Scott Olson/Getty Images News

Bausch Health (NYSE:BHC) shares are in a world of hurt. Shortly before the heavily indebted firm spun off Bausch + Lomb, the stock fell. Selling pressure intensified when the company posted first-quarter results that missed earnings and revenue expectations.

Bausch posted two major news events in June 2022. First, the company’s Chairman, Joseph Papa, resigned from his position. Second, the company will suspend its initial public offering plans for Solta Medical. After BHC stock rallied by 20% on June 24, 2022, with the markets, what do those developments mean for BHC stock?

First Development: Chairman Resignation

CEO Joseph Papa will give up his chairman title. John Paulson will take his place. BHC said that Papa’s decision to leave the board “was not due to any dispute or disagreement with the company, its management or the board on any matter relating to the company’s operations, policies or practices.”

Shareholders should not dismiss the executive change, as John Paulson takes that position. The executive change could lead to a management shake-up of the company. Paulson may look for a new leader to realize better growth in the company’s core products.

Paulson’s fund has allocated 18% of BHC stock to his portfolio. Only Horizon Therapeutics (HZNP) has a bigger weight. In the second quarter, Paulson cut his stake in Horizon. The re-weighting is unusual. Horizon Therapeutics posted revenue nearly doubling to $885.2 million in its first quarter. Furthermore, Horizon maintained a net sales guidance of $3.9 billion to $4.0 billion in 2022.

Horizon is advancing its Phase 2 trial in rheumatoid arthritis. It is completing enrollment in its Phase 2 trial in Sjogren’s syndrome. When it posts Phase 2 results next year, the stock could break out. Despite the potential, HZNP stock is on a downtrend. Markets expected a stronger net sales guidance. Still, the 22% Y/Y growth values the stock at a price-to-earnings-to-growth ratio of 1.0 times. The stock trades at a P/E of 23 times.

Bausch Health’s Weak First Quarter 2022 Results

In the first quarter, Bausch posted revenue falling by 5.4% Y/Y to $1.92 billion. It expects revenue for 2022 in the range of $8.25 billion to $8.40 billion. This is below the $8.56 billion consensuses. It expects a full-year adjusted EBITDA of up to $3.375 billion (non-GAAP).

In its press release, the company highlighted proceeds of $630 million from the B+L IPO. It completed debt financing of $2.5 billion to reduce its total long-term debt. Most worrisome is BHC’s long-term debt. Although it does not have upcoming debt due that would threaten its business, its total debt is $23.168 billion:

|

Debt Obligations in $ millions |

Mar 31, 2022 |

Dec 31, 2021 |

|

Senior Secured Credit Facilities: |

||

|

Term Loan Facilities |

3,562 |

3,756 |

|

Senior Secured Notes |

4,802 |

3,814 |

|

Senior Unsecured Notes |

14,792 |

14,787 |

|

Other |

12 |

12 |

|

Total long-term debt and other, net of premiums, discounts, and issuance costs |

23,168 |

22,654 |

Data from Bausch Health

BHC’s failure to extinguish debt at a faster pace is hurting the stock. The company should complete its B+L IPO in 2021. Last year, frothy stock markets would have fetched more money from the unit. When the management team saw weak stock markets in 2022, it should have canceled the B+L IPO.

In the management’s defense, IBM’s (IBM) spinoff of Kyndryl Holdings (KD) did not succeed. KD stock traded as low as $9.11 and lost half its value in 2022. When AT&T (T) spun off Warner Bros. Discovery (WBD), WBD shares fell from over $25 to close at $14.28 on June 24, 2022.

BLCO stock opened at $20. It then traded as low as $13.17. It bounced back to $15.85 in the last week, when the S&P 500 (SPY) rallied by 6.39%. The iShares Nasdaq Biotechnology ETF rose by 13.44% in the week.

Second Development: IPO of Solta Medical Suspended

On June 16, 2022, BHC said it would suspend its plans for its Solta Medical business. The aesthetic device sector is out of favor. Medtronic (MDT) is down after it lowered its profit forecast. It blamed supply chain issues. InMode (INMD), despite posting good quarterly results and trading at a 12.3x P/E, is near its 52-week low.

BHC does not need to sell Solta to the public market at a discount. Instead, it may re-negotiate its line of credit and renew its debt at favorable rates. If the stock market is receptive to the biotechnology and medical devices sector, Bausch may revisit the Solta IPO.

Other Risks

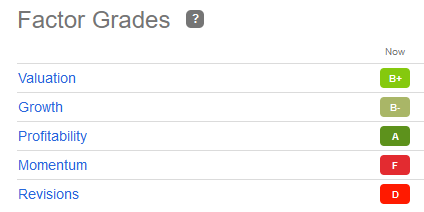

Bausch has good value and growth, according to its stock score:

SA Premium score for BHC stock (SA Premium)

Its stock is in a downtrend, earning it an F on momentum. EPS revisions are severe that the stock scores a D on revisions.

Investors should not ignore the sudden drop in BHC stock in recent months. Wait for the short interest of 5.87% to ease and for the stock to build an uptrend from here.

Your Takeaway

Market conditions are poor. This may keep Bausch below the $10-a-share level. In addition, the Federal Reserve shows no signs of ending its interest rate hike cycle. This will increase the cost of Bausch’s debt servicing costs.

Speculators may trade BHC stock whenever it rips higher and sell the stock before profit-takers do. Investors have other biotechnology companies to consider instead. Horizon Therapeutics has better growth prospects.

Be the first to comment