MJimages/E+ via Getty Images

Altria (NYSE:MO) has seen its dividend yield suddenly edge higher towards 9%, as a confluence of headwinds hit the stock. Besides the inflation risk that is affecting the entire market, MO is faced with both regulatory intervention in nicotine as well as a ban on JUUL products. The company has historically increased both earnings and its dividend, making the 8.6% yield look potentially attractive. I discuss why the future is more murky than it appears, with the stock not being the slam dunk that it may appear to be.

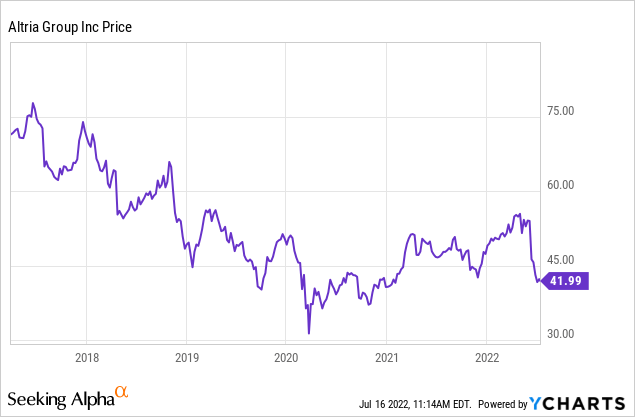

MO Stock Price

MO has had a rough several years as the stock is down 50% from 5 years ago.

I last wrote about MO when I called it a value trap. The stock is down 22% since then, leading to an even larger yield. Unfortunately, the valuation is still not compelling enough to change my view that this remains a value trap over the long term.

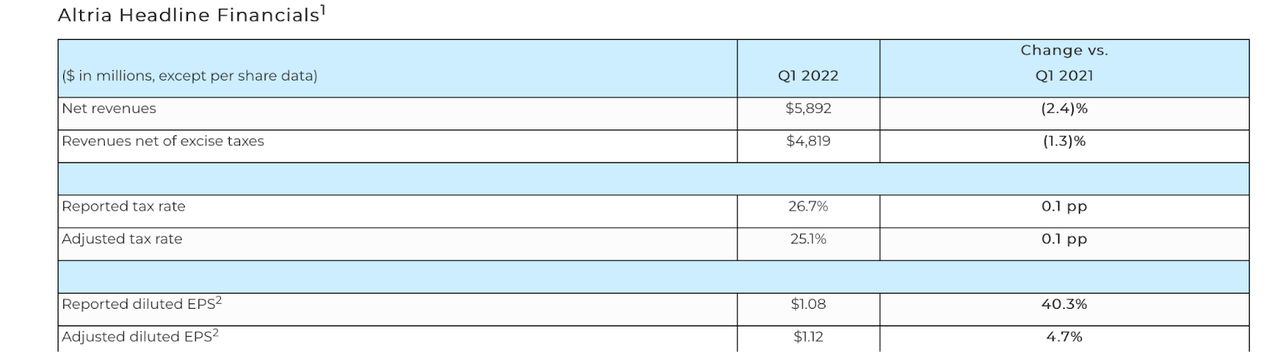

MO Stock Key Metrics

MO’s latest quarter was quite typical for the company, with steady revenues and single-digit EPS growth.

2022 Q1 Presentation

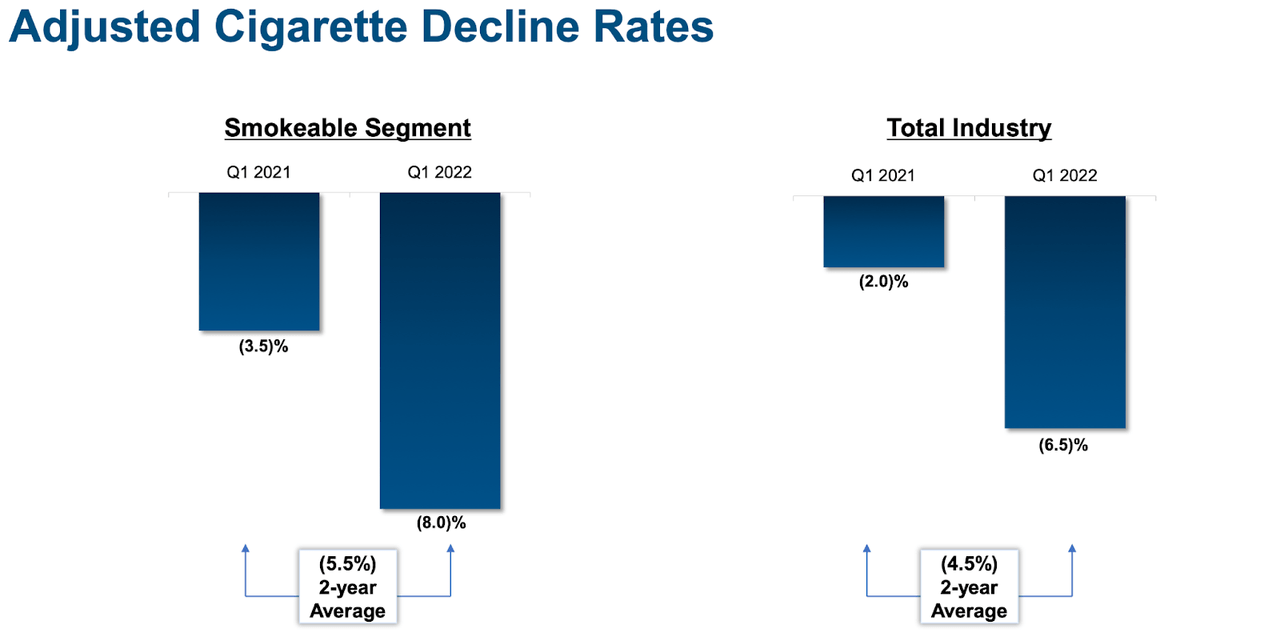

Cigarettes are not a secular growth story, but MO has shown that it does not need to be to generate solid fundamentals. MO saw its smokeable segment deteriorate at a single-digit pace in the quarter (by volume).

2022 Q1 Presentation

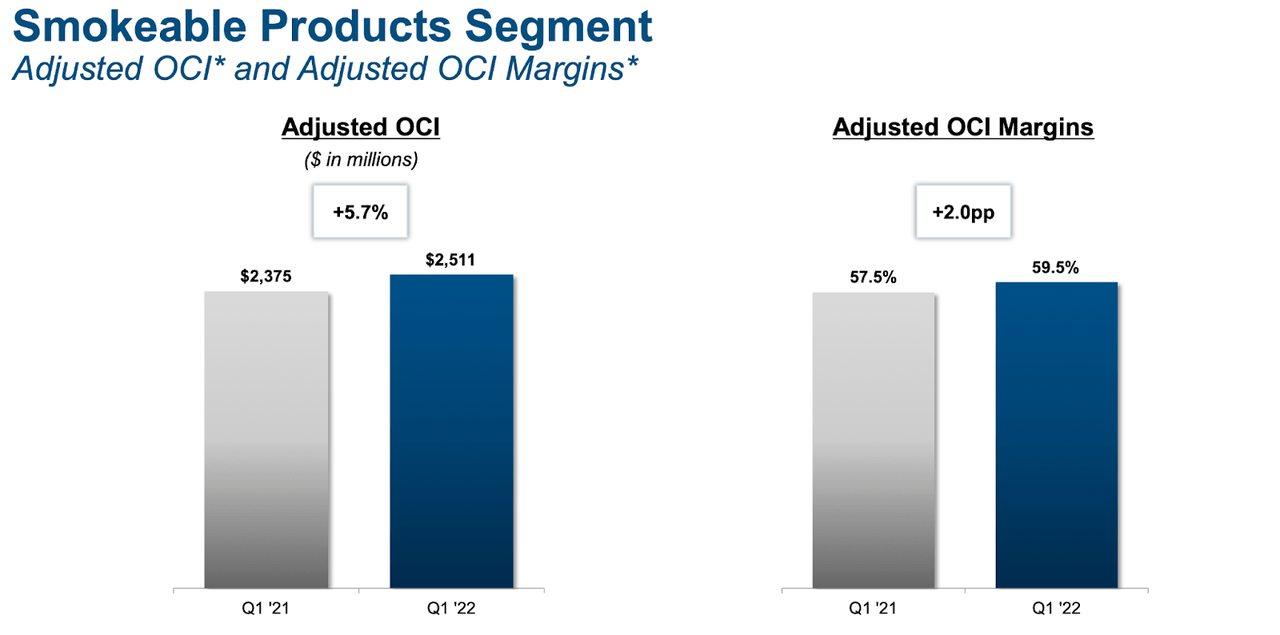

MO was able to offset the decline by increasing prices and realizing operating efficiencies, as evidenced by the 5.7% gain in operating income.

2022 Q1 Presentation

While MO has other operating segments, smokeable products still made up 85% of overall operating income.

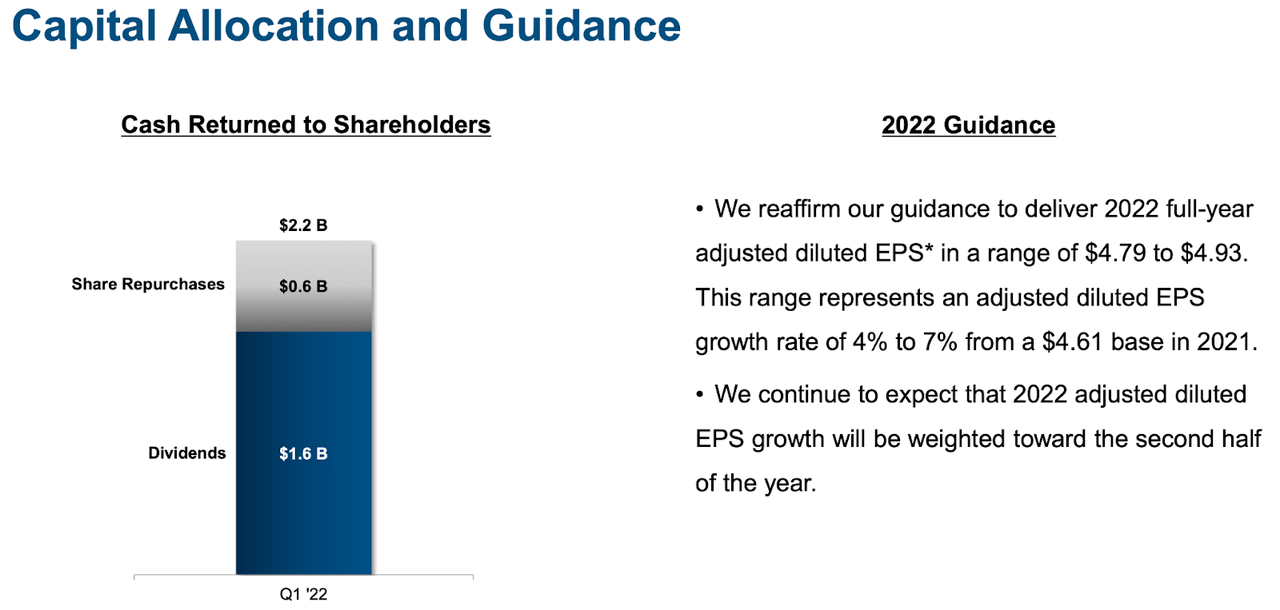

MO returned $2.2 billion to shareholders through dividends and share repurchases in the quarter.

2022 Q1 Presentation

MO ended the quarter with $22.5 billion of net debt versus $23.5 billion at the end of 2021.

What Should Investors Know About Altria’s Dividend?

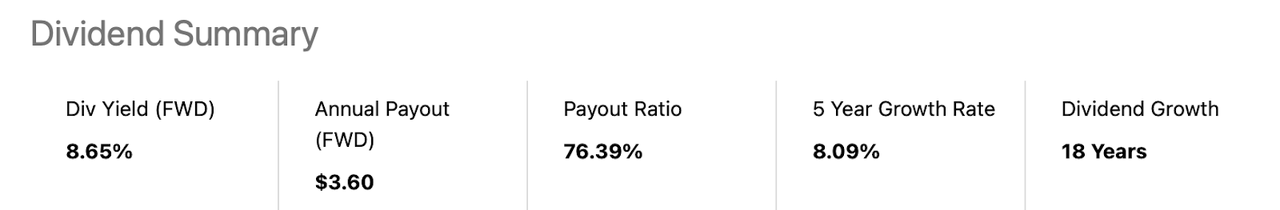

The stock is yielding 8.7%, raising fears of a dividend cut.

Seeking Alpha

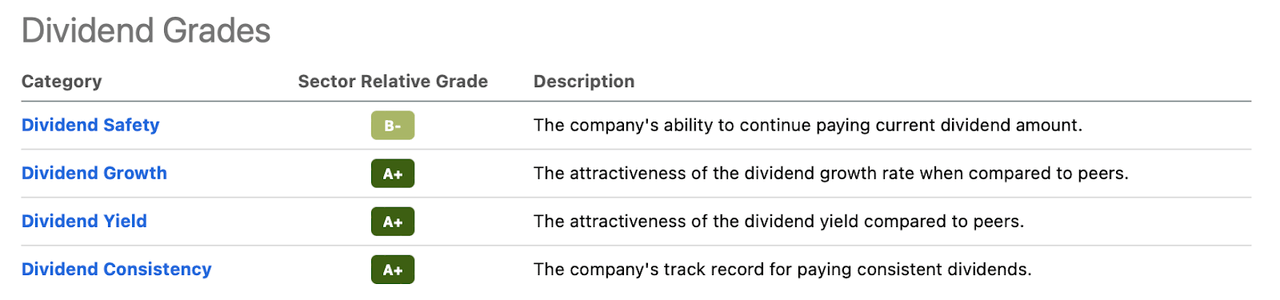

On the surface, MO’s dividend appears safe. MO has a reasonable payout ratio and history of dividend growth.

Seeking Alpha

Is Altria A Dividend King?

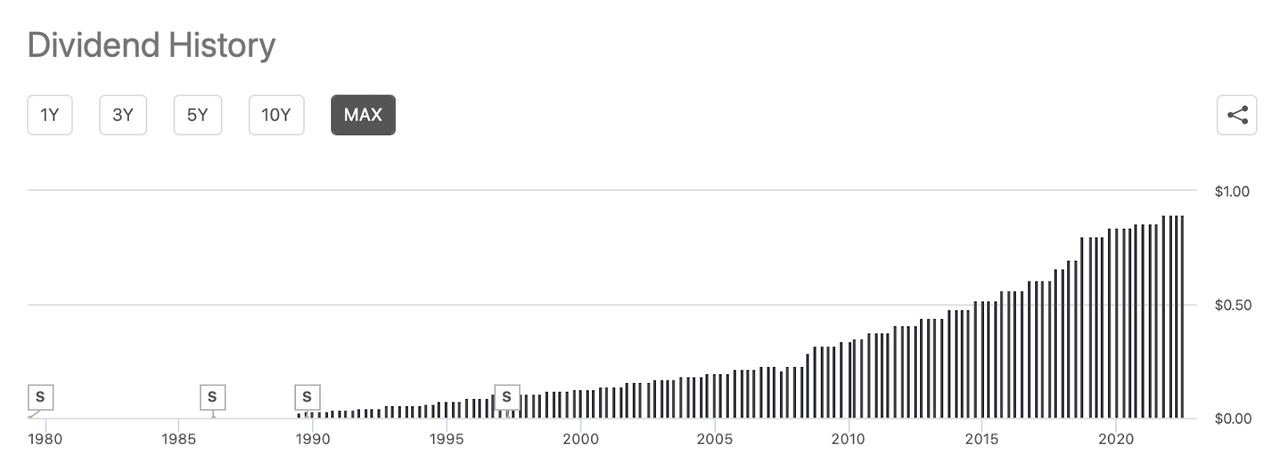

Regarding that history, MO has increased its dividend for 18 consecutive years. While that means it is not technically a “dividend king,” which requires 50 consecutive years of dividend growth, over the past many decades MO has consistently increased its dividend payout.

Seeking Alpha

Is Altria A Good Long-Term Investment?

Unfortunately, past results will play a little role in determining future results. I continue to predict that trouble is only 5-10 years away. There are already signs of negative catalysts emerging. First, the FDA has officially withdrawn authorization for JUUL products – MO had previously invested nearly $13 billion into the company in 2018. Sure, I have seen the argument that the inevitable impairments are non-cash charges and will not directly affect operating cash flows. However, e-cigarettes were supposed to be the new growth frontier for the company – impairment of that growth thesis is likely to put a cap on the potential for multiple expansion.

Next, the FDA is trying to reduce nicotine in cigarettes to nonaddictive levels. Smokeable products have already seen secular declines in shipment volumes over the years – I expect that to accelerate when the product’s addictiveness decreases. The key here is the long-term thesis. Video streaming is evitable. E-commerce is inevitable. I view the decline of cigarette smoking to be inevitable.

Is MO Stock A Buy, Sell, Or Hold?

Let’s now discuss how the long-term thesis factors in with valuation. MO is trading at an 8.7% yield and 8.5x projected 2022 earnings. The stock has traditionally traded at 12.4x forward earnings, suggesting that it trades at a historical discount.

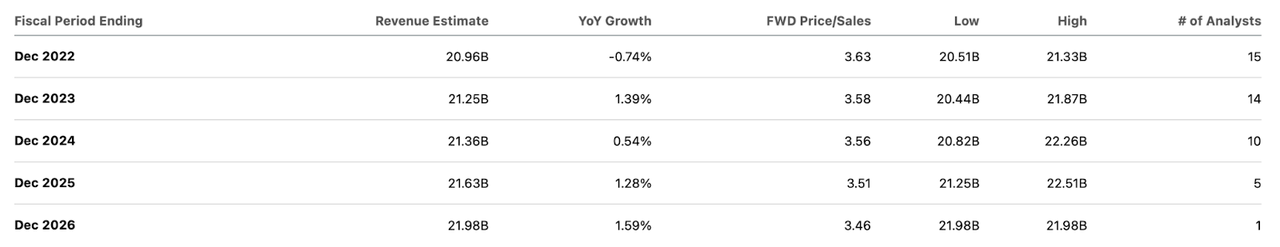

But one must always consider the risk-reward proposition of any investment. MO is the kind of company that is not projected to grow its topline by much at all.

Seeking Alpha

One can look at the high dividend yield and dream of receiving both the high yield and capital appreciation, but how realistic is that assessment? MO faces real secular risks from the decline of smokeable products. The company has been able to offset declines in shipment volumes with price increases and operating efficiencies. However, declines in shipment volumes look like secular headwinds whereas price increases and operating efficiencies can only go so far. I continue to believe that there is a certain price at which point the products become unattractive to the general market – not to mention ongoing price competition from competitors. I am doubtful that the average investor has the view that cigarette volumes will accelerate and become a secular growth story. My point is that the upside here is limited due to secular headwinds and at the very least negative sentiment. The current 8.7% yield does not look so unreasonable. Perhaps one might think that the stock can trade up to a 7% yield, equating to around 20% upside from capital appreciation.

On the flip side, the downside should not be underestimated. MO has a sizable leverage load at around 2x debt to EBITDA which drives much of the bearish thesis. Sure, the stock isn’t obviously expensive at 8.5x earnings, but if the company begins to show secular declines in earnings, then I expect that it will need to start aggressively paying down debt. The dividend payout ratio is under 75% but that does not imply that the earnings can decline by 25% without a dividend cut. MO will need to sustain or even decrease its leverage ratios in the event of secular declines in earnings because otherwise it may be unable to refinance maturing debt at comparable interest rates. I project that earnings need to decline by only 6% before any excess earnings above the dividend are fully redirected towards debt paydown.

Any bearish scenario may not be immediate – it is projected that any nicotine reduction policies won’t go into effect until 2024. But my point here is that the upside potential is capped at around market returns, as the stock might generate around 10% to 11% annual returns between its dividend yield, growth, and multiple expansion. But the more years that pass, the closer it may be to the “tipping point” discussed above where operating income hits secular declines. At that point, one should not underestimate the possibility that the stock trades down to 5x earnings or even lower – that would be likely enough to wipe out many years of shareholder returns and almost certainly ensure that the stock will not outperform or even match the market over the long term. I fear that many dividend investors may mistake MO to be a “safe” stock, but that assessment may be disproportionately impacted by past financial trends without enough consideration for the long-term outlook. I continue to recommend avoiding the stock, even if the high dividend yield has increased the potential for near-term upside.

Be the first to comment