Carl Court/Getty Images News

While it is now popular to criticize Cathie Wood, the fund manager of the popular ARK Innovation ETF (ARKK), she undoubtedly was one of the most defining characters of the brief pandemic-era investment period. Retrospectively, this period has now come to be defined by the excess of euphoric animal spirits on stock market valuations. This would see SoFi’s stock rise to just over $25 per common share, a level that now looks so alien and tall to current shareholders. But neither the ARK Innovation ETF, her most prominent fund, nor the more relevant ARK Fintech Innovation (ARKF) features SoFi (NASDAQ:SOFI). Why is that?

Indeed, Coinbase (COIN) and Block (SQ) both make an appearance. But Cathie’s mandate of investing in “disruptive innovative companies” has excluded SoFi. To be clear here, this is a positive for current SoFi shareholders. Whilst I’ll refrain from criticising the performance of ARKF, SoFi’s exclusion from the fund perhaps is reflective of one of the longer-term bull cases for the company.

SoFi

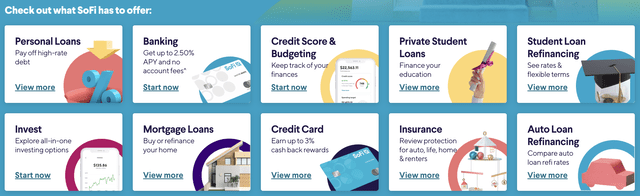

SoFi’s operating segments are not inherently high-risk “sexy” lines of operations that pull in the eyeballs of fast and loose traders looking for the next momentum-driven high. Personal loans, real banking, refinancing, and insurance. The company’s lines of business are in established industries that have always been in demand, are facing little regulatory scrutiny, and will be required long into the future. Households will need banking ten years from now but the same cannot be confidently said for some of the industries that Ark backs.

Stable Businesses Wrapped In An Ecosystem For Growth

There is a certainty that comes with such lines of operations as they are unlikely to be beset by catastrophic industry collapse or regulatory risk. The disintegration of bitcoin and the broader crypto industry for example has led Coinbase’s revenue for its last reported quarter to fall by nearly 64% year-over-year. SoFi is not dependent on a singular “disruptive” and volatile industry for the bulk of its revenues. This has meant that even against the broader economic and stock market chaos year-to-date, the company was able to grow its topline by almost 54% year-over-year for its last reported quarter. SoFi’s business operations ecosystem spans a diversified number of stable industries that have been around for centuries, long before the US was even established as a country. These are not inherently sexy, but they are structurally coherent and will be in perennial demand. SoFi’s initial acquisition of Golden Pacific Bancorp and successful move to get a traditional banking license cements its position.

The company remains one of the only post-2008 great financial crisis fintech firms that have swapped its non-bank lender moniker to get a banking license and essentially join the hat of the very same group it originally sought to compete with. Not a bad move, stable and boring JPMorgan Chase (JPM) reported revenue growth of 10.4% with earnings that beat consensus estimates. This rush to stability attracts a more stable investor base, de-risks SoFi’s long-term investment thesis, and increases the likelihood of the company eventually reaching consistent profitability.

Not Every Investment Has To Be Disruptive

It is important for shareholders to sometimes go over their investment notes and challenge their initial conviction on an investment. The inherent shunning of SoFi by one of the biggest celebrity investors of the last decade is not a negative. Further, SoftBank (OTCPK:SFTBY) closing its SoFi stake was more due to its internal disruptions from catastrophic losses its Vision Fund sustained from a series of consecutively bad investments.

That SoFi’s operational segments are not involved in non-fungible token trading or the latest cryptocurrency backing a metaverse has strengthened my initial investment conviction. Further, whilst SoFi is not profitable, the company is operating in more stable parts of the economy that are not subject to the fickle whims of animal spirits from inexperienced retail traders. This materially increases the likelihood of profitability being attained in the near term on the back of non-volatile revenues.

The previous investment environment that drove SoFi to its previous highs and made Cathie such a popular and dominant investor is likely all but dead with low interest rates a thing of the past. Further, the flush of liquidity from excessive fiscal interventions during the pandemic was unprecedented and unlikely to ever be repeated. Hence, the type of excessive euphoria that saw a large crowding of retail investors in every single Ark trade now likely sits as a footnote in the history of the pandemic.

A brutal recession, inflation, and an increasingly hawkish Fed await us all. Of course, these would all have an impact on SoFi’s growth either by softening lending and banking demand or increasing delinquencies. But that the company is not doubly exposed to both macro and micro level risks is a good thing for its shareholders. I continue to buy shares with the stock price showing great potential over a long-term holding period.

Be the first to comment