lindsay_imagery

Written by Nick Ackerman. A version of this article was published to members of Cash Builder Opportunities on August 29th, 2022.

Earth’s surface is 71% covered by water. With that statistic, it might be surprising that drought is even in our vocabulary. However, it’s once you look past that figure alone and start looking at the makeup of the water that it makes more sense.

The oceans make up around 97% of all Earth’s water. That means only 3% of the Earth’s water is fresh, with 2.5% locked in glaciers, ice caps, or other places that aren’t available for drinking. That leaves 0.5% of freshwater available that’s usable for humans.

We know this has been impacting the southwest region of the U.S. significantly. I’m from Michigan, so my personal understanding or experience of drought is nonexistent. The Great Lakes surrounding Michigan are about 20% of the freshwater on Earth. All except Lake Ontario touch the state. I’ve never had to restrict water use; worrying about being fined for water use is foreign to me.

All of that being said, I’m bringing any of this up because there is a way to play it. Even better, a way to play it that an income investor could even get behind. That is through Consolidated Water Co. Ltd. (NASDAQ:NASDAQ:CWCO). It isn’t a particularly high-yielding investment, but at 2.10% is interesting enough. Growth going forward and the essential nature of the company makes it a longer-term play.

What Is CWCO?

Consolidated Water is a play on desalination, taking ocean water and turning it into potable water. This is an expensive process, and it comes with its own drawbacks. However, it is one way to work towards increasing the supply where it is needed.

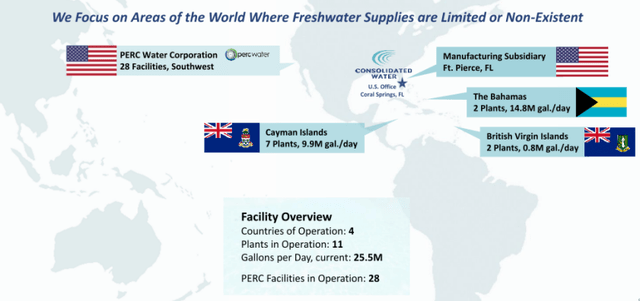

Consolidated Water Co. Ltd. (the “Company”, or “CWCO”) designs, builds, operates, and in some cases finances seawater reverse osmosis (SWRO) desalination plants and water distribution systems in several Caribbean countries, where the supply of drinking water is scarce and the use of SWRO is economically feasible. The Company was established in 1973 as a private water utility in Grand Cayman, the largest island in the Cayman Islands group, and obtained its first public utility license in the Cayman Islands in 1979. The Company is listed on the Nasdaq Global Select stock market under the symbol “CWCO”

It’s a small operation at the moment, with a market cap of around $250 million. That doesn’t mean it is any less interesting. The long history of the company, going back 49 years, gives us a great idea that they have been able to survive through several economic cycles. This is really a highlight of just how essential they are, and even more important they become every day that goes by.

The growth opportunity in the space they operate is quite attractive. Particularly noteworthy states are California, Florida, and Texas. As CWCO mentions, it isn’t only the scarcity of freshwater, but the rising demand for water in these states with growing populations. Thus, making the supply of freshwater even more strained. Too many mouths chasing too few water molecules, if you will.

CWCO Investor Presentation (Consolidated Water)

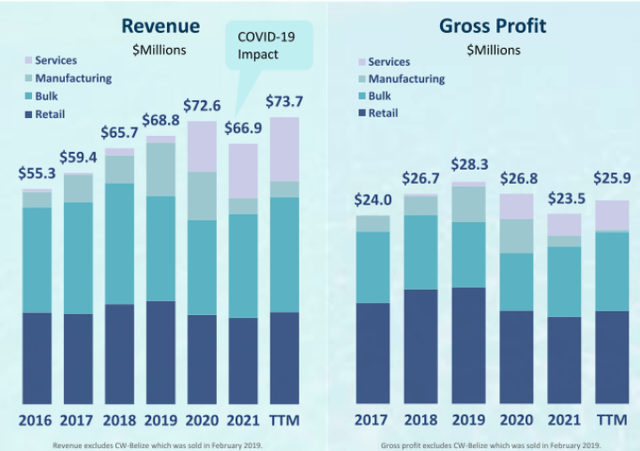

Consolidated Water has four operating segments that provide exposure to this growing industry. That’s through retail water (32% of total revenue), bulk water (40% of total revenue), manufacturing (6% of total revenue), and services (22% of total revenue.)

The majority of their operations are in the Cayman Islands, but the U.S. and other international markets are opening up for them. That would primarily be in the manufacturing and services operations.

CWCO Investor Presentation (Consolidated Water)

What Makes CWCO More Interesting In Particular?

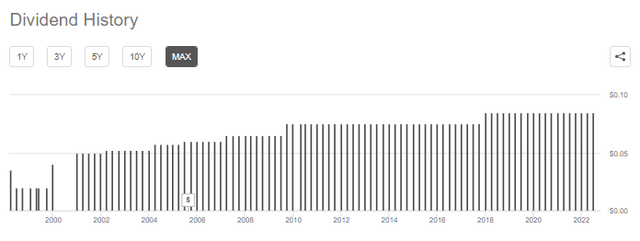

They aren’t the only operation to provide desalination solutions. However, they are one that also provides some yield in a fairly consistent manner. The trend has been gradually increasing over the years. However, it is the traditional annual increase that we often see. For me, that’s quite alright as long as it’s heading in the right direction.

CWCO Dividend History (Seeking Alpha)

The company has been growing its revenue for most of the last several years. That should often bode well for the underlying earnings. COVID-19 impacted the company’s operations, but that is to be expected. We can also see that the services segment is becoming a larger and larger portion of their business.

CWCO Revenue (Consolidated Water)

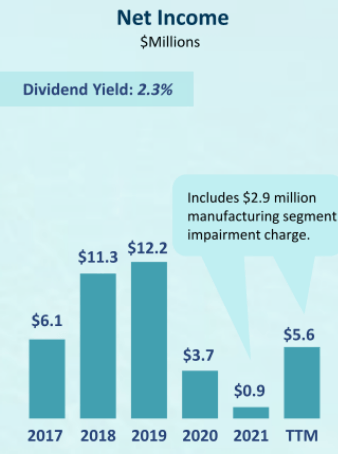

I would also note that while revenue had been growing consistently – and it looks set to continue growing again after COVID – that the net income has taken a big hit. The reasons have to do with what is one of the risks of this company. That’s the size, and how one or two setbacks can have an outsized impact.

As they show, the manufacturing segment impairment charges had been quite substantial.

CWCO Net Income (Consolidated Water)

Here is what they had to say in the earnings call for Q2 2021:

Our manufacturing segment revenue declined due to the loss of orders from Aerex’s largest customer, as we have also discussed last quarter. However, while this customer informed us in July 2021, that they expect to recommence their orders in 2022 and subsequent years, we expect that these new orders will be at much lower volumes than in the past and less than what we anticipated previously. It was this change in projected future revenue, along with the continuing weakness in the economy arising from COVID 19 that required us to record an impairment loss in the second quarter for our manufacturing segment.

That was just one setback. There was also a canceled desalination plant in Mexico, and they’ve confirmed they are in continued discussions to resolve the issues potentially. Then, proceed with hoping to address Mexico’s water shortage issues.

When dealing with a small company, any disruption such as this can have a meaningful impact. In this case, it was sizeable, but they are continuing to move past this now. They are working towards a project in Hawaii, as mentioned in the latest call:

We’re currently pursuing some major wastewater recycling projects and in June, our bid for a multi-decade design-build-operate seawater desalination project in Hawaii was submitted, and we’re currently awaiting the resolution of the Hawaii bidding process.

This project in Hawaii is very comparable to the types of projects that we’ve been successfully completing in the Caribbean for many years. We believe our extensive experience in designing, building and operating these seawater desalination plants allowed us to be shortlisted to bid for this major project.

They are also looking toward expanding projects in other southwest U.S. states. They aren’t immune to the supply chain impacts either, with materials and equipment being mentioned as reasons for delays. They don’t mention labor as a challenge, but I’d presume that it is and that it is also impacting certain areas.

All of this is to reiterate that the company is small and at the mercy of projects falling through. However, analysts believe they can continue to grow their earnings. The demand is definitely there and isn’t going away anytime soon. The latest earnings had EPS for the quarter coming in at $0.18, with revenue increasing 26.3% year-over-year. So there is coverage there and the company is returning to growth and profitability once again.

Given the record of their dividend, they seem to hold it in a bit of importance, since they could simply cut out the dividend and utilize all that capital for acquisitions or further invest in their operations.

Conclusion

This stock is an interesting play in the water processing space. Demand for freshwater only continues to grow with the human population expanding. Droughts worldwide only seem to be worsening, making a company like CWCO even more essential.

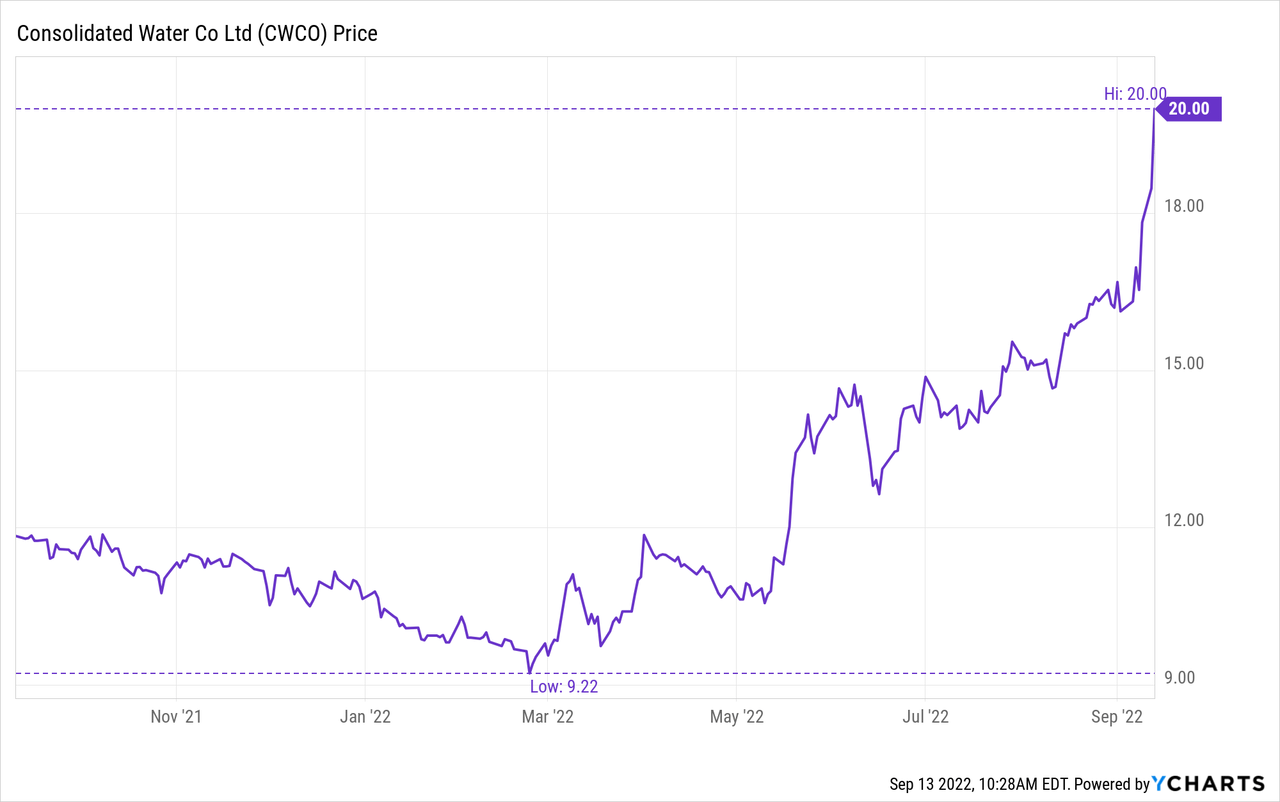

As a small operation, they are at the mercy of setbacks that only one or two projects can bring on. Additionally, I believe that the current run-up in the stock price is why I’m more comfortable putting this on my watchlist and not jumping in to buy today.

The stock is pushing its 52-week-high. In fact, it is surging higher at the time of writing, but I wasn’t able to find any specific news.

On the other hand, other metrics suggest we have more upside to go. Only two analysts provide a price target, which they put at $19.50. So on that basis, they suggest that there is still quite a bit of upside.

Additionally, the P/E valuation suggests that we are right around fair value. If earnings rise as projected, we could see the stock head higher anyway.

CWCO Fair Value (Portfolio Insight)

With the volatile market, I’m comfortable sitting back and waiting for a better entry. I think there is quite a bit to be optimistic about, though.

Be the first to comment