karenfoleyphotography/iStock Editorial via Getty Images

The U.S. cannabis space has generally been left for dead in the last year and the smaller multi-state operators (MSOs) are even more forgotten. MariMed (OTCQX:MRMD) is one such promising small MSO with plenty of upside when investors return to the sector. My investment thesis remains ultra-bullish on the stock trading here not too far from just $0.50.

Big Guidance

The U.S. cannabis industry has faced a tough period due to inflation hitting consumers while comps from 2021 are tough due to stimulus payments. Despite these issues, small MSOs like MariMed have solid growth plans due to either adding new dispensaries, expanding to new markets or via acquisitions.

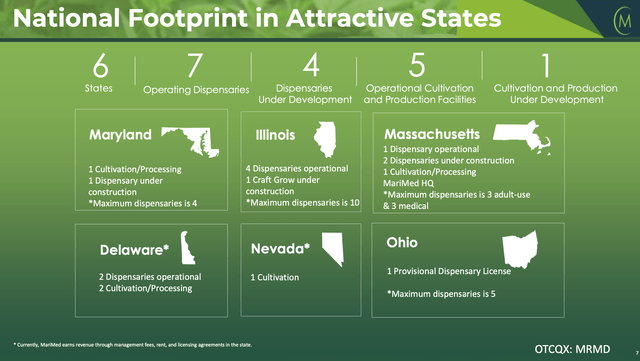

The small MSO reported Q1’22 revenues of $31.3 million for 27% growth. MariMed has already become a relatively large cannabis company with an annual sales run rate topping $120 million. These numbers were before the MSO won a provisional dispensary license in Ohio allowing for the opening of a dispensary in the state and the completion of acquisitions in both Maryland and Illinois.

Source: MariMed Q1’22 presentation

The company basically built the business from just 5 dispensaries in Illinois and Massachusetts. MariMed plans to add dispensaries in Maryland (1), Massachusetts (2) along with the potential to build additional dispensaries in multiple states including the new license in Ohio. The MSO will likely look for a deal to build out the state limit of 5 stores.

The opportunity here is massive with the craft grow acquisition in Illinois allowing for the building of a cultivation business in the state. MariMed forecasts 2022 revenues will reach up to $150 million with opportunities to more than double revenues from those levels.

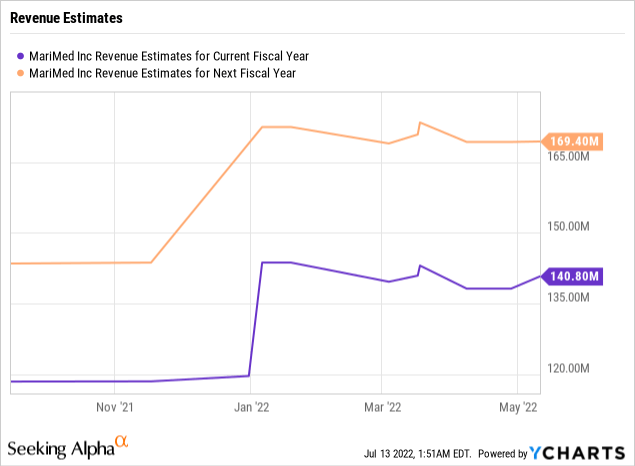

Analysts forecast 2022 revenues at $141 million with 2023 sales jumping to $169 million. The sales estimates both appear low for the opportunity here to quickly open new stores.

Big Future

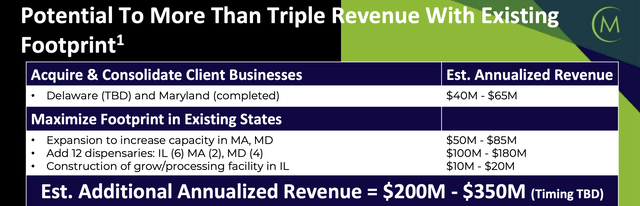

While a lot of MSOs have the ability to expand into new states approving recreational cannabis such as New Jersey, MariMed is a different story here. The company only needs to open dispensaries in existing states to vastly expand revenue. As highlighted below, the MSO can add 12 dispensaries in Illinois, Massachusetts and Maryland to add anywhere from $100 to $180 million in additional annual revenues on top of the current base approaching $150 million.

Source: Q1’22 presentation

Naturally, MariMed has to invest substantial capital in order to add both additional capacity and up to 12 new dispensaries in 3 different states. In total, the MSO could add up to $350 million in additional revenues and will spend ~$21 million in capex for the remaining 3 quarters of this year.

These numbers are substantial for a stock with a fully diluted market cap of just $260 million based on 438 million shares outstanding. This share count includes over 66 million shares tied to options and warrants that might never be exercised.

MariMed only has a minimal cash balance of $33.5 million, though the company produced operating cash flow of $8.5 million in the March quarter. If the MSO can continue at this pace, MariMed can continue to fund capex via ongoing positive cash flows. On the Q1’22 earnings call, management was clear the cash flow positive prevents the MSO from being capital-constrained.

The stock started trading on the Canadian securities exchange on July 12 helping MariMed rally recently. Although the dual listing is a positive, most other MSOs have such dual listings and the stocks have suffered mightily in the last year.

Takeaway

The key investor takeaway is that MariMed is a near-forgotten MSO. The company is still building out the business while the market has nearly lost all interest in cannabis stocks. The opportunity to expand the business far exceeds the current valuation of the MSO, making the stock a major bargain.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market during 2022, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

Be the first to comment