Michael Vi/iStock Editorial via Getty Images

Introduction

This week, we uploaded an article where we gave our opinion on a supposedly imminent semiconductor bust and how it would affect the industry. We also said the following:

We could say that manufacturing might be affected quite a bit by a bust, and this would evidently be true, but there are some companies like ASML (ASML) that we think offer more protection against a bust inside that specific group.

The objective of this article is to lay out the rationale that makes us think that ASML Holding N.V. (NASDAQ:ASML) might be more resilient than people think during a bust and why we think the market worries too much about double ordering. But, first things first, let’s see what double ordering is.

What is a “double ordering problem”?

ASML is the market leader in lithography systems used to manufacture chips. Of course, chip manufacturing requires additional equipment, but lithography systems make up a large chunk of a fab’s cost. A fab is the same as a foundry, a factory that makes the chips.

For this reason, much of the CapEx that foundries and IDMs (integrated device manufacturers, which design, manufacture, and sell integrated circuits) are planning to spend in the coming years will flow directly into ASML’s financials. This is good, right? It is, of course. But context is necessary.

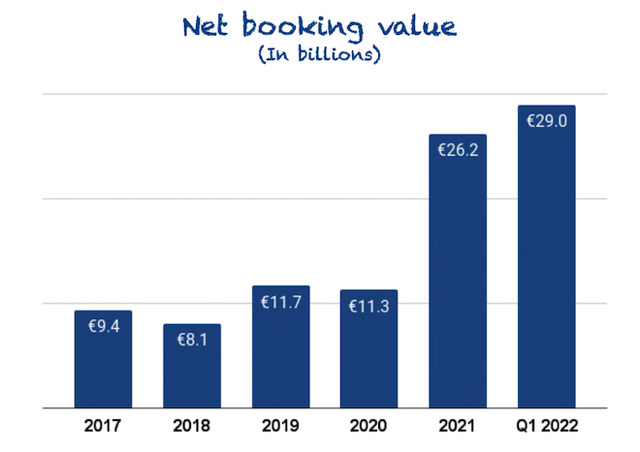

ASML has a supply problem. The company cannot satisfy all of its order backlog because of the worldwide supply-chain issues. As a consequence, much of its orders flow directly into “bookings” and not the top line. “Bookings” includes orders that ASML has accepted but has not yet delivered. This metric has gone up exponentially amidst the chip shortage:

Made by Best Anchor Stocks

It’s not only quantity playing its role in the metric, though. For example, EUV, which has a much higher price tag than DUV, has recently “jumped into” HVM (High Volume Manufacturing), which helps tilt the metric upwards. There’s more quantity, and there are more expensive units being sold.

The thing is that many customers are placing their orders knowing they won’t get the lithography system for a while:

If you would come in and you want a deep UV tool now, you’re going to the second half of next year for the simple reason that the purchase order lead-time is completely irrelevant now. It’s the capacity lead-time.

Source: Peter Wennink (ASML’s CEO) during Q1 2022 Earnings Call

This is precisely where the “double ordering” risk comes in:

Are customers placing orders knowing they will not get them immediately? What will happen if the demand landscape changes before the orders are shipped? Will customers cancel the order then?

Source: Best Anchor Stocks asking hypothetical questions

Of course, foundries will only cancel these orders if their customers start canceling theirs, and there’s a lot of talk going on about end customers stacking semiconductors just in case the shortage lasts longer. Once the shortage is over, these customers might have enough inventory to cancel some orders as there will no longer be waiting times and this effect would be transmitted through the supply chain up until ASML.

There are a lot of unknowns, and we certainly don’t know the answers to these questions. We’ll only know in hindsight, but we think ASML is more protected against this “double ordering” risk as quarters go by and is not as exposed as people think.

Let’s see why.

ASML’s protection against double ordering

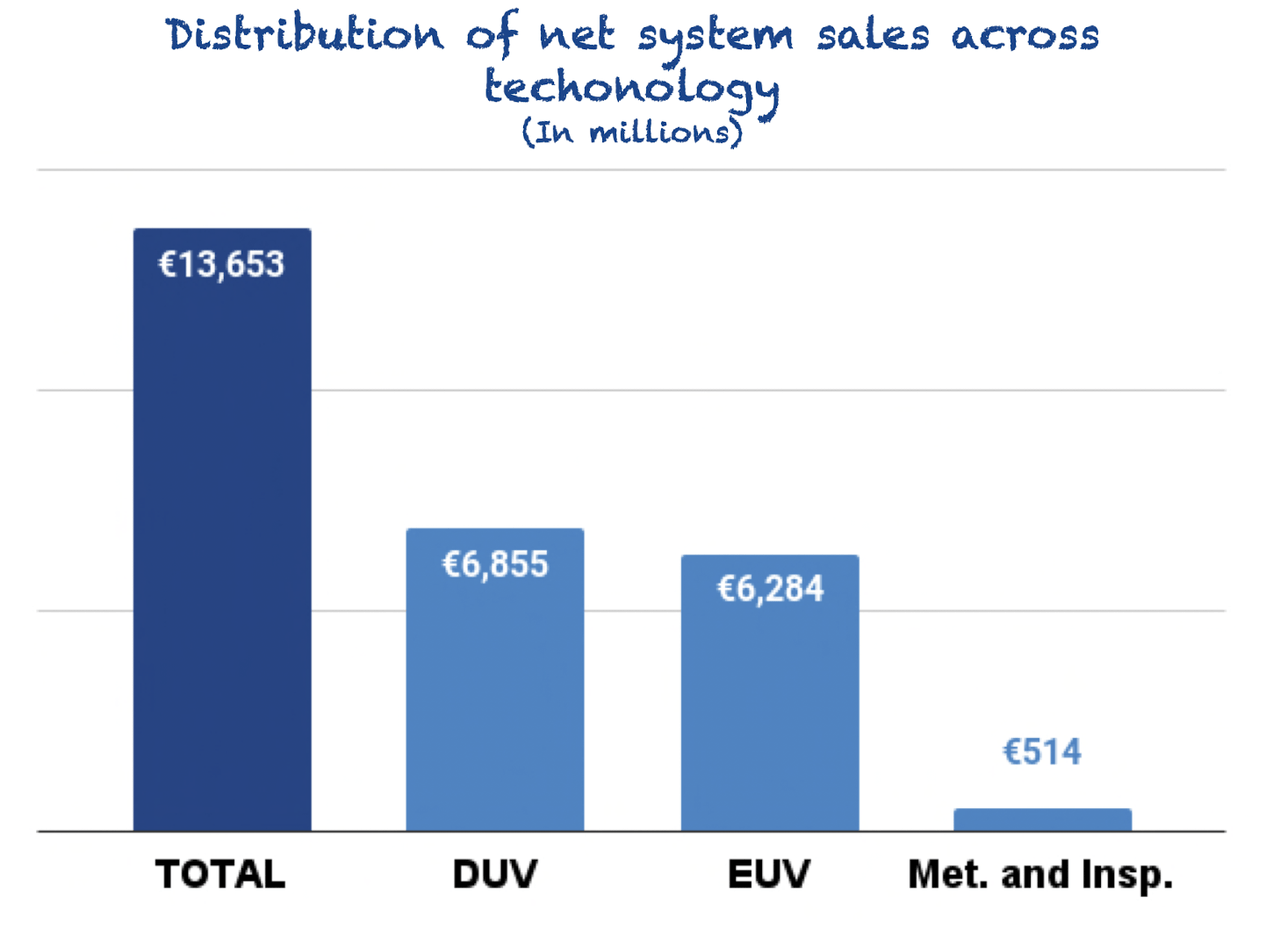

ASML’s revenue is distributed between net systems sales and service and field option sales. For this article, we’ll focus on net systems sales because it’s where double ordering can have the most immediate impact. Service and field option sales would also be impacted because this revenue source is a function of the installed base (i.e., fewer systems sold means less service and field option sales in the future), but we’ll focus a bit more on the short-term here. We’ll also focus on FY 2021 for simplicity reasons.

The majority of net system sales are distributed between DUV (Deep UltraViolet) and EUV (Extreme UltraViolet):

Made by Best Anchor Stocks

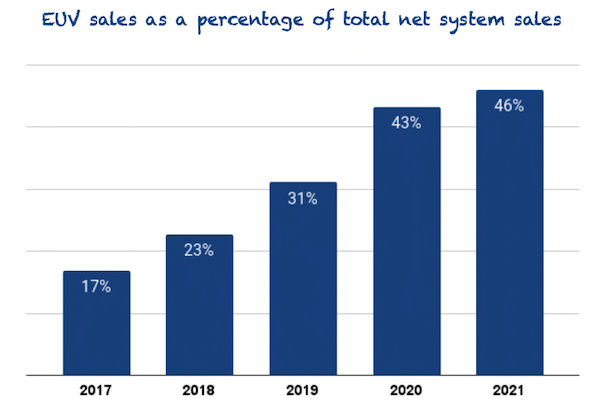

Between DUV and EUV, DUV has historically led sales, but this is starting to change now that EUV has gone into HVM. The percentage of sales that come from EUV will increase in the coming quarters because a significant chunk of the industry is jumping into the leading edge. This effect will be further amplified once ASML’s new high-NA EUV system goes into HVM (expected in 2025):

Made by Best Anchor Stocks

Because EUV is increasing its share of total sales, we think the risk of double ordering is reduced dramatically for ASML.

Why EUV is safer than DUV

We think that ASML might indeed have a double ordering problem regarding DUV. If the demand landscape starts to change and more capacity is unnecessary, we don’t see why customers wouldn’t cancel an order they have not yet received. However, we do think that several things protect ASML from EUV cancelations:

- Prepayments: as ASML is the sole producer of EUV systems in the world and the company is constrained on the supply side, it has the ability to charge prepayments for these systems. If a foundry wants to secure the supply of an EUV system, it must pay for it in advance. Of course, if you cancel this order, your pre-paid money is not coming back to you. Foundries are somewhat “forced” to pay in advance because there’s no alternative.

- Foundries need to remain competitive: digital-chip foundries always need to have cutting-edge technology. Their success or failure entirely depends on it. If TSMC (TSM) is able to manufacture the most advanced chips and Intel (INTC) or Samsung (OTC:SSNLF) (OTC:SSNNF) can’t, then TSMC will most likely win many customers from them. Being at the cutting-edge of chip manufacturing means you need ASML’s EUV.

Take the example of Intel, a company that has fallen behind in leading-edge nodes with respect to TSMC. What has been Intel’s solution to this loss of competitiveness? Securing the supply of the first high-NA EUV by (probably) making a hefty prepayment to ASML. Intel knows that without this system, the probability of being competitive with TSMC is near zero, and we doubt the company will risk making the same mistake again.

Will EUV customers cancel their orders? We feel they might consider it if things get very rough, but the probability is much lower than the probability of a DUV cancelation. Canceling a EUV order means losing money that you already prepaid and, most importantly, risking the loss of competitiveness in leading-edge chip manufacturing which can have even worse long-term consequences.

ASML’s supply “limitation” means that customers must place orders in advance, and canceling these orders means going to the back of the queue, having to wait even longer for them, and maybe making another prepayment. As ASML’s sales pivot to EUV, cancelations due to double ordering become less and less probable, in our opinion.

What if ASML suffers cancelations?

What you just read above is our opinion, but we always must keep in mind that reality might be different. The truth is that we’ll only know in hindsight. The fact that there is a chance we might be wrong implies that we must be prepared to see ASML suffer cancelations under a semiconductor bust. So, what will happen then? Probably people will panic, and the share price will drop considerably, but the long-term story would remain intact for us.

When we purchase a company’s stock, we never think about how smooth the growth runway will be but rather the magnitude and duration of that growth. With Best Anchor Stocks, we try to look for more predictable and stable companies, but thousands of variables play a role in a company’s growth, and zooming out is always key to understanding if the long-term growth path remains intact. That’s what we care about, so we are prepared to hold and add if a semiconductor downturn would happen.

The good thing about ASML is that it’s supply-constrained, and there’s no demand problem. But, of course, this supply constraint is not entirely good because it also means that the company is deferring sales into a future period, and you know what they say…

A bird in the hand is worth two in the bush.

Being able to satisfy this demand now would be awesome because it would “secure” the sales but not being able to do so helps the company be more stable and predictable. How? The demand is so much greater than the supply that cancellations would impact bookings but would take some time to flow into revenue. This would protect ASML’s financials, making them more stable during a hypothetical semiconductor bust. This is how Peter Convertito, ASML’s head of Investor relations, laid it out during a recent conference:

I think Peter Wennink, our CEO, and Roger Dassen, our CFO, have acknowledged, yes, there’s probably a bit of that (double ordering). But maybe it’s on a unit basis 10% or so. We’re undersupplying by 40%. So you’d have to have another pullback of 35% to kind of affect like the top line.

Simply put, the imbalance of supply and demand helps ASML enjoy a buffer regarding cancelations.

But, what happens if ASML expands supply and corrects the imbalance before a semiconductor bust?

ASML’s capacity expansion plans

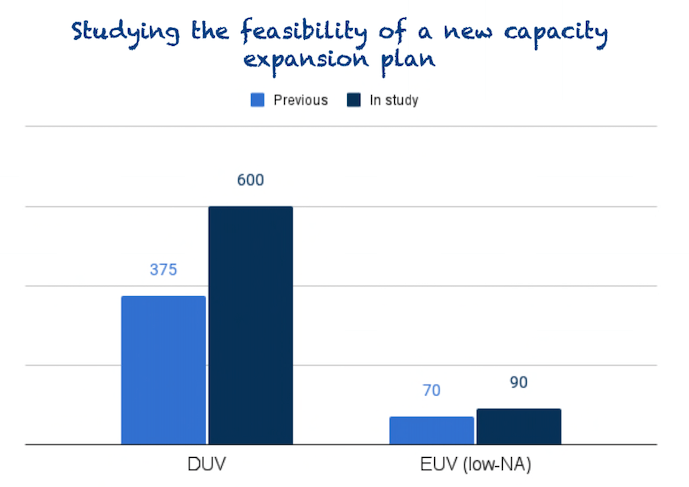

During the Q1 2022 Earnings Call, management announced plans to aggressively expand its supply capacity in the coming years:

With the goal of adding more capacity, we’re investigating the feasibility of increasing our annual capacity by 2025 and to around 90 EUV 0.33 NA systems and 600 deep UV systems. For deep UV, we’re planning to increase capacity for both immersion and dry, with a heavier weighting towards dry.

We’re also discussing with our supply chain partners to secure a capacity of around 20 EUV 0.55 High-NA systems in the medium term. Bear in mind that this translates to what we currently feel our maximum capacity goal should be and may therefore not be a final output plan. – Peter Wennink

For a little bit of context, this is how this capacity expansion plan compares with what was previously discussed:

Made by Best Anchor Stocks

Of course, this makes us think…what would happen if all this capacity goes online during a semiconductor bust? Well, margins would definitely suffer a bit if ASML is not operating at full capacity, but they would suffer less than many people think.

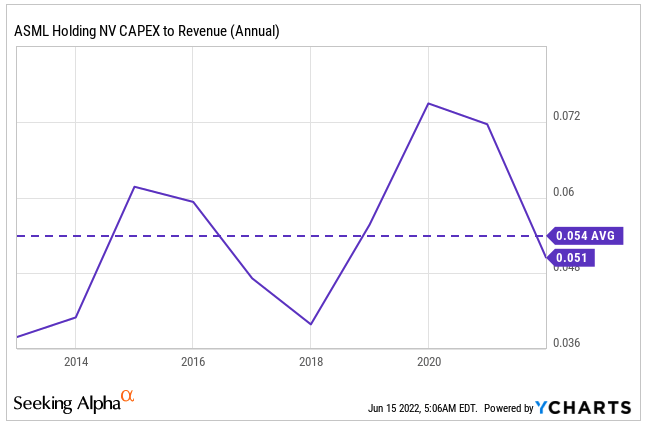

This might sound strange for people who don’t know the company well because most of the CapEx would go to waste (at least over the short term), right? Well, the reality is that ASML is CapEx light. Most of the capital expenditures necessary to expand supply are carried by the company’s network of suppliers, which puts it in a unique position to weather a possible oversupply. It’s pretty crazy to think that ASML’s CapEx/Revenue ratio has averaged 5% in the last decade despite how capital-intensive the business seems to be:

YCharts

For this reason, we think that even if ASML reaches a point where it’s not operating at full capacity, long-term investors shouldn’t be really worried. This said, take into account that this would only happen, if ever, from 2025 onwards.

Conclusion

We hope this article helped you understand what the double ordering risk is all about and how ASML might be protected from and/or impacted by it. The future is always uncertain, but we think ASML is uniquely positioned to weather any downturn in the semiconductor industry thanks to its supply-constrained nature and the mission-critical characteristic of its products. After all, human development starts with EUV.

If you have something to comment, feel free to do so in the comments section to start a worthwhile conversation!

In the meantime, keep growing!

Be the first to comment