Suriyapong Thongsawang

Companies involved in moving goods across the world have turned into very hot businesses. Maybe the strongest market of all is the global oil and LNG transport industry. Europe and Asia demand energy fuels to power their economies and soon to meet heating demand needs this winter. One small-cap Energy sector stock has gone from $9 to $18 in about two months and has a key earnings date Wednesday Morning. Energy stocks in general appear to have held key long-term technical support after a summer dip, according to technical work by Stephen Suttmeier at Bank of America Global Research.

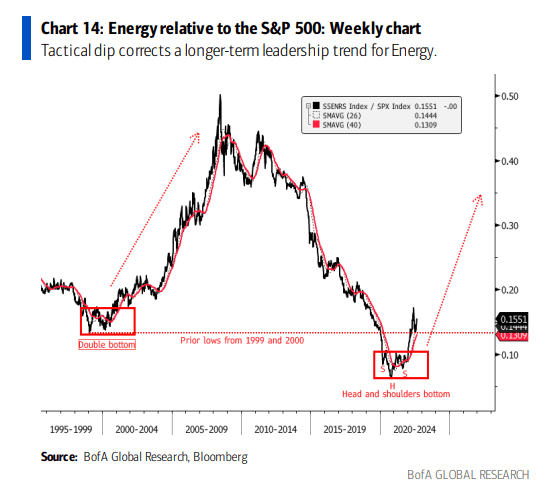

Energy Stocks Bottoming Versus The S&P 500

BofA Global Research

According to CFRA Research, Tsakos Energy Navigation Limited (NYSE:NYSE:TNP) provides seaborne crude oil and petroleum product transportation services worldwide. The company offers marine transportation services for national, major, and other independent oil companies and refiners under long, medium, and short-term charters. As of April 21, 2022, it operated a fleet of 66 double-hull vessels, comprising of 60 conventional tankers, three LNG carriers, and three Suezmax DP2 shuttle tankers.

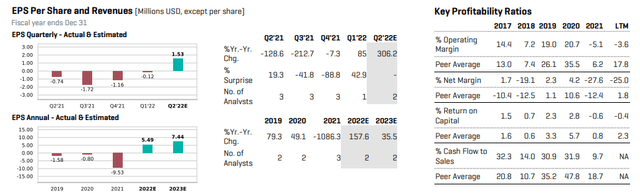

The Greece-headquartered $502 million market cap Oil, Gas, & Consumable Fuels industry company in the Energy sector has negative earnings over the previous 12 months and pays a small 1.1% yield, according to The Wall Street Journal.

TNP shares have doubled in the past two months as optimism about improving supply chains permeates and demand for LNG continues. While recent bottom-line numbers are negative, the current consensus earnings forecast shows a positive inflection in EPS. According to data from CFRA Research, profits should go into the black as the Q2 consensus forecast is for a positive $1.52 of EPS. For full-year 2022 and 2023, EPS is seen as swinging strongly positive at $5.49 and $7.44, respectively. That makes the forward P/E ratio very cheap.

Earnings Turning Into The Black, Shares Are A Value On A Forward Basis

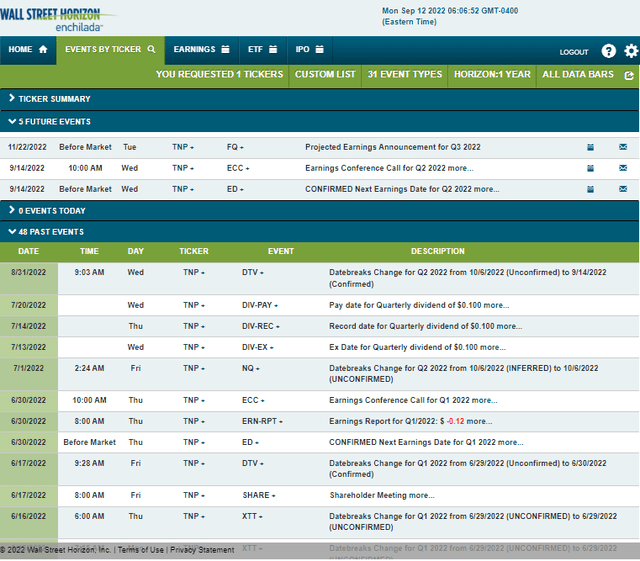

Tsakos has a confirmed Q2 earnings date for Wednesday, September 14 before market open, according to Wall Street Horizon’s corporate event data. The firm hosts a conference call at 10 am ET. You can listen live here.

Corporate Event Calendar

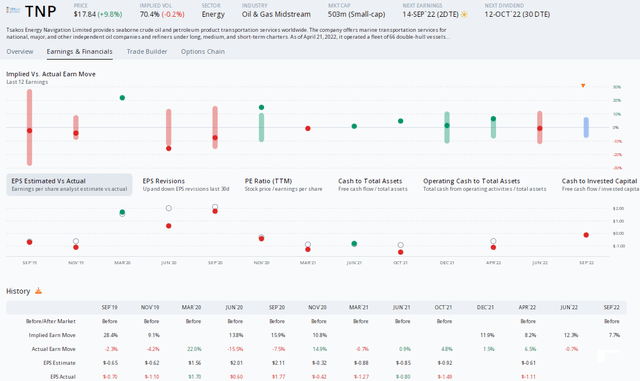

The Options Angle

Focusing on Tsakos Energy’s Q2 earnings report due out Wednesday morning, options traders have priced in a 7.7% earnings-related stock price move using the nearest-dated at-the-money straddle, according to data from Option Research & Technology Services (ORATS). Based on previous stock price-earnings reactions, that pricing appears fair. I’ll outline an options strategy later.

TNP: A 7.7% Earnings-Related Stock Price Move Expected

The Technical Take

With options priced about right ahead of the company’s quarterly report, what do the charts say? I see a bullish trend with some upside resistance that might come into play. There’s an uptrend line dating back about two years that the stock struggled at over several instances. Then in just the last two months, a monster bullish thrust took the stock from under $9 to nearly $18 last week. Along with doubling in price, the stock broke out above that former line of resistance.

I think the stock continues higher to about $23 – the late 2019 and spike high in Q2 2020. There’s also congestion starting there from back in 2016 and 2017. On the downside, the bulls want to see the $13 to $14 range hold. Based on the options situation and trend, I think being long a call spread at the $18 strike while selling the $23 strike makes sense. Expiration can be out up to a few months.

TNP: Shares Breakout, Eye $23 Resistance

The Bottom Line

I like TNP’s chart here and the earnings growth that kicks off with this week’s Q2 report. I think shares can at least get to $23, so a long call spread looks good for options traders while energy bulls can look for longer-term upside in Tsakos. A multi-year, if not multi-decade, demand story appears to just be starting for global oil and fuels shipping needs.

Be the first to comment