imaginima/E+ via Getty Images

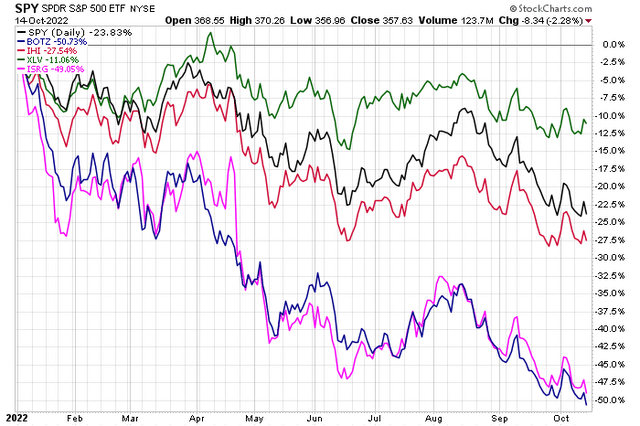

The Health Care sector (XLV) is down just 11% in 2022 while the broad market, as measured by SPY, is off by 24%. Defensive niches of the diverse space have been a safe spot for investors. A risk-on part of Health Care is medical devices and firms investing heavily in automation.

Is a turnaround in play? Or is more downside expected? We might know more following a busy week of earnings on tap.

Medical Device Stocks, Robotics ETF Down Huge in 2022

According to Bank of America Global Research, Intuitive Surgical (NASDAQ:ISRG) is the soft tissue surgical robotics pioneer and market leader that first received FDA clearance more than 20 years ago. ISRG sells robotic systems and accompanying instruments that can be used in a broad range of surgical procedures. ISRG has a global installed base of close to 7,000 robots. The stock is an 8% weight in the Global X Robotics & Artificial Intelligence Thematic ETF (BOTZ).

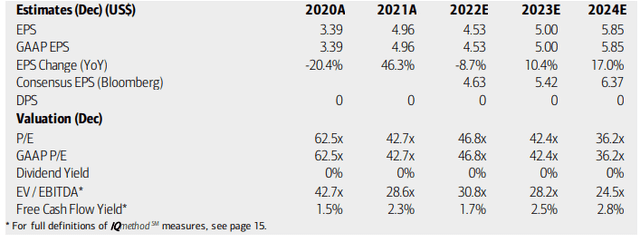

The California-based $68.0 billion market cap Health Care Equipment & Supplies industry company within the Health Care sector trades at a high 46.8 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

ISRG could be positioned well, though, post-Covid and with investments in robotics. The company’s stranglehold on soft tissue robotics is a major asset amid a growing competitive landscape. Risks to ISRG’s growth include weak surgical demand if Covid waves return, reduced hospital capex, and tight supply chains.

On valuation, BofA analysts see earnings falling by nearly 9% this year before a rebound into 2023 and 2024. The Bloomberg consensus EPS forecast is more optimistic than BofA’s. With Q3 per-share profits about to be reported, the focus soon shifts to positive periods ahead.

The company trades at a very high EV/EBITDA multiple and has just modest free cash flow. With a PEG ratio near 3, the valuation is not ideal. Its price-to-sales ratio has averaged more than 16 over the past five years but is now just 10.5 on a forward basis.

Overall, Seeking Alpha has a poor “D” rating. Overall, the stock still looks expensive despite a big share price decline.

ISRG Stock: Earnings, Valuation, Free Cash Flow Forecasts

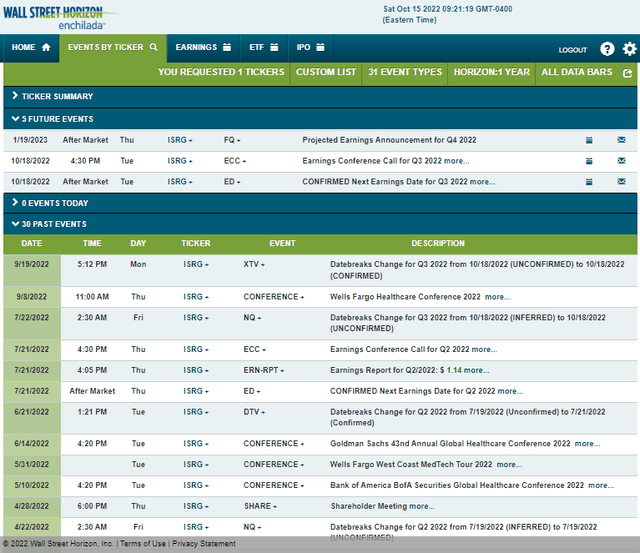

Looking ahead, corporate event data from Wall Street Horizon show a confirmed Q3 earnings date of Tuesday, Oct. 18 after market close with a conference call immediately after results hit the tape. You can listen live here. The calendar is light aside from earnings, though.

Corporate Event Calendar

The Options Angle

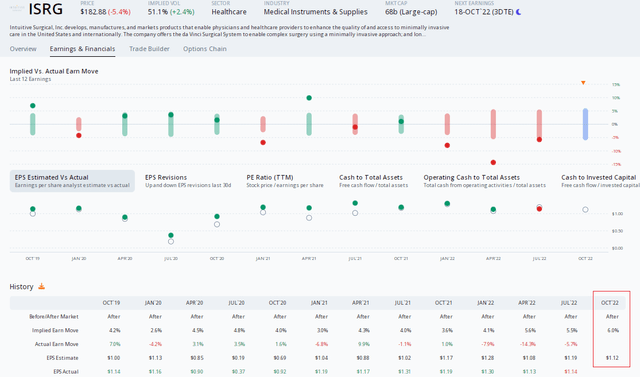

Homing in on the Q3 reports, data from Option Research & Technology Services (ORATS) reveal a consensus EPS forecast of $1.12 which would be a small drop from $1.19 in per-share profits earned in the same quarter a year ago.

Aside from a bottom-line miss last time, ISRG’s EPS beat rate history is stellar, so I’d expect a decent number Tuesday night. Stock price reactions, however, have been mixed. There have been two analyst upgrades of the stock since it last reported.

ORATS also shows a 6.0% implied share price swing post-earnings using the nearest-expiring at-the-money straddle on the stock’s options. That’s the biggest expected move in the last three years – not surprising given a VIX north of 30. With a trio of recent sizable earnings-related moves, options might actually be a decent value.

ISRG: Options Priced High, But Not Expensive Given the Environment

The Technical Take

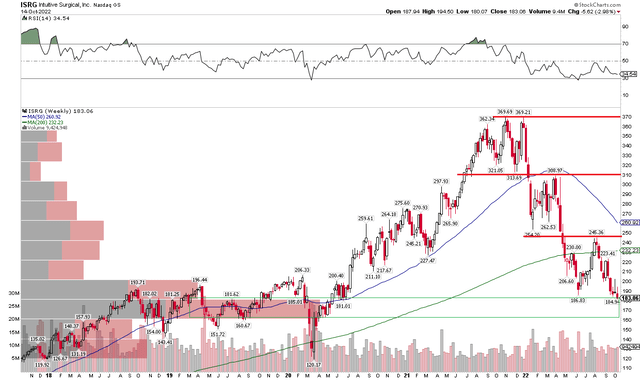

ISRG is at a critical juncture on the chart. Notice that the stock has stair-stepped lower off its $370 high about a year ago. A $60 drop to near $310 was the first stop, then came a break to $245, and this time $185 to $190 is significant.

What makes the latest pullback different from the others is that shares are coming into a heavy area of potential demand in the $165 to $180 range as measured by the volume-by-price indicator on the left. I think investors can dip their toes into the stock now or on a further pullback post-earnings. The weekly RSI also shows a higher low relative to the lower low in price, a sign of potential bullish divergence.

ISRG: A 50% Haircut. Shares Near Support

The Bottom Line

ISRG stock remains expensive, but the valuation has been slashed in the last year. Technicals are more constructive on the stock than the fundamentals. Overall, I think buying the stock in the $165 to $180 range makes sense.

Be the first to comment