AntonioSolano/iStock via Getty Images

Investment Thesis

Coterra Energy (NYSE:CTRA) is an E&P oil, natural gas, and NGL upstream company. On the one hand, it’s cheaply valued, with strong shareholder returns of capital, which I estimate could reach around 13.8% yield.

What’s more, I estimate that Coterra is attractively priced at 6x this year’s free cash flows.

That being said, the thesis with energy companies has always been, don’t invest at low multiples to free cash flow, as that often represents the end of the cycle. And that mantra has done a great job of protecting investors over the past decade.

However, I believe that that line of thinking isn’t constructive on this occasion. The company is cheap because nobody has wanted to invest in energy companies for so long.

Here’s why Coterra is a compelling investment.

Why Coterra Energy? Why Now?

Coterra Energy holds upstream assets that engage in the exploration and production of oil, natural gas, and NGLs. At the end of Q4 2021, it underwent a merger between formerly known Cimarex Energy Co. and Cabot Oil & Gas. The company then changed to a new name, Coterra Energy.

Coterra’s engagement in oil, natural gas, and NLG has the purpose of achieving greater resiliency to market fluctuations and other factors impacting any single commodity.

As you know, we are in the middle of an energy boom. This was brought on by many years of under-investment. And even now, although the price of oil oscillates meaningfully, there’s no immediate fix to this problem.

It can take more than a year for oil prices to start to drop back to $70 WTI because it takes time to meaningfully ramp up production.

You need to get capital infused in projects, leases approved, hire engineers, get machinery, and physically dig the well. Even with OPEC, they can’t just turn on a spigot and fix the problem. And even if they can, so far, they’ve shown absolutely no appetite to do so.

OPEC is unquestionably the global leader in this space and they are fully in the driving seat. There’s no point in any analysts pretending that they can forecast the supply and demand of oil better than OPEC can.

OPEC is in command here, and they are very much welcoming higher prices. They can write the book on oil demand destruction.

Meanwhile, on natural gas, it’s a different setup. Europe was fully reliant on natural gas from Russia and had massively underinvested in their own energy requirements.

And right now, sanctions on Russia have led to a massive spike in gas prices in Europe. And remember this, natural gas is a great climate solution. Natural gas doesn’t compete against solar panels and windmills. It competes against dirty coal.

Next, let’s discuss Coterra’s specific cash flows.

Cash Flows Discussed

Back in February, Coterra was projecting 2022 free cash flows of approximately $3 billion. But since that time, both oil and gas have moved higher.

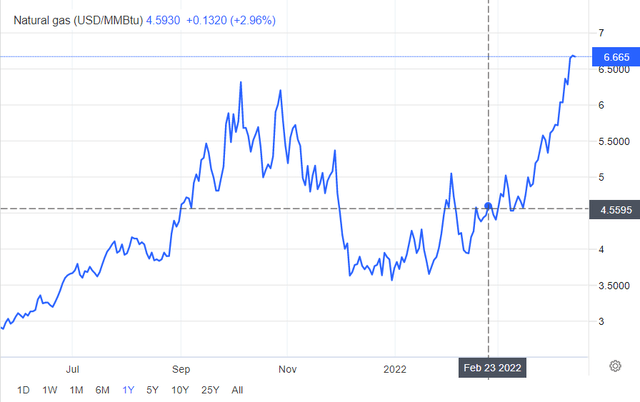

Trading Economics, price of gas (US)

Indeed, consider that since Coterra announced its Q4 2021 results towards the end of February, prices for natural gas are up more than 40%. It’s unimaginable. But it doesn’t stop it from being true.

Back in February, Coterra committed itself to returning 50% of its cash flows back to shareholders.

Given that oil and gas prices are so strong right now, it’s not inconceivable that Coterra ends up making around $3.8 billion in free cash flows this year.

With this line of thinking, let’s discuss Coterra’s valuation.

CTRA Stock Valuation – Attractively Priced

Coterra may well announce together with its Q1 2022 results that it’s going to increase its base divide yet again, as well as increase its share buybacks.

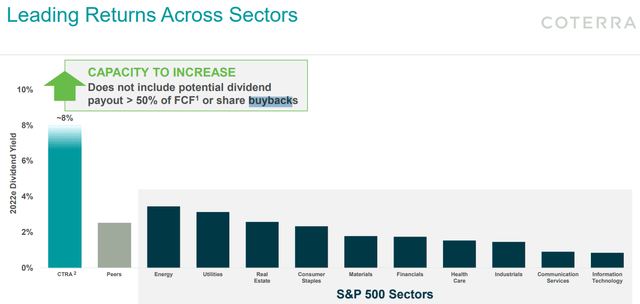

One way or another, I believe that Coterra is likely to return to shareholders 7.9% via dividends and special dividends throughout 2022.

Coterra Q4 2021 results

And this is just from dividend, as you can see above. There’s also Coterra’s share repurchase program.

Presently, Coterra has a $1.3 billion share buyback program underway that offers investors a further 5.9% return of capital yield.

These two capital return programs together mean that at present prices, Coterra’s shareholders are likely to get 13.8% via a combination of capital return programs.

And for all this, remember, investors are just paying approximately 6x free cash flow.

Moving on, Coterra carries approximately 25% of its oil and gas portfolio hedged.

Obviously, with oil and gas prices soaring higher, that’s not the most favorable situation to be in. You want maximum exposure with no hedges in this environment.

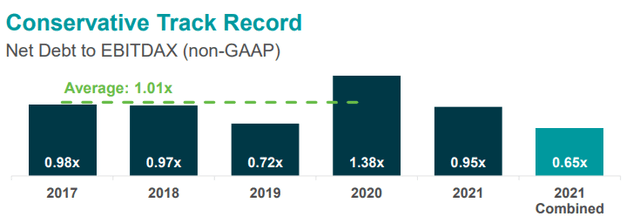

Coterra Q4 2021 investor presentation

On the other hand, Coterra has one of the best balance sheets I’ve seen in this space. I fully suspect that when Coterra updates the market on its Q1 2022 results, its net debt to EBITDAX figure will have dropped to below 0.5x.

In sum, this is further evidence that Coterra is going to increase its shareholder program imminently.

The Bottom Line

The most bearish consideration that investors can bring to the table is obvious. Oil and gas are so unpredictable and with prices moving so high and so quickly, there’s bound to be demand destruction.

And while that’s clearly going to happen at some point, my argument is that it’s not going to happen in 2022. At least not to a meaningful extent.

As a corollary to this thinking, many investors would make a claim that Coterra has moved so meaningfully in the past 12 months, that it’s overdue for a pullback.

And that’s called price anchoring. And I don’t believe that’s helpful when it comes to thinking about where Coterra’s share price could go over the coming twelve months.

To preempt your question, I have shares in this space too, just a company that is more tilted towards buybacks rather than dividends. Whatever you decide, good luck and happy investing.

Be the first to comment