Liudmila Chernetska/iStock via Getty Images

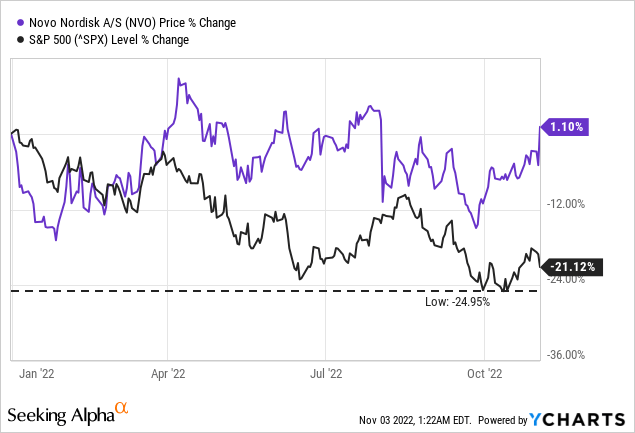

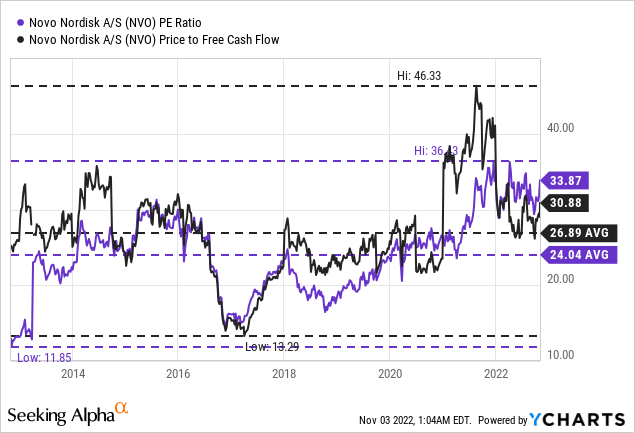

When looking at the list of high-quality businesses, Novo Nordisk (NVO) is certainly not the cheapest stock one can buy. Trading for valuation multiples above 30, Novo Nordisk is rather expensive. On the other hand, Novo Nordisk could clearly outperform the S&P 500 (SPY) year-to-date and increased 1% in value while the S&P 500 is now down about 21%.

And the performance is certainly not surprising as Novo Nordisk can be seen as resilient during recessions (one might be even tempted to call it recession-proof). But despite the great performance, we should be careful not to overpay for a business – especially as several other high-quality businesses are cheaper right now.

Quarterly Results

Novo Nordisk reported quarterly results on Wednesday and the growth rates were impressive once again. For starters, Novo Nordisk could increase sales from DKK 35,622 million in Q3/21 to DKK 45,566 million in Q3/22 – resulting in 27.9% year-over-year growth. And Novo Nordisk clearly profited from exchange rates and the strong USD, but growth was still 15% at constant exchange rates. Operating profit also increased 32.4% year-over-year from DKK 15,249 million in the same quarter last year to DKK 20,184 million this quarter. And finally, diluted earnings per share increased from DKK 5.27 to DKK 6.34 (20.3% year-over-year growth). Additionally, the operating profit margin improved from 42.8% in the same quarter last year to 44.3% this quarter.

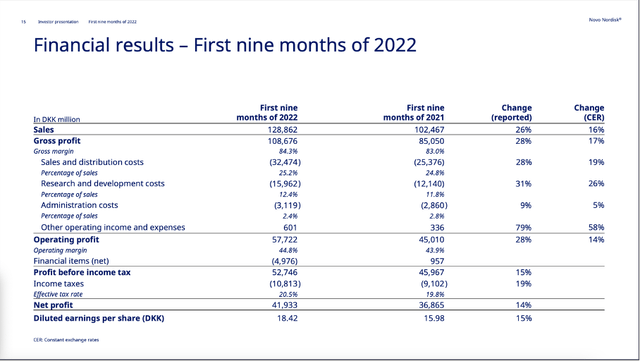

And when looking at the results for the first nine months of fiscal 2022, we see similar impressive growth rates as Novo Nordisk is outperforming for several consecutive quarters now.

Novo Nordisk Q3/22 Presentation

Novo Nordisk also increased its full-time equivalent employees from 46,982 at the end of Q3/21 to 52,696 at the end of Q3/22. And Novo Nordisk’s market share in the important diabetes GLP-1 market is also increasing. One year earlier, the global market share was 52.1% and improved to 55.7% in August 2022.

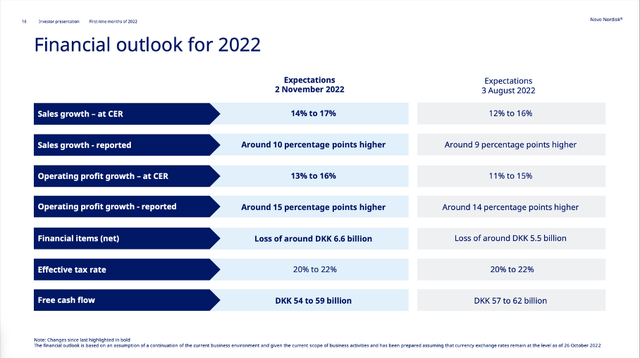

Guidance and Acquisition

As a result of the strong quarterly results, Novo Nordisk updated its guidance for fiscal 2022 once again. Sales at constant exchange rates are now expected to grow between 14% and 17% (compared to 12% to 16% growth before). And operating profit is now expected to grow between 13% and 16% (at constant exchange rates) compared to 11% to 15% before.

Novo Nordisk Q3/22 Presentation

Free cash flow on the other hand is expected to be only between DKK 54 billion and DKK 59 billion (instead of DKK 57-62 billion in the previous guidance). The lowered guidance is reflecting the acquisition of Forma Therapeutics, Inc. which Novo Nordisk acquired recently for DKK 8,098 million (all cash transaction). Forma Therapeutics is a clinical-stage biopharmaceutical company focused on sickle cell disease and rare blood disorders. The company’s lead development candidate is etavopivat.

Segment Results

When looking at the segment and regional results for Novo Nordisk, we can see high growth rates almost everywhere we look. And it is especially great to see North America Operations to perform great again. In the first nine months of 2022, sales increased 37% to DKK 64,447 million (22% growth at CER) and in Q3/22 sales also increased 37% to DKK 23,754 million (18% growth at CER). When considering the struggle of Novo Nordisk in North America only a few years ago (see article from 2019 for example), these are impressive numbers.

Novo Nordisk Q3/22 Presentation

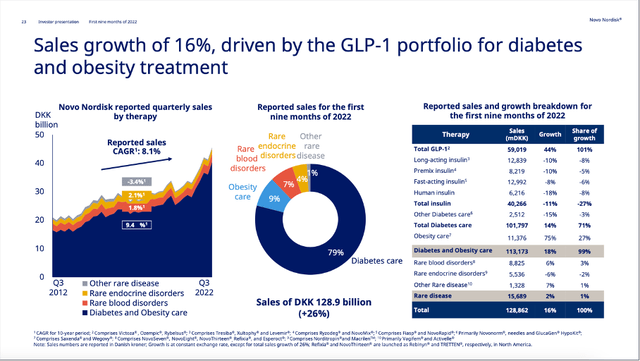

When looking at the different segments, we can start by looking at Rare Diseases, which increased sales from DKK 14,490 million in the same timeframe last year to DKK 15,689 million resulting in 8.3% year-over-year growth and 2% growth in constant exchange rates (all numbers are 9M numbers).

The other segment, Diabetes and Obesity Care increased sales from DKK 87,977 million in the first nine months of 2021 to DKK 113,173 million in the first nine months of 2022 – resulting in 28.6% year-over-year growth. At constant exchange rates, sales increased 18%. And when looking at Diabetes and Obesity Care, it was especially GLP-1 and Obesity care which drove growth while total insulin sales declined from DKK 42,033 million to DKK 40,266 million – a reported decline of 4%.

The biggest driver of growth are still the GLP-1 sales with total GLP-1 sales increasing from DKK 37,225 million to DKK 59,019 million (58.5% reported growth and 44% growth at CER). While Victoza sales declined from DKK 11,221 million to DKK 8,999 million, sales for Rybelsus increased to DKK 3,015 million (140% reported growth) and Ozempic sales increased to DKK 42,774 million (86% reported growth).

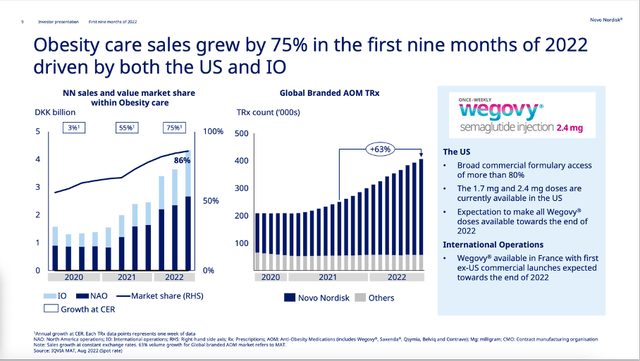

A second driver of growth is total obesity care, which saw sales increase from DKK 5,941 million to DKK 11,376 million resulting in reported growth of 91% year-over-year (in constant exchange rates, growth was still 75%). And while Saxenda could still report 43% growth, it was especially Wegovy with sales increasing sixfold that drove growth.

Continuous Growth

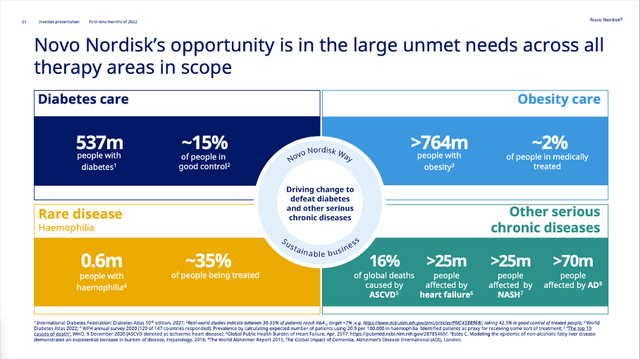

And we should not expect similar high growth rates for the years to come – revenue growth above 20% might be achievable for Novo Nordisk in some years but is certainly not the norm. Nevertheless, Novo Nordisk is operating in markets with huge demand.

Novo Nordisk Q3/22 Presentation

Especially in obesity care, we are looking at more than 764 million people with obesity (according to Novo Nordisk) and only about 2% are medically treated. As I have written in my last article, Novo Nordisk is expecting obesity care sales to be at least DKK 25 billion in 2025. But the company might reach this target already in 2024. Novo Nordisk will probably generate already about DKK 14 billion in obesity sales in 2022. Additionally, we must keep in mind, that Wegovy sales were lower in 2022 as they could have been due to the availability of filling syringes. The company is expecting to make all dose strengths available in the United States towards the end of 2022. Additionally, Wegovy will be available in France towards the end of 2022 – the first ex-U.S. commercial launch although it was already approved in November 2021.

Novo Nordisk Q3/22 Presentation

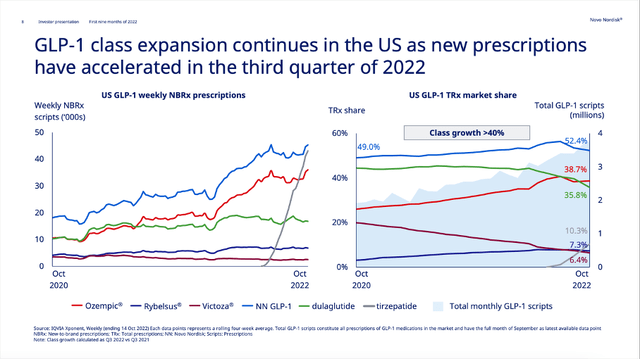

The GLP-1 market increased 37% year-over-year from 2020/2021 to 2021/2022 (see slide 40 Q3/22 presentation) and it seems likely for the market to continue growing in the years to come. Right now, about 4% of total diabetes prescriptions use a GLP-1 (United States: 10%; EMEA: 4%). And Novo Nordisk is now facing strong competition due to tirzepatide invented by Eli Lilly and Company (LLY) and marketed under the name Mounjaro. When looking at the number of weekly NBRx scripts in the United States, Mounjaro reached similar prescription numbers as Rybelsus within a few short months and surpassed Ozempic in prescription numbers.

Novo Nordisk Q3/22 Presentation

And although Mounjaro is available since June 2022 in the United States, we don’t see a slowdown in GLP-1 sales for Novo Nordisk. In Q3/22, GLP-1 sales increased 62% year-over-year compared to 59% YoY growth in Q2/22 and 54% YoY growth in Q1/22.

In my opinion, we can be confident that obesity sales as well as GLP-1 sales will continue to grow with a high pace in the next few years and drive growth for Novo Nordisk.

Intrinsic Value Calculation

Despite all these great numbers and results one problem remains: Novo Nordisk is trading for rather high valuation multiples and probably above its intrinsic value. When taking the company’s own guidance for free cash flow (midpoint of guidance is DKK 56.5 billion in FCF), Novo Nordisk must grow almost 11% for the next ten years followed by 6% growth till perpetuity to be fairly valued right now (2269 million outstanding shares, 10% discount rate). Of course, we can point out that the free cash flow is after acquisition expenses which is untypical, and Novo Nordisk is certainly able to grow 11% annually (it grew with a CAGR of 13.21% in the last 10 years), but I don’t want to bet on such a scenario.

Novo Nordisk could be fairly valued and climb even higher. In an article published one year ago I argued that Novo Nordisk could climb as high as DKK 1,000:

Right now, I would consider it a realistic possibility that Novo Nordisk will climb as high as DKK 1,000. Not only is this a psychological barrier, which could lead to a correction, we also have the 2.61 Fibonacci extension at DKK 1,015 and at this point we could see a steeper correction again.

And while it certainly seems like a possibility for Novo Nordisk to climb as high as DKK 1,000, a correction in the next few months is a scenario with a high probability (maybe Novo Nordisk will reach DKK 1,000 first). Targets for such a correction could be around DKK 600 where we find lows from late 2021/early 2022. And Novo Nordisk could also go back to DKK 400-450 – the previous break out level with the highs from 2015. I don’t know if such a scenario is likely as Novo Nordisk is pretty resilient in case of a recession. But the combination of a global recession and bear market as well as investors panicking could lead to much lower valuation multiples for almost all stocks.

And Novo Nordisk trading for 31 times free cash flow and 34 times earnings is not only above the 10-year average for Novo Nordisk (which has always been rather “expensive”), but a valuation multiple that investors are not willing to pay in case of a global recession and bear market. A decline to about 15 times earnings/free cash flow seems likely in such a scenario – even for a high-quality business like Novo Nordisk.

Conclusion

Novo Nordisk remains one of the best businesses in the world and not only is the company reporting impressive growth rates on the eve of a global recession when most other businesses are already showing signs of weakness. The stock is also outperforming the S&P 500 by a lot. Nevertheless, the stock is trading for high valuation multiples and is certainly not a bargain. At this point, I would rather wait for a setback before entering a position or adding to an existing position – despite dealing with one of the best businesses in the world.

Be the first to comment