloaded stocks associated with greater ESG-related controversy, and the trend in ESG scores of firms that were in the bottom of PRI funds’ portfolios and found there was no meaningful evidence of ESG incorporation. The exception was that quant funds (23% of the sample) exhibited weak evidence of improvement in ESG performance through buying high-ESG performers but no evidence they sold poor-ESG performers. Examining the firms held in signatories’ portfolios at the time of signing to determine whether those firms improved ESG performance, they found no meaningful evidence of ESG incorporation. Examining the ESG performance among firms held by PRI signatory funds with meaningful influence (they were large shareholders), they found no notable improvement. Examining how PRI funds vote on pro-ESG shareholder proposals, they found that PRI managers did not increase supporting (voting for) those issues. In fact, they found that they decreased their support of pro-governance proposals compared to the pre-signing period. The findings were robust to various tests (such as longer pre- and post-signing periods, as ESG implementation may take longer). PRI signatories exhibited a slight decrease in fund returns after signing the PRI.

Their findings led Kim and Yoon to conclude that on average “PRI funds enjoy a higher aggregate revenue from capital inflow, but do not exhibit a meaningful follow-through.” They added: “While we acknowledge the possibility of genuine ESG incorporation from some signatories, we believe that our findings call on regulators to direct more scrutiny to asset managers’ ESG execution, on asset owners to gain more awareness of the capital allocation process, and on asset managers to provide more transparent communications on their ESG incorporation.”

Kim and Yoon’s findings are consistent with those of Harshini Shanker, author of the 2019 study “Social Preferences of Investors and Sustainable Investing,” and those of Markku Kaustia and Wenjia Yu, authors of the September 2021 study “Greenwashing in Mutual Funds,” who found that funds profiled as ESG-based received higher inflows compared to other similar funds, but due to greenwashing, sustainable investors were not receiving what they had signed up for.

Investor Takeaways

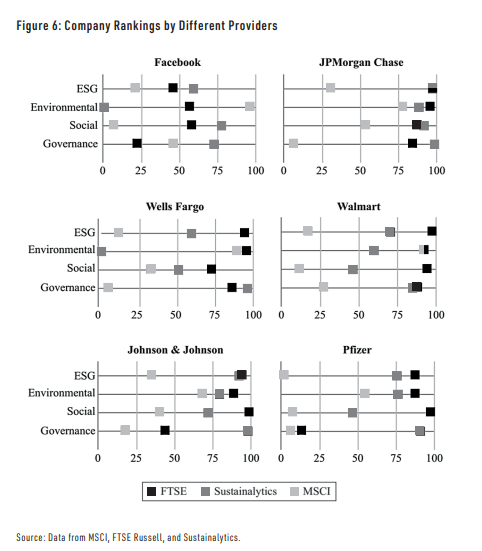

Investors interested in expressing their personal values through their investments face several hurdles. Perhaps the largest hurdle is that, as shown in the following charts, the various providers use very different metrics in determining their ESG scores, which results in the same company having very different ESG scores from the different providers.

ESG Ratings by Different Providers (MSCI, FTSE, and Sustainanalytics)

The research we reviewed demonstrates that there is a second hurdle, at least for investors using active managers who are signatories to the PRI-there is no evidence they actually follow through in terms of implementation or engagement. Instead, their signing could be an act of greenwashing, meant to attract assets without having to live up to the objectives of the PRI. In other words, as Kim and Yoon suggest in their article “United Nations Principles for Responsible Investment Signatories,” published in the Fall 2022 issue of The Journal of Impact & ESG Investing, they are not evangelists; they are hypocrites.

Larry Swedroe is the chief research officer of Buckingham Strategic Wealth and the co-author of Your Essential Guide to Sustainable Investments

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third-party data and may become outdated or otherwise superseded without notice. Third-party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. LSR-22-387

Be the first to comment