James Pintar/iStock via Getty Images

Exxon Mobil (NYSE:XOM) has been on a historic upward rip that has left its bears bewildered and galvanised the bullish narrative that for so long had been dominated by commentary about peak oil and activist ESG investors. The company’s last quarter was a blowout. Indeed, revenue came in at a 70% increase from its year-ago quarter with net earnings at $17.85 billion. This was close to a 4x increase in profit from its year-ago figure and the highest-ever quarterly amount.

During the beginning weeks of the pandemic, over two years ago, the price of oil had briefly turned negative for the first time in history as producers paid buyers to take the commodity off their hands over storage capacity fears. The benchmark West Texas Intermediate would fall as low as minus $37.63 a barrel. WTI now trades at just under $90 a barrel, a near $127 a barrel difference as the world since then has been beset by an energy crisis exacerbated by war.

The White House in response to the crisis has released about 142 million barrels of oil from the US Strategic Petroleum Reserve, driving it to a 40-year low just as OPEC+ recently defied pressure and cut its production quota by 2 million barrels a day. This has come on the back of the last redoubts of zero-covid disappearing in Asia with Japan and Hong Kong recently liberalizing their travel rules. Whilst China has recently emphasised that it intends to stick with its zero-covid policies even after the 20th national party congress of the CCP, the overall outlook for oil now is clear. The bulls still have it.

From a pandemic whose legacy has been inexplicably positive for oil to Russia’s invasion of Ukraine to OPEC+ actions to cut their production quota, Exxon is riding an incredibly unique intersection of events. These have acted as a salvo, some say the final, of an industry that just a few years ago was seemingly on the brink of large asset writedowns. Critically, the options to counter OPEC+ will be limited and the cartel could very much follow up with even more production quota cuts to keep oil at elevated levels. But shareholders should be aware that the recently signed Inflation Reduction Act represents a step change for the temporarily faltering drive towards net zero.

An 800-Pound Gorilla Stalking Oil And Gas

The party is going to eventually come to an end with Exxon’s current buoyant upstream revenue facing a short to medium-term downward reversal on the back of a possible global recession. Longer-term risks come from the recently signed Inflation Reduction Act which the current bullish oil market sentiment has not been entirely aware of. Yes, there might have been a level of prematurity to the transition towards more sustainable energy reflecting comments from Chevron’s CEO, but the Inflation Reduction Act represents a step change for the industry. The IRA looks to allocate at least $370 billion to accelerate the drive towards net zero over the next decade until 2032.

Exxon’s core upstream and downstream activities remain incompatible with the drive towards net zero as combating anthropogenic climate change remains at the centre of US government policymaking. The ESG movement might have been too euphoric on its initial timelines for the runway adoption of renewables, but the IRA intends to induce a longer-term collapse of fossil fuels by bringing this forward.

Oil bulls need to be cognizant of the fast-changing landscape. What was once the fringe vision of the future by a small number of environmentalists has now become encoded in US statute and will likely become one of the most defining shifts in contemporary American history. In my opinion, the Inflation Reduction Act is simply unprecedented in its scope and scale and represents the most pertinent effort by any government on the planet and against any time in American history to heavily influence the winds of change for its entire energy system. The incentives included in the IRA go beyond the initial $370 billion cost. They will fast become the ignition that sees transitioning to a lower carbon economy more of a likelihood than fiction.

Analysts from Credit Suisse in late October published a research note on the IRA that highlights just how staggering in scope it is. Firstly, the IRA might spend twice as much as the currently earmarked $370 billion figure as many important provisions including subsidies for solar, utility-scale battery storage systems, and advanced nuclear reactors are uncapped tax credits. Companies will be able to choose from a production tax credit of $25 per MWh for the first ten years of their plant operation or a 30% investment tax credit on new zero-carbon power plants placed into operation from 2025.

Essentially, the US government has written a blank check to the low-carbon industry. The frequently cited $370 billion figure is somewhat misleading. As long as a project meets the terms, the government will award credits. There is no upper ceiling, no budget, and no restrictions. The IRA’s total spending is likely to be more than $800 billion, 2x more than what the frequently cited figure. When you adjust for the crowding-in effects of private capital layering on top of government subsidies, the total allocated capital into technologies that compete directly with Exxon could top $1.7 trillion over the next decade until 2032.

Consultants from the Boston Consulting Group have estimated that the incentives included in the IRA could increase the deployment of zero-carbon energy to up to 80% of electricity production as soon as 2030 as US solar and wind by 2029 could be the cheapest in the world at less than $5 per MWh. Hence, whilst the pivot away from oil and gas might have been inherently faltering since the start of the energy crisis, the IRA in my opinion represents an 800-pound gorilla birthed by the current administration to eat away at the US dependency on carbon-based sources for its energy.

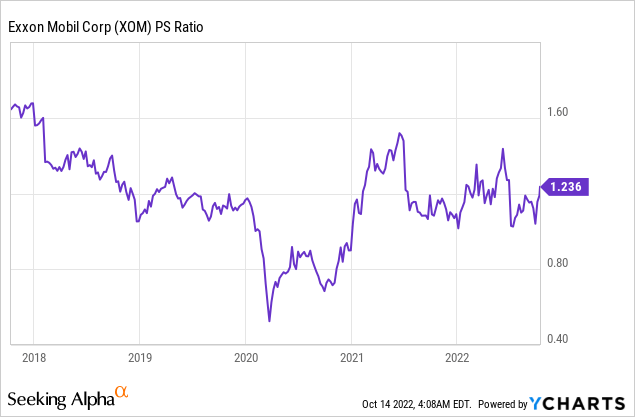

Exxon’s Valuation Still Lower Than Historic Average

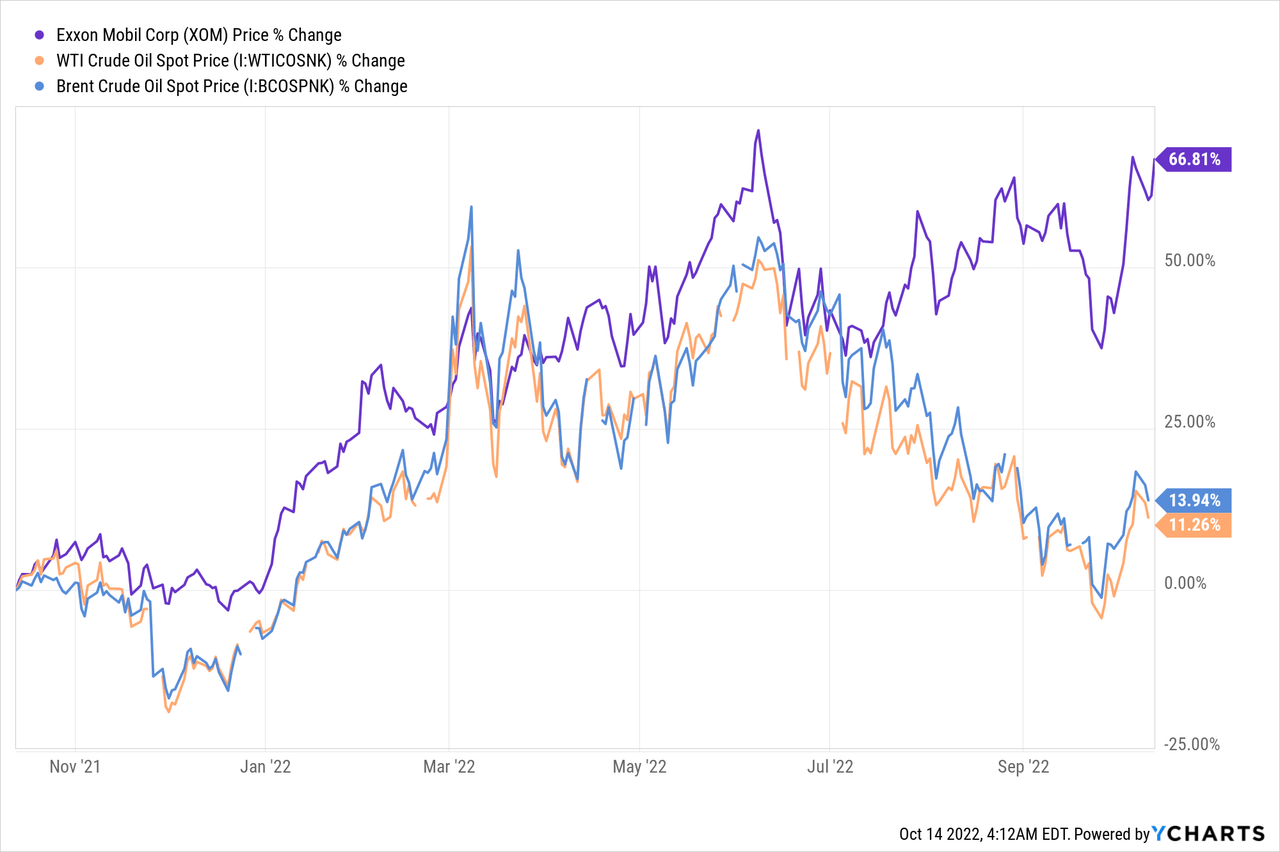

Whilst Exxon’s valuation has surged from its recent historic lows, the company is still only trading at a 4.47% premium to its 5-year average despite the drastically improved revenue and profitability figures it recently reported.

This lends some legs to the bulls. The geopolitical landscape could further deteriorate with the proposed cap on Russian crude holding the potential to spark unintended consequences that could further increase the price per barrel of crude. Hence, currently, high revenue figures could remain elevated for longer despite WTI pulling back from its first-quarter highs.

Phase Outs, EVs, And Geopolitics

The IRA intersects with the ongoing phase-out of internal combustion engine vehicles now being instituted by US states and other economies around the globe. New York recently joined California in legislating to make all new vehicle sales zero emissions by 2035. This places two of the USA’s largest economies on the same policy step as China, the United Kingdom, Japan, the European Union, and South Korea.

Critically, such phase-outs have already sent a signal to consumers that the old carbon zeitgeist is fast becoming incompatible in a world battling to reduce carbon emissions to try and restrict the global rise in mean global temperature to well below 3.6 °F above pre-industrial levels. EVs are experiencing their time in the sun with sales of 6.6 million plug-in vehicles in 2021 expected to triple by 2025.

The US and the world also sit on the brink of a nuclear power revival with the recent $8 billion purchase of nuclear technology services firm Westinghouse Electric by Cameco (CCJ) and Brookfield Renewable Partners (BEP) putting this in focus. The currently elevated prices for oil and gas have materially increased the likelihood of previously expensive proposed nuclear power projects being greenlighted just as Georgia’s Vogtle Units 3 and 4, the largest US nuclear power station, is set to come online and previously anti-nuclear California extends its Diablo Canyon nuclear power plant.

The OPEC+ decision to cut its production quota will prove myopic as it goes against NATO’s effort to support Ukraine to defend itself. A further cut would be a clear indication that OPEC+ has chosen a side, and some analysts don’t think the cartel will be willing to do that considering how much of their respective economies are dependent on trade with NATO countries. Hence, in the short-term oil will continue to move according to the direction of the global economy. In the longer term, the IRA might just be enough to revert sentiment in the commodity back to its previous lows. The impact will be measured in years though so current shareholders have nothing to be worried about in this interim period. Exxon remains a hold.

Be the first to comment