JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

Intel (NASDAQ:INTC) is going through a pivotal year in 2022 with the launch and ramp of several important products and milestones. These include Alder Lake (reclaiming PC leadership), Sapphire Rapids (reclaiming data center leadership), Arc GPU (entering GPUs), Ponte Vecchio (re-entering HPC and challenging NVIDIA’s AI training monopoly), ramping Intel’s first EUV node (on its path to reclaiming process leadership), and the robotaxi launch.

Nevertheless, these are mostly technology milestones. Revenue is expected to only grow modestly (but grow nonetheless). Still, I would advise investors to be wiser than the market and look at these many technology proof points as an indication of Intel’s progress to re-establish itself as a tech superpower, rather than just the financials. Since the stock has already been hammered two times in the last two quarters due to the gross margin pressure, investors may buy the dip.

Business and reporting restructuring

(Since this section is mostly a recap, feel free to skip.)

Intel for years – since the BK era in 2013 – has reported following business units in its earnings: the PC client group, the data center, the internet of things group, the programmable solutions group, and Mobileye. Intel also had the non-volatile solutions group, which encompassed its NAND and Optane businesses.

Intel’s narrative to investors was that the PC business represented a stable business that provided cash and IP for the rest of the company to leverage. The rest of the businesses were the “data-centric” businesses that together represented the other 50% of revenue. These had the potential to grow in the teens, and Intel forecast that over time they would make up 70% or more of total revenue.

However, going forward Pat Gelsinger is slightly reorganizing this structure into what he calls his six businesses. Obviously, the PC group remains the same, although without the modem, Mac, and home gateway businesses, and with a new leader given Gregory Bryant’s departure in January, who has been replaced by Michelle Johnston Holthaus, previously EVP of the sales group. Furthermore, Mobileye will also remain an independent business and will IPO in the coming months.

The rest of the business has been reshuffled. While there is still a data center group, now called Data Center and AI or DCAI, this group now also encompasses the full Optane business (Optane DIMMs were already reported in DCG, but not SSDs) as well as the FPGA business. (Although arguably PSG actually has more embedded sales than data center revenue.) It also contains Habana.

However, Pat Gelsinger has taken the networking part of the data center (where Intel sells ASICs, Xeon D, and basestation SoCs), and combined this with the IoT group (which sells Atom, Core, and Xeons) to form the new networking and edge group or NEX.

Next, given Intel’s high ambitions in graphics and accelerators (also called XPUs), Intel is making this a dedicated group, Accelerated Computing and Graphics or AXG, that contains three segments. First, the Arc dedicated GPU business. Secondly, the Ponte Vecchio and Arctic Sound data center products. And thirdly, a new XPU group that is currently primarily known for its blockchain/Bitcoin mining accelerator.

Lastly, Intel Foundry Services as the cornerstone of IDM 2.0 as expected is also getting its own P&L.

The new reporting structure is what observers had been expecting based on comments by Pat Gelsinger prior to the official announcement, where he said he had six businesses and those were the ones he would be investing in. In addition, he had already restructured the data center in mid-2021 into DCAI, NEX, and AXG.

Nevertheless, one could obviously debate whether Intel really has only six businesses, with, for example, the FPGA and Habana businesses now hidden inside DCAI, and IoTG and networking crammed together in one group. (Arguably Habana should be part of AXG.) Intel obviously further has several other small businesses such as silicon photonics, Barefoot Networks switches, and its emerging software business under new CTO Greg Lavender.

Still, overall the new reporting structure mostly accomplishes the goal/request of giving investors insight into the growth of graphics vs. NVIDIA (NVDA) and Intel Foundry Services vs. TSMC (TSM). Additionally, since Intel has the same mid-teens long-term growth target for both the data center and its IoT groups, taken together DCAI and NEX are basically equivalent to DCG and IoTG from the old scheme.

It has been remarked that despite just being at Intel for less than a year, Pat Gelsinger has personally chosen/appointed all of the six leaders for these businesses, although only Nick McKeown (and Greg Levander) are outside hires. The other moves are just reshufflings of existing Intel execs.

Q1 preview

There are many moving pieces to Intel’s Q1 guidance, which I will therefore just quote below, but in summary, Intel is basically expecting a flat Q1 (when normalizing for the sold NAND business).

We continue to see strong demand across all our businesses, and note that Q1 includes the impact of an additional 14th week. We expect results to be tempered by continued industry-wide component constraints, normal seasonality and PC notebook inventory burn as OEMs work through inventory imbalances created by ecosystem constraints that have limited their ability to ship systems in certain segments. We expect Q1 revenue of $18.3 billion, down 1% year-over-year, but up 2% when adjusting for an approximately $600 million onetime corporate revenue item recognized in Q1 ’21.

How should investors view this guidance? Basically, there should be a bit of a headwind from tough comps on the PC side, while there should be a major tailwind from incredibly easy comps on the DC side.

2022 preview

Given the current macro environment, investors will likely also be interested in some of the longer-term trends. However, Intel already discussed those at the February Investor Meeting. Pat Gelsinger basically said he expects the current surge in semiconductor demand (that has fueled the shortages over the last 18 months) to last for the next few years at the very least. Pat Gelsinger based his comment (quote taken from the Investor Meeting Q&A) on conversations with customers, such as the major cloud providers.

It is unlikely either inflation or Ukraine has really changed this outlook. In fact, given Intel’s integrated (IDM) model, Intel said that inflation is somewhat of a competitive advantage as for example, the TSMC middleman has been busy with hiking up its prices due to the shortages and inflation. Intel had previously said that it would shield its customers from inflation, but this is more of a near-term policy in order to increase its competitiveness with AMD (AMD). In the long-term, Intel said at Investor Meeting that it plans to increase ASPs (to drive gross margins) based on its leadership products as its competitiveness improves.

In any case, Intel expects $76B revenue in 2022, which would be a slight increase over 2021 since the NAND business would have added about $4B additional revenue, crossing the $80B mark. Intel continues to expect lower growth than what could otherwise be possible due to the shortages. Gross margin is expected at 50-52% depending on GAAP or non-GAAP measurement, and net capex of $27B.

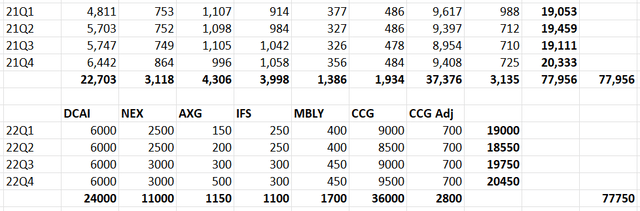

Above, I have provided a table that roughly indicates how Intel’s revenue should evolve over the year. GPU and IFS should both contribute about $1B. Mobileye should start to approach the $2B mark (although there are still reports about shortages and production shutdowns) and PC should be quite stable (Intel claimed it could deliver a seventh consecutive record year).

Data center at this point is the biggest unknown. Intel exited 2021 with a surprise record quarter, but this was mostly due to 14nm sales. It might be interesting if Intel provides some updates on its shipment numbers. For example, has Intel been able to double Ice Lake shipments to 2 million to drive continued DC strength, or could it achieve this in Q2? How about Sapphire Rapids? In any case, given that both Ice Lake and Sapphire Rapids will continue to ramp in 2022, in the bullish case (as the table above exceeds Intel’s guidance by nearly $2B), data center revenue will be fairly stable as customers move to Ice Lake and start their Sapphire Rapids buildouts.

As a reminder, Intel’s gross margin is not expected to improve until 2025 (as expected), but management did assure that it wouldn’t drop further either. The reason for this gross margin trend is because Intel will be busy with starting up its two new major nodes (Intel 4 and 20A) in 2022 and 2023 respectively. Intel incurs start-up costs prior to factory ramp, which is a traditional pattern that is getting amplified by the accelerated cadence between these two nodes. In addition, during the early stages of a process ramp, the yield will still be quite low (although the volume will also still be quite low). The reason gross margin will not drop further is because the Intel 4 start-up costs will disappear by the time the 20A start-up costs ramp.

Lastly, note that the major fab buildout (in Ohio, Germany, Arizona,…) is basically not a factor that drives gross margins. Gross margin is just a function of start-up costs and the process yield. Although in the long-term, foundry will be a bit of a drag given that this is a business below Intel’s corporate average.

Business trends

Intel had a pretty busy quarter. The CCG and CFO leadership transitions. The NAND sale. Investor Meeting. The impending Mobileye IPO and a few new product and design win announcements at CES. The two ~$20B fab announcements in Ohio and Germany. The Tower acquisition. On the product side, the full-blown Alder Lake launch as well as Arc Alchemist. Sapphire Rapids started to ship. The blockchain launch.

The most significant announcement was the official confirmation of Sierra Forest (and Granite Rapids) on Intel 3 in early 2024. These will be unquestioned leadership data center products.

Looking forward in 2022, the official launch of Sapphire Rapids will be quite significant. For the first time since 2019, Intel will have a leadership product in the data center even if it is just for a few quarters until Genoa launches. Note that until just one year ago, Intel was the laughing stock of the data center, and now it is “already” charging forward to leadership.

On the PC side, recent rumors suggest that AMD is not planning a core count increase with Zen 4 (contrary to the data center). This means Raptor Lake should maintain Intel’s competitiveness (and likely even leadership) by moving to a new big core architecture while also doubling the E-core count. As Pat Gelsinger said, AMD is now in the rear-view mirror forever.

Arc flop launch

There has been a lot of talk about Intel’s Arc GPU launch over the last few weeks. Although as expected Intel is starting the rollout in the laptop segment, and will move to the higher-end and desktop segments this summer, it is still quite a letdown to see the first Arc GPU being a low-end GPU that is barely faster than Intel’s integrated graphics.

This is like the late 2020 low-end DG1 launch all over again. Hence, the fact of the matter is that while a few years ago there was already some hype as Intel indicated that it would its first GPU in 2020, in reality, the first serious GPU that is of any substance to gamers will only launch in mid-2022.

In that light, given that the GPU ramp is quite back-end loaded in the year, Intel’s guidance for >4M shipments now seems quite respectable, since we can basically assume that these 4MU will pretty much all be sold in the second half of the year. Going from 0 to approaching a 10MU/year run rate in a few quarters implies quite a strong and respectable (market share) ramp over the next year. Given the reporting changes discussed above, this should be easily visible in the financials.

Many enthusiasts and even media have speculated that most of these 4 million sales will be for low-end GPUs, but there should be no reason why Intel couldn’t also sell a ton of Arc 500 and Arc 700 GPUs.

Secondly, the delayed Ponte Vecchio also has yet to launch. Note that Ponte Vecchio is delayed even when taking the revised schedule from mid-2020 into account. While Ponte Vecchio will still be competitive with NVIDIA given that it is a 5nm part, Intel obviously missed the chance to launch this while NVIDIA was still stuck with its 7nm Ampere generation. Nevertheless, Intel may get a new chance to leapfrog NVIDIA since the next-gen part is supposed to launch in 2023, presumably on 3nm.

Note that Raja Koduri already joined Intel in late 2017. So clearly, Intel’s discrete GPU efforts are one of the many case studies at Intel of underfunded projects that do not live up to their potential. This is why it was so important for Pat Gelsinger to join and for Intel to stop the stock buyback spending spree, and for Intel to hire well over 10k net new employees in the first year since Pat joined.

In short, investors aren’t excited about the past, but about the future as Intel unleashes its engineering prowess. With regards to the GPU business, the three business lines together would “approach $10B” by 2026, which translates to a triple-digit CAGR.

Intel isn’t a PC company

Many people and analysts continue to equate to a PC company, for example, in this recent report. But anyone who has followed anything about Intel for the past 5+ years should know that the whole point about investing in Intel is due to its newer businesses that can allow it to grow revenue substantially over time. A bit similar to how QUALCOMM (QCOM) has also been diversifying its business.

Risks

Although I said the stock has already been hammered two times in the last two quarters, if I were a trader, I wouldn’t necessarily bet my money on the stock going up after earnings, as the stock has a chronic tendency to drop instead.

Investor Takeaway

While Intel has made a lot of (perhaps underappreciated, looking at the stock price) progress in the last two quarters by ramping Alder Lake and Sapphire Rapids, as well as finally launching Arc, it is still the early days of what Intel calls its “investment phase”. For example, both the data center and PC GPUs have yet to ramp, the robotaxi business has yet to launch, and in 2022, IFS will still primarily be busy with running test chips and winning customers for the 18A node in 2025 (Intel said customers would make this decision in 2022).

On the financial side, Intel will benefit this year (especially in the first three quarters) from easy data center comps as Intel overall forecasts another record year (normalized for the NAND sale) despite ongoing semiconductor shortages. Nevertheless, as mentioned, investors shouldn’t measure Intel for the foreseeable future based on its financials, but on its product and technology milestones in both its legacy and emerging businesses.

To recap, Pat Gelsinger’s goal as stated at Investor Meeting was to deliver a 4x return to shareholders (“double double”): double the earnings at double the P/E multiple (while maintaining and growing the dividend). Given that the stock is currently near the low-end of its multi-year range, this may hence be an opportune time for investors to add shares (since the stock price won’t listen to the advice above to judge Intel by its technology milestones rather than financial performance).

Be the first to comment