arild lilleboe

The Quarter

Equinor (NYSE:EQNR) reported its best-ever quarter today (10/28) with pre-tax and after-tax earnings of $24.3 billion and $6.72 billion for the third quarter. Year-to-date free cash flow is now up to $21.7 billion versus $16.4 billion at the same point last year. It’s important to note this year’s cash flow comes after a catch-up of tax payments totaling nearly $30 billion, including $17 billion this quarter from the previous quarters’ strong profits and $6 billion of capital expenditures.

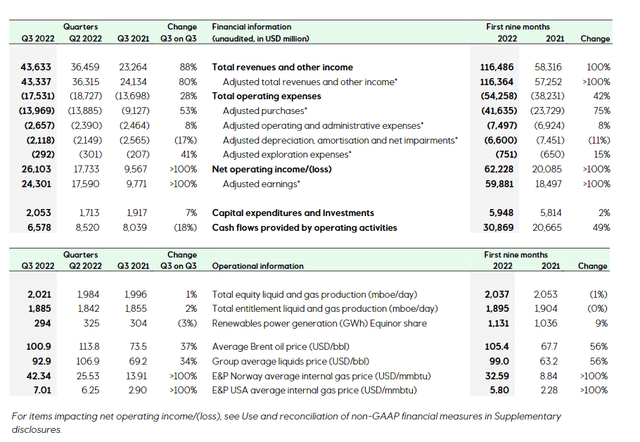

It should come as no surprise that both volumes and pricing were strong across the board, with particular strength in European natural gas price realizations at $42.34/mmbtu versus $25.54/mmbtu in Q2 of 2022 and $13.91 for last year’s third quarter. Natural gas production from the NCS (Norwegian Continental Shelf) was 11% higher year over year. In addition, the restart of production from the Peregrino field in Brazil helped offset the loss of production from Russian assets. Overall, the company expects production growth of about 1% above last year’s.

The company does an excellent job laying out volumes, pricing, and cash flows for quarters and year to date in the opening part of its quarterly presentation.

Equinor Operational Breakdown (Equinor Q3 Earnings Presentation)

Balance Sheet Strength and Return of Capital

The company remains in an enviable net cash position of over $10 billion, even after factoring in all deferred tax liabilities. This balance sheet strength and robust cash flow allow the company to return significant capital to shareholders. Year to date, it has returned approximately $6 billion, and it was close to an even split between dividends and share repurchases. These numbers will climb as the company did not pay a special dividend until after reporting the first quarter and upped that special dividend to $.70 this quarter from the original $.20. This quarter’s $.90 of regular and special divs represent a 2.5% yield this quarter alone.

Going Forward

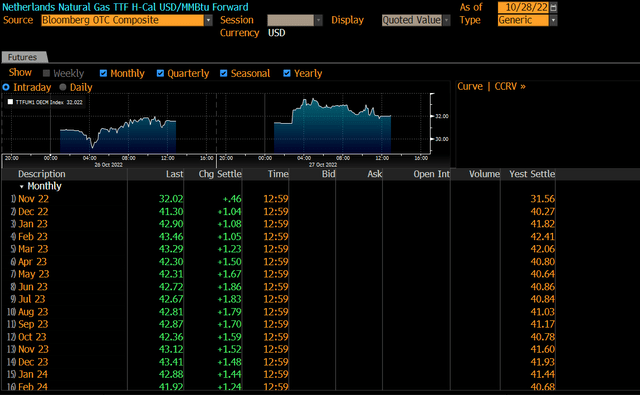

European gas prices so far this quarter are averaging about $40/mmbtu. While this pricing is lower than Q3, October is shoulder season, where mild weather means lower demand. Like any commodity, it’s pretty difficult to predict where prices will shake out, but the curve suggests higher prices for the winter and staying at that level through next year.

Netherlands Natural Gas 1 Month Forward Pricing (Bloomberg)

If you had told me when I first wrote about this company that it would be able to realize anywhere near these prices for natural gas, I might have thought you were crazy. But that was before the Ukrainian invasion and before someone (cough Russia, cough) blew up part of the Nord Stream pipeline. Now, I think these natural gas prices are unlikely to fall anywhere close to where they were this time last year any time soon unless Europe has an incredibly mild winter and/or its industry basically completely shuts down.

Risks

As with any commodity company, you are taking pricing risk. In this company’s case, there is risk from both oil and natural gas prices. Moreover, those gas prices are subject to US and European pricing, which are vastly different. But as I have mentioned in my previous write-ups on Equinor and Vermilion (VET) major European natural gas assets have become some of the most important geopolitical assets in the world and companies that own them deserve a premium, not a discount like EQNR and VET currently garner.

Conclusion

Equinor looks like it should earn about $8/share this year. Given its net cash balance sheet, its strategic positioning as Europe’s premier energy supplier, and its reasonable capital return policy, I think it should garner a P/E higher than 4.5x, which is less than half the multiple of Exxon (XOM) and Chevron (CVX). Notice that I haven’t even considered any of the benefits of the company’s considerable investments in renewable energy, where earnings I believe should start becoming material shortly. I consider EQNR a core energy holding.

Be the first to comment