James Nielsen

Amidst general market weakness, investor confidence in energy stocks seems to have been shaken by the pullback of oil and gas prices of late, even though such a skittish sentiment finds underpinnings neither in oil supply-demand dynamics nor idiosyncratic business fundamentals.

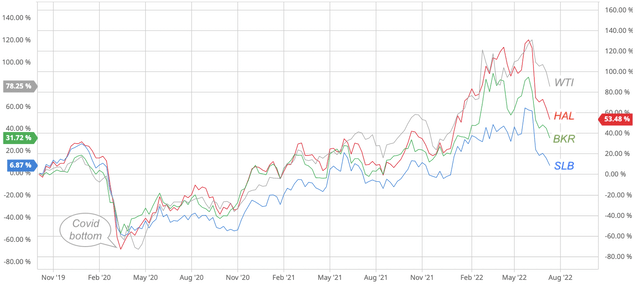

The stock of Halliburton Company (NYSE:HAL) was not spared in this episode of rout, having so far dropped 35% from the most recent peak. Meanwhile, the share prices of its oilfield service industry archrivals – Schlumberger (SLB) and Baker Hughes (BKR) – declined by 40% and 29%, respectively (Fig. 1).

Fig. 1. Stock chart of Halliburton (HAL), Baker Hughes (BKR) and Schlumberger (SLB), dividend back-adjusted, as compared with WTI benchmark (Seeking Alpha and Barchart)

Given the selloff, interested investors may be wondering whether it is time to cut loose, stay long, or pile into the stock. The question becomes ever more prominent as the release of the 2Q earnings report – scheduled for pre-market open on July 19, 2022 – approaches.

The macro picture

It is common sense among resident oil and gas investors, but little appreciated by general investors who recently arrived at the oil patch, that from time to time the futures market deviates from the physical market. The futures are a financial instrument, the trading of which is influenced by rational or irrational mood swings of traders, while the physical commodity is bought and sold according to the supply of and demand for the commodity. However, eventually, the futures market will realign itself with the physical market.

The oil price weakness since June 2022 (especially over the last couple of weeks) happened in the futures market due to fear of a recession, but not in the physical oil market. In the physical market, it was reported that a trader bid for a cargo of North Sea oil loading in late July 2022 at a premium of $5.35/bo over Brent futures – the highest since 2008 – yet he found no sellers, which clearly indicates an extremely tight physical market.

The E&P operators make capital spending decisions based on their views as to long-term supply-demand situations in the physical market, even though they hedge physical oil and gas production using financial instruments. Capital expenditures by E&P operators are the revenue for the oilfield service companies. Because the latest oil price pullback does not reflect a structural shift in the upstream industry as I discussed in detail in a recent article, not a single E&P company has so far signaled that it would cut back CapEx. It is safe to say the near to medium-term outlook remains bullish for the oilfield service players.

Taking one step back, the recent oil price decline, however painful it may be, is actually a healthy correction for the oil industry in the long run. Profit-chasing Asian refiners are expected to run cheap Russian oil through their spare refining capacity and export the resultant refined oil products to the rest of the world, thus driving down the crack spread and lowering gasoline and diesel prices at the pump, which will in turn create new headroom for crude oil prices to rise again without stoking fear of demand destruction.

Halliburton in focus

North American OFS market

In this cycle, the oil industry responds to high oil prices by pivoting to short-cycle barrels. North American shale is the most significant short-cycle play in the world. Shale fracking is the biggest service segment in North America, to which Halliburton has more exposure than its peers.

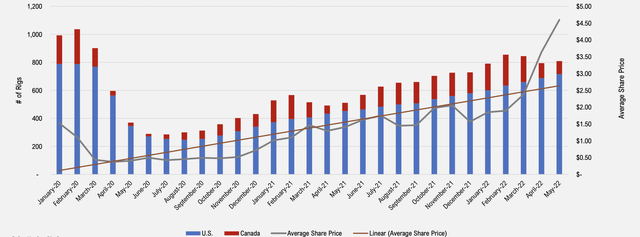

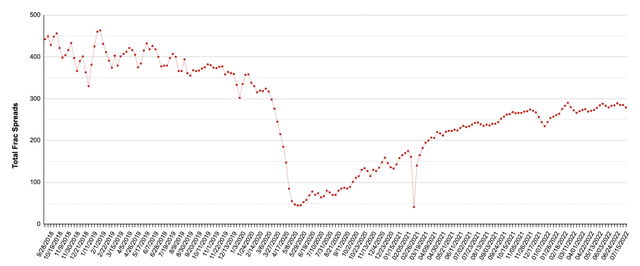

- Equipment utilization in North America has steadily improved since mid-2020, as suggested by rig count and frac spread count (Fig. 2; Fig. 3). By July 15, 2022, rig count has increased to 756 in the U.S. and 206 in Canada, and frac spread count reached 279 in the U.S.

Fig. 2. U.S. and Canadian drilling rig count, 2000 to May 2022 (STEP Energy Services)

Fig. 3. U.S. frac spread count (Laurentian Research based on AOGR data)

The fracking fleet of Halliburton was booked out for 2Q and will likely remain so for the rest of the year. The tightness of the fracking market is also confirmed by STEP Energy Services, a fracking specialist. It helps that the OFS space has undergone substantial industry concentration during the last downturn. With less intensive competition among the fracking service providers and fewer idled frac spreads around, day rates are expected to appreciate.

2Q outlook

Thanks to high equipment utilization and rising day rates, Halliburton is expected to report higher revenue than in the 1Q2022. CFO Lance Loeffler estimates the “second quarter revenue to grow in the mid-teens, and margins to improve 350-400 basis points” for the completions and production division. The company guides corporate-level revenue toward a >35% year-over-year growth.

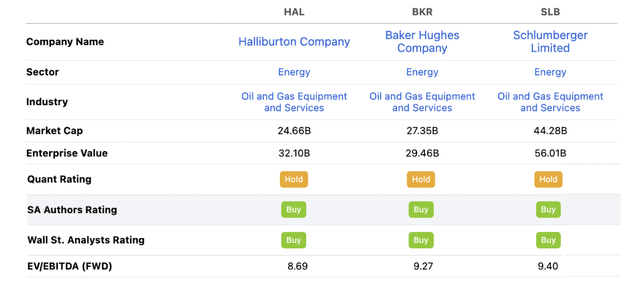

- Wall Street analysts think Halliburton will generate $0.45 per share of earnings on $4.71 billion of revenue in the 2Q2022. They have a ‘buy’ consensus rating. Seeking Alpha Quant has a ‘hold’ rating on the stock (Fig. 4).

Fig. 4. A comparison of the big three OFS players, Halliburton, Baker Hughes and Schlumberger (Modified from Seeking Alpha)

Relative valuation

Halliburton has a forward EV/EBITDA multiple of 8.7X, which is lower than that of Baker Hughes (9.3X) and Schlumberger (9.4X). That makes Halliburton a better value among the big three OFS players, considering it is projected to grow revenue at a faster pace, as I discussed in a recent article. The 35% drop in share price over the last 1 1/2 months has made Halliburton a great value.

What to watch in the 2Q earnings report?

In my opinion, investors should pay attention to the following when listening to Halliburton’s 2Q2022 earnings conference call:

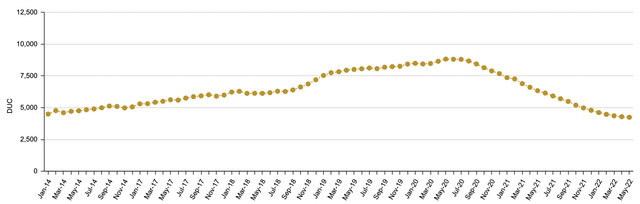

- As for equipment utilization, investors will need to ascertain the cause for the slower pace of frac spread count increase in the 2Q. Does it reflect decreasing willingness of the operators to complete drilled but uncompleted (or DUC) wells, is it a result of a dwindling pool of DUCs (Fig. 4), or is it a consequence of full equipment utilization (i.e., shortage of equipment, material supply and skilled labor)?

Fig. 4. The DUC counts in the U.S. (Laurentian Research based on EIA data)

- With respect to pricing, did day rates for various lines of services continue to rise in the quarter? This is a litmus test whether OFS commands a pricing power over E&P at this point in the up-cycle when equipment is utilized to a fuller extent.

- I believe Halliburton will report year-over-year and sequential growth in revenue; however, from by how much it beats the guidance and Wall Street consensus, we can learn about the rate of business fundamental improvement.

- On the cost side, the primary risk is that Halliburton may not be able to pass inflating costs in materials and labor down to its customers. This is important because it determines whether margins will expand or contract. I expect a tightening OFS market, Halliburton has pricing power at the bargaining table over E&P companies, which have been throwing off so much cash flow these days.

- Over the past two years, Halliburton incurred average quarterly capital expenditures of $188 million, substantially below the pre-Covid levels. Going forward, how will Halliburton allocate cash flow among various goals, including organic growth, acquisitions, debt reduction, share buybacks and/or dividend distributions?

- Lastly, back in March 2022, in the wake of the Russian invasion of Ukraine, Halliburton said it had stopped new business in Russia and would wind down its operations there. Among the big three OFS players, Halliburton has the least exposure to Russia; however, it is still pertinent to find out how the pulling out has progressed so far, and how big a financial impact the exit has resulted.

Investor takeaways

Indications from the physical oil market are that the industry up-cycle is still structurally robust in spite of recent volatility in the oil futures market. E&P companies are still willing to spend, which for OFS companies means continued improvements in equipment utilization and day rates.

Well-positioned to benefit from the unfolding industry up-cycle, Halliburton is expected to post faster growth than peers.

Based on the above analysis, I believe now is a good time to buy Halliburton stock.

Be the first to comment