Chip Somodevilla

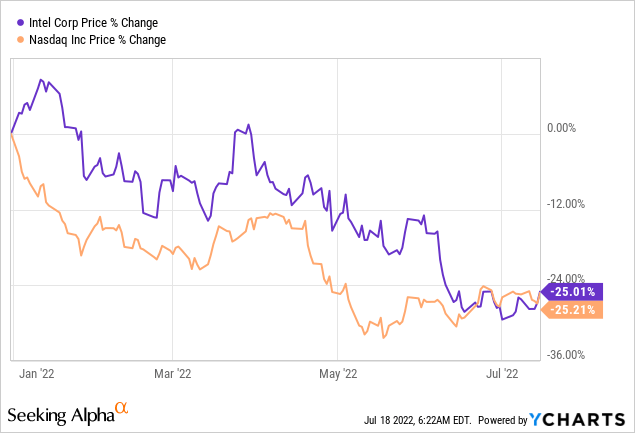

Investment Thesis – Update

There have been a lot of apprehensions in the market regarding the turnaround strategy, IDM 2.0, that Intel Corporation’s (NASDAQ:INTC) current CEO Patrick Gelsinger has so vehemently pursued since joining the company in 2021. Intel, without doubt, had become complacent and started to cede its leadership position in the chip industry to other competitors.

At this point in time, investors should focus on the company’s technical and operational updates rather than historical financial metrics. So instead, this report explores the company’s recent updates and progress. Regardless, since the launch of IDM 2.0, I firmly believe Intel is back on track and the current year updates on this strategy further support my initial bullish thesis on the firm.

Intel 4 – Catching Up With Competition

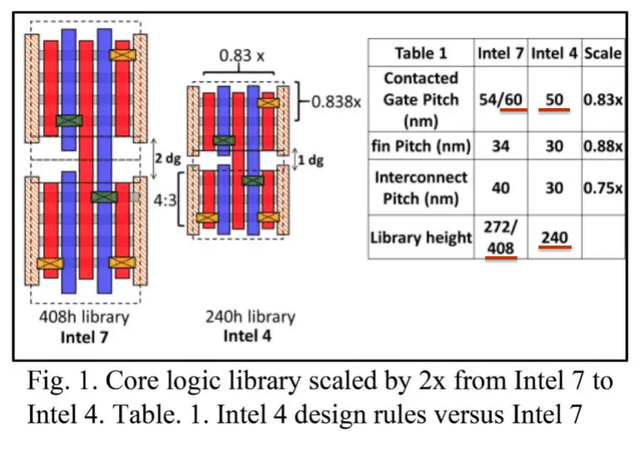

I have previously listed Intel 4 (7nm chip) production as one of the crucial catalysts for the stock, which is planned for later this year. Intel 4 remains Intel’s top priority on Gelsinger’s agenda. The long-awaited first EUV lithography 7nm chip promises a 20% performance-per-watt improvement, and accounting for the product of the nm and height (408*60 vs. 240*50), Intel 4 provides an impressive 2x density improvement (24,480/12,000) compared to Intel 7.

In addition, using EUV will simplify the lithography process and streamline Intel’s manufacturing process flow, leading to increased production capacity. The newly adopted modular approach will allow the company to make smaller steps by developing separate modules and avoiding the complexity and stress of having everything pre-built. The transition from DUV to EUV will also allow the company to increase transistor density, and the modular approach will support Intel in introducing new nodes fast with more frequent updates, a significant pivot compared to its old strategy of giant transistor density jumps every 4-5 years.

Quicker Return To Technological Leadership

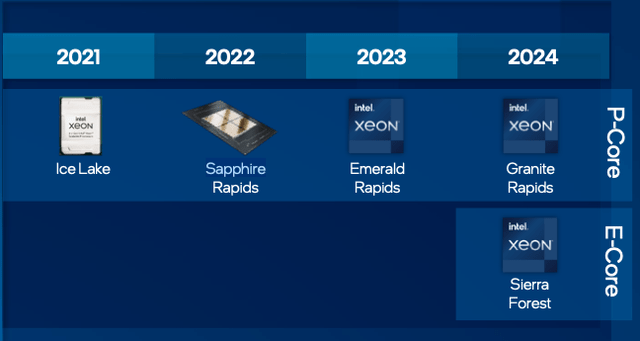

Despite a few minor delays, Intel Xeon Processor Roadmap is still on track, with initial SKUs of Sapphire Rapids dispatched to select customers in the first quarter. However, the ramping of Sapphire Rapids is delayed until the latter half of this year. It follows the plan as long as it is ramped up in 2022.

In terms of a leadership roadmap that aims to reach five nodes in 4 years, Intel is fast on track as it is set to launch the Raptor Lake this year and has powered on its first disaggregated product, Meteor Lake, on April 29th, which is due in 2023. Under the five-process node transition, Intel had aimed at parity performance by 2024 and leadership in 2025. However, the CEO seems so confident in the company’s trajectory that he foresees a quicker return to leadership by 2024.

Sapphire Rapids (intel.com/newsroom)

Intel’s Entry Into Other Growth Markets

The launch of Intel Arc A-series GPUs for laptops opens up a new market. Alchemist, the first of these products, began shipping to customers in the first quarter of 2022. Through this product, Intel has introduced itself as an alternative to Nvidia and AMD graphics cards. In addition, the GPU market enjoys strong pricing power as gamers continue to spend on their upgrades.

According to reports, Intel is playing safe by soft launching this product first in China, which is a small GPU market for Intel. Having fine-tuned its product according to the response of critical customers in China, the product will then be scaled aggressively in North America, which is when Intel will start to capture the market.

Update On CHIPS Act

The bill that involved $52 billion in subsidy funding to boost the semiconductor manufacturing industry in the US enjoyed bipartisan support and was passed by Senate last year. But there have been delays in passing this bill from Congress due to minor political issues. Nevertheless, numerous companies in the semiconductor manufacturing space have been pressing Congress to pass the bill before going on August recess.

Intel’s CEO has been actively lobbying for this bill and hinted toward slowing the pace of its Ohio plant and focussing more on investments in Europe in case the bill isn’t passed in July. However, I think it is just a matter of a few days before the CHIPS Act would pass Congress, potentially as a standalone bill, since the time sensitivity of this bill is being recognized across all levels. Once the bill completes its due course, Intel will benefit from the federal incentives and subsidies and accelerate the construction process.

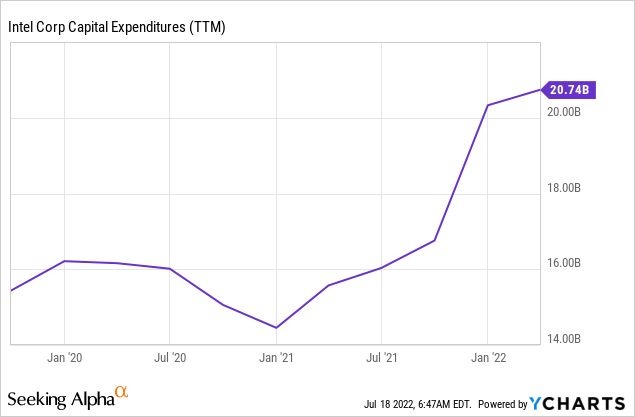

The Ohio Plant

Intel had earlier announced an initial investment of $20 billion for the Ohio plant, taking the investment up to $100 billion in the following years to build the world’s largest chip-making complex in Ohio. In progress toward this milestone, Intel has finalized the purchase of about 750.6 acres of land in New Albany. Early construction work has also started; however, the company awaits passing of the $52 billion CHIPS Act in Congress before pacing up the construction work.

Investments In Europe

Not surprisingly, following the introduction of the CHIPS Act in the US, the EU also introduced the European Chips Act, which added €15 billion to an existing €30 billion in public investments to create new STEM-focused programs, attract new talent to Europe, and build new infrastructure. However, unlike the US, the EU was quite aggressive in moving forward with its version of the Chips Act. Therefore, Intel has announced major investments in Europe to expand its production and R&D capacity there.

With the construction of two fabs expected to begin in H1 2023 in Magdeburg, Germany, announcing an additional €12 billion in expansion project in Ireland, getting into negotiation with Italy regarding a €4.5 billion manufacturing facility, planning to build its new European R&D hub in France, and increasing lab spaces in Poland, Intel is enjoying the support of EU governments and is all out to expand its manufacturing capacity to regain its crown.

Intel’s attempt to shift the balance of the chip supply chain back towards Europe and America will have a long-lasting impact and be a game changer for the company and the chip industry.

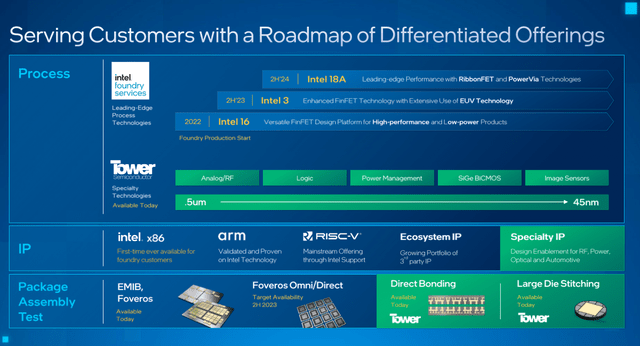

Intel Foundry Services

Earlier this year, Intel announced the acquisition of Tower Semiconductor for $5.4B. The acquisition will provide the company with direct access to a chip foundry and a jumpstart to becoming a major provider of foundry services and capacity globally.

Intel’s deal with the Israel-based semiconductor aims to enhance and boost its supply chain, bringing the company closer to its IFS target while bridging the gap to competition. Additionally, Intel will meaningfully expand its production capacity as Tower’s manufacturing facilities across the globe generate an annual capacity of 2 million wafers starts. As per the company’s forecast, the foundry market is expected to reach a sizable $180 billion TAM by 2030, suggesting a potential CAGR of 19% for the firm.

Investor Meeting 2022 (intel.com/newsroom)

The Game Is Not Short term But A Long One

I would reiterate my position that the chip giant has a sound plan in place, along with a dedicated leadership determined to turn the company around. The implementation seems satisfactory, but it must be kept in mind that Intel is a strong BUY only if you’re willing to wait for the next three to four years. With the stock currently taking a hit due to headwinds from supply-chain issues and other macro factors, do not panic if there are hiccups in the journey initially. This game is a long one.

Be the first to comment