shaunl

Small cap value has held up well versus long-duration growth stocks this year. The group, dominated by financials, energy sector names, and some defensive niches, also includes cyclical areas tied to global economic growth.

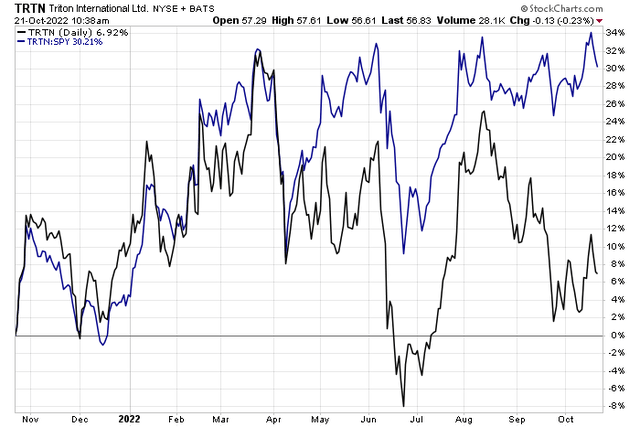

One international shipping and trading firm has been positive over the last year, beating the S&P 500 by more than 30 percentage points. Is more alpha ahead? Let’s assess the situation.

Triton International: Impressive Relative Price Strength YoY

According to Bank of America Global Research, Triton International (NYSE:TRTN) is an intermodal container leasing company with the world’s largest container fleet with 7.04 million twenty-foot equivalent (TEU) containers. Its customers include the world’s largest shipping liner companies. TRTN has a significant global presence, including 20 offices in 16 countries and a network of 299 third-party container depot facilities in 75 countries.

The Bermuda-based $3.5 billion market cap Trading Companies & Distributors industry company within the Industrials sector trades at a low 5.6 trailing 12-month GAAP price-to-earnings ratio and pays a high 4.5% dividend yield, according to The Wall Street Journal.

TRTN has exposure to the cyclical global trade market through its container box and liner company businesses. It has recently extended lease rates out more than 10 years to help buffer risks. BofA notes that the firm has historically traded at a 5x to 10x multiple to EBITDA, or a roughly 8x to 10x P/E.

Unfortunately, an international slowdown could lead to a near-term reduction in fair values. Still, the currently low earnings multiple suggests shares could be a decent value. Downside risks include weaker lease rates and a shift away from globalization. Overbuilding due to near-term high shipping costs seen earlier this year could be a longer-term headwind.

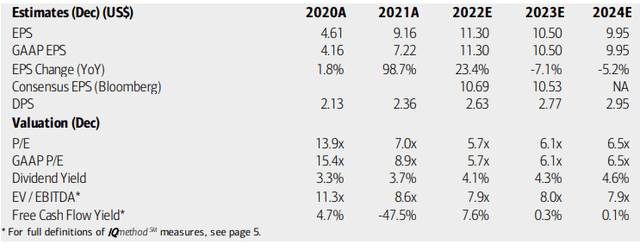

On valuation, BofA analysts see earnings having climbed sharply this year, but EPS declines are expected in 2023 and 2024. The Bloomberg consensus forecast shows similar figures through next year.

The dividend, however, is expected to increase in the coming quarters. The stock trades at a low GAAP and operating P/E while its EV/EBITDA multiple looks somewhat attractive, too. Free cash flow is seen turning flat, though. Overall, growth risks are elevated while the stock is bearishly priced for a recession.

Triton Earnings, Valuation, And Dividend Forecasts

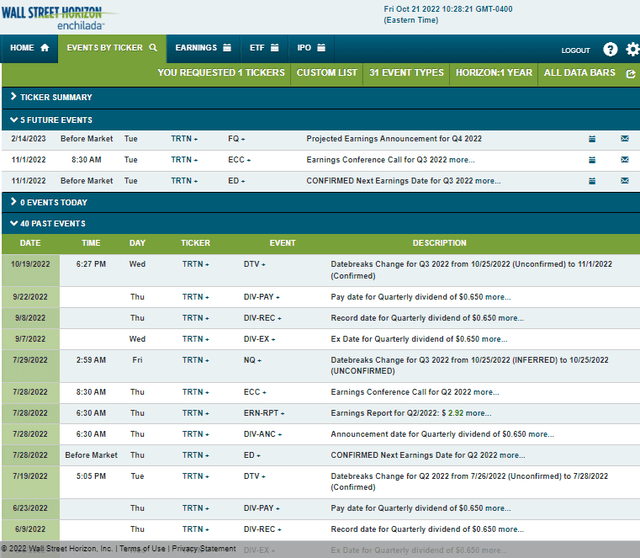

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3 earnings date of Tuesday, November 1 before market open with a conference call immediately after results cross the wires. You can listen live here. The corporate event calendar is light after that, though.

Corporate Event Calendar

The Technical Take

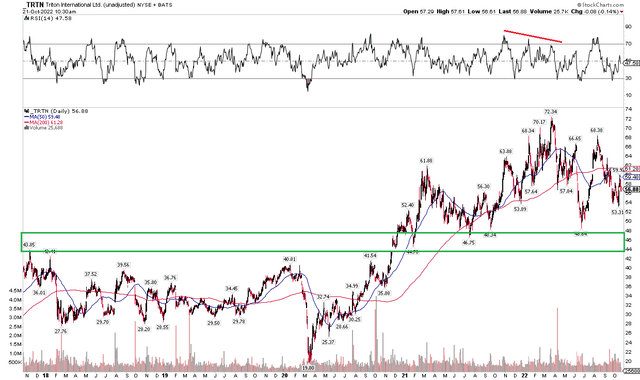

This small-cap value stock has held up relatively well amid market turmoil this year. The relative strength is made all the more impressive given TRTN’s exposure to potential weakness in the global economy. Shares remain above a key $44 to $46 range – the bulls want to see that area maintained on any weakness.

Near-term, the $53 price point is important to hold as well as $48 under that. Notice in the chart below that the stock exhibited a bearish divergence between its RSI indicator up top and price. The momentum gauge was making new lows earlier this year as prices rose. The stock indeed turned lower from above $70 to under.

On trend, TRTN’s 200-day moving average has turned flat and is now above the stock price – those are bearish technical factors.

The overall technical picture is mixed, but we’re clearly in a pause after the stock rallied big off its March 2020 lows to the April 2022 peak. That suggests the eventual move will likely be in the trend of a larger degree – higher.

TRTN: Bearish Divergence Resolved, Shares Remain Above Key Support

The Bottom Line

Triton is a mixed bag on both valuation considering growth risks as well as on the charts. I think it is still a buy-in net, though, based on a solid yield and relative price strength. While not a screaming buy, if there is an optimistic turn in markets, TRTN should help lead the way.

Be the first to comment