NirutiStock/iStock via Getty Images

Thesis

The Voya Asia Pacific High Dividend Equity Income Fund (NYSE:IAE) is a CEF focused on equities in the Asia-Pacific region. The vehicle combines an actively managed quantitative equity investment strategy with a call writing option strategy to create a diversified portfolio with enhanced total return potential. As per its literature, the fund…

seeks to maximize total returns and generate higher income relative to the benchmark over a full market cycle. Stock selection is model driven.

Sells call options on selected Asia Pacific indexes and/or equity securities and/or ETFs, with the underlying value of such calls representing 0-50% of the total underlying value of the portfolio.

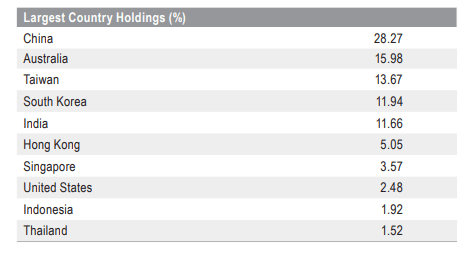

The vehicle has a heavy China allocation, which accounts for more than 28% of its exposure. The economic deceleration in the jurisdiction and the significant drawdowns observed in Chinese tech companies have accounted for a significant portion of the fund underperformance in the past year. The fund is down -12.63% year to date, but more worryingly exposes very mediocre long-term results with its annualized 5- and 10-year figures close to ~0% and 1.5% respectively. The fund has a low Sharpe ratio of 0.18 and a normalized standard deviation of 13.78.

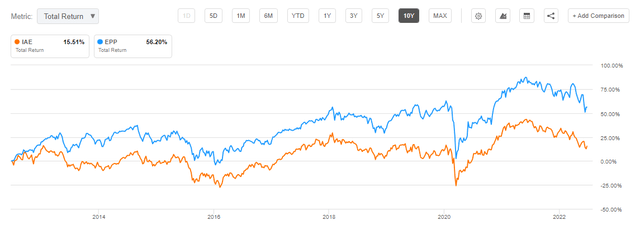

When comparing IAE to an ETF that purely follows an index, namely the iShares MSCI Pacific ex Japan ETF (EPP), we can see that IAE severely underperforms although the CEF structure is supposed to provide it with an advantage. To that end the CEF wrapper allows the manager to sell call options on up to 50% of the portfolio. In a down market, this strategy is supposed to generate additional income and bump up performance. We have not seen that occur successfully.

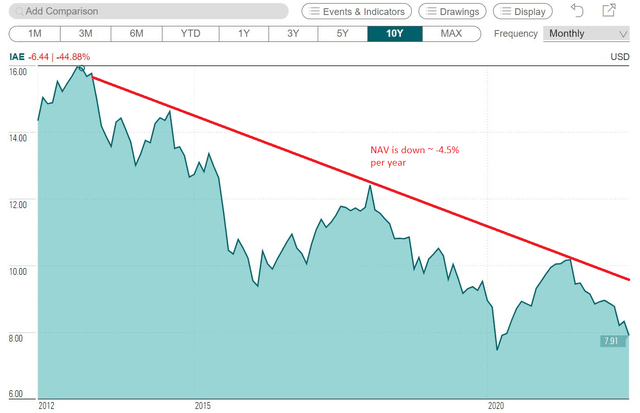

Despite the headline 12% dividend yield, the fund is unable to cover its distributions with very heavy return of capital utilization (more than 90% ROC for the April 2022 distribution for example). To that end we have seen an annual NAV erosion of approximately -4.5% in the past decade from ROC. We do not feel this is sustainable, and correlated with the fund’s small size of $84mm it will ultimately result in the fund needing to liquidate at some point.

Given the stabilization we have witnessed for Chinese Tech, and the monetary easing within the jurisdiction we feel there is a bit of upside here in the next 12 months. For existing fund holders we think a Hold is best suited, with a clear cut exit strategy 12 months out. For new money entering the space, there are much better alternatives in the Asia-Pacific equities space to consider.

Analytics

AUM: $84mm

Sharpe Ratio: 0.18 (5y)

Sortino Ratio: 0.57 (5y)

Standard Deviation: 13.78 (5y)

Premium/Discount to NAV: -11.5%

Z-stat: -1.17

Expense Ratio: 1.26%

Leverage: 0%

Holdings

The fund has China as its largest geographic concentration:

Country Concentration (Fund Fact Sheet)

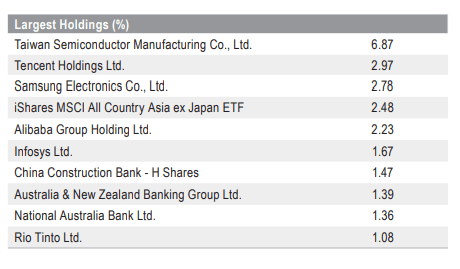

It is no surprise then that some of the Top-10 fund holdings are represented by Chinese technology companies:

Largest Holdings (Fund Fact Sheet)

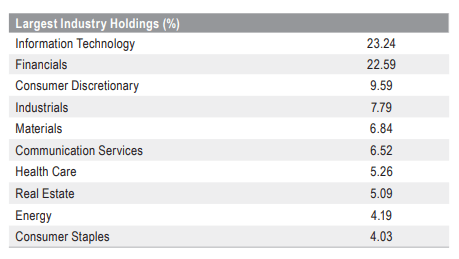

The same theme can be identified by looking at the sectoral breakdowns:

Holdings (Fund Fact Sheet)

We can see that Technology is the top sector, followed by Financials and Consumer Discretionary. Given the massive rally in Energy and Materials, it is unfortunate that the fund has only small weighting in those sectors.

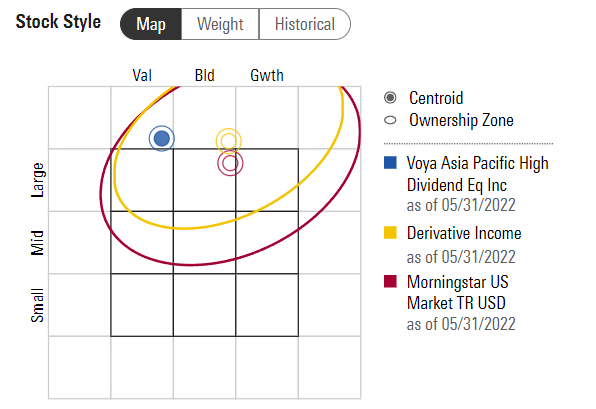

As per Morningstar the fund falls in the Large Cap – Value/Blend area of the stock style box:

Category (Morningstar)

Performance

IAE is down -12.63% year to date, on a total return basis:

YTD Performance (Seeking Alpha)

We can see that IAE has underperformed the iShares MSCI Pacific ex Japan ETF (EPP) on a year to date basis mainly due to the high concentration of Chinese Tech companies in IAE.

Longer term the picture is similar, with IAE significantly underperforming both on a 5- and 10-year basis:

5-Year Total Returns (Seeking Alpha) 10-Year Total Returns (Seeking Alpha)

On a 5-year basis, we can see that IAE has a flat total return, meaning an investor made basically no money by holding this fund. And this is before accounting for inflation. The annualized 10-year return is now only 1.5%. We feel these are really poor numbers, especially when comparing the returns to a simple ETF like EPP, which purely tracks an index, namely the MSCI Pacific ex Japan Index.

At the end of the day, the benefits of a CEF reside in its management team and the ability to generate alpha versus an Index. In this case, we can see that IAE is severely underperforming and basically generating no return on a long-term basis. Management fees for such a vehicle are not justified, and simply buying an index ETF seems a more viable alternative by looking at risk/reward metrics.

Distributions

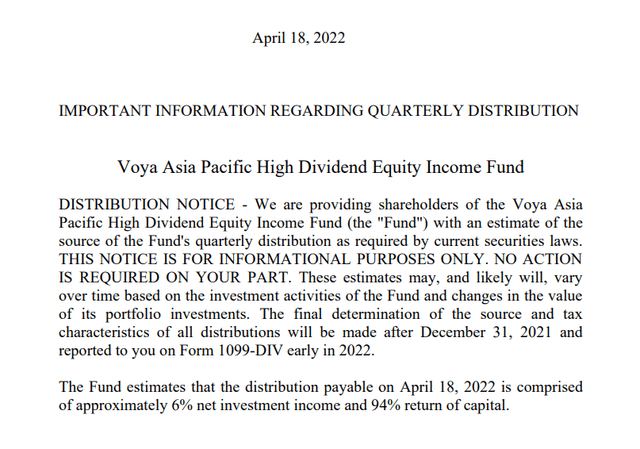

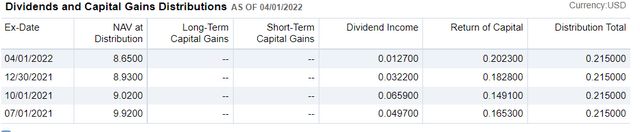

The fund currently sports a roughly 12% dividend yield which is unsupported:

Distributions (Fund Literature)

As per the April 2022 distribution notice we can see that more than 94% of the received cash by an investor represents return of capital. This means that an investor is not getting a “dividend” but purely their own cash back. This marketing gimmick is specific of CEFs and it ultimately gives a retail investor who is unable to do a lot of due diligence the false impression they are actually getting a 12% annual return here. This could not be farther from the truth. In fact the fund has a long history of disbursing mainly ROC:

This sort of policy has resulted in a massive NAV erosion. We can see how the NAV is down -4.5% per year in the past decade:

Unless the fund does some sort of capital raise / rights offering soon we are of the opinion that it will need to be liquidated in the not so distant future given its small size (sub $100 million AUM).

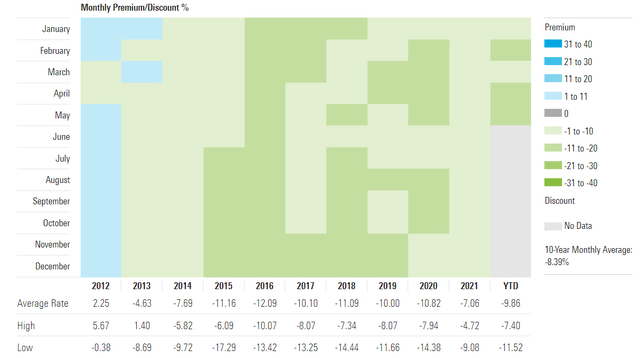

Premium/Discount to NAV

The fund is currently trading at a discount to NAV:

Premium/Discount to NAV (Morningstar)

The discount is in line with historic figures for the fund, and the z-stat is also indicative of a discount within statistical bands.

Conclusion

IAE is a CEF focused on Asia-Pac equities. With an overweight exposure to Chinese technology companies the fund has unperformed, although it writes covered calls on up to 50% of its portfolio to dampen down markets. The fund has an unsupported 12% dividend which results in very significant ROC distributions. To that end we have observed a -4.5% annual NAV erosion in the fund due to the ROC dividends. The vehicle has a very low Sharpe ratio and very poor annualized long-term returns which clock in at roughly 0% and 1.5% on a 5- and 10-year lookback. For existing fund holders we think a Hold is best suited, with a clear cut exit strategy 12 months out. For new money entering the space there are much better alternatives in the Asia-Pacific equities space to consider.

Be the first to comment