JHVEPhoto

Leggett & Platt, Incorporated (NYSE:LEG) designs, manufactures, and markets engineered components and products worldwide. It operates through three segments: Bedding Products; Specialized Products; and Furniture, Flooring & Textile Products.

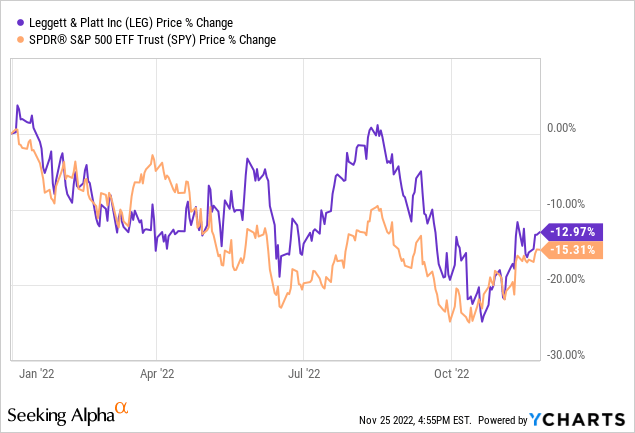

The aim of today’s article is to highlight two reasons, why we are still not confident in investing in LEG’s stock, despite the fact that it slightly outperformed the broader market year-to-date.

In our previous article about LEG, titled: “Leggett & Platt: Declining Consumer Confidence Is Likely To Hurt The Sale Of Durable Goods” , we have analyzed several factors, which we believed at that time, could influence the company’s financial performance in the near term. These factors were: contracting margins, declining consumer confidence and potential change in the trend of building permits.

These factors seem to have indeed a substantial negative impact, as reflected in the Q3 results of the firm.

This takes us to the first reason, why we maintain our sell rating: Poor Q3 results.

1) Q3 results

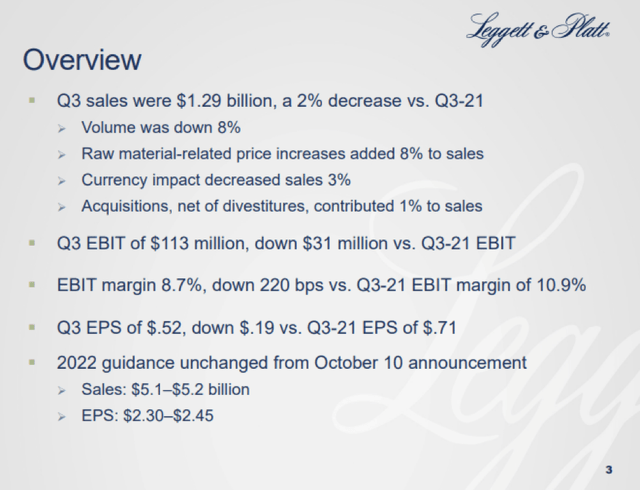

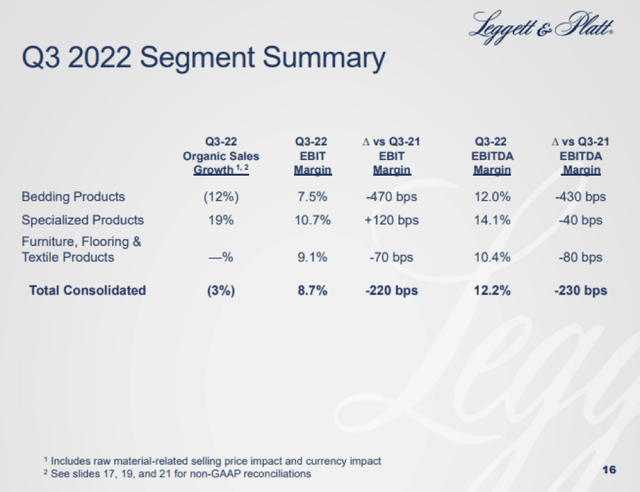

The demand for LEG’s products has declined substantially over the previous months. Volume has decreased by as much as 8% year-over-year. Currency headwinds have also had a -3% negative impact on the sales. On the other hand, raw material related price increases have somewhat offset the negative impacts, but Q3 sales still decreased by 2% compared to Q3-21, totalling in $1.29 billion.

Not only sales were negatively impacted, but also various cost increases have led to further contracting margins and decreasing EBIT and net income.

Overview (LEG) Q3 sales and EBIT (LEG)

While the firm has left its previous guidance unchanged, we are not impressed by the third quarter results. The risks that we have mentioned in our previous articles have played out, and keep affecting the firm negatively.

The following slide shows the results by segment, to understand what is the main drive of the declines.

What do we expect in the near term?

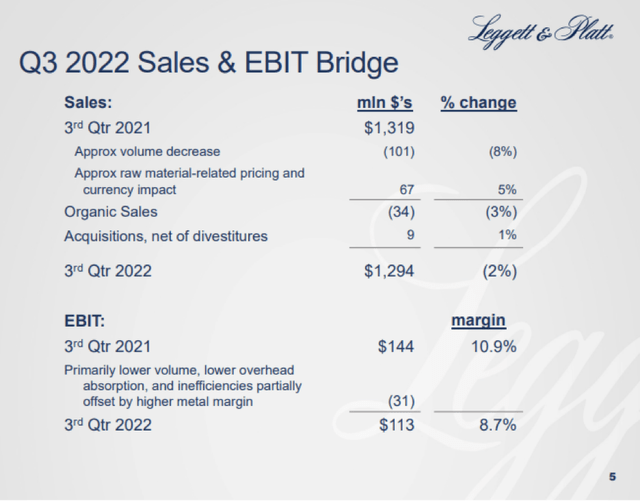

Consumer confidence in the United States has somewhat rebounded from it June lows, but it remains at extremely low levels. As long as the consumer sentiment is poor, we do not expect the spending to increase on durable, non-essential goods. For this reason, we believe that the demand for LEG’s products is likely to remain low in the near term.

U.S. Consumer confidence (tradingeconomics.com)

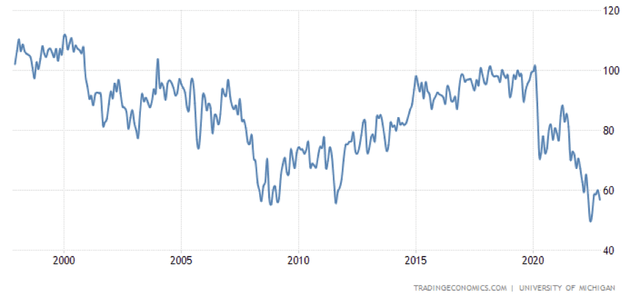

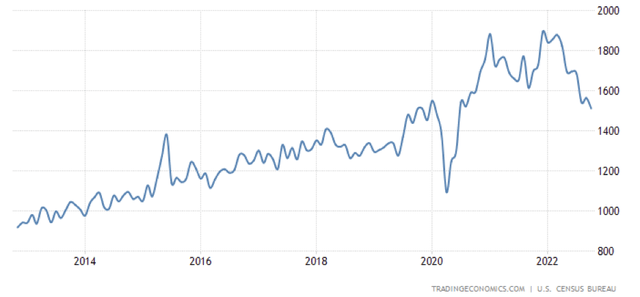

Another factor that may indicate weak demand ahead is the continuing decrease of building permits.

Building permits (tradingeconomics.com)

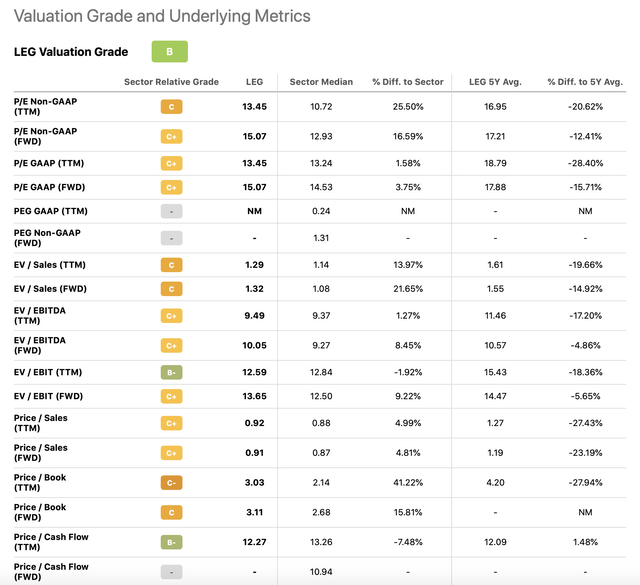

The other reason, why we remain bearish is the valuation

2) Valuation

Since our last writing, the price has not changed substantially. Even the poor earnings results haven’t led to a sell off. Already in June, we were writing that the valuation appears to be too high, based on a set of traditional price multiples, and the premium compared to the sector median is not justified. We would like to see the stock price come down by 15% to 25%, so that the firm’s P/E ratio would be in line with the sector median P/E ratio. In our opinion, if the macroeconomic environment does not substantially improve in the near term, such a decline is a realistic scenario.

Valuation metrics (Seeking Alpha)

Important to point out that many investors own LEG’s stock because of its solid track record of paying dividends to their shareholders. While the payout ratio of 65% and the dividend coverage of 1.38 suggest that the payments are still sustainable for now, we have to keep in mind that, if earnings keep declining, it may lead to cutting or pausing the dividend. In our opinion, it is not a threat in the short term, but a such a development could also lead to a substantial stock price decrease.

Key takeaways

Macroeconomic headwinds, including poor consumer sentiment and the unfavorable FX environment have had substantial negative impacts on LEG’s financial performance. Demand for their products have substantially decreased, leading to a 2% sales decline year-over-year.

Margins and net income has also been negatively impacted.

The macroeconomic environment does not appear to be improving and we believe that demand is likely to remain soft for the coming quarters.

From a valuation perspective, we are also not impressed with the stock. LEG’s stock still trades at a premium compared to the respective sector median, which we believe is not justified in the current market environment.

We maintain our “sell” rating.

Be the first to comment