piranka

Published on the Value Lab 8/9/22

The iShares Cybersecurity and Tech ETF (NYSEARCA:NYSEARCA:IHAK) contains a lot of exposures that we like. Being tech focused, but on the subsector that sees an intersect between cloud and cybersecurity, it has traded down a lot YTD. Revenue growth remains strong in cloud and cybersecurity, both being supported by secular trends, especially cybersecurity. These are infrastructural backend, and while macro concerns do affect general corporate spending plans, both are unlikely to be dialed back on. Growth prospects remain relatively intact. IHAK is a buy.

A Bit on Cybersecurity

Work from home and cloud migration have been interacting together with more disparate corporate structures and with more access to company systems from the internet to create greater cybersecurity risks. Besides phishing which can be quite easily avoided with a bit of technical literacy, concerns of more sophisticated cyberattacks continue to grow. Insurance premiums are increasing for cyber risk, which is becoming more substantial in both potential damage and probability, and paying for cybersecurity consulting and software is essential in mitigating these risks. Moreover, cybersecurity is a necessary arms race. Attackers will try new things, and cybersecurity will have to try anticipate new modes of attack, which is very difficult, as well as find ways to do post-mortems after attacks that were successful to prevent further damage. If you’re a big company, you’re getting attacked by hacker groups all the time, and the threats and ransoms are usually happening discreetly and behind the scenes. The need is already highly recurring for cybersecurity. Work from home is here to stay, not even white shoe Wall Street companies can eliminate it.

Cybersecurity and AI

So the more work from home and the more cloud gets used the more cybersecurity will be essential. That is already a strong case for cybersecurity. But another angle is that a cybersecurity ETF could become an AI factor for your portfolio. Data science is going to be essential to deal with anomaly detection that might be byproducts of various modes of attacks. The arms race puts the defenders at a disadvantage against an unknown and limitless enemy. With the cloud also meaning that companies are sharing facilities and data flows, open sourcing some of the server data could be a way to gain data scale in combination with AI tools to detect unanticipated modes of attack by looking for anomalies. Cybersecurity companies could become data platforms as well as software and consulting providers. The introduction of network effects could do a lot to change the profile of cybersecurity companies even further.

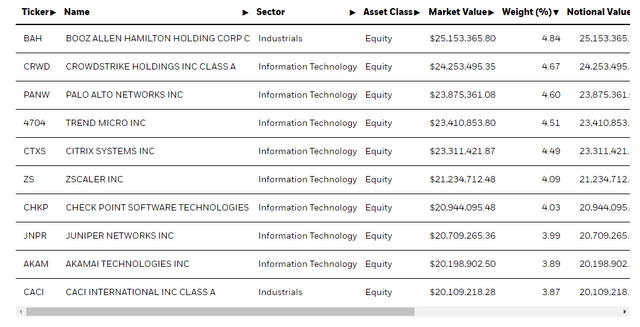

IHAK Holdings

IHAK is a pretty small ETF with only 48 holdings, but the allocations are fairly uniform. Most companies are cybersecurity companies that have a clear cloud proposition like Zscaler (ZS) and Palo Alto Networks (PANW). In the last earnings season for tech companies, we saw strength in cloud, with the likes of Microsoft (MSFT) continuing to post mid double-digit growth in Azure despite macro headwinds. Likewise, cybersecurity and cloud related holdings in IHAK are posting strong double digit growth as well, Zscaler at 50% and PANW at around 30%. As far as cybersecurity goes, the growth of corporate spending on that is actually outpacing general spending on IT, which would include cloud, and primarily on services benefiting the likes of Booz Allen Hamilton (BAH) and other companies that offer a major service component in their businesses. Growth is solid for BAH at around 5% TTM. While a lower rate, the growth rate is consistent with prior years and can be extrapolated on a secular basis. CrowdStrike (CRWD) is another great business with superb growth rates and high recurring model. Ultimately, cybersecurity is a necessary infrastructure to limit even an insurable risk that matters a lot for your business.

Conclusion

Cybersecurity continues to be a relatively underinvested part of IT infrastructure despite its importance in protecting from major business damage. There is immediate scope for wallet penetration. Moreover, the pie grows with secular trends like cloud creating even more need for cybersecurity, and work from home is another nice impulse for the sector. Cybersecurity could also turn into an important AI factor and create businesses with great platform economics. All of these are reasons to invest in IHAK. The P/E is a little high at 24x, but this is because many of the constituent companies have very high growth rates, and those rates can be extrapolated for a while. There’s also no yield to speak of. The fees are also on the average side at 0.47%, so not particularly lightweight. Nonetheless, this part of tech has traded down 20%, and we argue for little reason. If there’s any part of the economy that will resist even a reckoning in corporate fortunes, it will be cybersecurity.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment