Douglas Rissing

Headlines in the Wall Street Journal on Friday read, “Wall Street Bets The Fed Is Bluffing In High-Stakes Inflation Game.”

“Markets pummeled by the Fed’s rate increases in the first half of the year are racing upward.”

“The S&P 500 is up 17 percent from its mid-June low.”

To respond, the Fed sends out members of the Federal Open Market Committee to talk up the Fed’s commitment to fighting inflation and doing what is necessary to achieve the victory.

James Bullard, President of the Federal Reserve Bank of St. Louis and a member of the FOMC, has recently been discussing his belief that the Fed needs to post another 0.75 percent increase in its policy rate of interest.

And, the discussion goes on.

But, now, the Federal Reserve is also working to reduce the size of the securities portfolio.

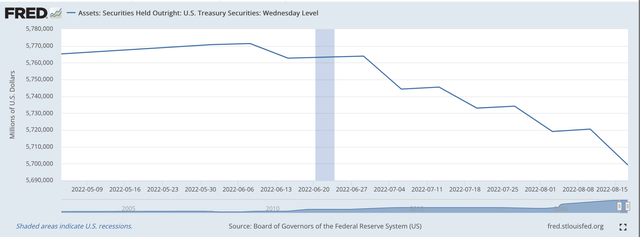

Just this past banking week, the week ending August 17, 2022, the Fed showed that it had reduced its securities portfolio by $11.5 billion.

Actually, the size of its portfolio of U.S. Treasury securities was reduced by $21.4 billion during the banking week, but this was offset by a $9.9 billion increase in the Fed’s portfolio of mortgage-backed securities.

Since the banking week ending June 22, 2022, the Fed has overseen a reduction in its securities portfolio of $65.5 billion, where $64.1 billion of the reduction came in U.S. securities.

U.S. Treasury Securities Held Outright (Federal Reserve)

U.S. Treasury Operations

Federal Reserve operations are not that easy, however.

As the Fed was reducing the size of its securities portfolio, the U.S. Treasury Department was reducing the deposits it held in the Treasury’s General Account at the Fed, and, also in other accounts.

Since June 22, 2022, the Federal Reserve account, “Deposits With Fed,” has declined by $252. billion, with $205.8 billion of the decline coming in Treasury Deposits in the General Account.

This movement of funds adds reserves to the banking system. This large of a movement would generally put downward pressure on short-term interest rates.

But, this was apparently not the case during the time period under review.

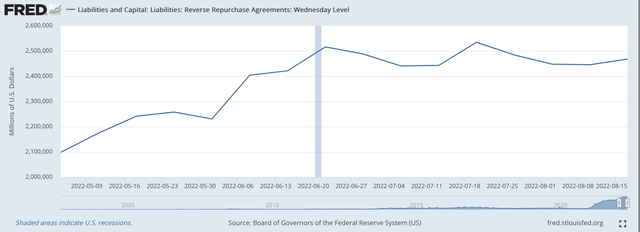

The Federal Reserve, itself, added to bank reserves through its use of Reverse Repurchase Agreements, the facility where the Fed sells securities on a short-term basis with an agreement to repurchase the securities after a very short time.. maybe one day…or, three days.

The Fed has been very active in using the “repo” market to help maintain the target range for its policy rate of interest.

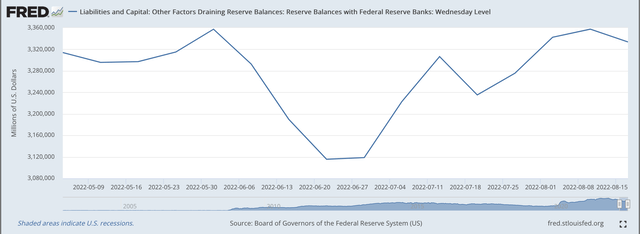

Some feel for this activity can be discerned from the Fed’s balance sheet line-item, Reserve Balances With Federal Reserve Banks.

This account, Reserve Balances can be used as a proxy for “excess reserves” in the banking system. As Reserve Balances go up, more liquidity is available in the banking system As Reserve Balances go down, there is less liquidity available.

Reserve Balances With Federal Reserve Banks (Federal Reserve)

So, the Federal Reserve has been managing the “excess reserves” in the commercial banking system so as to support the interest rate policy of the Fed.

Notice how the Fed has used “reverse repos” to maintain its policy rate of interest in the June 22, 2022, to August 17, 2022 period.

Reverse Repurchase Agreements (Federal Reserve)

Longer-Term View

It should be noted that since March 16, 2022, the date of the FOMC meeting where the new Fed policy to “fight” inflation was decided upon, the Reserve Balances with Federal Reserve Banks have actually declined and declined by a very large amount.

Since March 16, 2022, Reserve Balances with Federal Reserve have fallen by about $560.0 billion. So, the Fed tightened up very quickly at the start of the effort and has been “managing” the policy rate ever since.

To “manage” commercial bank excess reserves, the Fed has actively used reverse repurchase agreements. It has used “reverse repos” because it has stated that it was in the business of reducing the size of its securities portfolio.

It did not want market participants to get confused by highly volatile changes in the securities portfolio. So, the Fed used “reverse repos” to more closely manage the rise in the policy rate of interest.

Eventually, the Fed will reduce or eliminate its use of “reverse repos” and just focus on the securities portfolio, but this will come with time.

Confusion

The problem is that all this maneuvering on the part of the Fed is confusing to investors and to analysts.

There is no question in my mind that Jerome Powell, Fed Chairman, and others at the Fed have not done to best job possible in managing monetary policy.

The Fed over-reacted in responding to the dangers presented to the economy by the spread of the Covid-19 pandemic and the subsequent recession.

But, the general feeling is that in the case of a possible financial collapse, it is better for the central bank to err on the side of monetary ease so as to reduce the chances of the economy moving into an even worse downward shock.

The problem is that the Fed then faces the problem of “cleaning up” after the threat has gone away.

In the current situation, one can argue that Fed “stayed” too long “erring on the side of monetary ease” and left a huge amount of liquidity in the banking system that needs to be reduced.

But, others also criticize the Fed for “falling behind the curve” in responding to the inflationary threat.

“Dr. Doom,” otherwise known as Henry Kaufman, former economist from Salomon Brothers, who was known for his pessimism and for his August 17, 1982 call for falling interest rates, has just given us his views on the current situation.

Mr. Kaufman fears “that today’s Fed…is failing to combat inflation with the resolve displayed by Paul Volcker….”

In other words, Mr. Kaufman feels that Mr. Powell has fallen behind the market.

Mr. Powell’s inability to generate the market confidence in what he and the Fed are doing arises from him not acting boldly enough.

As to Mr. Powell’s pivot on inflation last November:

“His forecast was right, his inaction was wrong.”

And, this just makes the Fed’s job harder.

What is Mr. Powell going to have to do in order to convince “Wall Street” and others?

Be the first to comment