AdrianHancu

Markets dropped another leg lower over past weeks after strong CPI data and another jumbo rate hike pushed prices towards the June troughs. While the Tesla (NASDAQ:TSLA) stock has not been spared and followed suit with recent market declines, It continues to trade as one of the most expensive companies in the market, let alone the broader auto peer group. The large valuation premium attributed to Tesla is largely due to optimistic market expectations for both its long-term growth trajectory, as well as anticipation for generous returns on capital stemming from its persistent dominance in the burgeoning electric vehicle (“EV”) market, as well as high profile innovative projects that promise high-margin recurring revenue streams (e.g. software subscription sales, robotaxi fleet, etc.).

Yet, with rising costs of capital amid tightening monetary policies, and compressing returns on capital due to near-term input cost pressures, we believe the Tesla stock faces an inevitable fate of falling another leg lower in tandem with broader market declines until macro tightening risks peak. Although the stock has been largely more resilient compared to peers in the recent selloff, the lofty valuation it continues to enjoy is, in our opinion, becoming increasingly at risk due to mechanics of valuation theory that will likely kick-in to propel a downtrend over coming months.

Understanding the Composition of Tesla’s Valuation

General valuation theory deems a firm value is largely composed of two components – a “steady-state value” representing a company’s valuation in the event that earnings are sustained in perpetuity, and “future value creation” representing a premium for expectations of incremental growth.

In the case of Tesla, much of its lofty valuation is sustained by the generous premium pertaining to future value creation in which the market has rewarded the stock. And this is not without reason – Tesla is considered one of the most prominent disruptors of our generation in upending norms of legacy automaking. Although Tesla was not the first ever to build EVs, it has definitely pioneered the electrification of the passenger vehicle market and spearheading the global transportation sector’s transition to electric. The company has also done a tremendous job in scaling productions as one of the most efficient manufacturers in the auto industry, which is further corroborated by its industry-leading margins, though its volumes are not nearly as close as those of some of the largest legacy automakers.

Now, let’s dig a little deeper into the two components of firm value:

1. Steady-State

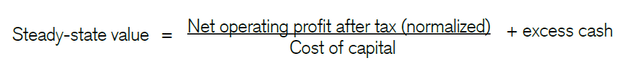

Steady-State Firm Value Equation (Credit Suisse)

The steady-state value represents the value of the firm when “NOPAT (net operating profit after tax) is sustainable indefinitely and incremental investments will neither add, nor subtract, value”. This is the so-called terminal value of a company when a certain perpetual growth rate is applied to future cash flows. The perpetual growth rate is typically determined by using GDP as a key benchmark, adjusted for maturity of the industry as well as other company-specific factors such as market leadership and/or market share. Companies operating in industries that are higher growth in nature are typically valued at a perpetual growth rate closer to or more than GDP, given their greater contributions to economic growth. Alternatively, companies operating in lower growth and/or mature industries are typically allocated a lower perpetual growth rate. Another key input in determining steady-state firm value is the cost of capital, which reflects the costs of sustaining this perpetual steady-state growth. The Gordon Growth Model is a typical representation used in determining a firm’s steady-state value:

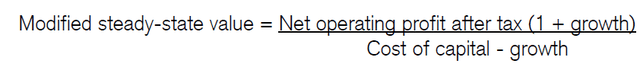

Gordon Growth Model (Credit Suisse)

2. Future Value Creation

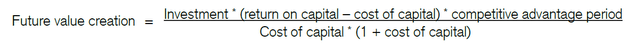

Future Value Creation Formula (Credit Suisse)

Future value creation represents the incremental value that investments earn (i.e. return on capital / “ROC”) relative to cost of capital, and takes into consideration the time period in which this value-creating opportunity will last. This firm value component is where much of Tesla’s premium valuation is explained.

The future value creation premium typically reflects various growth-cost combinations – high growth, low spread between return on capital and cost of capital; moderate growth, moderate spread between return on capital and cost of capital; low growth, high spread between return on capital and cost of capital. In Tesla’s case, the company’s future value creation premium represents its high growth and high spread between return on capital and cost of capital (see here for further discussion), underscoring its market leadership and what has largely been justifying the stock’s lofty valuation multiple in recent years.

The future value creation premium is where Tesla’s near-term valuation weakness is expected to stem from. When the return on capital and cost of capital spread narrows, the future value creation premium is reduced. Vice versa, when the return on capital and cost of capital spread widens, the future value creation premium expands, which explains the case for Tesla’s rapidly rising valuation in recent years. The company’s return on capital has been gradually expanding in recent years as it continues to benefit from scaled productions and generous margins. Meanwhile, it has also managed to keep its cost of capital at a manageable level thanks to robust profits and operating cash flows that have brought its credit rating closer to its investment-grade peers:

S&P Ratings has upgraded Tesla to BB+ last week [October 2021] with a positive outlook – this brings the EV maker one notch away from an investment grade rating. In addition to being the first EV pure-play to scale productions and achieve consistent growth in profits and operating cash flows, Tesla has also prudently navigated through the global supply chain constraints that have upended legacy automakers with years of additional experience within the automotive industry under their belts. Time and again, Tesla has proven its ability in minimizing inherent business and financial risks such as operational constraints by maintaining record-setting margins and robust cash flows, while ensuring sufficient resources and talent to solve problems. From a financial and operational standpoint, it will only be a matter of time until Tesla’s credit rating finally catches up with its fundamental reality.

An investment grade rating would underpin better pricing if Tesla were to raise capital through debt financing. This would also accordingly bring down the weighted average cost of capital (“WACC”) applied in valuing its future earnings, thus underpinning even better valuation prospects ahead. An investment grade rating would also be a pivotal indicator of Tesla’s ability to fulfil market expectations for it to maintain the dominant share of the fast-growing electric and autonomous vehicle markets in the long-run, underscoring better valuation prospects ahead.

Source: “Tesla Vs. Lucid Group: Which EV Stock is the Better Buy?“

In addition to a favourable spread between its return on capital and cost of capital, Tesla also benefits from an elongated competitive advantage trajectory given the burgeoning EV industry buoyed by global corporate and political agendas that are moving forward with climate change and global warming mitigation as one of the forefront factors of decision-making.

Near-Term Macro Implications on Tesla’s Valuation

However, increasing macro headwinds in the near-term are threatening the high growth, wide cost-returns spread that has come to Tesla’s benefit in recent years. With central banks gathering pace in raising interest rates to tame record-high inflation, companies – including the seemingly “untouchable” Tesla given its still-high valuation – face higher borrowing costs in addition to rising input costs ahead.

In valuation theory, the fed funds rate (“FFR”) directly impacts the risk-free rate (“RFR”) and equity risk premium (“ERP”) inputs of determining cost of debt and cost of equity – and inadvertently, cost of capital on a holistic basis. Essentially, with aggressive rate hikes in the books within the foreseeable future, it means the cost of capital will inevitably rise for all market participants. Meanwhile, inflation threatens to erode returns on capital by adding pressure on margins – a point that Tesla CEO Elon Musk has repeatedly warned of, even though the company continues to boast industry-leading margins and best-in-class manufacturing efficiency. The combination of inflation and rising rates will likely narrow the spread between Tesla’s generous returns on capital and favourable cost of capital, thus reduce the future value creation premium that has been sustaining the stock’s lofty valuation. This also provides an explanation of why Tesla’s stock price, as well as the broader market, as wavered this year amid tightening financial conditions.

Now, you might say – well, Tesla has market leadership that is expected to last into the longer-term and contribute to a lengthened competitive advantage period that is poised to compensate for the near-term spread reduction between return on capital and cost of capital within the future value creation premium leg of its valuation. In this, we point to our recent discussion over Tesla’s imminent loss of market share as the EV landscape becomes increasingly crowded:

The European Federation for Transport and Environment predicts more than 300 available EV models within the European automotive market by 2025, while the IHS Markit predicts more than 130 available EV models in the U.S. by 2026, which is equivalent to the number of ICE options available in the market today.

Specifically, in Tesla’s largest U.S. market where it currently commands a 75% share of annual EV sales, the emerging sector’s penetration rate surpassed the 5% inflection point in the first half of the year, marking the beginning of rapid mass market adoption. More than 25% of American population have identified EVs as their choice of preference when purchasing their next car, compared to 16% in 2019.

While the trends may appear as favourable tailwinds for Tesla on the surface, a deeper dive would reveal that many prospective buyers are alluding to the increasing availability of different EV models for their preference. The increasing availability of non-Tesla EV models across a wide array of performance, range capability, and price categories is what has encouraged rapid mass market EV adoption in the U.S., heightening risks of share erosion for Tesla over the longer-term.

Similar challenges are also being felt in China, one of Tesla’s fastest growing markets that has investors wondering if it will overtake the U.S. as the EV titan’s largest segment:

It’s an understatement to say Tesla had a breakout year for vehicle sales in China in 2021. They sold over 340,000 vehicles, nearly 2.8 times the number of vehicles sold in 2020 and just 8,000 less than what they sold in the U.S. It’s unclear whether China will overtake the U.S. as Tesla’s biggest market in 2022, but it will certainly be close.

Source: Bloomberg

According to Morgan Stanley, the recent push for reduced corporate reliance on China due to rising geopolitical tensions may imply that “Tesla is passing through its peak China dependency stage over the next 12 months”. This is further corroborated by Tesla’s ambitions in ramping up sales within the European EV market this year by taking advantage of its local production capacity, while maintaining its prominence in China still by continuing the build-out of Superchargers in the region – a core undertaking that has been credited for Tesla’s success in the world’s largest EV market.

While Tesla is expected to recoup some of the anticipated near- to mid-term market share losses over the longer-term (perhaps in the latter parts of the decade) given its strategic procurement of long-term material supplies critical to EV production, rising competition stands to cut short its competitive advantage period towards normalized industry-levels.

Risks to Shorting Tesla in the Near-Term

Admittedly, Tesla remains one of the most resilient stocks amid this year’s violent selloff despite also being the most expensive. The stock has only lost 22% of its value this year, compared to key market benchmarks like the S&P 500 and Nasdaq 100 which have lost 24% and 32% on a year-to-date basis, respectively. While the foregoing analysis argues that Tesla’s lofty valuation leaves much headroom for further declines in the near-term due to external macro factors that are poised to erode the spread between its returns and costs, the stock’s resilience this year may be indicative of compensating factors, including 1) expectations for continued growth that will generate positive returns in the near-term despite deteriorating economic conditions, and 2) robust investment demand from index-tracking funds due to Tesla’s significant market cap:

1. Expectations for Returns-Generating Growth

Tesla continues to operate under a supply-driven environment, where vehicle demand remains robust with lengthy wait times that extend out to July 2023. This continues to corroborate Tesla’s high-growth nature, which stems from the burgeoning EV industry as consumer demand remains resilient against the looming economic downturn.

Although Tesla’s profit margins are not anything to write home about when compared to less capital-intensive sectors like software – stocks like Microsoft (MSFT) and Google (GOOG / GOOGL) have lost more than 29% of their values this year – which defies investors’ shift in preference for near-term cash flows over growth under mounting macro uncertainties ahead, the resilience of the EV titan’s market value this year potentially implies that its growth profile remains virtuous by generating positive “incremental economic returns”. In other words, even when near-term macro headwinds stand to erode the returns-cost spread that has been sustaining Tesla’s valuation premium, investors’ confidence in the stock could maintain its strength on the company’s market leadership in terms of volume productions, sales, and manufacturing margins when compared to the broader auto industry. Similar to Apple shares’ (AAPL) resilience against violent declines observed across its FAANG counterparts this year, Tesla shares could potentially demonstrate similar strength with near-term declines to remain at a smaller extent when compared to the broader market given its robust fundamentals.

2. Robust Investment Demand

Despite shedding more than 20% of its value this year, Tesla’s market cap remains well above $860 billion, making it the fourth largest contributor to the Nasdaq 100 and S&P 500 indexes. Given Tesla’s significant influence on the performance of key market benchmarks, it accordingly becomes a well sought-after stock by index-tracking funds, drawing additional investment demand that gives the shares’ performance an additional boost beyond the underlying business’ fundamentals. As such, related volumes from index-tracking funds could potentially offset near-term weakness stemming macroeconomic factors discussed in the foregoing analysis, and mitigate the stock’s exposure to risks of further valuation deterioration.

Final Thoughts

The combination of a narrowing spread in the return of capital and cost of capital, and a normalizing competitive advantage period means the future value creation premium is poised to reduce, pushing Tesla’s near-term valuation closer to its steady-state. In other words, Tesla’s valuation could potentially decline to adjust for rising capital costs and decreasing returns on investments under today’s macro climate.

While we remain optimistic on Tesla’s persistent market leadership and sustained margin expansion profile over the longer-term, the lack of moderation observed in the stock’s near-term performance relative to peers ahead of tightening economic conditions could imply a time lag that will eventually materialize. Although the Tesla stock appears a valid long-term investment considering expectations for sustained gains even under a normalized operating environment with its strong fundamental prospects and market leadership on a relative basis to peers, the current macro environment paired with general valuation theory could, in our view, imply that its lofty valuation could buckle in the near-term to create better entry opportunities.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment