alvarez/E+ via Getty Images

Bassett Furniture Industries (NASDAQ:BSET) is a $151m market cap manufacturer and retailer/wholeseller of branded home furnishings, with a focus on the upper-mid price segment in the US. The company has $85m in net cash (56% of the current market cap). In Jun/Sep’22, the company received two merger offers from retail-focused PE firm CSC (2% stake), however, BSET management did not engage with the buyer. CSC then decided to make a public proposal at $21/share (27% spread to current prices), however, the offer was rejected as undervaluing the company. Notably, CSC has stated that the latest acquisition proposal was made public in order to facilitate discussions “with the goal of entering into a mutually agreeable transaction”. This could suggest that a CSC is willing to negotiate and a price bump might be in the cards.

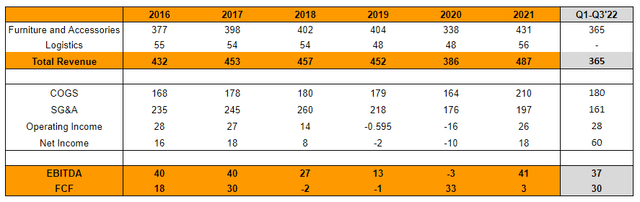

CSC’s interest in BSET comes at an opportunistic time as 1) BSET’s management has been leading the company through a strategic transformation and (2) operating performance has peaked driven by macroeconomic tailwinds, such as WFH trends, and seems poised to normalize. As part of the ongoing strategic transformation, BSET sold its logistical service business in Jan’22 to focus solely on the retail and wholesale segments. BSET has since shifted to a regional fulfilment center (RFC) based strategy ensuring faster purchase-to-delivery cycle. Moreover, BSET acquired Noa Home, online furniture retailer, to expand online/international presence. That said, BSET’s transformation seems to be in the early innings as the first (and only) RFC was built in Apr’22 while the Noa platform is yet to be introduced in the US (planned in 2023). Operationally, BSET has clearly benefited from pandemic-driven demand as indicated by record-high EBIT/revenues in 2021, with the company being on track to match or even exceed previous highs in 2022. However, given macroeconomic headwinds, including a gloomy household consumption outlook and rising interest rates, earnings are expected to normalize going forward. Overall, these factors might be what makes BSET an attractive acquisition target for CSC.

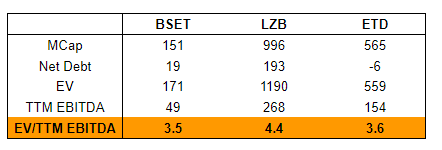

While the fact that the previous offers were rejected makes the investment thesis somewhat speculative here, a quick glance at peer valuation suggests that management might eventually become more agreeable if CSC makes another offer at a higher price. At current levels, BSET trades at 3.5x TTM EBITDA – generally in line with larger and higher-margin peers such La-Z-Boy (LZB, $996m market cap, 4.4x) and Ethan Allen Interiors (ETD, $565m, 3.6x). At $21/share, BSET would be valued at 4.3x EBITDA. Management also seems to think the company is cheap. In Mar’22, BSET increased share repurchase authorization to $40m. So far, $10m has been repurchased year-to-date.

Potential buyer CSC is backed by quite prominent firms, including Panasonic, Khosla Ventures and Altos Ventures. CSC focuses on acquiring B&M retailers and turning them into digital companies. CSC has numerous such acquisitions under its belt, including DirectBuy, Z Gallerie and One Kings Lane. Importantly, CSC recently pursued another acquisition in the home furnishing space – in Aug’22, CSC made a bid for FLXS. However, the offer – which valued FLXS at 5.1x 2021 EBITDA – was rejected by the company’s board as low-ball and opportunistic. Nevertheless, this clearly displays CSC’s firm intentions in the home furnishings space. Timing is somewhat opportunistic due to macroeconomic headwinds and BSET’s ongoing strategic transformation. Given all this, I think it is quite likely CSC will continue pressuring BSET management.

Business And Financials

BSET manufactures and sells furniture and related accessories through retail and wholesale channels. The company focuses on the upper-mid price home furnishing segment in the US.

Financially, the company has seen improving performance recently (other than the COVID-19 induced trough), with record-high revenues in 2021. On YTD run-rate, BSET is on track to reach 2021 sales levels (note that BSET’s fiscal year ends in November). Having said that, it seems as though the business has reached peak earnings and the recent growth trend will not be sustainable given macroeconomic headwinds, including interest rate pressure on the housing industry. In the latest earnings release, the company noted the expected impact from these macroeconomic factors, though still maintaining confidence in the business:

High inflation, rising mortgage rates, and a slowdown in the housing market have certainly taken a toll on the equity values of publicly traded furniture companies this year. We are definitely in the mode of “focusing on what we can control” as there are currently forces at work greater than Bassett in a macro sense.

[…]

We do believe that although our customer is being more judicious with their disposable income today than two years ago, their personal balance sheets are strong. So, there will be folks in the marketplace and we have to win them over.

Company Filings

Valuation And Peers

Despite BSET’s slightly lower EV/EBITDA multiple versus peers, it is worth noting here that both competitors – LZB and ETD – are larger and have boasted higher TTM EBITDA margins of 11% and 19% compared to 9% for BSET, suggesting BSET might currently be valued fairly. It is worth noting here that while LZB focuses on the mid-priced segment, ETD operates in the luxury priced furniture segment, which justifies the peer’s higher EBITDA margins. Moreover, LZB and ETD’s wholesale revenues have made a bigger portion of total revenues — 69% and 80% as of 2021 compared to 42% for BSET (excluding intra-company wholesale segment sales to retail).

Company Filings

BSET Investor Presentation, August 2022

Risks

Several points worth mentioning:

- The most obvious risk is the possibility that CSC does not make another acquisition offer for BSET in a short timeframe given that two bids – proposed at a significant premium to market prices – were rejected. An important note here is that CSC initially acquired a 7.4% stake in early Jun’22. CSC rather promptly materially trimmed its stake to 1.9% in only three weeks, showing that the previous acquisition offers were rather opportunistic.

- A smaller point is that a prominent asset manager/activist GAMCO Investors (formerly Gabelli Asset Management) used to hold a position in BSET from 2014 with a 9.5% stake as of Mar’21. However, the well-known asset manager has exited its position since. The timing of the exit might have been timely as BSET was trading north of $30/share in mid-2021 driven by peaked customer demand.

Be the first to comment