winnond/iStock via Getty Images

Article Thesis

Medical Properties Trust (NYSE:MPW) has dropped to a new multi-year low this week. At current prices, the healthcare REIT is priced for perpetual declines in its operating metrics — even though that seems like an unlikely scenario. I do believe that the 8.5% dividend yield is sustainable and think that MPW has a lot of upside potential over the coming years once things normalize and the current market panic has ended.

A Tough Year For MPW Stock

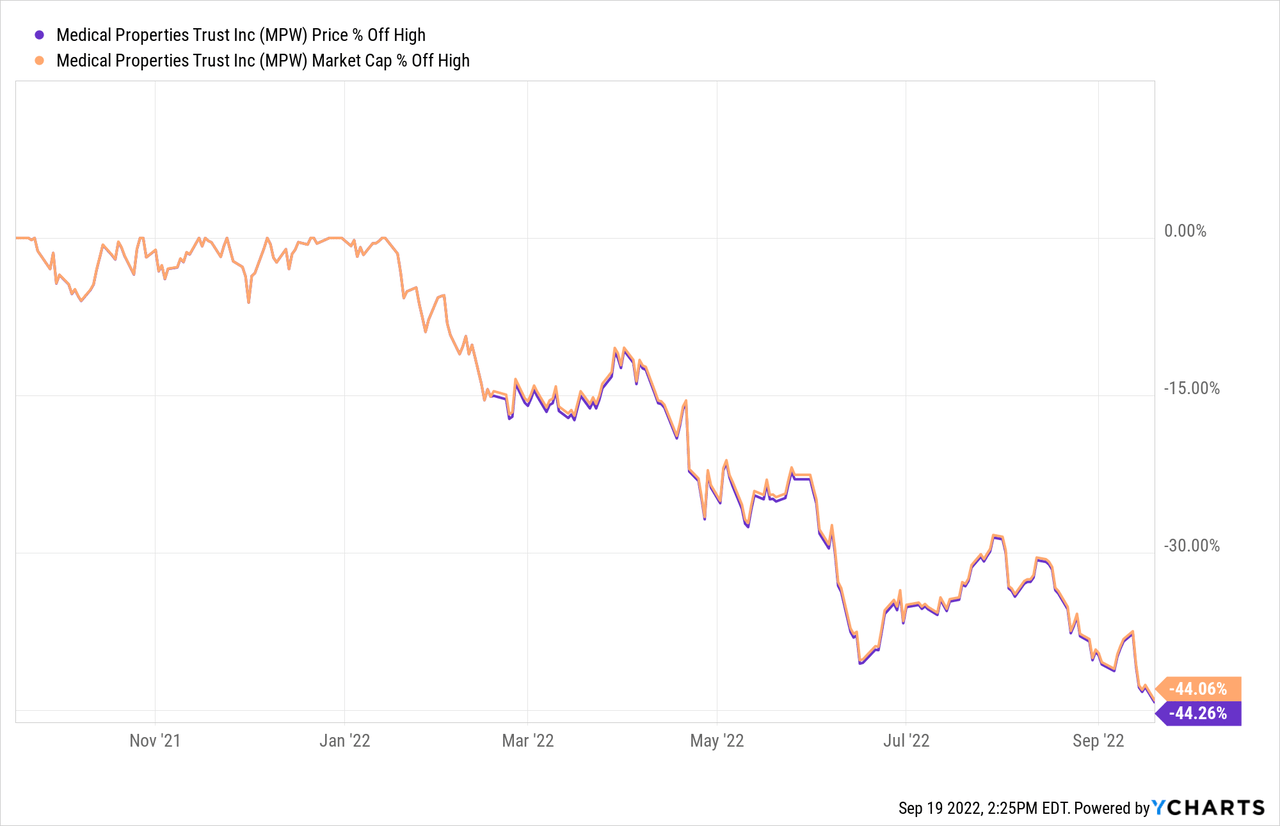

If one looks at Medical Properties Trust’s share price, one might guess that the company is experiencing a big hit to its top or bottom line:

Both Medical Properties’ share price and its market capitalization have dropped by 44% from the 52-week high. In other words, the market-ascribed value of the company has roughly been cut in half. And since the share count has not changed meaningfully, this was not the result of dilution, which sometimes is the case with other companies that experience a steep share price decline.

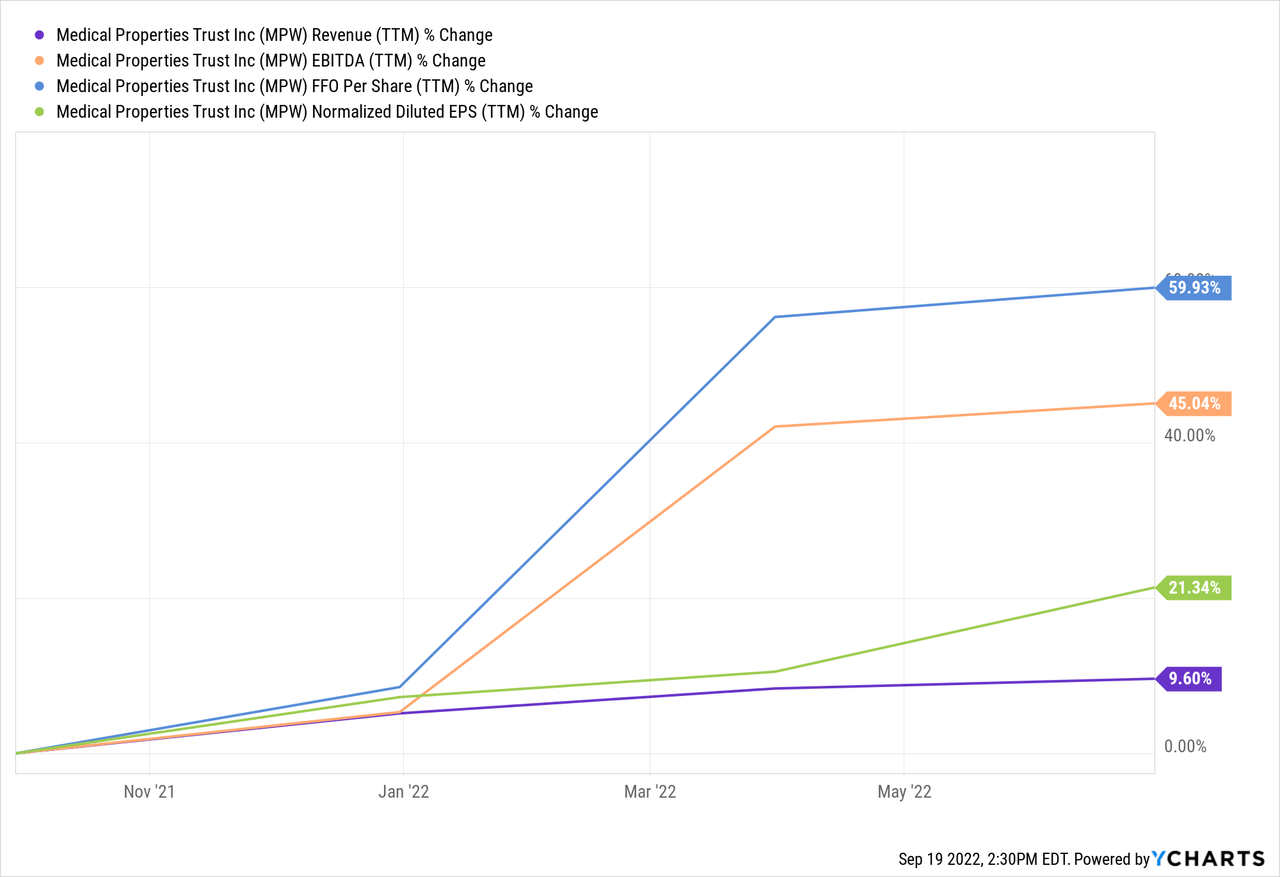

Did Medical Properties Trust’s revenue get cut in half as well? It didn’t, and neither did its profit, EBITDA, or cash flow:

All metrics have been moving in the right direction over the last year: Medical Properties Trust’s revenue is up, and its EBITDA, funds from operations per share and earnings per share all rose substantially. There also was no dividend cut, which might have been a good reason for a sell-off in case it had occurred. But MPW did actually increase its dividend by around 4% over the last year, so the sell-off can’t be explained by income investors fleeing from the stock.

So if Medical Properties’ fundamentals have been moving in the right direction over the last year, why has the stock performed so badly? There are a couple of reasons that explain the market’s weak sentiment when it comes to MPW. But I personally do not believe that they are fundamental enough to warrant a price cut of almost 50%. I thus do believe that the current sell-off is overblown and that investors are presented a buying opportunity in this high-yielding income stock that is now trading at a very undemanding valuation.

Tenant Worries

One of the reasons for weak sentiment among MPW investors is the fact that some of its tenants aren’t in a strong financial position. This brings up some questions about whether the REIT will receive full rent from all of its tenants in the future. In general, that’s a valid concern with REITs that have tenants of questionable quality/financial health. But in MPW’s case, I do not think that this issue is too concerning.

A mall REIT might see one of its tenant go bankrupt, and if it is a lower-quality mall, it’s possible that no other retailer wants to enter that now-vacant retail space as retailers might be inclined to reduce their overall brick-and-mortar footprint as e-commerce becomes more important. But in MPW’s case, that does not seem like an overly realistic scenario. The REIT owns hospitals, and those are located in places where many people live. Those people will require hospital services, no matter what. Acute care, surgeries, and so on can’t be done online or via a video conference, so it seems unlikely that hospitals will close down and not get replaced. Thus even if one of MPW’s tenants were to go bankrupt, the hospital service in that area or region would have to be offered by someone else, who would likely move into MPW’s existing infrastructure/property as this would make more sense than to build a new hospital in a time-consuming and costly manner.

It’s also worth noting that the rent coverage of many of Medical Properties Trust’s tenants isn’t as bad as some investors seem to believe. The tenant investors focus on the most is Stewart. Stewart’s rent coverage (on an EBITDARM basis) was 2.8 in 2021, which means that Stewart was able to cover its rent well on a property-level basis. In its recent August investor update, Medical Properties Trust showed that things are improving at Stewart:

Improving profitability, declining costs, and volume gains are positives for Stewart. Most importantly, it looks like Stewart will see its free cash flows rise meaningfully towards the end of the current year, which naturally will reduce all Stewart-related risks for Medical Properties Trust — a company that generates surplus cash will not have any problems when it comes to rent payments, after all.

Likewise, other tenants had solid rent coverage as well, including Prime with a pretty strong 5.2 rent coverage ratio. It should be noted, however, that some other tenants’ coverage ratios were weaker, such as Priory with a 1.8x reading.

Nevertheless, the tenant issue is not dramatic enough to warrant a share price cut of close to 50%, I believe. Quite the contrary — rent coverage looks solid overall, and in case a tenant goes bankrupt, another hospital company will most likely take its place — it’s unlikely that areas or regions will suddenly not have any access to hospital services any longer at all.

The Rates Impact

Another reason that might explain the sell-off in Medical Properties Trust is the increase in interest rates. In theory, that can have a negative impact on companies with significant debt loads. Most REITs belong to that group of stocks, including Medical Properties Trust. But again, worries seem overblown once we take a deeper look.

First, Medical Properties Trust operates with long average maturity times when it comes to the money it borrows. An increasing interest rate does thus not impact MPW meaningfully in the near term. Instead, it will take many years until MPW will have refinanced all of its loans, thus rising interest rates aren’t a near-term issue.

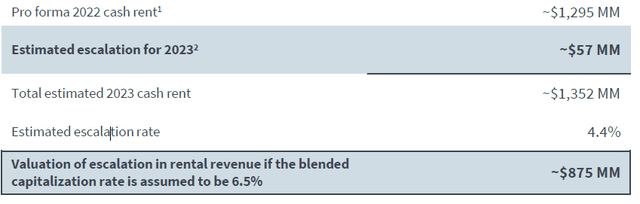

Second, the increase in interest rates is the result of high inflation. And high inflation is beneficial for Medical Properties, as high inflation inflates away the company’s debt in real terms over time. On top of that, high inflation also leads to an attractive rent escalation pace for Medical Properties Trust:

MPW presentation

A 4%-5% rent escalation rate increases MPW’s cash flow meaningfully, all else equal. As shown above, it also generates close to $1 billion in theoretical value at a capitalization rate in the 6%-7% range, all else equal. Thus while rising interest rates have a negative impact on MPW in the long run, once its debt needs to be refinanced, the reason for those rising rates — inflation — has a clear positive impact on MPW in the near term.

An Ultra-High Yield At A Low Price

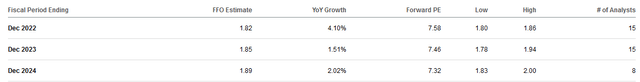

Overall, Medical Properties Trust seems to be positioned to deliver solid results this year and beyond. That’s why the company is forecasting solid FFO per share growth this year. Wall Street agrees, as MPW is expected to hit new record-high FFO per share levels this year according to the analyst consensus:

Sure, 4% FFO growth isn’t extraordinary, and neither is 2% annual growth in 2024 and 2025. Estimates are lower compared to the growth MPW has delivered in the past, as MPW’s current cost of equity is higher than it used to be. This makes it more complicated for the company to find and pay for accretive deals, which is why future growth will likely be less pronounced compared to the past.

But at current valuations, even 2%-4% annual growth is more than enough. Medical Properties Trust trades at just 7.5x FFO, which pencils out to an earnings yield of around 13%. Even if there was no growth at all, investors could expect total returns in the double-digits, assuming MPW would pay out all of its FFO to investors directly (via dividends or buybacks) or indirectly, via debt reduction that moves value from debt holders to equity investors.

The current dividend yield alone is 8.6%. Even if there was no dividend increase ever again, and if there was no share price increase ever again, MPW would arguably be a very solid investment, offering a high-single-digit return while being active in a recession-resistant industry. Between the high dividend yield, MPW’s potential for future dividend increases thanks to some FFO growth and a non-demanding payout ratio of 64%, and the potential for share price appreciation, I believe that MPW is a compelling pick at current prices. The interest rate worries should wane eventually, and as Stewart’s financials improve, tenant worries should wane as well. In that case, MPW has considerable upside potential. Even a 50% share price increase would result in an FFO multiple of just 11, which doesn’t seem high. In the meantime, I’m happy collecting an 8%+ dividend yield.

Be the first to comment