RHJ/iStock via Getty Images

Uranium Energy Corp. (NYSE:UEC) is the largest American uranium exploration, mining, and processing company. UEC, headquartered in Texas, commenced developing uranium properties in the 1970s. Since then, the company has garnered an expansive portfolio of mining operations in the United States, Canada, and Paraguay. The long-term strategy of UEC is to become a regional producer of uranium without being dependent on hostile foreign governments. This strategy requires time and cash to reach fruition, both of which the company has in abundance, thanks to its wealthy lobby of institutional investors. Riding on some of the most prominent megatrends in the world, UEC is gearing up to capitalize on favorable demand and commodity prices in the future.

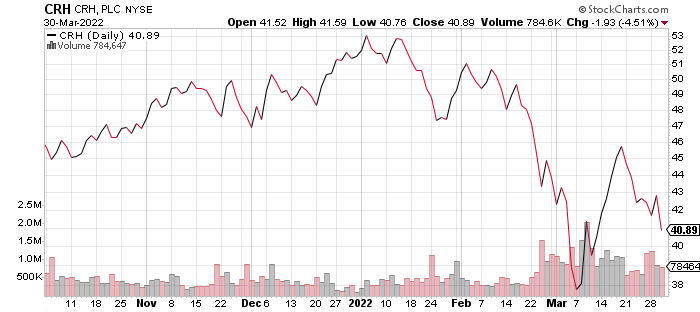

stockcharts.com

Currently, the company is in an early phase of operation that does not entail short-term profits. By making its first sales and establishing revenue pipelines, the company is entering a mature phase of operation that will translate to an increase in market valuation. Prospective investors might want to wait for a dip in the stock price of UEC before entering, but it is not very important as, in the long run, the company is expected to grow exponentially.

Industry Analysis and Competition

Being in the commodities market, UEC’s financial success is mainly dependent on the state of the uranium industry as a whole. Two major megatrends are currently inflating the price of uranium. First, the war in Ukraine and sanctions on Russia have fractured the global economic order, which previously relied on international energy interdependence. Oil and gas prices are soaring, forcing governments to push for energy independence and autonomy.

Similarly, in Kazakhstan, the most uranium-rich country globally, the civil war disrupted the production and export of uranium, sending shockwaves across the market and spiking commodity prices. The most efficient and reliable means of energy production is nuclear power. The United States is well-positioned to achieve nuclear energy independence as it is home to vast deposits in the so-called “uranium mineral belt,” which stretches across parts of Texas, New Mexico, Colorado, Arizona, and Wyoming. The federal government is eager to cultivate the country’s uranium production to insulate existing and future nuclear power plants from global events that could restrict supply.

Second, there is a collective, multilateral push for decarbonization. In the latest UN COP meeting, almost every country committed to reducing emissions. This has created a global demand for alternative energies, including nuclear power. As a function of these two megatrends, the demand for uranium is expected to continue rising faster than production. The global forecast for 2022 estimates that there will be a 64 million lbs. production gap below demand. This cumulative production gap will continue to grow, and, short of any new discoveries or advances, will amount to over 450 million lbs. by 2032.

Both geopolitically and multilaterally, there are strong signals suggesting that the uranium industry will grow significantly. It’s important to keep in mind that, despite the inflated demand, as of 2022, the price per lb. of uranium is lower than it was before the global recession in 2009. This is a positive sign as, at worst, the market is not overvalued, and at best, the commodity price is still in recovery and will eventually rebound.

Covid-19 Impact

The 2020 Covid-19 pandemic harmed the overall economy, subsequently affecting UEC and the uranium industry. Due to shelter in place requirements, the company’s uranium production was slowed down, leading to a production target shortfall of 20 million lbs. that will not be made up.

Despite these setbacks, in December 2020, the company’s market valuation was stirred by the trend of accelerated market rebalancing, which was triggered by supply chain issues and international tensions caused by the pandemic. For example, there was a hike in shipping prices that, in some cases, made imports and exports more expensive than domestic production. Additionally, U.S. relations with China, Iran, Russia, and the Gulf worsened due to the pandemic, placing global supplies of energy commodities at risk.

In a hostile world where foreign entities use resources to manipulate and control energy-dependent countries, the United States was impelled to look inward and invest in its uranium industry. UEC was the first and only U.S. company to be contracted by the government to supply the federal uranium reserve. The Department of Energy is buying around 18 million lbs. of uranium from UEC. The contract will be issued later in 2022 and will be worth $72 million.

Risks and Mitigants

The foremost risk to UEC is an event that flattens the price of uranium, such as the discovery of large uranium deposits or a breakthrough in carbon capture technology. For example, in 2011, the price of uranium dropped by almost 50% in response to the Fukushima nuclear disaster. Due to the high cost of production, the company relies on a production gap in the uranium market to remain soluble. A drop in demand means that the company will incur additional expenses to safely and securely store massive amounts of uranium, which can be costly and complicated due to the radioactivity and destructive potential of the substance.

To mitigate some of the financial damage that a single point of failure event would cause, UEC has diversified into titanium and vanadium mining. Vanadium is used in alloys to make steel cutting tools and sulfuric acid. Vanadium is crucial for producing sulfuric acid but comes with inherent risks as it is mainly derived from slag mines in China and Russia. UEC has localized production in the United States, lowering the risk of supply issues in the future. The diversification reflects not only the overall trend of economic isolation but also the company’s long-term strategy to create an internal ecosystem under the UEC umbrella. Internal production of key manufacturing and mining chemicals will significantly reduce costs and speed up production.

UEC faces significant security risks. Uranium and the company’s specialized equipment are highly sought after by rogue governments, terrorist organizations, and black-market dealers. As of the fiscal year 2022 (FY22), the company has over 4 million lbs. of uranium in its U.S. storage facilities. Due to the extensive infrastructure needed to stockpile this much radioactive material, UEC hires third parties to store and transport its uranium reserves. This places the liability for secure handling and storage on third parties, preventing the company from overstretching its capabilities and ensuring that specialized companies handle complex logistics. Given the company’s track record of acquiring subsidiaries to expand its capacities, storage may soon be conducted internally, which will bear new risks, cut expenses, and provide novel opportunities.

Another risk to the company is regulation. Mining can be extremely taxing on the environment, and there are a growing number of environmental laws that limit the extent of uranium production. There are two broad methods of mining uranium, and they depend on the nature of the deposits. Open-pit mining accounts for almost half the world’s uranium and entails the destruction of forests, soil, water tables, and ecology. What’s more, this technique of uranium mining poses fatal hazards to workers.

UEC is protected, in part, from environmental and labor risks as it utilizes a relatively non-invasive uranium extraction technique called In Situ Recovery (ISR) The ISR process uses pumps and wells to dissolve uranium from hard rock ore using oxidized water or sulfuric acid. The dissolved uranium is then transported from the “hub” to the “spoke” – a processing facility where the substrate is dried into a stable form called Yellow Cake.

Illustrating UEC’s insulation from the risk of regulations, the U.S. government has bipartisan support for nuclear energy and is actively buying uranium from UEC. In addition to this, the company has a dedicated Environment, Social, and Governance (ESG) division to maintain good relations with regulators, auditors, and shareholders.

Revenue Streams and Opportunities

UEC primarily sells uranium. Most of the company’s mining, exploration, and logistics operations are conducted by subsidiaries and third parties. Acquiring subsidiaries is a part of UEC’s growth strategy. In Q1-22, UEC acquired Uranium One Americas, the fourth-largest producer of uranium in the world and the largest producer in America. The purchase cost $112 million and was paid for entirely with UEC’s large pool of cash reserves. The expansion will immediately double production capacity by increasing the total number of ISR projects, growing available resources, and expanding access to specialized infrastructure.

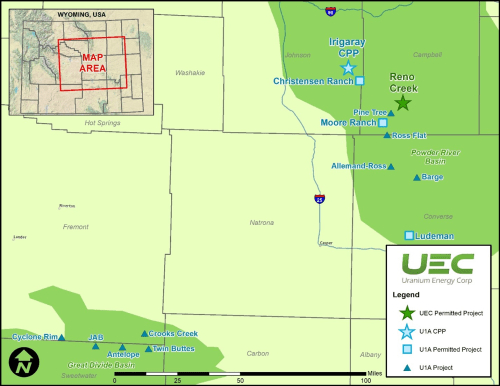

greencarcongress.com

The company has working facilities in Wyoming and Texas. These “hub and spoke” facilities are time and cost-saving. From mining to end-product, all of the processes that go into uranium production happen in the same production complex. Using this structure, the company saves on transporting hazardous materials along a vast supply chain, thus reducing its footprint and risk of contamination.

The company is rapidly building its production capacity. Each facility has a limit to how much uranium can be produced in any given year. To get past these limitations, UEC aims to fortify and diversify its uranium sources across multiple ISR facilities. The company is actively spending significantly on the development of four new facilities: Two of them are in Paraguay, one in Arizona, and one in Colorado. Once operational, UEC will have one of the largest uranium production capacities in the world, which is especially attractive as an investment as the company will achieve market leader status without incurring severe geopolitical risk.

Financial Analysis

While the company made significant losses amounting to over $14 million in FY20 and FY21 respectively, financials from FY22 suggest that a turning point is underway. Several factors are driving the shift in financials. For the first time, the company made revenue in the second financial quarter of FY22 (Q2-22), selling $13.2 million of inventory and achieving a gross profit of nearly $4 million.

However, due to one-time expenses related to expansion and acquisitions, UEC ended the quarter with a net loss of $7.5 million, a 10.4% improvement year-on-year (y-o-y). This reveals the company’s patient strategy of delayed gratification to capitalize on the inflated commodity price. Even though UEC has had millions of pounds of uranium in storage for several years, the company abstained from selling its product until the price was more favorable. UEC has the size and scale of operations to be calculated in its operations, taking cuts in revenue if needed and making up for the losses when prices are higher.

As of Q1-22, UEC is debt-free, having paid off its credit facilities. This is a powerful indicator that UEC is on the cusp of entering a mature operations phase. The company is strengthening its fundamentals and positioning itself to achieve risk-adjusted profitable growth in the long term. This long-term growth strategy is likelier to succeed due to the governance structure at UEC, where executive management is accountable to an independent board of directors and has a personal stake in the company’s share price.

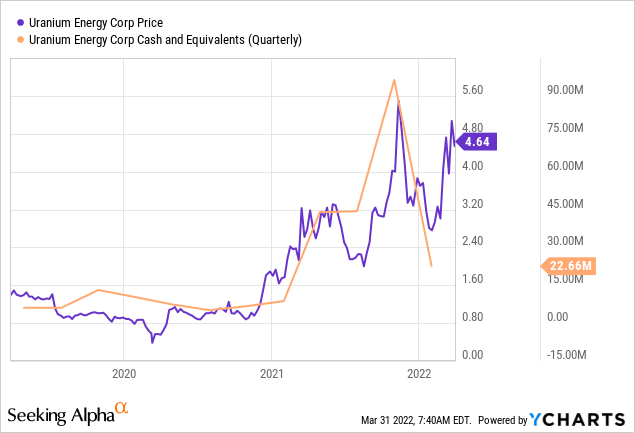

ycharts.com

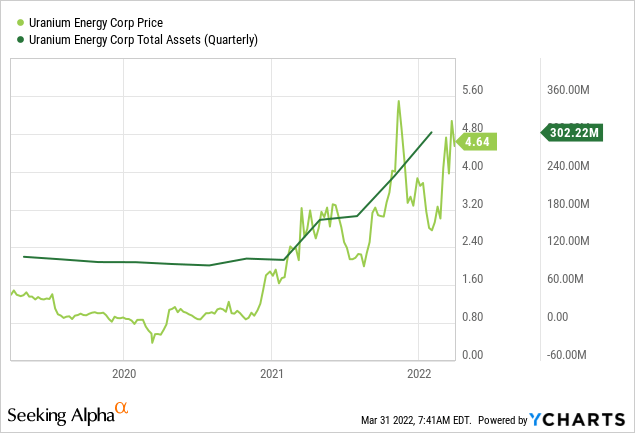

Looking to the future, all indicators suggest that UEC is preparing to invest heavily in its growth and expansion. In Q2-22, the company boasted a substantial cash and equivalents position amounting to $127 million which now stands at $22 million. Much of this cash will continue to be spent on its new mining and processing plants in Arizona, Colorado, and Paraguay. Based on past trends, UEC has shown an eagerness to invest in and acquire smaller companies, thereby moving closer to localizing the entire supply chain under the Uranium Energy Corp. umbrella. This is an ambitious trajectory to be followed and requires massive spending that often comes at the cost of profits. As the company’s portfolio of facilities, commodities, and countries expands, general and administrative costs will form the highest share of operational expenses in FY22. The company has unrealized gains amounting to at least $72 million from a uranium contract with the U.S. Department of Energy. Based on the current spot price of $56.70/lb. of uranium, UEC has liquid assets worth over $ 100 million, nearly a third of their total assets of $302 million. The company has the backing of top institutional investors like BlackRock (BLK), Vanguard Group, Fidelity (FNF), and UBS (UBS), among others, which is a sign of confidence in the long-term profitability of Uranium Energy Corp. UEC should see a steady increase in revenue in the next financial quarters.

ycharts.com

Final Thoughts and Conclusion

UEC is a good investment opportunity with potential for gain in the medium term. Reflecting sound management, the company uses industry best practices to produce uranium quickly and cost-effectively. In short, the company’s long-term strategy is to slowly build its uranium production capacity without incurring geopolitical risks associated with import dependence. To achieve this, UEC is aggressively investing in new facilities and subsidiaries that fall under the jurisdiction of the United States and its allies. While UEC has historically traded profits for growth, relying on institutional backing, government contracts, and subsidiary revenue, as of FY22, the company is generating revenues and gross profits for the first time, marking a major milestone and shift to a new phase of operation that is focused on profitable growth.

As of March 29, 2022, Uranium Energy Corp. is highly valued – but not overvalued — on the stock market, which means that it may not be the most ideal time to enter into the investment. However, focusing on fundamentals alone, the company should grow meaningfully in the years to come, making the current stock market high insignificant in relative terms.

Be the first to comment