peterschreiber.media

First American Financial (NYSE:FAF) is America’s second-largest title insurance company.

Historically, title insurance has been one of the better ways to profit from the housing market.

Title insurance is a niche service which is vital for buying homes, in particular for securing a mortgage. A bank typically won’t lend against a property without making sure that the underlying title is free and clear of all potential defects. As buyers have to secure title insurance to get mortgages, it serves as a sort of transaction fee on virtually all residential property sales in the United States. There is also substantial demand for title insurance on commercial property deals.

The industry makes more money from mortgages when a property changes hands. However, title insurers also typically earn a fee when an existing home mortgage is refinanced.

How Housing Market Shifts Impact First American

It’s no secret that the housing market is having a dramatic change in direction. After a huge run-up in 2021 and the early part of this year, housing appears to have topped and is likely to drop significantly in many parts of the United States. Higher mortgage rates greatly reduce potential home buyers’ total purchasing power as a much larger portion of a monthly payment on a new mortgage now has to go to interest instead of principal.

The easy conclusion would be housing sales will be down, therefore First American’s earnings and stock price should collapse. But let’s take a more nuanced look.

First American makes money on both refinancing deals and new home purchases.

On refi transactions specifically, these will disappear almost entirely for the time being. Very few people have existing mortgages at high enough rates to justify refinancing at the current prevailing market level today. That said, it’s not as bad as it looks. For one, First American makes about 2.5 times as much from new home purchases as refi transactions. So, think of refis as icing on top, rather than being the cake. Title insurers do better in a world where people are refinancing existing mortgages, but it’s not the biggest profit driver.

Also, some future earnings power is being formed with right now. Every 7% fixed mortgage made today becomes a good candidate to be refinanced when mortgage rates dip back to 4% or 5% at some point in the future. Volatility in interest rates is a plus for title insurers, in that anything which creates more full-cycle opportunities to refinance is a net benefit.

On home purchases, that volume will be down as well. But most of the elements that made the housing market so hot in 2021 are still around. People’s incomes have gone up a lot. There’s a sizable millennial generation that needs to buy homes at a faster than usual rate to catch up to where they’d be expected to be at this stage in their life cycle. High rents are discouraging folks that would forego home ownership. And American consumers have less debt and better finances than in markets such as Canada and Australia.

Housing went up a lot in the U.S. in 2021, but it wasn’t anything close to a bubble. First American doesn’t need housing prices to go to the stratosphere, it simply wants transactions to continue occurring at a reasonable clip.

Earnings Remain At Or Above Pre-Pandemic Levels

Judging by First American’s stock price, you might think that the company’s operating business is on the verge of a complete breakdown. However, the actual results are far less dramatic:

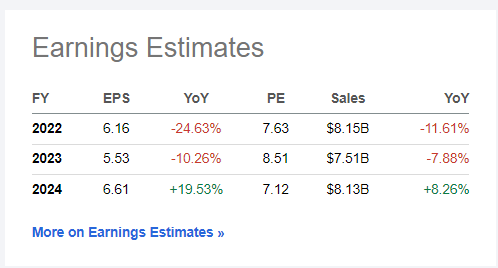

First American earnings estimates (Seeking Alpha)

Analysts expect a 25% decline in earnings for the fiscal year currently in progress, and another 10% decline in 2023 before things bottom out and return to rapid growth in 2024.

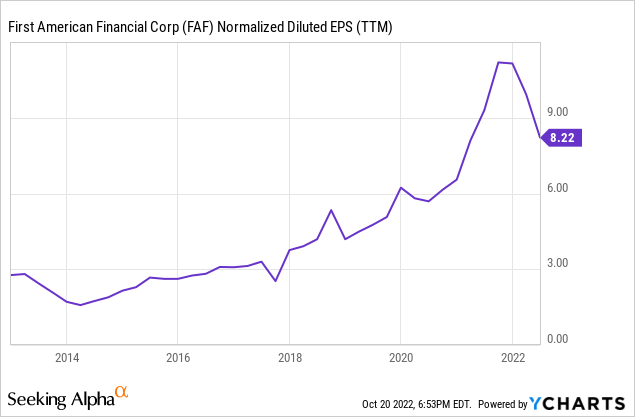

A 25% decline might sound like a big deal. However, keep in mind that the housing industry, and thus First American, earned absolutely staggering amounts of money in 2021. Dropping 25% from that peak is hardly a disaster. Here’s the past decade of First American’s earnings per share:

As you can see, earning $6 a share this year and $5.50 in 2023 is not anything to be too worried about. This business was earning in the $5-$6 per share range annually just prior to the pandemic. The difference is, however, that FAF was a $60 stock in 2019 whereas it is now at $45 despite having the same amount of mid-cycle earnings power now as it did then.

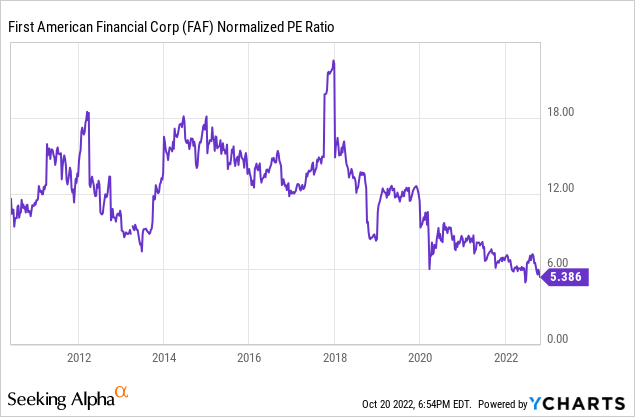

Dating back to the recovery out of the financial crisis, FAF stock typically traded around a 12x P/E and sometimes moved up into the mid-teens:

It’s only since 2020 that it has become normal for First American to trade at a single-digit P/E ratio, and the current 6x is unprecedented.

I get that housing is in a rough spot now and may remain so for a good deal of time longer. However, I see a company that is being punished too dramatically for a poor macroeconomic backdrop. The company’s earnings are still going to be around $6/share even during this down period for the housing market. The company’s historically normal 12x P/E multiple gets you a $72 stock price compared to a $45 share price today. Throw in the generous dividend and the total return forecast is quite favorable indeed.

Strong Dividend, Well-Covered Out Of Earnings

First American currently offers a dividend of $2.08 annually, which works out to a 4.6% dividend yield. Despite the downturn in the housing market, First American’s dividend is easily covered out of earnings. The company is expected to earn $6.16 per share in 2022 and more than $5.50 per share in 2023. This is far more than necessary to afford the current $2.08 payout rate.

I’d also note that First American bumped its dividend 2% higher in August. While this isn’t a huge increase by any means, management could have easily left the dividend flat given the gathering clouds on the horizon. Instead, First American stuck with a dividend increase to reward patient shareholders during this current market volatility.

Data & Digital Services Growth

First American has a great core business with its title insurance operations. That isn’t going anywhere anytime soon and is reason enough to be interested in the stock. However, as I highlighted in my thesis last year, First American is building out a sizable software and services business on top of its core title operations.

Management has noted that some of these are not accretive to earnings yet today and cause a near-term hit to profitability. However, First American is willing to invest capital because the long-term rewards could be rather significant. Here’s CEO Ken DeGiorgio describing one of these investments:

Significant among these is Endpoint, our digital title and settlement company that we built from the ground up. Endpoint has attracted leading talent that has developed technology to streamline the closing process and power prop tech companies and investors looking to scale their operations. After demonstrating strong customer acceptance in early test markets, Endpoint is rapidly building a national footprint and is currently operating in 27 states and by year-end expects to be licensed in 43 states.

I believe First American is ideally situated to build this sort of business. As the second-largest title insurer, it has a national footprint and understands well what its customers and partners need. Furthermore, the title insurance business provides robust cash flows with which to internally finance these growth ventures. Finally, First American is active in financing start-ups in the property technology “PropTech” space. As such, it has a great handle on what is out there, what is already being developed, and what market opportunities remain for First American to take on itself.

As for First American’s own operations, in 2021 it disclosed that its data and digital services division passed $100 million in annual pre-tax operating income. This could be continuing to grow significantly, given the rapid buildout of the business, however, let’s assume it’s still around $100 million annually now.

Even with the drop in the valuation of software and data companies in 2022, I believe First American’s data and digital services is worth a lot higher valuation than its title insurance operations. A mortgage software and data peer like Black Knight (BKI), even after its decline this year, is still being acquired around 24x earnings. It’s reasonable napkin math to assume a $2.0 billion valuation (20x pre-tax earnings) for First American’s data and digital services business.

As First American’s entire market cap is now under $5 billion, this implies a valuation for the core title insurance business of less than $3 billion for around $600 million of annual insurance profits.

Would management consider selling or spinning off data to maximize shareholder value? I haven’t seen any concrete sign that they would. But management is aware that shares are undervalued and is running a buyback program to take advantage of the current depressed valuation. And peers in the mortgage space have used financial engineering, such as spin-offs, to unlock value.

For now, the data division at First American is a hidden asset within the broader company. The thesis doesn’t rely on it, since shares are already so cheap just based off the core business. Just keep in mind there’s serious upside optionality. One day, we might wake up and hear the data business is going into an IPO, spin-off or whatnot at a hefty valuation in comparison to the remainder of FAF’s market cap.

FAF Stock’s Outlook

The bottom line is that FAF stock is much too cheap just based on its current operating business. Even accounting for the slowdown in the housing market and the complete disappearance of refinancing transactions at the moment, FAF is still projected to earn around $6/share going forward on a $45 stock.

Management announced a $400 million share buyback this summer. With the stock at its current price, that would retire about 8% of the company’s outstanding shares by itself. That’s enough to add to earnings dramatically, in addition to the usual support you get for a share price when a company is that actively buying its own shares.

The company is also paying a 4.6% dividend yield on top of the share buyback, and that dividend was just increased.

First American doesn’t have the most torque to an improving housing market. Buying a homebuilder or construction materials company offers more upside if you think the housing bust narrative is overblown.

However, I don’t have any strong conviction on when mortgage rates will level out and housing demand will pick back up. As such, I’m more interested in buying housing stocks that can endure at least a couple of years of soft results without any material hit to the company’s balance sheet or long-term prospects. First American was nearly breakeven during the worst of the 2008 housing crisis and returned to robust profitability by mid-2009. Title insurance is one of the most resilient pieces of the housing ecosystem, and the downturn we’ve seen so far is not nearly of a magnitude to significantly damage First America’s outlook.

Given the high margins, limited competition, and bank-mandated usage of First American’s core title insurance product to get a mortgage, this is one of the best plays on the housing industry. And, at less than 8x trough earnings with a hidden digital business asset inside that number, shares are a compelling bargain at today’s price.

Be the first to comment