TommL/E+ via Getty Images

Above: Singapore’s ebullient recovery is significantly reducing the cash burn rate of Las Vegas Sands linked to Macau.

A departure from our usual prologue of quotes from the proven wisdom of great minds, commands our insertion of such a famous quote, “Not the beginning of the end, but the end of the beginning,” in the headline of this article. It was, of course, uttered by one of the giant figures of the twentieth century, British Prime Minister Sir Winston Churchill. He is a personal hero, and a man of scintillating brilliance in navigating the pathways of war, peace, and life. He understood that reality is all about nuances.

Here’s the full quote uttered by Churchill after the first Allied victory over the Nazi war machine at the battle of El Alamein, November 1942. It was no small thing to beat “the Desert Fox,” German General Erwin Rommel. Ebullience engulfed defeat-weary England. But Churchill, wiser than most men, demurred-not yet, he noted, not yet.

Here is the full quote:

“Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning….”

This to me is a precise expression of where, in our tiny little world of gaming, I believe the valuation of shares of Las Vegas Sands Corp. (NYSE:LVS) now stands. And in its own way, with due apologies to the memory of Churchill in the real world, it best expresses my stronger than ever conviction that the valuation of LVS is about to turn a real corner. And in my view, it is headed higher from here through the first two quarters of 2023. It is the end of a long beginning that began in 2020, when covid first struck.

I have stated my prior mea culpas for prior wrong guesses about the recovery path of LVS stock mostly stuck in a dead pool trading range. My error was believing that Beijing, its economy being crushed by zero tolerance, would begrudgingly become a rational actor here and slowly reopen travel in and out of China province by province. That idea sprung from my long experience dealing with Asia gaming, where I learned nobody ever leaves a dime on the table-even the communists.

Hence my sense that relief would come sooner rather than later and that LVS would be a disproportionate beneficiary of a reopened travel policy from Beijing. After all, LVS sits on 12,000 rooms in Macau. But now, signaling in my mind the end of the beginning as noted above, I see a steady improvement in LVS prospects, sensing a true end of the beginning. From here on in I see a growing margin of safety in LVS shares at their current price. Call it a new beginning.

A barrage of “defeats” for LVS, near three years, has battered conviction about the stock

For context:

- July 1, 2018, LVS traded at $71.90. It had shown considerable resilience from the 2015 Beijing crackdowns on junkets and VIP. Its stress on the mass segment paid off as did the big bet Adelson made on the Paris IR..

- February 2020: Covid outbreaks begin and turn to global pandemic. Travel bans, lockdowns and red ink flood Macau. LVS, with one of the two biggest shares of market, tanks along with all concessionaires stocks.

- January 2021: Death of founder Sheldon Adelson no surprise but management fell into an uncertain path. New CEO Goldstein, a former industry colleague from Atlantic City took the helm. He was a good choice as a successor, as a long time hands on operator from his earliest days in the business. However, Goldstein and COO Patrick Dumont, the son-in-law of widow Dr. Miriam Adelson (a principal heir for the Foundation) steered the company into its next huge decision: Selling the Vegas assets.

- Shortly after Adelson’s death, LVS sold its Vegas assets for $6.2b. The theory here as the market understood it was that it was actually a Sheldon decision. The idea was to get the balance sheet flush with cash in order to finance a potential third Asian nation integrated resort. Adelson’s take was that longer term, Asia promised stronger growth than Vegas. He further wanted cash in his pocket if and when a U.S. opportunity in either New York or Texas materialized.

- Mid-2021 to present: Las Vegas reopens. Pent up demand propels gaming revenue north for 19 straight months, breaking pre-covid records in the process. LVS departure early in ’21 was ill-timed since exploration of Asian move was complicated by determining value amid covid disruptions there. That Adelson envisioned a future in Asia vs. Vegas as a sunnier one was not wrong. In fact, it made great demographic and economic sense.

- But management could have delayed the Vegas sale until such a development deal came closer to fruition and then sell its Vegas assets. Seeing what Vegas realty was fetching by real estate investment trusts (“REITs”) as well as big moves by the likes of Carl Icahn and now Tilman Fertiitta, suggest management’s rush to sell was untimely.

No fly on any wall has reliably reported here whether Goldstein and his team might have quietly opposed the sale. The thinking among some of our Vegas colleagues was that Dr. Adelson pressed them to take equity off the table when valuations were high and saw the sale as a fulfillment of her late husband’s goal in Asia. The key being the Adelson Foundation’s future.

As we now nearly two years after the death of Adelson, it seems to us that Mr. Market has yet to see any forward momentum for LVS that suggests they are nearing some kind of Asian deal. There have been persistent rumors about Thailand. Nor has there been any movement into digital, though management has targeted it for over a year. (That might well be the best decision of all: staying away from money bleeding sports betting isn’t the worst path to travel for now.)

Thailand’s special legislative committee has studied legalizing casinos for several years. It has come out favoring casinos. Though the infrastructure of regulation and administration of a gaming industry does not yet exist there, on any basis, the demographics, geography, and economics of Thailand are a clear home run.

Some of our Vegas colleagues who had been close to Adelson, have told me that were he alive and well, a deal would have long been struck in a third Asian nation.

Bottom line on the sequential “defeats” for LVS that have impaired recovery of the stock: management may have many good reasons for slow walking its next big move, but given the performance of the stock, it would appear that there are few believers ready to buy an LVS recovery story.

On a macro basis, showing small signs of turnaround, LVS remains undervalued. So now the beginning of the end of the LVS stock dive may be at hand. It’s up from the summer but still lagging its potential in our view.

We now turn to the end of the beginning: It spells BUY

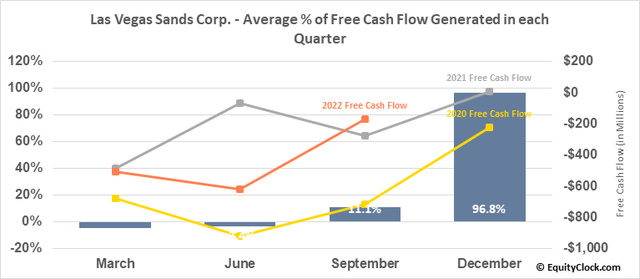

The cavalry is on the way, led by LVS’s strong showing at its Marina Bay Sands property in Singapore. Its among Asia’s most lucrative gaming markets, totally freed from covid headwinds, a strong locals market and rising visitation from ASEAN tourists and VIP. The MBS performance went a long way toward contributing to a reduction in group loss. Net corporate loss for 3Q22 from ongoing operations was $380m vs. $594m y/y 2021.

Macau: This market continues to be hostage to the zero-tolerance covid policy. However, our sources believe that pressures have been building at the high councils of Beijing to at least moderate some of the protocols as the economy heads down the path to disaster. So they have, at best, budged a bit on quarantine duration while at the same time issuing a statement about doubling down on the core policy. Our Asian associates believe that Xi Jinping cannot see himself losing face over this continuing disaster for the macro economy.

They believe he is awaiting a face rescue from some major international body, like the WHO, which would issue some kind of moderating statement supporting some re-openings. “Xi would jump at the chance to hide behind some big international group. It’s a perfect face saver for him to begin real easing of the travel bans,” one Hong Kong-based journalist told us last week. “It’s a puzzle, but it would not be inaccurate to suggest that by spring, long past any winter surge, we could well see some re-openings of mass China travel.”

Even the faint-hearted push-pull by Beijing that vaguely suggests moderation may be on the way moved sector stocks a bit last week.

Meanwhile, we believe that the central truth of all this lies in an appraisal of industry liquidity in Macau, assuming in the worst case that Beijing stays locked into a paralyzed state on zero tolerance.

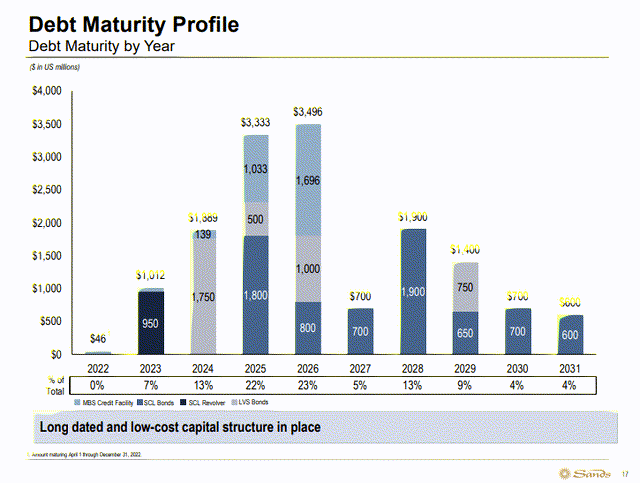

The total cash/equivalents liquidity of the six Macau concessionaires is about $70b. The industry is burning cash at the rate of ~$1b a year. As maturities on low cost debt creep up, it could begin to get scary for major players. But LVS is well-situated to endure. Here’s evidence of resilient balance sheet staying power:

Cash on hand: $5.84b

Cash per share: $7.64

Levered FCF: $2.22b

Long term debt: $15.2b.

Current ratio: 1.83. This is healthy and should remain so through the duration of the most draconian part of the covid-zero tolerance policy. Our view is that even if there is no significant moderation of covid policy through 2Q23, LVS would not face anything near a liquidity crisis. In fact, betting that there will be some moderation, and that move would spike LVS shares on positive news flow, makes good sense here.

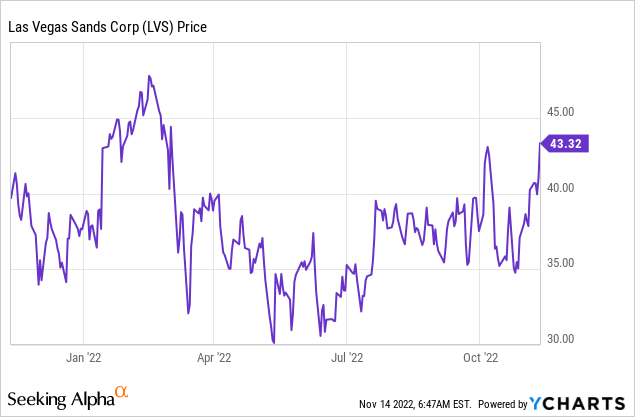

Price at writing: $43.22. The stock hit a 2022 low last June at $31. It is one of those stocks that lives and dies on news flow, much of it mindless, some of it outright crazed.

Above: Marina bay Sands positive cash flow will become an even bigger factor when expansion plan adds more rooms, attractions and gaming in three years.

Case in Point: Last month, we noted four articles in major financial publications that tied the “re-election” of Xi Jinping as a huge headwind for LVS/Macau. The rationale: that Xi was the immoveable power behind the zero tolerance policy and that he was likely to keep it alive long term. Making that connection assumes that Xi was “re-elected.” What? We’re talking about a communist country here. Has anyone ever had a second’s doubt that Xi and his henchmen would remain in power?

What did the reporter and analyst expect? After a long and bitter campaign battle for power, president Xi Jinping was re-elected by a slim majority????… The world knew the fix was in on Xi’s reelection. To even use the word “election” is sheer idiocy in a communist dictatorship.

But it is evident of the kind of inane news flow that has attended all Macau stocks for years. It follows on dozens upon dozens of news briefs and opinions we have followed for years that also belong in the land of make-believe-click bait desperadoes in the financial media. That is the idea that the late Adelson’s financial and political support for former President Trump would cause LVS to be singled out for punishment by not getting its concession renewed was a recurring theme of much financial news on the sector.

Now, here we are probably weeks away from what we believe will be the likely confirmation by Macau authorities of the six present concessionaires of their renewed 10 year licenses. That fact is one of the components of what we see as the slow, but inevitable, turn of positive news flow that will play a role in the continuing recovery of LVS shares. Clearly, Xi Jinping has much bigger fish to fry than the little Macau enclave’ gaming future.

Conclusion

To support our contention that the timing is right for an entry point into LVS, we have this bull case:

- 3Q22 results show rising revenues, easing losses.

Singapore continues to provide ballast against worse case cash bleed for its parent.

- China has been nudged, ever so slightly, to ease on some covid quarantine protocols. Nobody expects a sweeping end to travel bans any time soon. But for a command economy, ideological dictatorship like China, even a nudge has meaning. We think we could see more little nudges ahead. And each one of them will play to the upside of LVS stock.

- Lastly, it would appear that the lack of transparency by LVS management giving investors some sense of direction in its quest for an Asian move ahead, is well past its sell date. Shareholders understand the ongoing need for discretion in any kind of negotiation. Nobody expects a who, what, when and where report on any talks LVS is having on prospective moves. But silence and vague allusions to “ongoing interest” simply is a poor substitute.

- Investors are surely smart enough to realize that in these chaotic times in Asia, there are reasons for quietude on possible deals. But it our view it remains a disservice to the market to keep LVS tap dancing. If there is no progress, it is no sin to admit it.

- LVS is financially sound, improving its results from Singapore,. With its 12,000 Macau rooms it stands to benefit mightily from the growth of the mass market sector whenever that may happen. It’s a price and potential story that is lost in in the miasma of the entire Asian gaming sector. Yet we see success in Singapore, in the Philippines, in Cambodia and to an extent, in Vietnam and South Korea.

- We think LVS has turned a corner. Its discounted cash flow (“DCF”) value hits close to its current trade, perhaps a bit shy in the $41 range. But that, in a way, suggests to us a margin of safety value that should prompt investor interest in watching this stock over the next two quarters. We believe we can see a price target by 2Q23 of $51/$56.

Be the first to comment