SimonSkafar

One of the favorite investments among more conservative investors and retirees has always been utility companies. There are many reasons for this, including their general financial stability and high dividend yields. However, the strong bull market that we have seen over much of the past decade has had the unfortunate effect of suppressing the yields of many of these firms. They do still have the other characteristics that many people appreciate, though, and the stability of these companies is something that could prove very appealing as the economy continues to weaken. It can be difficult though for an investor to put together a portfolio of these companies without having access to a considerable amount of capital.

One solution to both this problem and the current low yields of the sector is to invest in a closed-end fund (“CEF”) that specializes in investing in utility companies. This is because these funds provide easy access to a diversified professionally-managed portfolio of utilities that can use a variety of strategies to generate a higher yield than any of the underlying companies possesses.

In this article, we will look at one of these funds, the BlackRock Utility & Infrastructure Trust (NYSE:BUI), which currently yields an impressive 7.27%. I have discussed this fund before, but more than a year has passed, so obviously a great many things have changed. This article will therefore focus specifically on these changes as well as provide an updated analysis of the fund’s financial performance.

About The Fund

According to the fund’s webpage, the BlackRock Utility & Infrastructure Trust has the stated objective of providing investors with a high level of total return through a combination of current income, current gains, and long-term capital appreciation. This is not surprising, since common equities are themselves a total return instrument. After all, most people investing in the stock market are seeking both dividend income and capital gains. This is especially true in the case of the utility sector, which has become somewhat famous for paying out above-average dividends.

As the name of the fund implies, it specializes in this sector, although it also invests in infrastructure companies. The fund does not actually define what it considers to be an infrastructure company is, but based on the assets of the fund it appears to mean midstream companies, railroads, toll roads, and other companies that basically provide the things that are needed for modern society to function. This is not a significant departure from utilities, because most infrastructure companies likewise have reasonably stable cash flows through any economic conditions and pay out a sizable proportion of their cash flows to investors. This is certainly true in the case of utilities, most of which have yields that far exceed that of any utility in the market.

The fund makes a point of emphasizing its environmental, social, and governance credentials. According to the webpage,

“The Trust considers the ‘Power Opportunities’ business segment to include companies with a significant involvement in, supporting, or necessary to renewable energy technology and development, alternative fuels, energy efficiency, automotive and sustainable mobility, and technologies that enable or support the growth and adoption of new power and energy sources.”

I will admit that I do not particularly like seeing this in the description of a fund that ostensibly invests in utilities and infrastructure. This is not because I have a problem with non-traditional energy per se, but companies in this sector tend to have vastly different fundamentals. For example, this definition could easily include a company like Tesla (TSLA) or any other automobile company that produces electric cars. It is pretty difficult to argue that these companies enjoy slow and steady growth and pay out a large proportion of their cash flows through dividends!

Although some renewable energy producers such as NextEra Energy Partners (NEP) have managed to fulfill these characteristics through the use of power purchase agreements, most renewable energy companies and the like simply do not have the characteristics that an investor in a fund like this is probably looking for. I will admit that I am not surprised to see this particular statement in a fund from BlackRock given that company’s heavy presence in the environmental, social, and governance investing space, but it is a bit of a turnoff for this particular fund.

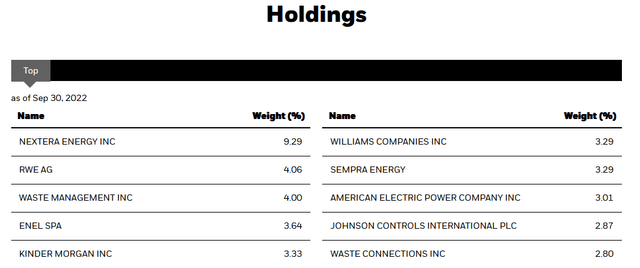

As most of my regular readers know, I have spent a great deal of time and effort over the years discussing utilities, midstream companies, and other companies that could qualify as infrastructure firms. As such, many readers will likely recognize many of the largest holdings of the fund. Here they are:

I will admit that I have not discussed very many of these companies on this site, although I have posted a discussion of several of them. In particular, I have discussed NextEra Energy (NEE), Kinder Morgan (KMI), The Williams Companies (WMB), and The American Electric Power Company (AEP). Most of these are indeed what most people would think of when investing in this fund as we see a few electric and natural gas utilities, along with two of the largest midstream companies in the United States.

We also see companies like Waste Management (WM) and Waste Connections (WCN), which likewise provide services that are extremely recession-resistant so they have many of the same characteristics as utilities. However, both Waste Management and Waste Connections have significantly lower dividend yields than either utilities or midstream companies. As such, their presence means that the fund is going to be receiving less income than it would if these companies were replaced with a traditional electric utility.

Johnson Controls (JCI) is a questionable decision for the fund, as it is primarily an HVAC provider for commercial buildings. It does not necessarily enjoy the same recession-resistant characteristics as the other firms here do. After all, construction activity tends to rise and fall with the economy, and while Johnson Controls may have some stability providing service to buildings during a poor economy, it is still going to be affected by such events.

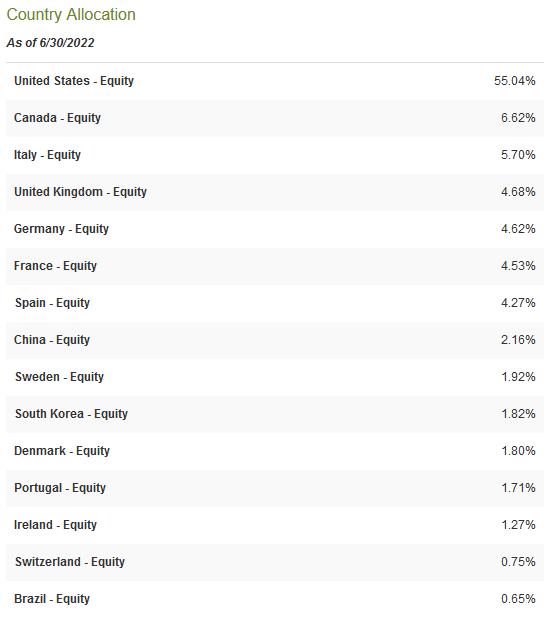

We do see that there were a number of changes to the largest positions in the fund over the past year. Iberdrola (OTCPK:IBDSF), Trane Technologies (TT), Atlas Copco (OTCPK:ATLKY), Vestas Wind Systems (OTCPK:VWSYF), and Vinci (OTCPK:VCISF) were replaced by Kinder Morgan, The Williams Companies, Sempra Energy (SRE), The American Electric Power Company, and Waste Connections. I cannot say that I have a real problem with these changes since this diversified the fund somewhat away from renewable power and moved it more towards traditional utilities and midstream companies. These companies tend to have somewhat more attractive cash flow characteristics for risk-averse investors, such as retirees. Interestingly though, it did not significantly increase the fund’s weighting toward the United States. The BlackRock Utility & Infrastructure Trust only has a 55.04% weighting toward American companies compared to 51.46% a year ago:

CEF Connect

International diversification is important because of the protection that it provides us against regime risk. Regime risk is the risk that a government or some other authority will take some action that has an adverse effect on a company that we are invested in. We saw a great example of this back in January 2021, when the incoming Biden Administration unilaterally canceled the permits for the construction of the Keystone XL pipeline and caused the money that TC Energy (TRP) had invested into the project to be essentially wasted.

The only realistic way to protect ourselves against this risk is to ensure that only a relatively small proportion of our assets are invested in any individual nation. The BlackRock Utility & Infrastructure Trust seems to be doing this better than most other closed-end funds. Usually, we see a 60% to 70% weighting to the United States in any international fund, but this one is quite a bit lower. With that said, the United States only accounts for a bit less than a quarter of the world’s economic output, so the fund’s allocation to the nation is still significantly higher than the country’s actual presence in the global economy. However, this fund is still doing an adequate job at diversifying assets internationally.

As the fund’s positions have changed dramatically over the past year, we might assume that it has a fairly high annual turnover. A high turnover can be a concern because trading stocks or other assets costs money, which is then billed to the investors. This creates a drag on the fund’s returns as management needs to generate sufficient income and gains to both overcome the expenses and still deliver a return that investors find acceptable.

This is one of the reasons why index funds have become so popular, as they tend to do minimal trading and have incredibly low expenses. That does not necessarily mean that a fund with a high turnover will underperform, but it does make things more difficult for management. Interestingly, this fund only has a 20.00% annual turnover despite the number of changes that we see in the fund’s holdings list. That is one of the lowest levels around for an equity closed-end fund, so we must assume that at least some of the changes that we see among the fund’s positions were caused by things other than management either purchasing or disposing of stocks. For example, some changes might be explained by a given asset outperforming another in the market over the past year. This could certainly be the case for Kinder Morgan and The Williams Companies, which are some of the only stocks that have delivered gains over the past twelve months.

As my regular readers on the topic of closed-end funds are likely aware, I do not generally like to see any individual asset account for more than 5% of a fund’s portfolio. That is because this is approximately the level at which the asset begins to expose the fund to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification but if the asset accounts for too much of the portfolio then this risk will not be completely diversified away. Thus, the concern is that some event may occur that causes the price of a given asset to decline when the market does not and the asset may end up dragging the entire fund down with it if it accounts for too much of the portfolio. As we can see above, the only asset that has such a high weighting in the fund is NextEra Energy. Therefore, any potential investor in the fund should ensure that they are willing to take on the risks of this company individually before making an investment in the fund.

Fortunately, the risks no longer appear to be as great as they once were. In my last article on NextEra Energy, I pointed out that the stock was incredibly expensive relative to its peers even when taking the company’s growth potential into account. However, the stock has fallen quite a bit since then and the valuation has become much more reasonable. We can see this by comparing the company’s price-to-earnings growth ratio against its peers, just like we did in the original article:

|

Company |

PEG Ratio |

|

NextEra Energy |

2.71 |

|

DTE Energy (DTE) |

3.03 |

|

Eversource Energy (ES) |

2.90 |

|

American Electric Power |

2.81 |

|

Avista Corporation (AVA) |

3.79 |

(all data courtesy of Zacks Investment Research)

A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its forward earnings per share growth. However, almost no company has a ratio that low in today’s market, which is especially true in the utility sector. As we can see, though, NextEra Energy now appears to be very reasonably priced relative to its peers after accounting for forward earnings per share growth. Thus, the fact that the BlackRock Utility & Infrastructure Trust is very heavily weighted toward this company is no longer as big of a concern as it once was.

Distribution Analysis

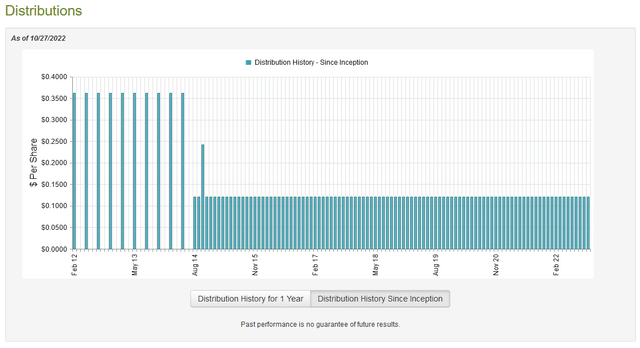

As stated earlier, the BlackRock Utilities, Infrastructure, & Power Opportunities Trust aims to deliver both current income and current gains to its investors as a component of its total return. As such, we might assume that the fund boasts a respectably high distribution yield. This is indeed the case, as the fund currently pays out a monthly distribution of $0.121 per share ($1.452 per share annually), which gives it a 7.27% yield at the current price. The fund has been remarkably consistent about this payout over time. In fact, the fund has not cut its distribution once in its eleven-year history:

There may be one or two people that point out that the distribution in the early years was much higher. In fact, what the fund did is change from a $0.3625 per share quarterly distribution to a $0.121 per share monthly distribution. The total payout over the course of a year remained exactly the same. This is the sort of thing that seems likely to appeal to anyone that is seeking a reliable source of income to use to pay their bills. Unfortunately, a stable distribution is not necessarily the most attractive thing today due to inflation. After all, this means that our incomes stay the same but our expenses are going up so we are getting poorer and poorer over time. However, it still has a better track record than many other closed-end funds possess, and the yield is sufficient to allow an investor to both receive spendable income today and reinvest to increase the amount that they get paid. As is always the case though, it is critical that we determine the fund’s ability to afford its distribution. After all, we do not want to get caught off guard by a sudden reversal of the policy since that would both reduce our incomes and likely cause the fund’s share price to decline.

Fortunately, we have a fairly recent report to consult for this purpose. The fund’s most recent financial report corresponds to the six-month period ending June 30, 2022. As such, it should give us a pretty good idea of how well the fund performed during the volatile market that existed during the first six months of this year. This volatility would have been a rather confusing time for this particular fund since the midstream companies that it holds were performing quite well during the period but the utilities and the renewable power companies were not. During the six-month period, the BlackRock Utility & Infrastructure Trust received a total of $7,919,124 in dividends from the assets in its portfolio. After we net out foreign withholding taxes and add in the fund’s securities lending income, we get a total income of $7,459,964 during the period. The fund paid its expenses out of this amount, leaving it with $4,667,626 available for the shareholders. This was nowhere close to enough to cover the $15,992,324 that the fund actually paid out in distributions during the period, which may be very concerning to any investor looking for a reasonably secure source of income.

However, there are other ways that the fund can obtain the money that it needs to cover its distributions. The most common way that this is done is with capital gains. Unfortunately, the fund was rather unsuccessful at this during this period. It did manage to get $13,333,209 in realized gains but this was more than offset by $94,366,463 net unrealized capital losses. Overall, the fund’s assets declined by $81,161,745 after accounting for all inflows and outflows. This is overall not encouraging, as we generally want a closed-end fund to manage to increase its assets even after paying the distribution. With that said, the fund did manage to generate enough income and realized gains to cover the distribution. Overall, the distribution is probably pretty safe, but we will want to watch to make sure that the fund’s assets do not decline too much more.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the BlackRock Utility & Infrastructure Trust, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to buy shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a situation implies that we are acquiring the fund’s assets for less than they are actually worth. Fortunately, that is the case right now with this fund. As of October 26, 2022 (the most recent date for which data is currently available), the BlackRock Utility & Infrastructure Trust has a net asset value of $21.03 per share. However, it only trades for $19.96 per share. This gives it a 5.09% discount on net asset value, which is a reasonable price. This is also much more attractive than the 0.64% discount that the fund has traded on average over the past month. Overall, it might be worth picking up some shares at this price.

Conclusion

In conclusion, there certainly appears to be a great deal to like about the BlackRock Utility & Infrastructure Trust. The fund is mostly diversified across companies that enjoy generally stable cash flows and finances, which makes it appealing to risk-averse investors. The fund possesses a much higher yield than the underlying companies do, which makes it appealing to those investors focused on generating income. This is especially true considering that the fund appears to be able to maintain its distribution.

I will admit that I’m not a particularly big fan of the fund’s attraction to the environmental, social, and governance trend, but that does not appear to be a particularly big part of its portfolio. Finally, the fund currently has a very attractive valuation. Overall, BUI may be worth considering for any risk-averse investor that is seeking income.

Be the first to comment