Robert Way

Thesis

Alibaba Group Holding Limited (NYSE:BABA) reported a better-than-expected Q1’23 earnings release that helped stanch the decline of its stock due to the recent delisting fears.

We discussed in our pre-earnings article that the downside volatility induced by the delisting fears presented a fantastic opportunity for investors to add exposure. Notably, BABA held its July lows resiliently above its March and May lows, indicating selling exhaustion could be near.

Management also offered confident commentary that suggests further improvement in its revenue growth moving forward. In addition, Alibaba’s cost optimization strategies have also been executed well, setting up the recovery of its operating profitability, despite challenging macros in China.

Therefore, unless a significant COVID outbreak leading to a nationwide shutdown occurs again in China, we believe the risk/reward profile is increasingly tilted to the upside. Along with an improving regulatory climate, Alibaba’s current valuation supports a re-rating as consumer sentiments improve moving forward.

Furthermore, the company has proved that its execution prowess remains robust as it continues to generate resilient free cash flow. Moreover, Alibaba’s competitive moat as China’s leading commerce player is also unquestioned, as it focuses on monetizing its 1B annual active customers (AAC) base.

Therefore, we believe BABA is looking increasingly attractive fundamentally and technically. Accordingly, we reiterate our Buy rating and urge investors to use the recent downside volatility to add more positions.

Alibaba’s Fundamentals Remain Robust Despite Massive Headwinds

Alibaba posted a flat topline growth in Q1, which came ahead of the Street’s consensus. Notably, Alibaba also posted an operating margin well ahead of the consensus estimates (very bullish), indicating the company’s strong execution of its cost optimization strategies. CFO Toby Xu accentuated (edited):

We’ve implemented a whole range of different cost optimization strategies across our different businesses. And I think certainly what you’re seeing this quarter is that this overall cost control strategy has been paying off with good results. In the coming quarters and the remainder of this fiscal year, we will continue to pursue the strategy of cost optimization and cost control. We’re also in a financial position that allows us to have considerable flexibility in terms of our approach. And certainly, as we continue to optimize our cost structure and drive further efficiencies, the improvements will be reflected in our EBITA margin. And we expect that as we further pursue high-quality growth and high-efficiency growth, we’ll continue to achieve that kind of improvement in our EBITA margin. (Alibaba FQ1’23 earnings call)

Furthermore, Alibaba continued to generate strong free cash flow despite significant headwinds. Therefore, we are confident that its competitive moat as China’s leading commerce player remains intact. Accordingly, it should help Alibaba drive a more robust recovery as China’s consumer spending headwinds stabilize moving forward. Xu articulated (edited):

We continue to maintain a strong net cash position of $51B. Our strong net cash position is supported by robust cash flow generation, as we generated $3.3B in free cash flow. The most valuable asset that Alibaba has as a company, is that consumer mind share. We don’t need to be paying money to induce the consumers to come back. Our DAU figures and page views have remained relatively stable throughout the period. So we have 1B consumers within our AAC user base and a strong differentiated matrix of different apps, and this positions us to further improve that mind share and capture the opportunities. (Alibaba earnings)

Buy BABA When The Chips Are Down

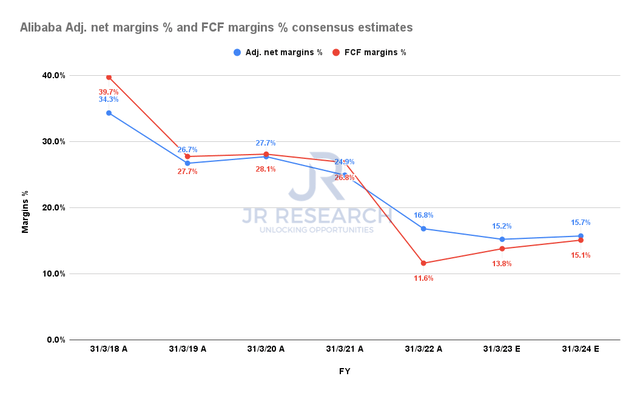

Alibaba adjusted net margins % and FCF margins % consensus estimates (S&P Cap IQ)

Therefore, we are confident that the consensus estimates that suggest a bottom in Alibaba’s profitability profile in FY22 (the previous FY) are credible. Notably, Alibaba is projected to post an improvement in its FCF margins through FY24, further undergirding its valuations.

However, we believe that Alibaba will unlikely post the massive revenue growth it delivered in the pre-crackdown years. Therefore, its renewed focus on driving higher-quality profitability improvement will be critical to sustaining its valuation moving ahead. As such, investors are urged to continue monitoring the results of its cost optimization strategies.

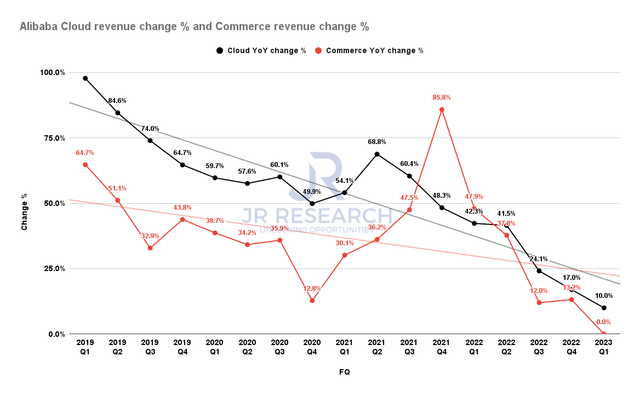

Alibaba commerce revenue change % and cloud computing revenue change % (Company filings)

Furthermore, Alibaba has continued to make good progress in the profitability of its cloud computing segment as it scales up. Nonetheless, the macro headwinds and slower enterprise spending from Internet companies have impacted its cloud’s growth cadence. As a result, it has continued a marked downtrend in its cloud computing growth, as Alibaba posted a revenue increase of just 10% YoY in FQ1.

However, we believe the below-trend growth (as seen above) should normalize moving forward as cloud computing is a secular opportunity for Alibaba beyond just Internet companies. CEO Daniel Zhang emphasized that it has been making solid progress in penetrating non-Internet verticals, as it added (edited):

So I think in this regard, it’s not a cyclical opportunity. It’s like a structural opportunity. And so that’s why I think in China and in the global market, we are actually repositioning cloud as one of our core strategies. And now we are very happy that we are in the leading position in this sector. With the slowdown of the Internet sector and many people talk about what’s the next generation after this consumer Internet. Actually, the consensus is very straightforward. It’s industrial digitalization. We are coming to an era where every company becomes a digital company. So that’s why we highlighted the revenue contribution from non-Internet companies, where we improved by 5 percentage points as compared to the same quarter last year. (Alibaba earnings)

Is BABA Stock A Buy, Sell, Or Hold?

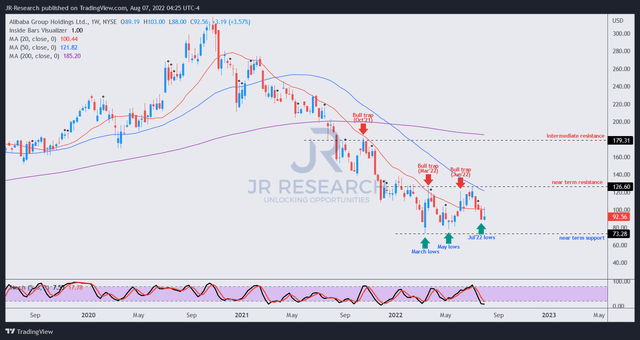

BABA price chart (weekly) (TradingView)

As seen above, BABA has fallen markedly from its near-term resistance of $120, which has been a critical source of buying momentum failure in 2022.

However, we noted that BABA had held its July lows firmly above its March and May lows. Therefore, the selling downside in BABA stock seems to be fading out, as dip buyers came in to support the buying upside.

We believe its valuation is attractive for a stock that last traded at an FY24 FCF yield of 9.41% (Vs. all-time average of 4.36%). Therefore, we urge investors to add more positions to capitalize on its recent downside volatility.

As such, we reiterate our Buy rating on BABA.

Be the first to comment