mixetto/E+ via Getty Images

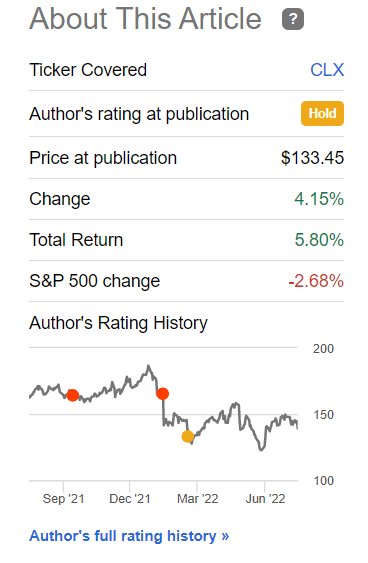

When we last covered The Clorox Company (NYSE:CLX), we did a small pivot. After 18 months of relentlessly bearish articles, we saw a “hold” rating as more appropriate.

Today, we don’t see CLX presenting the same downside risks as it did 18 months back. Sure, we could stay in the bear camp longer but the risks tend to increase if one presses their call this far below the 200-day moving average. The thesis has also fulfilled its potential and the risks remain that this is priced-in for the medium term. We are upgrading this a neutral/Hold rating today. While the downside risks have diminished, we still think a lot of work needs to be done to establish CLX as a bull play.

Source: Peak Inflation Pressures

That was a good point to pivot and certainly there were risks in pressing the downside that late in the game.

Seeking Alpha

But as we looked at CLX’s most recent results, we had to start reconsidering. Perhaps we were giving this company way too much credit. We go through the report below and tell you what we think.

Q4-2022

CLX’s fiscal year ends in June, so the reported results are for Q4-2022. The numbers were weak across the board. The starting point net sales, came in at just $1.8 billion and the bottom line of 93 cents a share was down 2%. For the whole year, adjusted EPS was down 43% to just $4.10 and sent a punishing message to those that chased this stock into the mid “$200s” during the pandemic. While sales in the US were flattish, international sales were a badly needed bright spot in CLX’s report. Organic net sales increased by 12% and that number looked awesome for the bulls. Unfortunately, that 12% was whittled down to nothing as you progressed further in the report. The first point about that growth was that it was all driven by price. CLX marked its products up by 13% while volumes fell 1%. That is how you got 12% gains. Even that 12% was offset by 8% of currency pressures as foreign sales translated into lower US dollars. Finally, that 4% of net sales gain in USD that CLX squeezed out amounted to a flat segmental profit as cost pressures prevented any bottom line gains.

Guidance

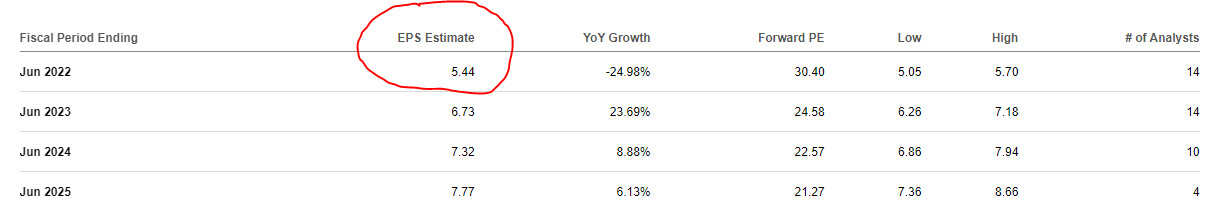

A cursory glance through our multiple previous articles will show you that we have felt the analysts were completely detached from reality. It was almost as if they had to show some stupendous growth to justify their price targets. In February of this year, estimates for this fiscal year, were at $5.44.

The Sum Of All Fears

There was zero, and we mean literally zero evidence, that CLX could pull this off. We said so at the time, and we got $4.10 in EPS finally. That same screenshot shows $6.73 for 2023. That was such a faith-based exercise, and we saw that when CLX guided for 2023.

Adjusted EPS is expected to be between $3.85 and $4.22, or a decrease of 6% to an increase of 3%, respectively. It reflects continued normalization of demand in parts of the portfolio that saw the most significant surge over the last two years and progress rebuilding gross margin. It also reflects the company’s long-standing commitment to continue investing in its brands as well as a return to more normalized levels of incentive compensation and a higher effective tax rate. To provide greater visibility into the underlying operating performance of the business, adjusted EPS outlook excludes the long-term strategic investment in digital capabilities and productivity enhancements, estimated to be about 55 cents, and an estimated 20-cent charge related to the streamlined operating model announced today.

Source: CLX Press Release

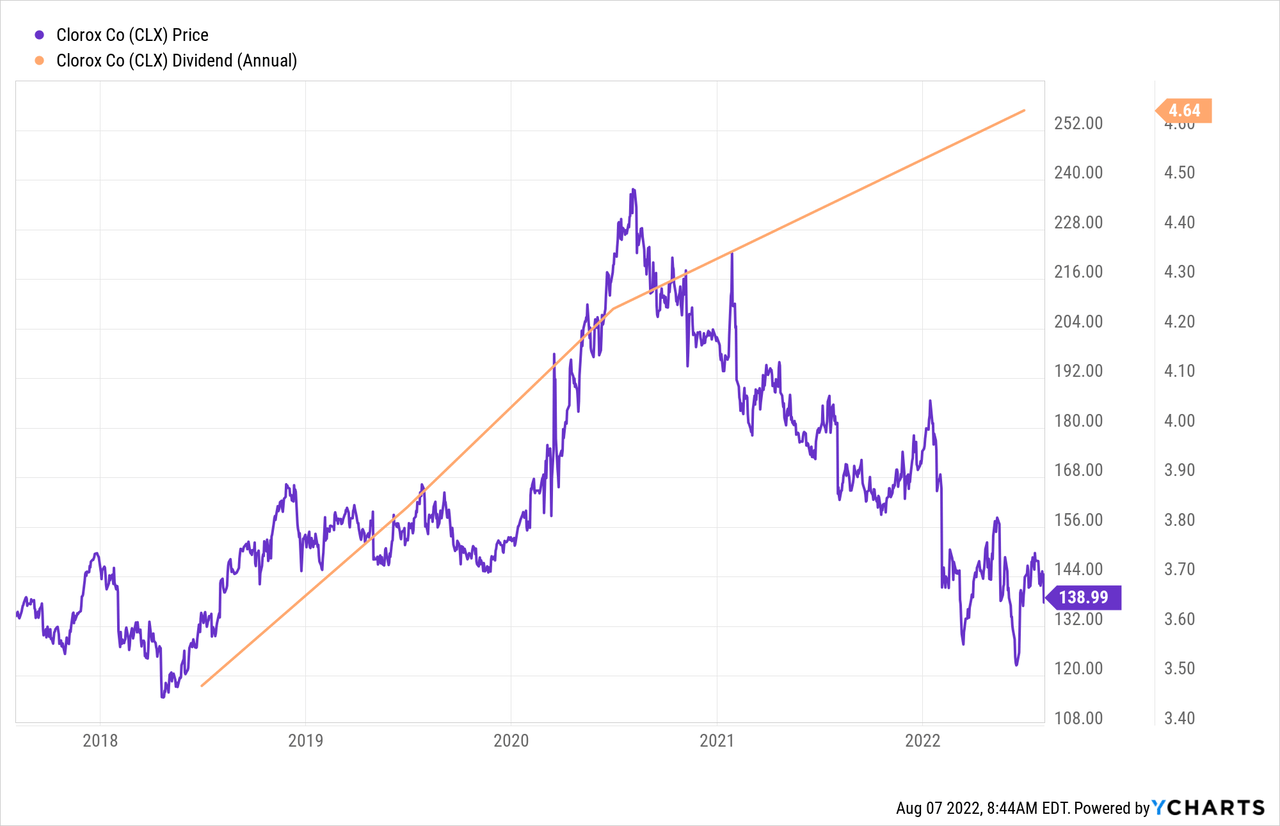

As stated above, the EPS number excludes everything bad. So when you add back 75 cents to earnings via adjustments you land at a high number of $4.22. The dividend is at $4.64.

So it is entirely possible that real earnings based on GAAP will come in as low as $3.10 and the company will have a 150% payout ratio on the dividend. That is extremely problematic, even for a company as solid as CLX.

Outlook & Verdict

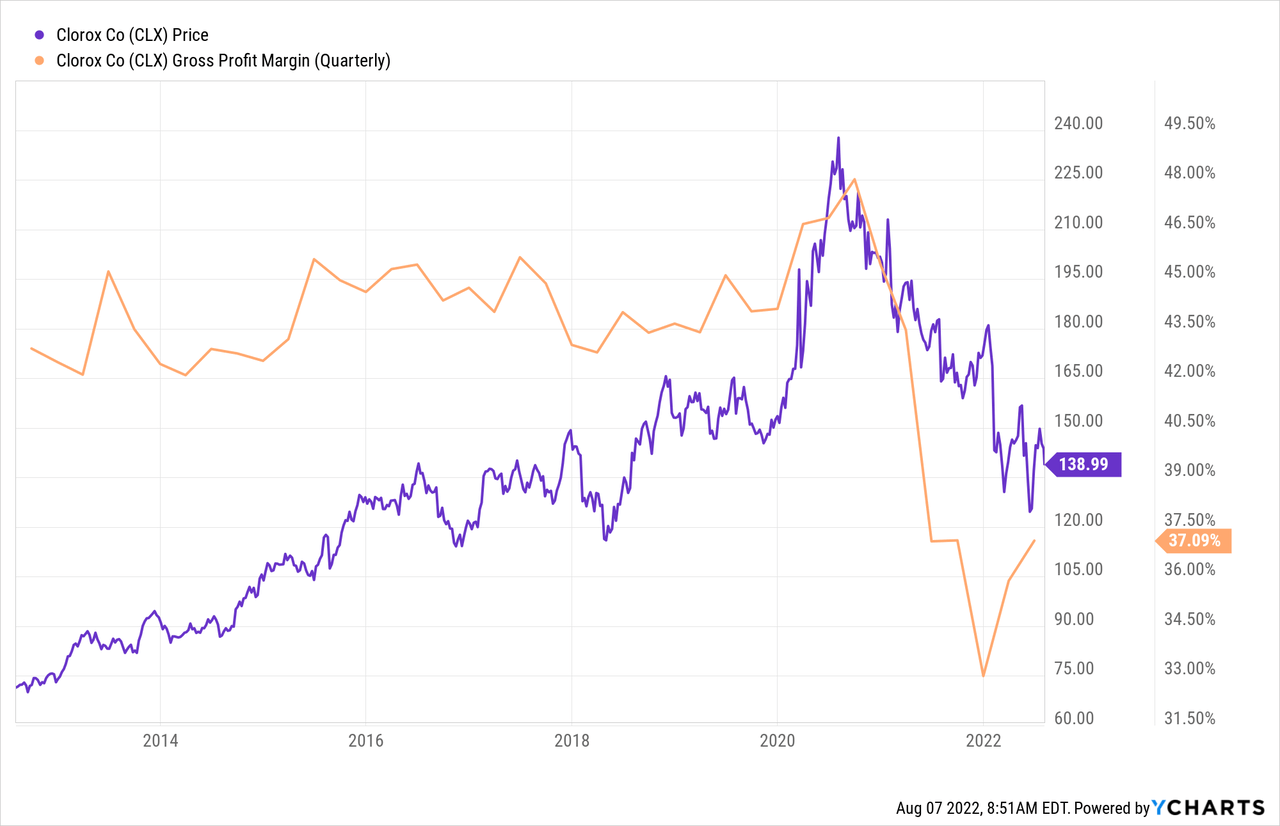

CLX’s fate will come down to where the gross margins go and what multiple the market bestows on it. On the former, with inflation peak likely in the rearview mirror, there is room to be optimistic.

Perhaps 40% can be reached in 2-3 years. That is certainly on the CEO’s mind.

We lost about 800 basis points last year. And our goal is to build that back over time. As we’ve said, I think very clearly we don’t expect to do that in one year, but we expect to make progress this year and then we’ll continue to work at that. We are pulling every lever available to us. And so Chris, you think about the areas that we’re pursuing that will drive that benefit this year for us, the, the biggest lever we’re pulling is pricing.

Source: CLX Transcript

But as the above mentions, it will take time and if we hit a recession in the interim, that pricing will be delayed. Our outlook here is that we get to $5.00 of earnings by 2025. The multiple you spin on that is the next step, and we would think a 15-25X range is appropriate for CLX. At the very high end, you basically break even after dividends ($125 + $4.64 annually). At the very low end you take another clobbering. Risks here are to the downside as pricing power tends to be weak in recessions and investors will start questioning dividend safety if we maintain 100% plus payout ratios beyond two years. We will note that we have already had a fiscal year where the dividend was not covered from earnings. Based on the information here, we are downgrading this again to a Sell Rating.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment