Abstract Aerial Art

Thesis

ZIM Integrated Shipping’s (NYSE:ZIM) FQ2 earnings release initially led to a sell-off as the company revised its volume growth guidance downwards, seeing normalization trends persist further.

However, the market has absorbed the selling pressure robustly, following through with its bear trap price action (indicating the market denied further selling downside decisively) in early July. In a late June article, we posited that investors should be cautious. However, even though downside volatility followed subsequently, the buying support seen at its July lows was resilient, leading us to review our assessment.

Given the current macro headwinds, we believe the company has offered conservative guidance through H2’22, which could further impact freight rates. Notwithstanding, we are confident that ZIM’s July lows should hold resiliently, despite the near- to medium-term headwinds over a potential slowdown.

As such, we revise our rating on ZIM from Hold to Buy.

The Battering In ZIM Is Justified

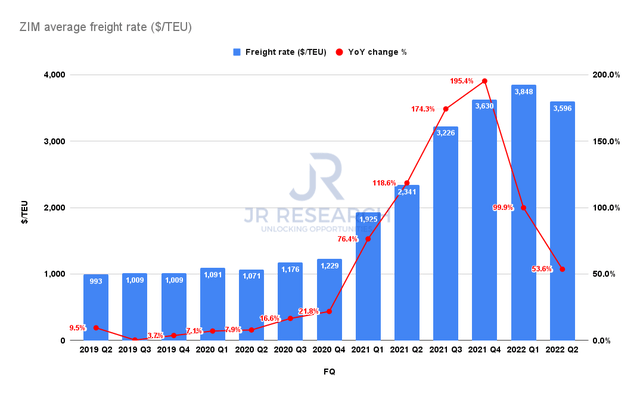

ZIM average freight rate (Company filings)

As seen above, the growth in ZIM’s average freight rates has already been trending down since Q4’21. Therefore, we aren’t surprised that the company posted a 53.6% growth in its average freight rate in Q2, down from Q1’s 100% surge.

Moreover, the company highlighted that it continues to see further normalization through Q4, given the current headwinds impacting the spot and contract market. Our analysis of global freight rates also shows that the moderation is still ongoing. Still, it’s critical for investors to note that the rates remain well above pre-COVID highs, which is instrumental in helping ZIM to maintain its FY22 profitability guidance. Management accentuated:

When we talked about our guidance for 2022, on average that the rate normalization will continue, albeit at a pace that is gradual, which has always been our assumption when it comes to the normalization agenda. We are still remaining exposed to spot at 50%. Let’s be clear. There are signs of weakening in demand as well and that may be weighed significantly in the explanation of why the rates are starting to normalize. But the demand is still there. Compared to the pre-pandemic level, we are still very resilient. Remembering that last year was extremely strong. So when we compare year-over-year, yes, there might be signs of weakness but it’s still a strong market. (ZIM FQ2’22 earnings call)

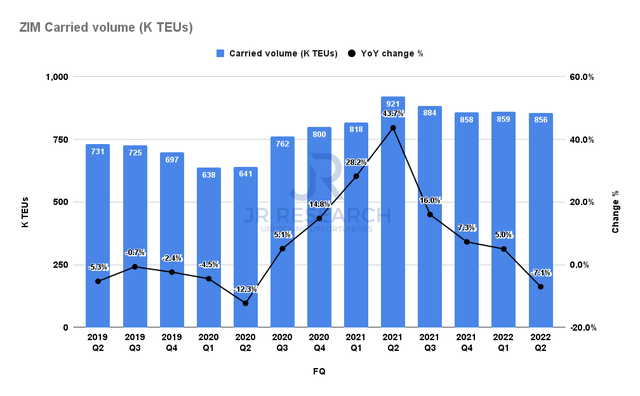

ZIM carried volume (Company filings)

The company’s carried volume has also normalized further (down 7.1% YoY) as it dealt with port congestion, which it expects to ease through Q4, consistent with its view of rate normalization. As a result, the company lowered its average volume growth down to 2-3% from its 5% guidance previously.

Given the weaker growth metrics seen above, we believe that the battering in ZIM over the past five months is justified. However, we postulate that the pummeling in ZIM seems overdone as it fell more than 55% from its March highs to its July lows.

Dividends Are Attractive, But Watch For Earnings Compression

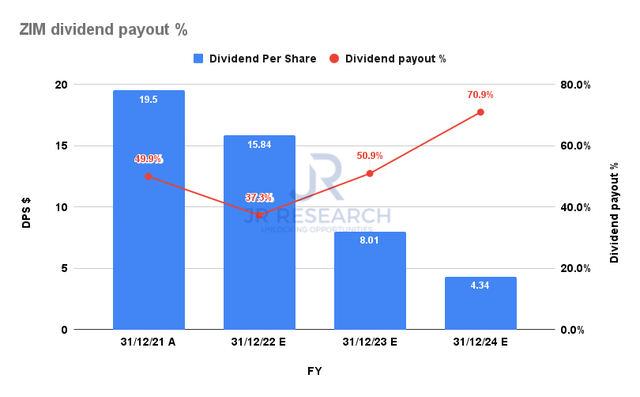

ZIM dividend payout % consensus estimates (S&P Cap IQ)

The company improved its dividend policy in Q2, as it looks to distribute 30-50% of its earnings as dividends to its shareholders. However, investors also need to be wary about the ability to sustain its attractive dividend policy moving forward if earnings start to suffer compression due to an impending slowdown.

For instance, ZIM’s dividend per share is projected to fall further through FY24, which could likely impact its payout ratio. Therefore, we urge investors to pay close attention to the company’s guidance on its dividend policy if economic conditions worsen further, leading to earnings compression. As a result, it could impact ZIM’s valuations in the medium-term.

Is ZIM Stock A Buy, Sell, Or Hold?

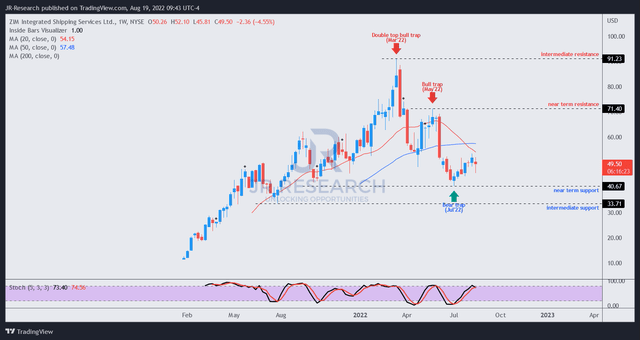

ZIM price chart (weekly) (TradingView)

ZIM last traded at an FY23 free cash flow (FCF) yield of 29%. We believe the market has demanded for higher yields due to the potential for declining earnings, worsened by the macro headwinds. Therefore, investors are urged to parse the cash flow impact moving forward as it could also affect its valuations.

Notwithstanding, we noted that the market has supported buying upside robustly at its July lows. Furthermore, despite the relatively tepid Q2 release, the market did not pummel ZIM back to its recent lows. As such, we postulate that the market is accumulating ZIM as the destruction from its March highs seems complete.

Therefore, we revise our rating on ZIM from Hold to Buy.

Be the first to comment