posteriori/iStock via Getty Images

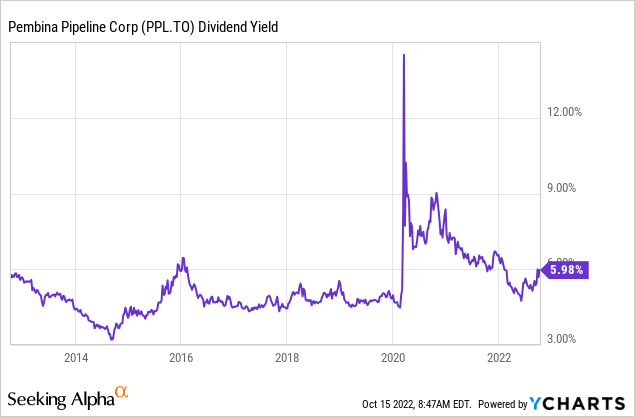

We had recently highlighted the amazing value and quality that we saw in Pembina Pipeline Corporation’s (NYSE:PBA) preferred shares. We saw the 3.65% spread reset to the 5-year Government of Canada bond yield as the ultimate protection against inflation. We also felt the floor yield of 5.25% would protect against deflationary outcomes in the future. We left off with what would be your worst outcome.

One small risk to the thesis is that Pembina might call these. At close to 7%, this is the highest coupon the company is paying. If it sees this as “debt” then it may go after this issue and redeem. If it sees this as equity (which it is), then the 7% is cheaper relative to its 10% AFFO yield. The company has massive room on its unsecured credit facility, so this can be done. Of course, investors don’t really lose anything if they are called as these are still trading below par. The worst case is that this becomes a cash parking area for a 10% plus annualized yield.

Well turns out that we got our worst-case scenario.

CALGARY, AB, Oct. 14, 2022 /CNW/ – Pembina Pipeline Corporation (“Pembina” or the “Company”) announced today its intention to redeem its issued and outstanding Cumulative Redeemable Minimum Rate Reset Class A Preferred Shares, Series 23 (“Series 23 Shares”) (TSX: PPL.PF.C) on November 15, 2022 (the “Redemption Date”).

Pembina intends to redeem all of its 12,000,000 issued and outstanding Series 23 Shares, in accordance with the terms of the Series 23 Shares, as set out in the Company’s articles of amendment dated December 16, 2019, on the Redemption Date for a redemption price equal to $25.00 per Series 23 Share (the “Redemption Price”), less any tax required to be deducted or withheld by the Company. The total redemption price to Pembina will be $300 million.

As previously announced, the dividend payable on November 15, 2022, to holders of the Series 23 Shares of record on October 31, 2022, will be $0.328125 per Series 23 Share. This will be the final quarterly dividend on the Series 23 Shares. Upon payment of the November 15, 2022, dividend, there will be no accrued and unpaid dividends on the Series 23 Shares as at the Redemption Date.

Source: Pembina

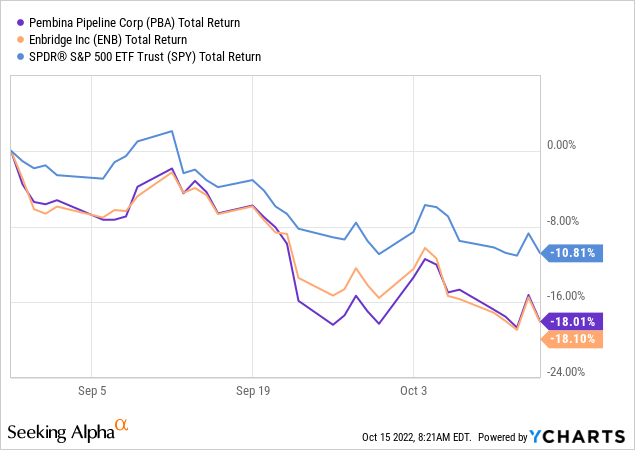

Of course, that 10% annualized return from August 29, 2022 sure beats what we have seen from the broader indices, the pipeline sector, or even in PBA common shares.

We look at where investors should consider deploying the cash next.

This sister issue from PBA has very similar terms to the one that was just called for redemption. The terms are slightly less onerous on PBA with a floor yield of 5.20% (PPL.PF.C had 5.25%) and a spread vs government of Canada 5 yield of 3.51% (PPL.PF.C was 3.65%). All other things being equal, PBA would have likely called this one if it was scheduled today as well. But the redemption date here is February 15, 2023, and Pembina has until January 15, 2023, to decide on this one. For those bullish on interest rates, this is one to consider. Our take is that PBA will definitely call this one as well, if the 5-year bond yield rate exceeds 4%.

Investing

In between 3.5% and 4.0%, redemption is uncertain, and PBA will most likely pass on redeeming, if the yield is below 3.5%. We would watch how prices move in response to this move on Monday, before deciding whether a purchase makes sense. If PPL.PF.E gets slammed right up near par (at $23.10 on last close), we would exit rather than buy.

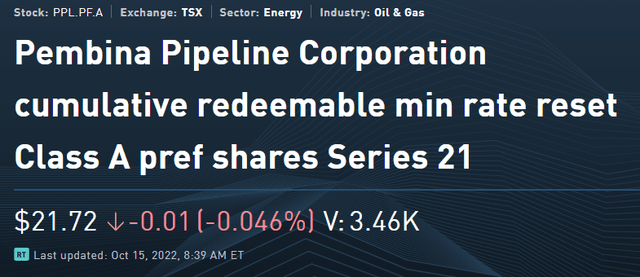

This one again has very similar terms, but the spread is lower at 3.26%. This is going to go in the category of “least likely to be redeemed” on March 1, 2023. There are a couple of reasons for this. The first of course is that PBA will pay less on this over time, compared to other two sister issues. The second is that it also has a lower floor yield of 4.9%. So down the line, there is a retained option of paying even less dividends vs the other two with higher floor yields. The final reason here is that if rates continue higher, PBA will likely lose its appetite to keep redeeming more and more of these using its unsecured facility. PPL.PF.C is a $300 million redemption. PPL.PF.E has $250 million par value outstanding. PPL.PF.A is humongous with $400 million par value outstanding. The reset on this one would be a shade under 7% (3.71%+3.26%) based on last known rates. That works out to about an 8% yield on the current price.

Keep in mind the extreme uncertainty that is part and parcel of this till then.

Notice of any redemption of Series 21 Shares will be given by the Corporation not more than 60 days and not less than 30 days prior to the date fixed for redemption.

Source: PPL.PF.A Prospectus linked above

PBA

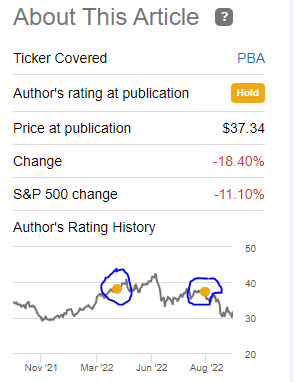

The common shares were rated as neutral the last two times we wrote on the company.

Seeking Alpha

The big drop here, alongside a steady improvement in fundamentals has moved us back in the buy-zone. Keep in mind that in the face of such aggressive central bank hiking, all asset classes will deliver extremely poor returns. Nonetheless, we think PBA can deliver 7%-9% total returns from here, with the vast majority of that coming from its dividend.

Verdict

A 10% annualized total return certainly beats the drubbing investors in the stock market over the last 45 days. There are a lot more opportunities present on TSX preferred shares than there were a few weeks ago. We will be keeping those alerts for our subscribers. That said, PBA has some of the best fundamentals and there is very little wrong in staying with this company’s preferred shares with the redemption proceeds. We will caution though that all common shares (not just PBA) will struggle when faced with such huge competing lower-risk yields on corresponding preferred shares.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment