Elena Perova

Signet Jewelers Limited (NYSE:SIG) is feeling the brunt of the pullback in discretionary spending. The company announced it was revising prior guidance lower for both the top and bottom line, citing “rapid inflation” as the primary driver behind the revision. Also in the release, Signet announced it agreed to acquire Blue Nile Inc. for $360m in cash. The market’s preliminary reaction to the news was negative, sending shares down nearly 12%.

Despite the macroeconomic headwinds (i.e., inflation, recession) facing Signet, the company continues to make choices that progress its strategic priorities and make its shares very attractive to investors. Nevertheless, until macro challenges abate, Signet maintains its Hold rating.

Revised Guidance

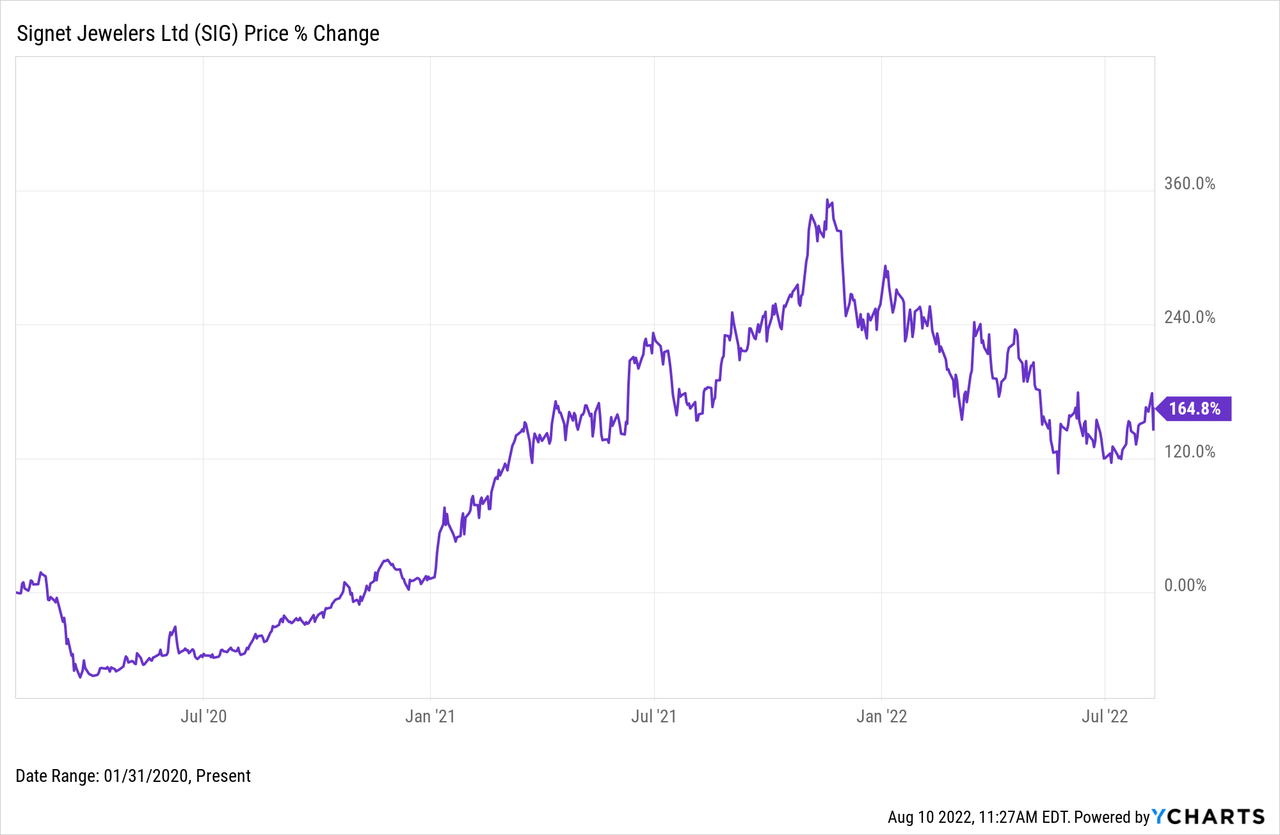

The revised guidance comes after a period of spectacular growth for the company. In FY’22 (fiscal year ending January 29, 2022), Signet’s $7.8b in sales grew nearly 50% and 28% over FY’21 and pre-pandemic FY’20, respectively. The incredible sale growth was driven, largely in part, by the infusion of stimulus money into the market. Growth in sales also increased Signet’s operating leverage and profitability. Between FY’20 and FY’22 Signet’s adj. operating margin expanded a whopping 640 bps, from 5.2% to 11.6%; and the company’s GAAP net income grew 9-fold, from $72.6m to $735.4m, over that same period. Ultimately, Signet’s operational improvements resulted in the stock appreciated nearly 165% from year-end FY’20 through present day:

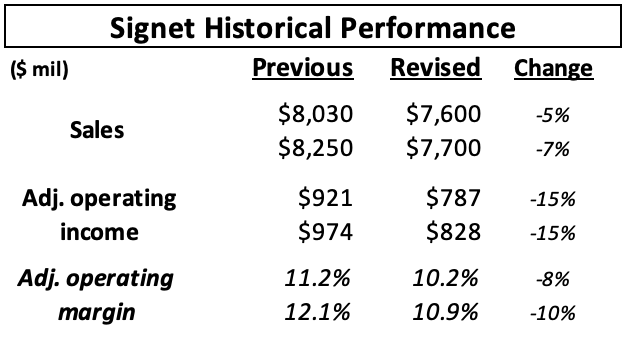

Signet’s FY’22 strong operating performance was not, however, built to last. Management now expects a decline in FY’23 sales and adj. operating income as well as margin contraction:

Signet 8-K, Author’s analysis

Bear in mind, the updated guidance does not include accretion from the Blue Nile acquisition, which is expected to close later this year.

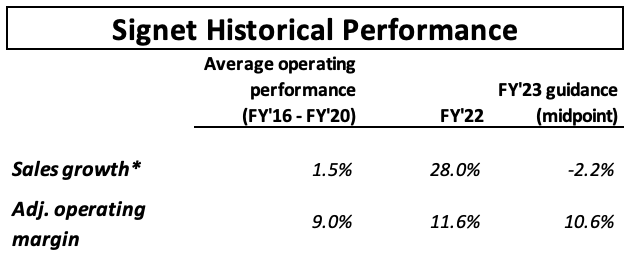

Signet’s revised outlook brings its operating profile closer in line with historical performance but retains improvements attained through the company’s strategic initiatives. Pre-pandemic (between FY’16 – FY’20), Signet’s sales grew a measly 1.5% on average (organically it was flat) while adj. operating margin averaged 9.0%:

FY’22 sales growth compares to FY’20 (Signet SEC filings, Author’s analysis)

Signet made several lasting changes under its previous turnaround plan (Path to Brilliance FY19 – FY’21) including reconfiguring its physical store footprint while expanding online capabilities, shrinking headcount, shuttering several hundred of underperforming stores, refreshing its merchandise, and clarifying its banner value propositions. These changes should preserve at least some of the company’s recent margin improvements in future periods, and its new guidance reflects this sentiment.

Future Growth

One of Signet’s strategic priorities over the next several years is to obtain 10% of the jewelry market. As of FY’22, Signet controlled 9.3%. One way Signet plans to capture market share is through acquisition. To this end, the Blue Nile acquisition will be a nice addition to the company’s growing portfolio of online-focused banners. Signet first purchased an online jeweler in 2017 with its acquisition of James Allen. Then in 2021, the company purchased Rocksbox, an online jewelry subscription service, and Diamonds Direct, a physical and online jewelry retailer. In FY’22, online sales accounted over 19% of Signet’s total sales.

On its face, it appears Signet got a good deal for Blue Nile. The company agreed to acquire Blue Nile, which generated ~$500m in revenue in 2021, for $360m in cash, or .7x sales. Compare this to the 1.1x paid for Diamonds Direct not even a year earlier. More importantly, the acquisition will provide Signet access to a more affluent customer base and extend its digital leadership.

Housekeeping Items

Two other noteworthy developments for Signet were resolving its employment practice lawsuit and selling its U.K. pension liability. The lawsuit settlement cost the company ~$190m while the U.K. pension liabilities divestiture cost ~$130m. Removing these two items reduces future financial risk for the company and makes it more appealing from investors’ perspective.

Conclusion

The revised guidance, while disappointing, is not a surprise and better reflects the long-term outlook that investors can expect moving forward. Also, the Blue Nile acquisition is a welcome addition to Signet’s portfolio of jewelry banners and should help the company achieve its strategic priorities. Finally, management continues to make Signet appealing to investors by, in part, removing uncertain risks from its balance sheet.

The current macroeconomic environment, however, makes it difficult to recommend Signet as a Buy at this point. The company is certainly the strongest company in the market and is steadily gaining market share, but until inflation relents, it is prudent to avoid discretionary retailers. With that said, if Signet weakens significantly from here it would be worth another look. Currently, Signet maintains a Hold rating.

Be the first to comment