Alex Wong

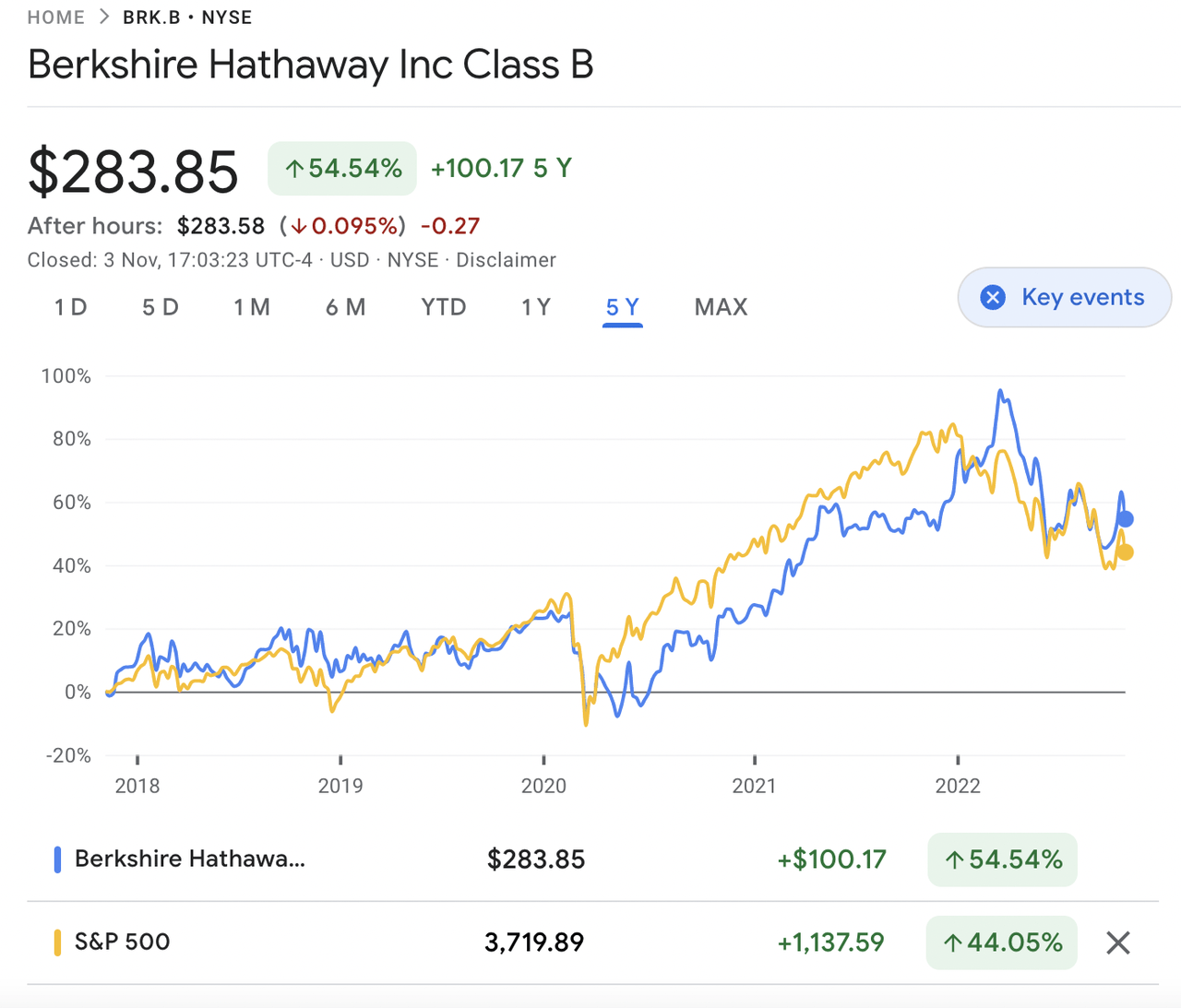

Berkshire Hathaway (NYSE:BRK.B) has been among the best-performing mega cap stocks of 2022. Down only 3.8% for the year, it is far outpacing the S&P 500. In a year that has seen wild price volatility and many 10%-20% dips in large cap stocks, Berkshire’s stability has stood out.

Berkshire’s success this year comes down to two main factors:

-

Overall financial structure.

-

Specific bets on energy stocks and Apple (AAPL).

First, the financial structure. Berkshire Hathaway’s balance sheet boasts $26.5 billion in cash, $74 billion in treasuries, $76.4 billion in total borrowings, $440 billion in liabilities, $909.86 billion in assets, and $469 billion in equity. This yields an incredibly low 0.162 debt/equity ratio, and an amount of assets that vastly outstrips liabilities. The solvency observed here is second to none. In addition, Berkshire has more in cash and treasuries combined than it has in debt, so it scores well on liquidity too.

Second, there are some specific bets that have driven interest in Berkshire Hathaway this year. Warren Buffett, the CEO of Berkshire, has been betting heavily on energy this year, buying up huge stakes in Occidental Petroleum (OXY) and Chevron (CVX). Energy has been the best performing sector of 2022, so those bets are working out for Buffett. Apple has also been a comparatively strong performer for Buffett this year. It’s down this year, but it has performed better than any other FAANG stock, and Buffett’s been adding to the position as the stock falls. The AAPL that Buffett held at the start of the year has underperformed the market, but the fresh 2022 buys may have out-performed the S&P 500, as they were bought after a prolonged first-quarter dip.

So, we’ve got a financially sound company whose individual bets are working out. It should come as no surprise that Berkshire is beating the market this year. However, it’s one thing to note that Berkshire is outperforming, and another to say it will continue. Berkshire famously went on a decade-long streak of underperformance during the 2010s/early 2020s tech bubble. During the bubble, many pundits were adamant that Buffett had lost his touch. Now, Berkshire is outperforming year-to-date, and over five years. The latest developments seem encouraging, but a major dip in oil prices or a poor earnings release from Apple could easily cause short-term volatility. Berkshire is very resilient, but it’s not immune to the kind of volatility that causes panic selling. Like all stocks, it is “risky” from the perspective of an investor who believes that volatility and risk are synonymous.

Berkshire hathaway vs the S&P 500 (Google Finance)

Nevertheless, Berkshire Hathaway is a solid bet for pretty much anybody who has the stomach to invest in common stocks. It has a strong balance sheet, excellent leadership and a proven track record. These qualities suggest that its future is even brighter than its illustrious past.

Competitive Landscape

It’s not possible to do a complete competitive analysis for Berkshire Hathaway because it operates in so many verticals that it’s basically in competition with the entire S&P 500. However, we can narrow in on two of Berkshire’s assets to gauge its position in the market:

-

The insurance business.

-

The equities portfolio.

We can use Berkshire’s competitive advantage in insurance to gauge how well that part of the business is likely to do going forward. Also, we can take Berkshire’s equity portfolio as a proxy for how Berkshire’s operating businesses are likely to perform, since Buffett picks individual businesses by the same standards he uses for stocks.

First, the insurance business.

Berkshire Hathaway has countless advantages in insurance. Some of the key ones include:

-

Compensation policy. Buffett famously avoids incentivizing insurance agents to chase bad policies, leading to Berkshire’s insurance companies realizing profits in years when the industry is in the red. He does this through a sales philosophy that emphasizes quality (of the individual prospect) over quantity (of prospects).

-

Specialty insurance. Berkshire offers a number of types of insurance that not just every insurance company can boast. For example, marine insurance and life science insurance. These forms of insurance are fairly unique, giving Berkshire a moat in the specialty part of its insurance business.

-

Lucrative investments. Berkshire’s insurance segment has the entire BNSF railway as part of its capital. This is an equity investment that produces growing profits over time, which is much better than the fixed coupons most insurance companies’ bond investments pay. And, because it is wholly owned, it is not subject to price fluctuations that might make some shareholders nervous.

Next up, we have Berkshire’s equity portfolio. It has compounded at 20.1% annualized over nearly 60 years, with a cumulative return 120 times greater than that of the S&P 500. Warren Buffett has said that his out-performance is due to picking stocks with strong competitive advantages, high cash flows, and high returns on equity. Given that competitive advantages are among Buffett’s investing criteria, and his equity investments have worked out, it appears likely that Berkshire’s wholly owned businesses have competitive advantages too. BNSF, for example, got a ‘wide moat‘ rating from Morningstar (MORN) when it was still a publicly traded company. It appears likely that other Berkshire subsidiaries would have the same distinction if they were publicly traded. We can see clearly that Berkshire’s insurance companies have competitive advantages, and if Berkshire’s businesses are picked by the same criteria as its stocks, the non-insurance companies have competitive advantages too.

Recent Performance

Next up, we can look at Berkshire’s recent performance and valuation.

In the most recent quarter, Berkshire Hathaway delivered:

-

$76 billion in revenue, up 10%.

-

($55 billion) in earnings before taxes, down from a $35 billion profit.

-

($43.7 billion) in net income, down from a multi-billion dollar profit.

-

($19.84) in class B share EPS, down from $12.33 in positive EPS.

-

$15 billion in cash from operations, down 21%.

These metrics look rough on the surface, but keep in mind that GAAP accounting rules require companies to report unrealized stock losses as if they were realized losses. If you add the $66.9 billion in stock market losses back to net income you get to $23.5 billion in adjusted net income, which is pretty good for a company of Berkshire’s size.

As for the long term growth and profitability, Seeking Alpha Quant reports the following CAGR growth rates over the last five years:

-

Revenue: 4.33%.

-

EPS: -9.88%.

-

Book value: 13.94%.

-

3.8% in cash from operations from 2016 to 2021 (this metric calculated by the author).

As you can see, this year’s stock price slide was enough to pull five year earnings growth into the negative territory, but with Buffett’s oil bets starting to pay off, that could turn around as soon as the Q3 release. In the meantime, Berkshire stock looks moderately cheap. It currently trades at 2.25 times sales, 1.4 times operating book value, and 18 times operating cash flow. These aren’t the cheapest multiples on earth, but they’re cheaper than a lot of stocks out there. Today’s stock price will certainly look cheaper than it does now if Buffett’s oil bets cause book value to increase in the upcoming earnings release.

Risks and Challenges

As we’ve seen, Berkshire Hathaway has a great management team, a modest valuation, and decent growth if you exclude non-cash factors. It’s a pretty compelling picture. However, there are risks and challenges to be aware of, including:

-

Natural disasters. The past year has witnessed a lot of natural disasters, from Hurricane Fiona to China’s numerous earthquakes. Berkshire Hathaway does a lot of property and casualty insurance, so it is vulnerable to an increase in claims when natural disasters rise in frequency.

-

Earnings-related volatility. Berkshire Hathaway has an enormous stock portfolio whose market price fluctuates every business day. This portfolio is big enough as a percentage of Berkshire’s total value that it can cause negative GAAP earnings when it goes down. We saw that happen in the second quarter. Over time, these accounting technicalities tend to even out, but for the risk-averse short term investor, the possibility of post-earnings volatility might rule out Berkshire Hathaway as a potential investment.

-

Succession. Greg Abel is set to take over from Warren Buffett when Buffett steps down. Abel works in Berkshire’s energy business, he isn’t part of the stock picking team in the insurance business. It isn’t clear that Abel will be able to pick stocks outside of the energy sector as well as Buffett has, although Berkshire could compensate for that by having Todd and Ted take over a larger portion of Berkshire’s equity portfolio.

A prudent investor should keep these risks and challenges in mind. Warren Buffett is a legend, but Berkshire Hathaway is as susceptible to volatility as any other common stock. If your goal is to invest in a portfolio of profitable businesses over the long term, then Berkshire might meet your needs. If you seek an investment totally free from volatility, BRK.B will not suffice.

Be the first to comment