onurdongel/E+ via Getty Images

Thousands have lived without love, not one without water. – W.H. Auden

The Invesco S&P Global Water Index ETF (NYSEARCA:CGW) offers investors access to 50 of the largest water-based global stocks; note that this ETF tracks not just traditional stocks but ADRs and GDRs that are involved in the water business as well. To be considered for selection, stocks ought to be involved in the businesses of water equipment, water utilities, water materials, and water infrastructure. Even though this is a global-themed ETF, note that the product tilts overwhelmingly in favor of American-based stocks that account for 56% of the total portfolio.

The case for water

Water appears to be one of those archetypal goods that mankind has taken for granted and I don’t believe we truly appreciate how fundamental it is, to keeping the world in order. The impact of water scarcity can leave its mark in a myriad of ways but let’s just look at one angle – food production for the burgeoning global population. Over the past 12 months, a lot of attention has been showered on the exorbitant rise in food inflation. Whilst this may ease in the short term on account of steep base effects, one ought to be mindful of the long-term trend which points to some rather worrying signs. The UN believes that the global population could be anywhere between 9bn and 10.2bn by 2050, and to cater to this surge in numbers, it is estimated that current food production would need to be raised by 70%. Think about the quantity of water that would be needed to sustain this surge in food production.

Sustainable and well-rounded water policies around the world appear to be in short supply, and the requirements of the prime agents of food production – the farmers, are often cast aside in favor of the industrial class. If the status quo in water policies persists, I have serious doubts about the ability of these farmers to meet the daunting food requirements of the global populace.

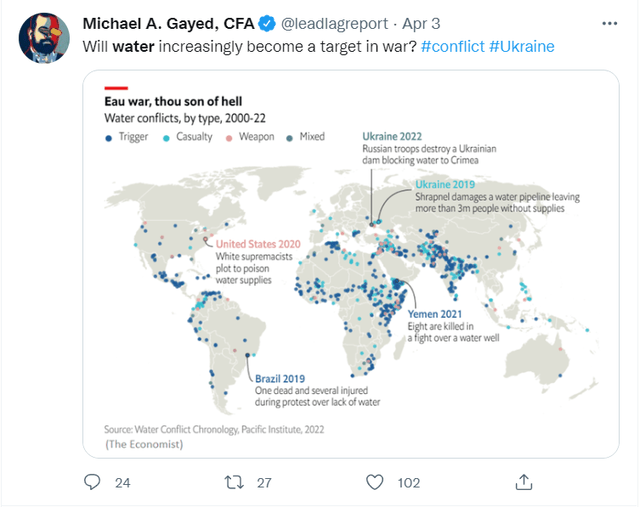

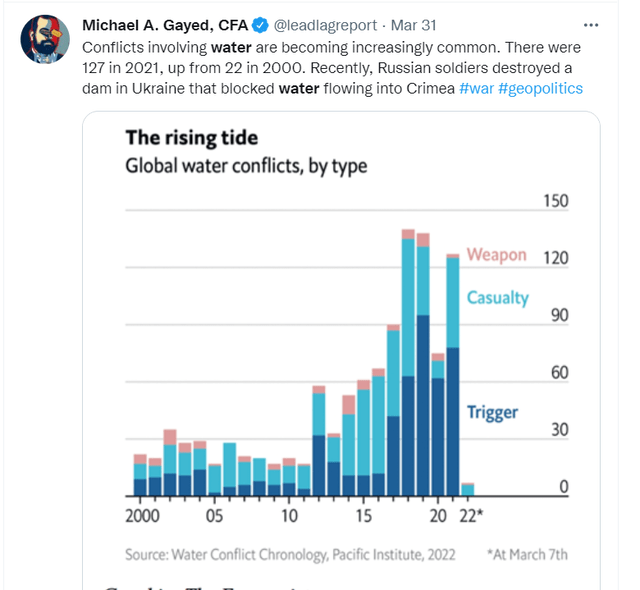

In addition to all this, there’s also this fast-emerging headache of water being used as a weapon of sorts. If you follow The Lead-Lag Report, you’d also note that in recent months, I’ve put up some data points highlighting the surge in water-related conflicts. In essence, over the last two decades, global water-related conflicts have surged by almost 6x.

All in all, the water scarcity narrative is something that is likely to become more pronounced in the years ahead and it would pay to expose yourself to entities that are deeply involved in this field. I believe smart investors across the globe are also recognizing the growing impact of these sort of companies. I recently provided some data on the great festivity seen with the listing of the Dubai Water and Electricity Authority (DEWA). In another 8 years, the company will be the sole source of all of Dubai’s desalinated water capacity. Reports there show that the company had to triple the size of its offer on account of huge demand from investors.

Conclusion

Before I conclude, I also wanted to provide some insight into the portfolio of CGW which points to some good and bad qualities which could result in a mixed performance in the near future. Essentially, CGW is dominated by two broad sectors. Industrials and Utilities, both of which contribute 45% each. Well with industrials, the outlook doesn’t look great with slowing factory growth momentum reflecting on these shares.

With utilities, subscribers of The Lead-Lag Report would note that in recent weeks, I’ve been highlighting the favorable conditions in this sector. Investors may not yet be gravitating to treasuries as a safe haven arena, but I believe this is only a matter of time before this happens. Rather, for now, what we’re seeing is some very strong interest in the utility sector which has outperformed the S&P 500 quite handsomely these last few weeks. In fact, as pointed out in this week’s edition of my report, we are currently in the midst of the largest risk-off consensus we’ve seen within all my inter-market signals, and when the bulk of your signals are pointing in one direction it pays to be cautious and gravitate to products with a low volatility profile. CGW appears to have these credentials; its annualized volatility of 15% is lower than the asset class median of 22%. What is perhaps off-putting is that this ETF isn’t particularly cheap, trading at 21x forward P/E, which is pricier than the 19.7x multiple of the broader markets.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment