Igor Kutyaev/iStock via Getty Images

Fed to Wall Street: Drop Dead

“How far do we think the Fed will go in their new excellent adventure of QT? We don’t know. The Fed’s new mission will be to put a top in inflation, not a bottom in asset prices. Another easy forecast based on the Fed’s long history, we are sure they will proceed until Powell & Co. breaks something – the bond market, the stock market, or the junk bond market.”

Wedgewood Partners, April 2022.

“My main message has not changed since Jackson Hole. The FOMC is strongly resolved to bring inflation

down to 2%, and we will keep at it until the job is done.”

Jerome Powell, September 2022.

“There is no gadgetry in monetary mechanisms and no device that will save us from our sins. We’re

going to have a good deal of pain and suffering before we can solve these things.”

Fed Chair William McChesney Martin, June 1969.

Review and Outlook

|

3Q |

YTD |

1-Year |

3-Year |

5-Year |

|

|

Wedgewood Composite Net |

-4.1 |

-29.0 |

-22.1 |

10.7 |

11.2 |

|

Standard & Poor’s Index |

-4.9 |

-23.9 |

-15.5 |

8.2 |

9.2 |

|

Russell 1000 Growth Index |

-3.6 |

-30.7 |

-22.6 |

10.7 |

12.2 |

|

Russell 1000 Value Index |

-5.6 |

-17.8 |

-11.4 |

4.4 |

5.3 |

|

10-Year |

15-Year |

20-Year |

25-Year |

30-Year |

|

|

Wedgewood Composite Net |

10.1 |

9.7 |

11.0 |

9.7 |

11.3 |

|

Standard & Poor’s Index |

11.7 |

8.0 |

9.8 |

7.4 |

9.6 |

|

Russell 1000 Growth Index |

13.7 |

10.1 |

11.0 |

7.7 |

9.6 |

|

Russell 1000 Value Index |

9.2 |

5.7 |

8.7 |

6.9 |

9.3 |

A Personal Note: This quarter marks the 30-year anniversary of our Composite track record. On behalf of all of us at Wedgewood Partners, we wish to offer a heartfelt “Thank You” to all of our current and past clients, plus long-time Friends and Supporters of Wedgewood Partners, over our journey and battle with Mr. Market. Thank You!

Top performance detractors for the third quarter include Meta Platforms (META), Alphabet (GOOG,GOOGL), Taiwan Semiconductor Manufacturing (TSM), Visa (V) and Edwards Lifesciences (EW).

Top performance contributors include PayPal (PYPL), Texas Pacific Land (TPL), Motorola Solutions (MSI), Apple (AAPL) and Copart (CPRT).

There were no changes to the portfolio during the quarter.

Q3 Top Contributors

| Avg. Wgt. |

Contribution to Return |

|

|

PayPal |

5.36 |

0.84 |

|

Texas Pacific Land |

3.41 |

0.56 |

|

Motorola Solutions |

6.48 |

0.30 |

|

Apple |

7.44 |

-0.03 |

|

Copart |

4.22 |

-0.05 |

Q3 Bottom Contributors

|

Avg. Wgt. |

Contribution to Return |

|

|

Meta Platforms |

6.63 |

-0.95 |

|

Alphabet |

6.97 |

-0.77 |

|

Taiwan Semiconductor Manufacturing |

4.89 |

-0.75 |

|

Visa |

6.29 |

-0.56 |

|

Edwards Lifesciences |

4.73 |

-0.52 |

| Portfolio contribution calculated gross of fees. The holdings identified do not represent all of the securities purchased, sold, or recommended. Returns are presented net of fees and include the reinvestment of all income. “Net (actual)” returns are calculated using actual management fees and are reduced by all fees and transaction costs incurred. Past performance does not guarantee future results. Additional calculation information is available upon request. |

Meta Platforms detracted from performance during the quarter. Meta’s advertising revenue grew +3% (currency-adjusted) over 2021 and is up +70% since 2019 (pre-pandemic). The shift of advertisers and consumers to social media has been fairly dramatic and sticky. The Company reported $2.88 billion “daily active people” of its Family of Apps (as of June 2022) and is +35% higher than the comparable month pre-COVID (June 2019). Meta also serves over 10 million advertisers which is up from 8 million in January 2020.

In spite of these impressive gains, the stock now trades at absolute levels well below where it traded before the pandemic. We suspect much of the market’s concern revolves around slowing revenue growth. It is fairly evident that there was a tremendous pull-forward of demand for many businesses and services over the past couple of years, and that the normalization of revenue growth from that “pull-forward” is hardly an existential crisis.

Further, while Meta’s profit margins have fallen below pre-pandemic levels, it’s important to note that the Company likely hired well in excess of what it needed because it assumed the pandemic induced growth would continue. Meta has plenty of room to moderate its expense base and drive significant value by repurchasing shares at today’s historically depressed multiples.

Alphabet grew its core search revenues +18% (foreign exchange adjusted) on a staggering +68% year ago comparison. Despite this stellar top-line performance, shares continued to sell off as the market discounted fears of a recession. Our multi-year time horizon allows us to tolerate this exact kind of short-term volatility in growth rates (rather than implicitly extrapolating near-term slowing growth trends into perpetuity by selling).

The past few years of economic activity and dramatic shift in company-specific drivers of growth have been unprecedented, so a “normalization” of end-market demand at Alphabet is not the end of the world in terms of surprises. In addition, core Google Search has been less affected by disruptions related to Apple’s privacy initiatives thanks to the Company’s long-term investment in the Android Mobile operating system.

Alphabet’s Cloud segment is generating revenue at a $25 billion run rate, but is still running at a loss. This business is capable of generating much better margins at some point. In the meantime, the Company has a fortress balance sheet and has been repurchasing shares at attractive historical multiples.

Taiwan Semiconductor detracted from performance despite business performance that saw revenue growth accelerate to over +40% growth (in TWD) and lapped +20% revenue growth from a year ago. The Company is one of the few fabs in the world that is capable of manufacturing leading-edge integrated circuits (IC).

TSM’s leading edge capacity is being absorbed by high-performance computing applications, particularly in the case of Apple, which has become an IC powerhouse over the past decade. The Company’s aggressive investment in leading-edge equipment, tight development with fabless IC designers and embrace of open development libraries, should continue to foster a superior competitive position and attractive long-term growth.

Visa continues to report strong double-digit growth in payment volumes throughout the first two months of the calendar third quarter. The stock suffered after concerns about potential adverse legislation related to its credit card routing practices began to surface. Similar legislation related to the Company’s debit routing practices was passed into law back in 2010.

Not unlike the previous legislation, the Company’s value proposition to merchants, consumers and bank-issuing customers and acquirers is robust enough to help blunt the potential effects the legislation might have in the near term. Over a multiyear time horizon, it would be quite difficult for any currently non-existent or even sub-scale credit routing network to add the value that Visa (or MasterCard) can already add today.

Edwards Lifesciences reported just +5% growth in revenue (foreign exchange adjusted) compared to a year ago. While this quarter represented a deceleration in revenue growth from earlier this year, much of that was due to hospital staffing shortages and the vagaries of global healthcare systems emerging from pandemic disruptions. The Company received FDA approval for its minimally invasive mitral valve repair system, PASCAL, and also presented compelling related clinical data, which should help support accelerating growth over the next few years.

As for Edwards’ core TAVR system, there continues to be a (unfortunately) pent-up, untreated population suffering from severe aortic stenosis that will finally be able to find their way back into healthcare systems as labor market pressures ease.

PayPal Holdings contributed positively to performance as the Company reported accelerating revenue growth and more concrete measures to drive long-term profitability. Revenue growth accelerated throughout the quarter as the Company is taking share in e-commerce while lapping the headwinds of the eBay (EBAY) rolling off. While eBay’s revenues represented higher-margin revenues, the Company should be able to drive better transaction margins as total payment volume growth reaccelerates.

Part and parcel of this growth comes from PayPal’s investments to drive higher penetration into its 429 million active accounts. PayPal’s active accounts have grown by +50% since the onset of the pandemic so it makes sense for management to focus on driving higher transactions per account, thus better to monetize this historical windfall of users. The Company also authorized a $15 billion share repurchase program, which represents over 10% of shares outstanding. This is a good use of capital relative to the Company’s historically depressed multiples.

Texas Pacific Land was a top contributor to performance during the quarter. Revenue vaulted over +80% as oil and gas royalties more than doubled, plus water sales nearly doubled. Most of this was driven by higher realized prices on the production of oil and gas on the Company’s acreage. Production of oil and gas also grew +21%. The Company’s royalty interests span over 880,000 acres in West Texas. Most of this land is located in the highly productive Delaware Basin within the Permian Basin.

We expect development activity will continue to grow at a rapid pace in this region, primarily driven by both domestic and multinational producers looking to maximize returns on increasingly scarce oil and gas capital expenditures. Further, as the tragic war in Ukraine has unfolded, energy security has become an increasingly important issue for countries around the globe. The production of hydrocarbons on Texas Pacific’s acreage represents a “port in the storm” for the U.S. and for allies too that are dependent on the energy of hostile countries.

It is difficult to know how any specific policy will evolve but possessing a commanding acreage position in one of the most productive regions in the country puts the Company in an excellent strategic and competitively advantaged position.

Motorola Solutions contributed to performance during the quarter. The Company generated +9% revenue growth and reported +19% growth in its backlog during the quarter. Motorola offers critical services to its public safety and corporate customers and has operated Land Mobile Radio (LMR) networks for decades, which requires numerous software updates and constant cybersecurity support.

This long-term work is often included into backlog. Further, the Company has amassed a suite of software offerings that manage public safety emergency and 911 call center workflows. We expect Motorola’s core public safety market to continue adopting these software and service solutions that drive higher productivity in the face of chronic labor shortages.

Apple grew revenues +5% (foreign exchange adjusted and excluding Russia) driven by record iPhone revenues that were up about +3% on an exceptional year ago comparison of +50%. Apple’s installed base is over 1.8 billion devices which helps drive a software and services business that has generated almost $80 billion of revenue over the past 4 quarters.

As we have highlighted in the past, Apple’s relentless focus on the development and integration between hardware (especially ICs) as well as software, continues to add significant value for customers of its products and services. We expect this favorable competitive dynamic to continue for the foreseeable future.

Copart reported +8% growth in operating income driven by a +5% increase in volume of totaled vehicles processed and an +8% increase in the value of those units. Although overhead expenses outstripped revenues in the face of persistent wage inflation, Copart can contain these costs over a multi-year time horizon.

The Company maintains an effective duopoly in U.S. salvage vehicle auctions (along with IAA Inc.) and has been able to flex is salvage business to conform to the changes filtering through from the unprecedented supply (and demand) challenges of the new and used vehicle market. This is due to Copart’s unique, two-sided network platform that consists of the largest North American P&C insurance carriers and automobile dealerships, which are getting increasing access to foreign salvage buyers.

As automobiles are becoming more sophisticated with hard-to-repair electronics and computers on-board, we think Copart is helping insurance partners find a life “after salvage” with consumers, particularly outside the U.S., that place a higher value on these vehicles, often simply due to different regulatory regimes. Copart can grow at attractive double-digit rates as this phenomenon continues for the foreseeable future.

Company Commentaries

Alphabet

Alphabet’s business segmentation has been gradually broken out over the past few years and often it seems most of the discussion about the Company’s segment performance revolves around YouTube, Google Cloud Services, and even the Company’s Other Bets. But the standout performer of the Company’s segments over the past few years has been “Google Search & other.”

The ignominious descriptor of “other” is used in more than a couple of Alphabet’s named segments, but in the case of Search, “other” contains the revenues from no less than: Google Maps, Gmail, and Google Play. These “other” businesses along with Search have generated an incremental $50 billion in revenue since the pandemic emerged.

Gmail is an 18-year-old, nearly ubiquitous service utilized by over 1.5 billion users every day.[1] During the pandemic, this service became even more important as digital communication supplanted office interactions. The Company pushes dozens of new features per year, often related to automation and other ways to boost productivity of its users. Despite this strong usage and support, Google has more recently de-emphasized monetizing Inboxes and shifted to less intrusive but more relevant forms of advertising.

Further, Gmail is deeply integrated with other Google services, often serving as an onramp to those services. These services can also be monetized through subscriptions to Google Workspaces (formerly known as G Suite). We suspect Workspaces is positioned in the market to take share from more traditional productivity offerings like Microsoft 365. Admittedly, Alphabet discloses little financial details about Gmail.

However, with 1.5 billion daily active users, we can compare it to other businesses that disclose active user counts. Twitter’s (TWTR) equity was recently valued at $44 billion and has around 240 million daily active users of the service as a forum to communicate, whereas advertisers and subscribers are Twitter’s primary sources of revenue.

In lieu of any revenue, assets, or cash flow data about Gmail, we can estimate value using a similar market cap to daily user multiple. Using this multiple, the value of Gmail would be approaching $275 billion, which would be equivalent to about 20% of Alphabet’s current market cap.

Of course, we realize that using Twitter as a comparison is problematic, not least because the investor valuing Twitter at $44 billion has reportedly made the case that it is worth substantially less. Even if the comparable multiple ends up being half of what we used, the point is this: Gmail as an “other” business would still be worth over $135 billion. Disclosing more relevant financial data about this business line would go a long way towards driving a higher multiple for Alphabet.

Another one of Alphabet’s “other” business is Google Maps. Maps has more than 1 billion visitors per month and is deeply integrated into the Google’s core search services which helps facilitate more than 2 billion interactions between businesses and searchers per month.[2] Businesses rely on these interactions to drive sales and brand awareness, particularly local businesses, when it comes to Maps.

So, the value proposition of Maps not only helps to drive wallet share of ad budgets, but also helps expand the total addressable market for ad budgets by creating new revenue-generating experiences and opportunities, previously unavailable to other ad formats. For example, even businesses that do not have websites can be connected to customers because Maps serves up a phone number than can be directly dialed by a Google searcher on a smartphone. While many users take this function for granted, over 120 million businesses can rely on this to be connected to their customers.[3]

Other than the “other” businesses of Maps and Gmail, Alphabet’s Google Play is also another franchise. This other, other, “other” business might not be as well-known to Apple iOS users, but it is basically the Android-equivalent to the App Store and Apple Music. Google Play was launched roughly a decade ago, and Alphabet recently reported that over 2.5 billion people in 190 countries use the service every month.[4]

We can better size Google Play revenues than Maps or Gmail, because Alphabet offers an alternative form of segmentation in its filing, but again, the Company manages to declare Google Play revenues as “Google other” revenue along with hardware sales (Fitbit, Nest, Pixel phone, etc.), YouTube subscriptions and other (of course). As recent as 2021, we estimate Google Play revenues are 75% of Google Services’ “Google other” revenues, which means the business could be generating over $20 billion in revenues – up a third since pre-pandemic.

We suspect these revenues have very little in the way of costs compared to Apple’s App Store, as Alphabet has mentioned that Google Play revenues are net of any pass-through revenues. Using an Apple-like 10% overhead expense and an Apple-like 20X trailing pre-tax multiple, Google Play could be worth close to $400 billion. Not bad for another other, other, other business.

As mentioned earlier, Alphabet grew its second quarter 2022 core search revenues +18% (foreign exchange adjusted) on a staggering +68% year ago comparison. Despite this stellar top-line performance, shares continued to sell off as the market discounted fears of a recession. Our multi-year time horizon and appreciation for the Company’s “other” assets allows us to tolerate this exact kind of short-term volatility in growth rates (rather than implicitly extrapolating near-term slowing growth trends into perpetuity by selling).

The past few years of economic activity and dramatic shift in company-specific drivers of growth have been unprecedented, so a “normalization” of end-market demand at Alphabet is certainly not the end of the world. In addition, Google Search has been less affected by disruptions related to Apple’s privacy initiatives thanks to the Company’s long-term investment in the Android Mobile operating system. Alphabet’s Cloud segment is generating revenue at a $25 billion run rate but is still running at a loss.

This business can generate much better margins at some point. In the meantime, the Company has a fortress balance sheet and has been repurchasing shares at attractive historical multiples. The Company could expand that multiple in a very low-risk manner, simply by disclosing more information about its “other” businesses that we think are clearly powerhouses in their own right.

Whip Inflation Now – Until Something Breaks

We lead off this Letter with the same Ford Administration WIN graphic from our last Letter and a short summary, cutting to the chase: Please see our market commentary from our past couple of Letters. We note that on literally every economic and market measure chronicled in those Letters has gotten worse during the third quarter – some materially. (30-year mortgage rates have raced to 7.14% – up from just 3.07% over the past 12 months.)

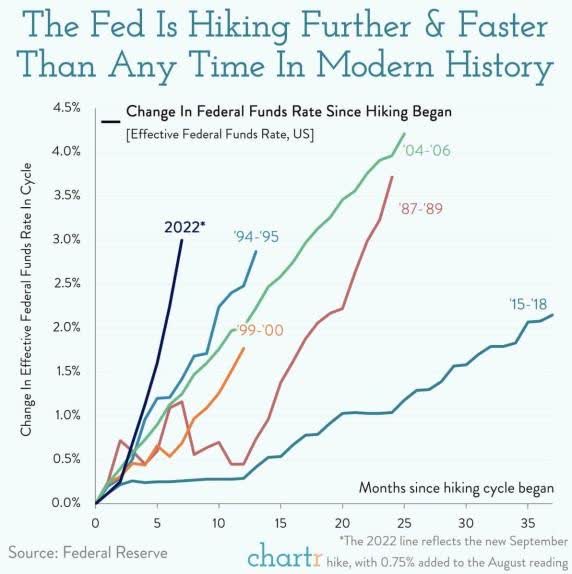

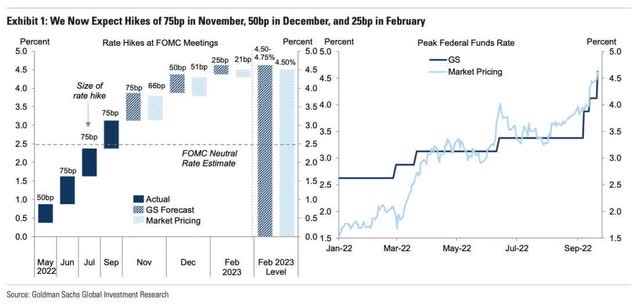

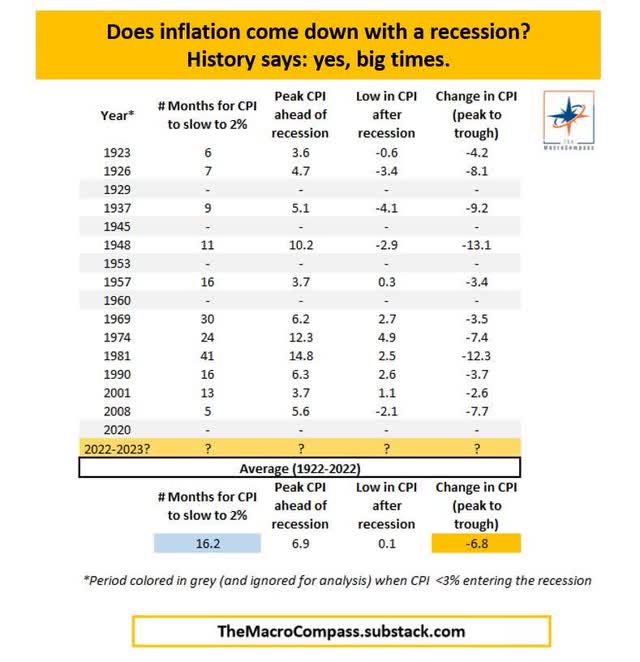

Powell & Co. has finally convinced investors around the globe that they are most serious in channeling their inner-Volcker to rein in inflation. However, getting inflation back to their desired 2% level will not be a surgical operation, but blunt force economic shocks. In other words, Fed to Wall Street: Drop Dead!

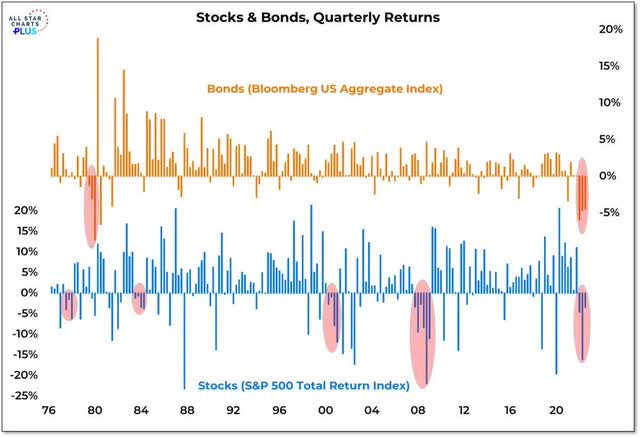

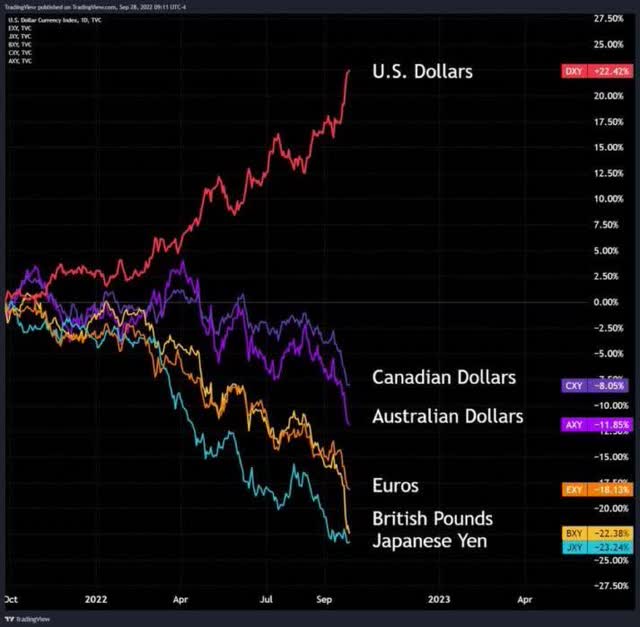

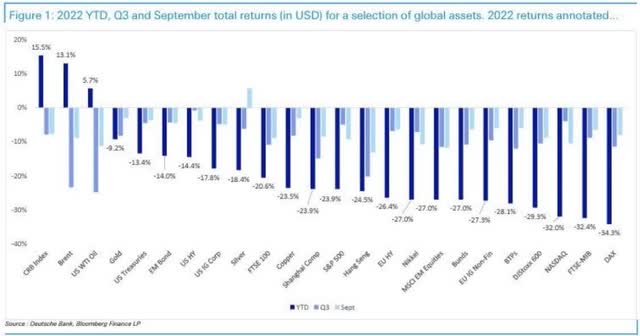

As bad as our stock and bond markets (and housing affordability) have suffered this year, international markets have experienced nothing short of shock and awe destruction as the strength in the U.S. dollar has quaked forex markets, which in turn have begun to break those markets that have feasted on too much leverage – such as the U.K. Gilt market.

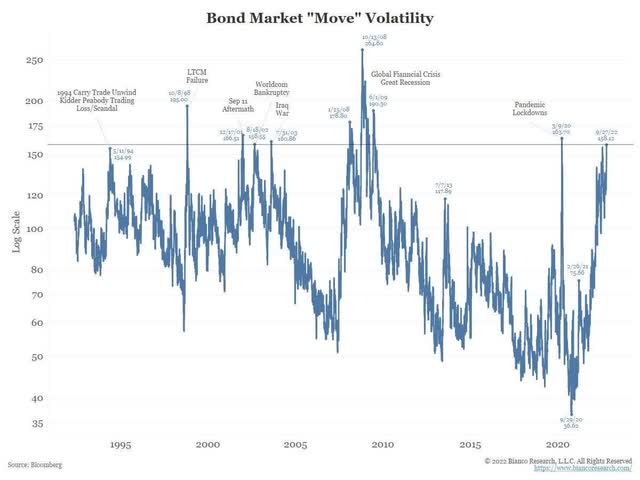

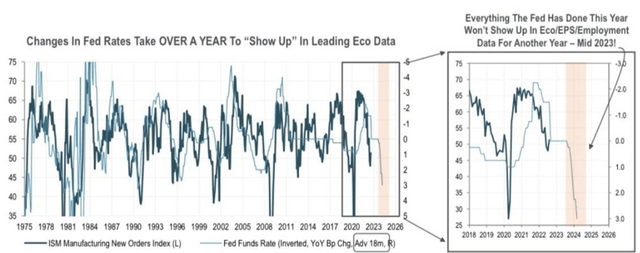

The Fed’s inflation fighting resolve is likely to be tested as we write this Letter. The U.S. bond market’s wild swings have reached elevated levels associated with past financial destruction and concomitant central bank intervention. Discounting the significant lag times interest rate hikes take to filter through the economy is a second order to future wild swings.

We’ve never put much stock in mind reading, but we’d guess, considering how long it takes historically for our central bank Mandarins to meaningfully reduce inflation, that Fed Chair Powell will do all in his intestinal fortitude to avoid adding “Powell Pivot II” on his CV. We suggest investors gird themselves for the inevitable epic battle of Powell vs. Brainard. Note, Lael Brainard, the Fed’s Vice-Chair, is so dovish on the easiest possible monetary policy that she makes uber-dove Janet Yellen resemble a Harris’s Hawk.

The stock market continues to sniff out this battle royale of wits and political clout in the Eccles Building – and recession risk too.

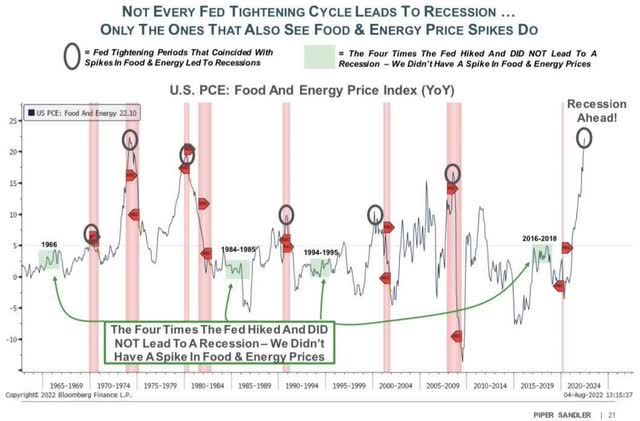

Source: Piper Sandler

We ended our last Letter as follows:

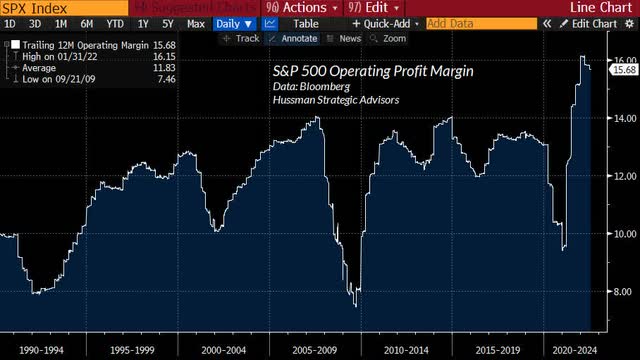

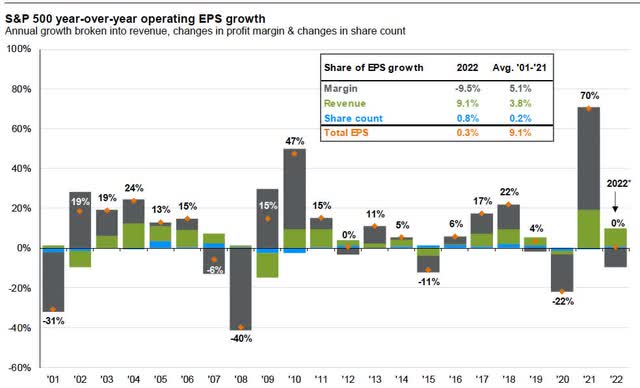

“Even if inflation recedes below current, evolving expectations, Corporate America still faces higher levels of sticky cost structures that may take a few years to claw back. Margin headwinds may dominate earnings well into 2023. Needless to say, we expect second quarter earnings (and third quarter forecasts) to add another whirlwind in stock prices.”

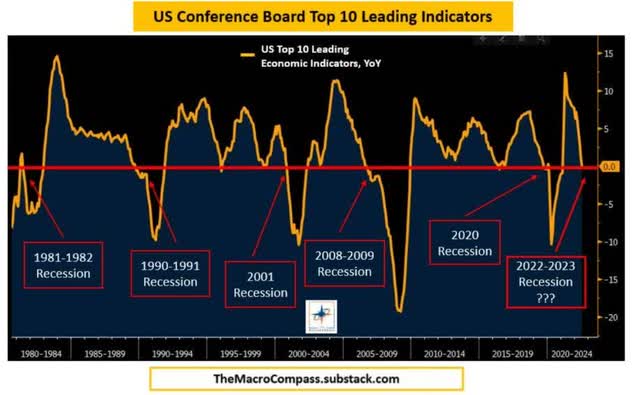

Our current thoughts on corporate earnings are unchanged, but more worrisome. Can Powell & Co. engineer the ever elusive “soft landing”? Although the consumer still seems to be in good spending shape, the list of companies, across most industries, reporting hard earning landings (and outlooks) grows by the day. Rare is the company that is not choking on too much inventory. Those companies who sell into international markets face a tsunami of revenue headwinds due to the soaring dollar.

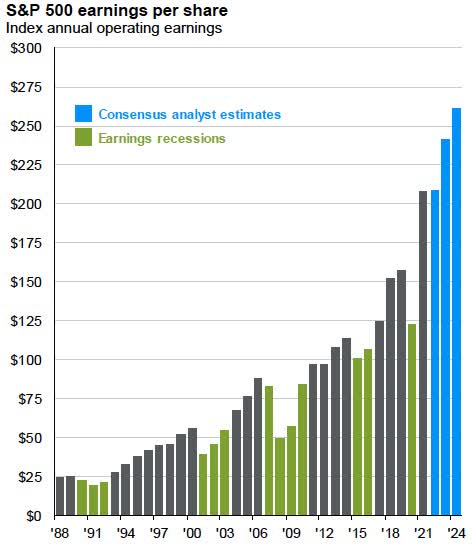

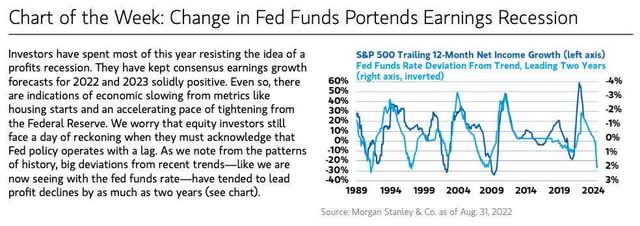

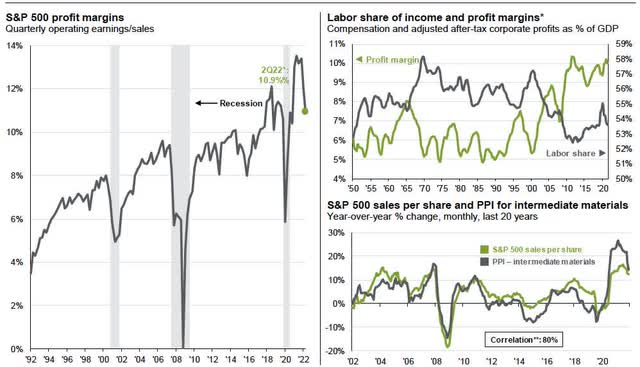

Record high corporate profit margins have barely begun to recede from the once in a generation cocktail of $1.7 trillion in monetary quantitative easing and $3.5 trillion in fiscal stimulus pandemic relief. In our view, analyst expectations for growth in earnings in 2023 and into 2024 seem hopelessly optimistic. Needless to say, we expect third quarter earnings (and fourth quarter forecasts) to add another whirlwind in stock prices.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

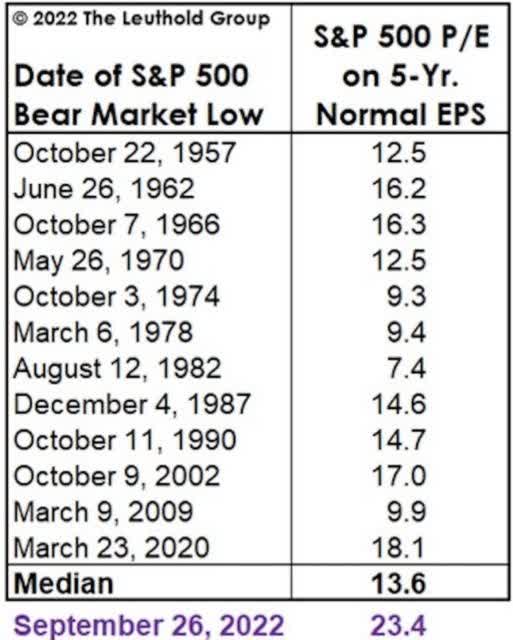

The graphic below best describes the sum of all of our fears. Many of our brethren value stocks on future earnings expectations. All is well on that front. Wall Street is inherently a discounting mechanism, as the past is prologue. However, when the operating environment reaches historic extremes, measures of “normalization” are prudent to consider. On that score, if 2023 and 2024 earnings disappoint current expectations (as we expect), given the Fed’s long road of tightening to get to their ideal 2% inflation, “normalized” earnings levels paint a picture that the next leg down in the current bear market may be a long road as well.

Despite our admitted bearishness, the contrarian element in our investing nature cannot help but think such bearishness (and fear of another Fed mistake) are not rare views these days. The stock market was at a similar moment of fear just make in mid-June, only to see the stock market stage a wicked sharp rally of nearly +20% by mid-August. Such rallies are part-in-parcel of bear markets – and why market timers are nowhere to be found on Forbes 400 List of Richest Americans.

In addition, the recent stock market rallies, and declines of +/- 2-3% each day, are even more evidence that the stock market can’t shake its addiction with the “Fed Put.” Each and every trading day starts with the hope or fear that Powell & Co. will or won’t “pivot.” In essence, the stock market trades as a single commodity, rather than a collection of vastly different individual businesses. We welcome a future when global financial markets can finally divorce themselves from the promises and foibles of central bankers. We aren’t holding our breath.

On the other hand, perhaps we should not look a gift horse in the mouth. If the stock market must be hooked on the opioids of central bankers, long-term “business owners” should relish the opportunity to take advantage of the opportunities central bankers will serve up.

We are reminded of the fact (paradox?) that the greatest source of significant gains in wealth are served up during bear markets. Our investment strategy remains the same. We will remain patient for Mr. Market to serve up fat pitches to either overweight current positions or add new positions.

Finally, Wedgewood is pleased to announce the well-deserved promotion of Bill Thomas to CEO and President. Bill has been with the firm since 2015 and President since 2016. He has had a substantial positive impact on the culture and operations of Wedgewood in a relatively short period of time.

Tony Guerrerio, who had been CEO, Chairman, and Portfolio Manager will remain Chairman and Portfolio Manager. Bill’s previous positions include CEO of Grail Advisors, as well as senior leadership positions at large national firms like Charles Schwab and Scudder Investments. His wealth of experience has benefitted the firm over the last seven years, and we look forward to a seamless transition.

David A. Rolfe, CFA, Chief Investment Officer

Michael X. Quigley, CFA, Senior Portfolio Manager

Christopher T. Jersan, CFA, Portfolio Manager

|

The information and statistical data contained herein have been obtained from sources, which we believe to be reliable, but in no way are warranted by us to accuracy or completeness. We do not undertake to advise you as to any change in figures or our views. This is not a solicitation of any order to buy or sell. We, our affiliates and any officer, director or stockholder or any member of their families, may have a position in and may from time to time purchase or sell any of the above mentioned or related securities. Past results are no guarantee of future results. This report includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. These comments may also include the expression of opinions that are speculative in nature and should not be relied on as statements of fact. Wedgewood Partners is committed to communicating with our investment partners as candidly as possible because we believe our investors benefit from understanding our investment philosophy, investment process, stock selection methodology and investor temperament. Our views and opinions include “forward-looking statements” which may or may not be accurate over the long term. Forward-looking statements can be identified by words like “believe,” “think,” “expect,” “anticipate,” or similar expressions. You should not place undue reliance on forward-looking statements, which are current as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate. The information provided in this material should not be considered a recommendation to buy, sell or hold any particular security. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment