Mikhail Mishunin

Thesis

Antero Resources Corporation (NYSE:AR) is slated to report its highly-anticipated Q2 earnings release on July 28, after its steep fall in June. Major oil and gas players have benefited from the sharp run-up in energy prices since the March 2020 COVID bottom.

Furthermore, the onset of the Russia-Ukraine conflict, coupled with current demand/supply dynamics, has spurred investors to rush in, expecting the good times to persist.

Our valuation analysis indicates that AR is unlikely to meet our revenue targets at the current price levels. Moreover, our price action analysis suggests ominous price structures in AR’s long-term charts. Therefore, a deeper retracement to the downside to digest its valuation looks likely.

We rate AR as a Hold for now, as it’s likely at a near-term bottom. However, we urge investors to watch for a subsequent bull trap (significant rejection of buying momentum) to cut exposure further.

Don’t Dismiss The Risks Of A Potential Fall In Natural Gas Prices

The Street is bullish on AR, with 11/16 Buy and Strong Buy ratings. Truist Securities also highlighted its bullish take on a recent update (edited):

Several drivers could materially drive higher natural gas and NGLs such as limited public E&P natural gas growth and notable future international NGL demand. Its strategic shift to one of the least hedged operators allowing the company to benefit from any gas move given its strong domestic and international marketing. – Seeking Alpha

Notwithstanding, natural gas contracts continue to point to lower prices ahead. August 2022’s pricing of $7.16 is markedly lower than August 2026’s pricing of $4.10 at writing. Therefore, investors need to monitor the hedging positions and their impact on Antero’s operating results. The company also cautioned investors in its filings (edited):

Prolonged low, and/or significant or extended declines in, natural gas, NGLs and oil prices may adversely affect our revenues, operating income, cash flows and financial position, particularly if we are unable to control our development costs during periods of lower natural gas, NGLs and oil prices. (Antero Resources FQ1’22 10-Q)

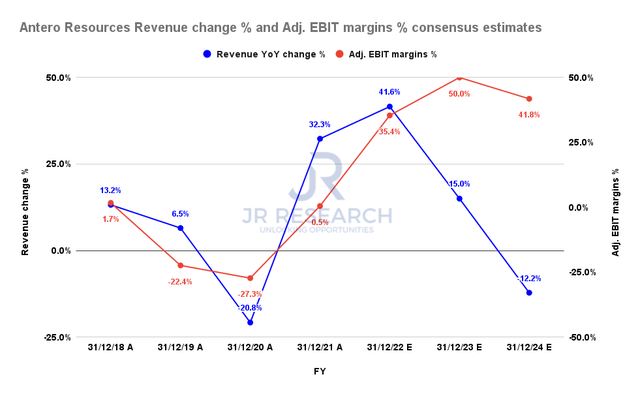

Antero revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) indicate that Antero’s revenue growth is expected to moderate significantly through FY24, with FY22’s growth as the peak. Notably, Antero’s revenue is expected to decline in FY24, down 12.2% YoY.

However, the Street remains confident in Antero’s strategies to lift its operating profitability, despite the significant drop in revenue. As a result, Antero is expected to deliver an adjusted EBIT margin of 41.8% in FY24, above FY22’s 35.4%.

Therefore, investors are expecting its robust profitability to sustain its valuation. But, the market seems to have other ideas.

AR – Downside Risks Look Menacing

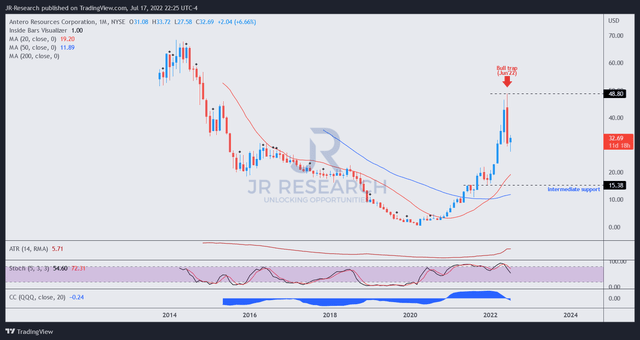

AR price chart (monthly) (TradingView)

The market set up a massive bull trap in June, as seen in AR’s long-term chart above. Therefore, we believe a steeper fall in AR could follow after its recent consolidation phase is completed as the market draws in dip buyers.

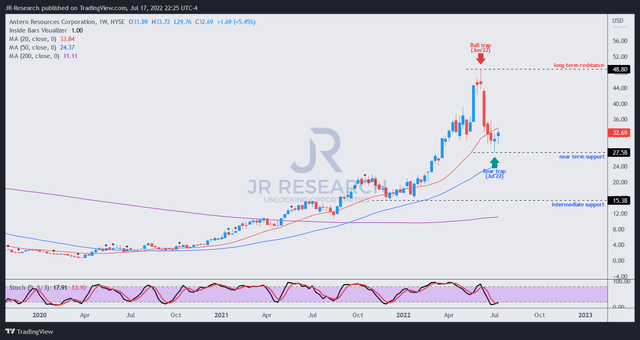

AR price chart (weekly) (TradingView)

We can glean AR’s price structures more clearly on its medium-term chart. Notably, AR is likely at a near-term bottom, underpinned by its bear trap (significant rejection of selling momentum) two weeks ago. Therefore, we believe some dip buyers could have used the price signal to add exposure as they attempted to benefit from the shaking out of the weak hands at its near-term support ($27.5).

However, we don’t encourage investors to add exposure now. As the bull trap occurred on its long-term charts, we give higher precedence to its bull trap price structure. We posit that the market is likely using its consolidation zone to attract buyers before forming another bull trap that could portend a steep sell-off.

AR’s Valuation Suggests Caution Is Warranted

| Stock | AR |

| Current market cap | $10.17B |

| Hurdle rate (CAGR) | 5% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 18% |

| Assumed TTM FCF margin in CQ4’26 | 29% |

| Implied TTM revenue by CQ4’26 | $7.85B |

AR reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied a market-underperform 5% hurdle rate, with a free cash flow (FCF) yield of 18%. The market lifted AR at its near-term support at an FY24 FCF yield of 22.8%. However, it was rejected by the bull trap in June at an FY24 FCF yield of 12.9%. Hence, we believe an 18% yield requirement is appropriate to model for the market’s current dynamics.

As a result, we require Antero to post a TTM revenue of $7.85B by CQ4’26. Based on the falling consensus revenue estimates, we believe Antero is unlikely to meet our revenue target.

Therefore, we urge investors looking to add exposure to continue to be patient.

Is AR Stock A Buy, Sell, Or Hold?

We rate AR as a Hold as we await its next bull trap.

We urge investors to be cautious, given the worsening macro headwinds. Moreover, futures prices on natural gas also suggest a declining trend over the next four years.

We noted that AR is likely at a near-term bottom. However, we posit another steep fall to occur subsequently.

Our valuation model indicates that AR will likely underperform over the next four years at the current price levels.

Be the first to comment