ermingut/iStock Unreleased via Getty Images

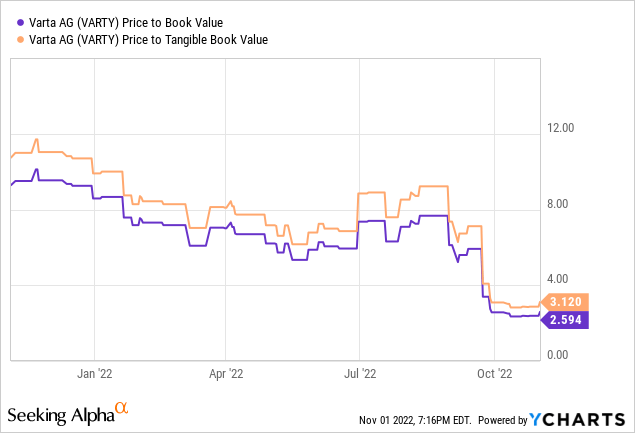

Varta AG (OTC:VARGF), a German manufacturer of industrial, commercial, and miniaturized batteries for equipment and devices, recently posted a downbeat preliminary Q3 result that will reignite concerns about the viability of its earnings growth trajectory. While management had previously suspended guidance based on the view that the company’s current operating weakness was down to cyclical factors such as inflation and supply chain headwinds (vs. a structural downturn), the extent of the Q3 miss signals a protracted revenue and earnings slowdown going forward. Plus, the inflationary environment in Europe is showing few signs of easing, and this will severely impact Varta’s long-term competitiveness relative to its Asian peers at a critical phase in its growth trajectory. In a base case scenario of more inflation and consumer weakness, Varta will struggle to outearn its cost of capital, and thus, I would hold off on the stock at the current ~3x P/Book valuation.

A Disappointing Preliminary Q3 Update

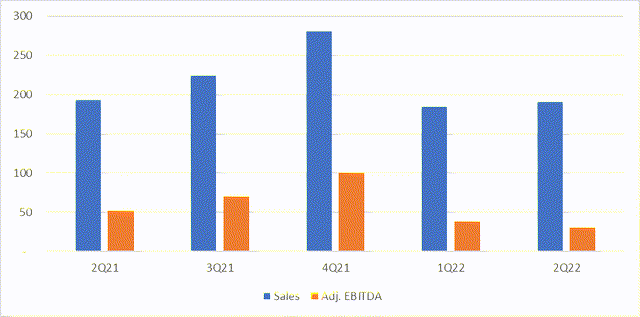

Coming on the heels of its decision to withdraw full-year guidance, Varta’s latest Q3 results again fell short of already pessimistic expectations. For starters, Q3 sales fell by ~14% YoY to EUR194m, while adj. EBITDA turned negative. Commentary mirrored the profit warning in September as well, with Varta citing elevated input costs (i.e., raw materials and energy), as well as delays in customer business. Worryingly, the press release noted that much of the latter headwinds were focused on the higher-margin Microbatteries segment, as worsening economics led to customer projects being delayed. So, while a YoY increase in Consumer Batteries segment sales helped, the unfavorable mix shift in Q3 led to a decline in margins and overall profitability.

The key hurdle remains Varta’s industrial footprint, which is concentrated almost entirely in Germany, where energy costs have risen significantly. Not only has this impacted margins again, but it has also reduced the company’s competitiveness relative to its Asian competitors, as reflected in the contrasting quarterly performance for this period. In effect, the divergence in sales implies Varta has lost share across its key customers in the True Wireless Stereo Headset (TWS) segment. Given the customer and product overlap with its Asian peers (for instance, with Apple (AAPL) AirPods), Varta’s continued inability to produce batteries at an attractive cost base could hurt its mid to long-term positioning as well.

Further Delay to New Guidance is Concerning

Alongside its disappointing Q2 results, which saw Varta’s revenues declining 1% YoY and adj EBITDA down by >40% YoY. the Executive Board had previously withdrawn its guidance for FY22 and Q3 2022. Recall that the prior rationale was that the company was not in a position to offer a reliable guide for FY22 amid lower customer call-offs in Microbatteries and input cost headwinds from raw materials and energy; instead, a new forecast would be issued for FY22 as soon as possible. Yet, even at this point in the year, Varta remains unable to provide a meaningful full-year outlook.

The reluctance to update the guidance raises concerns about the magnitude and sustainability of the headwinds, as well as the overall business visibility. Compared to auto supplier peers such as Valeo (OTCPK:VLEEY), Continental (OTCPK:CTTAY), and Faurecia (OTCPK:FURCF) as well, the financial underperformance stands out. In essence, Varta’s lack of pricing power means it has been unable to fully pass through raw material costs to customers. A key reason for this is that its industrial footprint is concentrated in Germany, where energy cost inflation has been particularly acute.

The comparison gets worse if we use Asian producers (which Varta mostly competes with) as a benchmark – as energy inflation there has been less of an issue, their pricing competitiveness has far outpaced Varta’s in recent months. More broadly, demand for consumer electronics looks set to be challenged amid declining disposable incomes as we head into a global recession. Given Varta’s outsized exposure to consumer discretionary items like TWS headsets as well, I suspect the Q3 weakness could go on for some time yet.

Another Earnings Disappointment Clouds the Outlook

Varta’s long-term growth potential is attractive, given its competitive positioning in a fast-growing lithium-ion battery market. Yet, the near-term headwinds to its core business are too material to ignore. In particular, the elevated German energy price inflation has resulted in the company suffering a lasting disadvantage in pricing competitiveness relative to Asian peers that benefit from significantly lower energy costs. Plus, the company is embarking on a multi-year investment cycle to ramp up production of V4Drive (i.e., Varta’s proprietary battery cell technology) despite facing a loss-making FY22 and underearning its capital costs.

Coming off a disappointing preliminary Q3 report, my main concern is the prospect of Varta’s current problems lasting for longer than expected, weighing on its margins and competitive positioning. Coupled with the likelihood of more demand challenges on the consumer electronics side of the business, the current ~3x P/B valuation multiple could be vulnerable to more compression, in my view. Upside catalysts that could change this view include new customer orders related to V4DRIVE, as well as the success of key customer Apple’s new launches (e.g., the new AirPods Pro and Beats).

Be the first to comment