Sibani Das/iStock via Getty Images

Article Thesis

Intel (INTC), NVIDIA (NVDA), and Advanced Micro Devices (NASDAQ:AMD) all reported their most recent quarterly results over the last couple of weeks. The performance during that period was very uneven, however. One of these companies, AMD, clearly outperformed its peers and seems to be well-positioned for strong results in the current year. As it is also not trading at a high valuation, AMD looks like the best pick among these three today.

3 Semi Stocks With Very Different Results

Intel, NVIDIA, and AMD all reported their most recent quarterly results over the last two weeks, with the addendum that in NVIDIA’s case, the release was a pre-earnings announcement where it reported its revenue but not its profits.

Results in the respective second quarters of these three companies were very different. Intel, the worst performer during that period, saw its revenue plunge by 17%, which can only be described as disastrous. A more in-depth discussion of Intel’s weak quarter is available here. But in short, the company missed estimates on both lines, revised its guidance downwards, lost market share, and the free cash flow picture worsened dramatically. Intel has been the company with the least growth and the lowest valuation among these three peers, thus it is not too surprising to see it perform worse than AMD and NVIDIA growth-wise. But still, the results during the period were worse than expected, even though expectations weren’t very high.

NVIDIA is the most expensive among these three chip stocks, which was mostly the result of its excellent growth in recent years. The company saw its business grow massively on the back of strong gaming demand, crypto miners buying its GPUs, AI tailwinds, and so on.

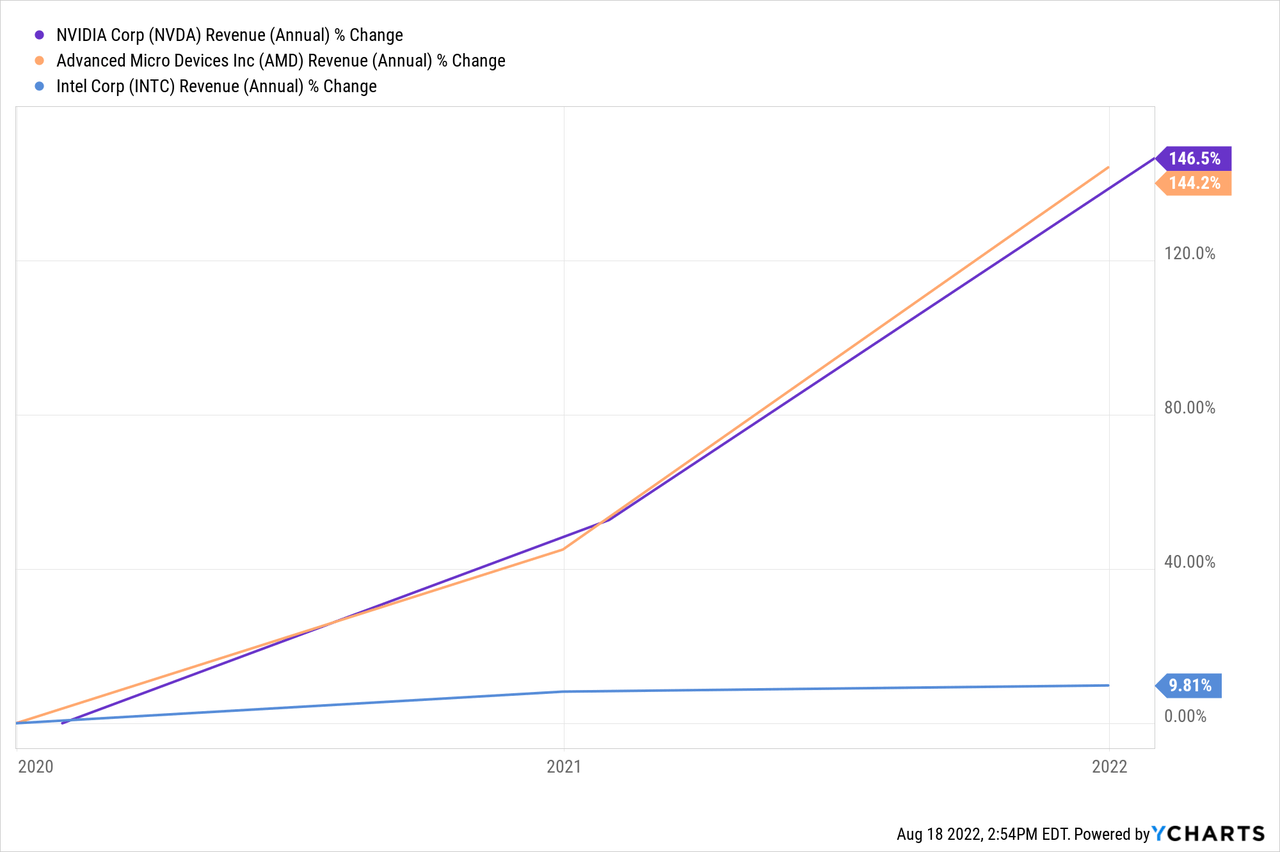

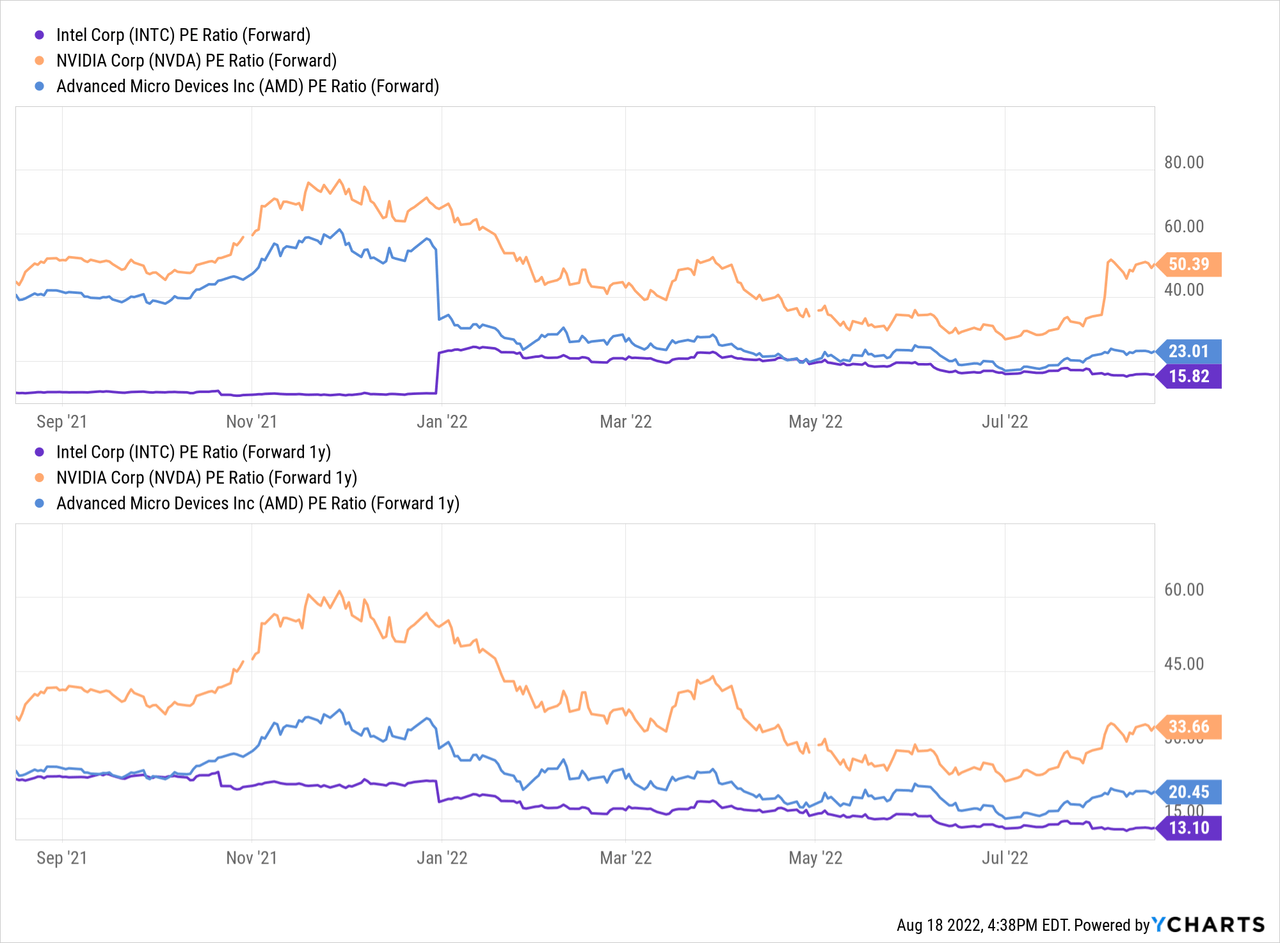

Over the last three years, NVIDIA has slightly beaten AMD when it comes to growing the top line, whereas Intel has not really managed to add to its sales in a meaningful way. That, combined with the strong market outlook for NVIDIA’s AI chips, made the market value NVIDIA at a pretty high valuation. When NVIDIA was trading at more than $300 per share last year, its valuation arguably was crazy high, but even today, NVIDIA remains a pretty pricy stock — shares are valued at 50x this year’s expected net profit. The pre-announced results for the most recent quarter do not really justify a valuation this high, one could argue.

The company stated that it would generate revenues of around $6.7 billion during the quarter, down by double-digits year over year. On a two-year stacked basis, revenues are still up quite a lot, which is not the case for Intel, but the revenue decline nevertheless isn’t good news at all. Looking more closely, the data center business performed very well, as NVIDIA saw its sales grow by 61% in that unit. AMD’s data center sales were very strong, too, whereas Intel’s performance in that space was weak — it seems clear that NVIDIA and AMD are taking share from Intel, a trend that could continue.

NVIDIA’s gaming business, however, suffered from a major revenue pullback. To some extent, that can be explained by the fact that consumers aren’t investing as much in new hardware as they did during the peak of the pandemic — with lockdowns gone, they want to go out instead of sitting at home in front of their computers. But the crypto winter also plays a role in the gaming revenue pullback, as NVIDIA’s GPUs are being used to mine cryptocurrencies such as Ethereum (ETH-USD). That has become less profitable as cryptos plunged, which led to lower demand for new chips.

In the long run, NVIDIA will most likely do well thanks to its strong position in data centers, autonomous driving, and so on. But at least for now, the company is not performing too well, which is why analysts have lowered their earnings per share estimates for the current year dramatically:

EPS estimates for the current year dropped by a hefty 30% over the last month. And yet, NVIDIA’s shares climbed by around 10% over the same time frame. I released a bullish article on NVIDIA in July, but my stance has become less bullish since — shares gained more than 10% and have outperformed the broad market since, and at the same time, the near-term outlook worsened. Locking in some gains might not be the worst of ideas, I believe.

AMD, on the other hand, has reported excellent results for its most recent quarter, and at the same time, it’s quite attractively priced, I believe. Revenues jumped by more than 70% year over year. Even when we back out the impact of M&A (mainly the Xilinx acquisition, which was an all-stock deal), AMD saw its sales soar. Revenue per share was up by around 50%, with data center revenue being the main source of additional sales. AMD also beat expectations for both lines.

Even better, the company’s outlook for the remainder of the current year is pretty healthy as well. The company generated revenues of $12.4 billion during H1 and guides for full year revenues of around $26.3 billion. That means that revenue in H2 should come in around $14 billion, up double-digits from H1. At a time when many market participants are fearing a semiconductor downturn, caused by factors such as a recession, AMD is guiding towards ongoing compelling growth. That differentiates it from its peers NVIDIA and Intel, which are not seen growing by double-digits during the remainder of the year. In fact, Intel’s and NVIDIA’s shareholders might be quite happy if their companies managed to keep revenues flat during the second half of the year.

And yet, while AMD is the best performer from a growth perspective by far, it’s not the most expensive among these three companies at all:

AMD is more expensive than Intel right now, but that seems more than justified based on AMD’s way better growth, market share gains, stronger data center position, and stronger free cash flow generation. At the same time, AMD is way cheaper than NVIDIA — based on forecasted profits for this year, NVIDIA trades at a more than 100% premium relative to AMD, which does not seem justified to me.

So from a growth and value perspective, AMD looks like the best pick among these three major semiconductor companies right now. It’s growing faster than the other two, has a better near-term/H2 outlook, and yet does not seem expensive relative to its underlying performance and potential.

Is AMD A Good Buy Today?

Due to the aforementioned reasons, I think that Advanced Micro Devices is the most favorable investment among these three right now. But that does not necessarily mean that buying it right now must be a great choice. Shares have risen by ~40% from the lows seen earlier this year, and shares are also up by double-digits since we called AMD a Buy in April (while the market is flat since then).

I do believe that it might not be the perfect time to enter a position now, as shares have climbed considerably in recent weeks. But for someone with a longer-term outlook, AMD should still be a very solid investment at around $100 per share. Analysts are expecting that AMD will earn around $4.90 next year. The company has strong growth potential in the data center space via further market share gains, e.g. due to the company’s introduction of new products such as its fifth-generation EPYC chips (“Turin”) that will launch in 2024. On top of that, healthy market growth in the data center space would allow AMD to grow its business meaningfully even without market share gains. New product launches in other categories and the company’s buybacks — the current program from this year covers 5% of its market capitalization — will add additional earnings per share growth potential. All in all, a 12% earnings per share growth rate seems quite achievable over the next five years, I believe — it’s possible that actual growth will come in way ahead of that. But even with just 12% annual earnings per share growth, 2027’s EPS would total around $7.70 — put a 21x earnings multiple on that, and AMD is a $160 stock five years from now, which would make for pretty solid returns of 10% a year. If actual earnings per share growth comes in at 15%, which would still be way below the growth rate from the last couple of years, annual returns easily be in the low-teens range.

So from a timing perspective, right now is not the best time to enter a position — the stock was considerably lower not too long ago, and might revisit those levels again in case the broad market turns lower. But despite that, it’s reasonable to assume that AMD will deliver solid returns over the next couple of years, which means that AMD is far from a bad investment at current prices.

Be the first to comment