Moussa81

Article Thesis

During times of crisis, going with reliable and crisis-proven companies can be a good idea. The Dividend Kings, a group of companies that have managed to grow their dividends for at least 50 years in a row, include many such companies that offer recession resilience and foreseeable income growth.

In this article, we’ll look at five Dividend Kings that offer high dividend yields today and that trade at reasonable or attractive valuations right now, which could make them suitable picks for the current harsh macro environment.

Dividend Kings For Reliable Income Growth

As a sub-group of the Dividend Aristocrats — companies that have raised their dividends for at least 25 years in a row — the Dividend Kings are an even more “elite” group of income growers. They have not only raised their dividends during the pandemic, the Great Recession, and the bursting of the dot.com bubble. On top of that, these companies have also raised their dividends during other crises and recessions, such as the 1987 Black Monday market crash.

Maintaining a dividend growth streak that is this extended is only possible under certain conditions. First, these Dividend Kings must have at least somewhat resilient business models that do reasonably well during all kinds of macro environments. A very cyclical company, such as an automobile manufacturer, will have a hard time reaching Dividend Aristocrat or Dividend King status.

Second, these companies must have a shareholder-friendly company culture. Different management teams must have put a lot of value on sharing the company’s profits with its owners. Other management teams are more focused on empire building or potentially value-destructive M&A, whereas the management teams of the Dividend Kings have proven to be focused on creating value for shareholders by offering a steadily growing income stream.

Overall, these factors make the Dividend Kings attractive for (income) investors. Not all of them are necessarily a buy at the same time, however, since company-specific factors including valuation should be considered as well.

1: Altria

Altria (MO) is one of the largest tobacco companies in the world. It’s primarily active in the United States and owns some non-core tobacco assets as well, such as its stake in JUUL and in beer company Anheuser-Busch InBev (BUD). Still, the vast majority of its profits and cash flows are generated by selling cigarettes and cigars.

Selling tobacco is a very resilient business, as demand for cigarettes does not really decline during recessions. That’s why Altria has managed to grow its earnings per share like clockwork over decades. This includes its ability to hit new record profits in both 2020 and 2021. For the current year, Altria is expecting record earnings per share as well, as EPS are forecasted to come in around $4.85, which would represent a 5% increase versus Altria’s earnings per share last year.

Altria has raised its dividend for 53 years in a row, which includes the most recent dividend increase that was announced in August and that came in at 4.4% versus the previous level. At current prices, Altria offers a dividend yield of 8.8%. With a yield this high, no dividend growth would be required to make Altria a solid stock from a total return perspective. But with some dividend growth, even if only in the low-single-digit range, Altria could return 10%+ per year. The currently pretty low valuation — Altria is trading at 8.9x this year’s net profit only — also could allow for a total return boost via multiple expansion. All in all, Altria could offer quite compelling returns and has been a strong performer during all kinds of crises in the past.

2: Federal Realty Trust

Federal Realty Trust (FRT) is a real estate investment trust that primarily invests in retail real estate in major coastal markets. But unlike mall REITs that do, in some cases, suffer from the Amazon threat, most of Federal Realty Trust’s tenants are not impacted by online competition to a large degree. Its tenants mainly consist of Amazon (AMZN)-threat-resilient businesses such as grocers, restaurants, etc. and the company has been putting focus on increasing its mixed-use exposure. That means that its building communities where shopping, living, and working are integrated with each other, thereby making its assets even more resilient versus e-commerce risks.

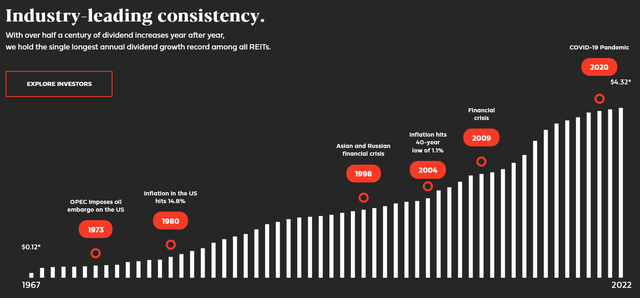

That has worked well for Federal Realty Trust, which has raised its dividend for 55 years in a row, throughout all kinds of crises as the following chart shows:

In the above chart, we see that FRT continued to hike its dividend no matter what. The growth rate was higher in some periods and lower in others, but every year, FRT continued to deliver when it comes to growing the income stream of investors. In the years following the financial crisis, dividend growth was very pronounced, although it has slowed down somewhat in recent years. Still, Federal Realty Trust continued to increase its payout, which is attractive when combined with a 5% starting yield.

Federal Realty Trust is trading for 14.5x forward FFO, which isn’t a high valuation considering FRT’s resilience to recessions and other crises and its strong track record. I do believe that shares could have some upside potential via multiple expansion, although that is of course not guaranteed.

3: Johnson & Johnson

Johnson & Johnson (JNJ) is one of the largest and most diversified healthcare companies in the world. Along with Microsoft (MSFT), it is also one of just two publicly traded companies that have an AAA credit rating — that’s better than the AA rating of the US government. The excellent credit rating is the result of very resilient and non-correlated businesses. JNJ is active in pharmaceuticals, medical tech, and consumer staples (e.g. skin care and contact lenses). Neither of these industries is very cyclical, as spending isn’t correlated to the strength of the economy or dependent on commodity prices. Also, when JNJ is experiencing some weakness in one area, e.g. due to a drug going off-patent, that can be balanced out by the other business units that are not tied to it.

JNJ has thus managed to generate very reliable earnings and cash flows in the past, and since healthcare spending continues to grow at a meaningful pace globally, JNJ has also had significant business growth. The same should hold true going forward, as healthcare expenses growing is a macro trend that has not shown any signs of ending.

JNJ has raised its dividend for an excellent 60 years in a row, with the most recent dividend increase being 7%, while the 5-year dividend growth rate is 6%. JNJ has seen its shares decline over the last couple of months, which has made its dividend yield climb to 2.8%. Add the 6%-7% annual dividend growth rate, and total returns in the 8%-10% range seem quite likely. That’s a very solid total return outlook in general, and especially attractive when it comes from a very safe, reliable, resilient company like Johnson & Johnson.

4: Illinois Tool Works

Illinois Tool Works (ITW) is an industrial products and equipment company that primarily offers welding equipment, construction products, and parts for the automobile industry. While these markets do not sound particularly resilient versus macro downturns, ITW has nevertheless managed to grow its dividend for a very impressive 59 years in a row, throughout all kinds of crises, including recessions, financial crises, and the pandemic that had resulted in lockdowns for different industries.

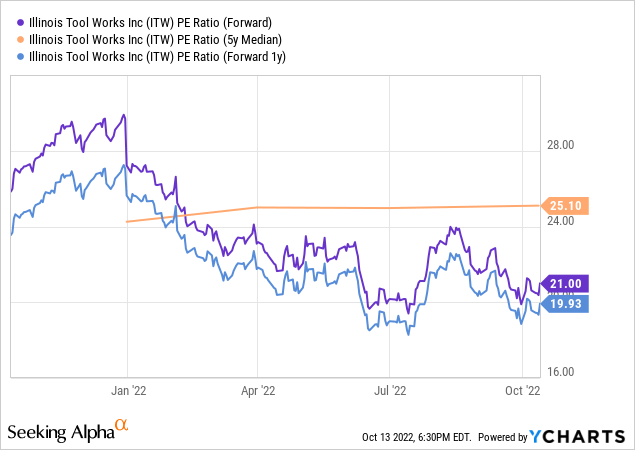

Over the last five years, Illinois Tool Works has not moved up a lot, which is why its valuation has declined in that time frame:

Based on current estimates, Illinois Tool Works is trading at 21x this year’s earnings, and at less than 20x next year’s earnings. The median earnings multiple over the last five years is slightly north of 25. In other words, ITW currently trades at a ~20% discount compared to its historic valuation, potentially adding some total return potential via multiple expansion from the current level.

ITW’s dividend yields 2.8% today, which is close to twice as high as the broad market’s dividend yield. Illinois Tool Works has raised its dividend by 7% over the last year, while its 5-year average dividend growth rate is quite attractive, at 11%. Even half that growth rate would allow for high-single-digit annual returns going forward, when added to the dividend that yields close to 3% today.

5: AbbVie

AbbVie (ABBV) is a leading biotechnology company that owns one of the biggest drugs in the world, Humira. Humira will go off-patent in the US next year, which is why management and the analyst community believe that revenues will decline slightly in 2023. But the company owns a wide range of growth assets, from its cancer portfolio to next-level immunology assets such as Skyrizi and Rinvoq, which is why revenue growth is forecasted to resume in the not-too-distant future once the Humira patent expiry has been lapped.

AbbVie offers a pretty nice dividend yield of 4% based on current prices, and its dividend payout ratio is relatively low, at just 41%. AbbVie has raised its dividend for 50 years in a row, and has averaged a compelling 17% dividend growth rate over the last five years. That won’t be maintained forever, showcased by the more recent 9% dividend increase that AbbVie has done over the last year. But even that, combined with a dividend yield of 4%, makes for a pretty compelling dividend growth investment.

AbbVie is currently trading for 10x this year’s expected net profit, which is a lowish valuation in absolute terms and which is also very undemanding relative to how the company was valued in the past. Once the Humira patent expiry has happened, the market may start to attach a higher multiple to ABBV’s shares again, potentially providing some multiple expansion tailwinds.

Takeaway

The world is experiencing several macro crises at the same time right now. Inflation, an energy shortage, war in Ukraine, and so on. In times like these, going for companies that have proven to be resilient and predictable could pay off. The Dividend Kings showcased above fit that description, and they offer solid to very high dividend yields at the same time.

Be the first to comment