Scharfsinn86/iStock via Getty Images

The Inflation Reduction Act includes a substantial amount of spending related to climate change and, more specifically, green energy alternatives. Hydrogen power production is likely to be one of the beneficiaries of the spending benefits. Hydrogen power also appears under-owned compared to many other alternative energies that are accepted as green and/or ESG friendly. I believe the Defiance Next Gen H2 ETF (NYSEARCA:HDRO) is a reasonable way to get diversified exposure to the industry, and that it also appears to be breaking out of a downtrend.

The Inflation Reduction Act directly promotes hydrogen power through the introduction of a 10-year production tax credit for clean hydrogen that may be elected to claim as an investment tax credit. In addition, the act makes energy storage technologies, which it defines to include hydrogen, eligible for the investment tax credit.

The Inflation Reduction Act also introduces a substantial credit for clean commercial vehicles, which is a primary initial use case for hydrogen power. Similarly, the act expands the alternative fuel station credit, which should help expand the production of hydrogen fueling stations.

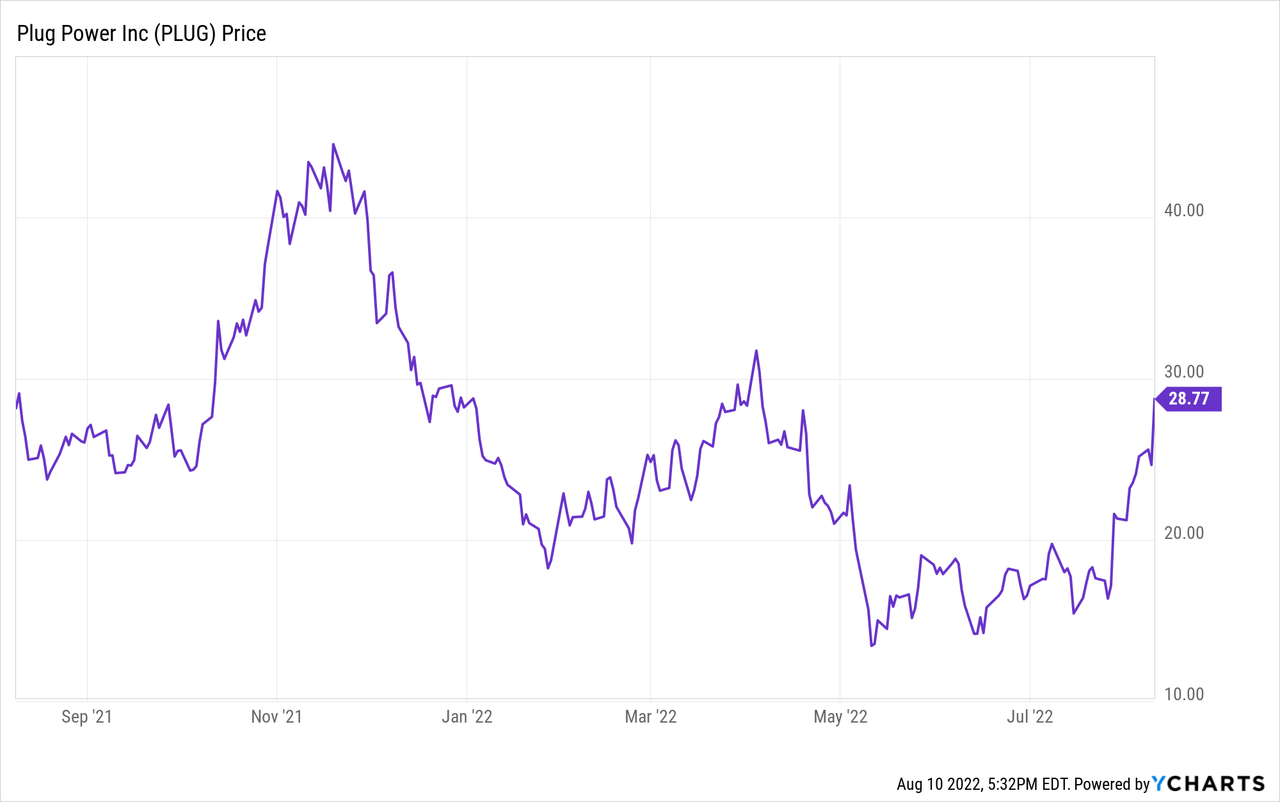

Even though many, many companies engaged in hydrogen power have performed well over the last few days, most are still down a substantial amount over the last year. For example, Plug Power (PLUG) was up about 17% yesterday, and around 50% since late July, but it is still down over 35% since late 2021.

Today’s move came despite PLUG’s reporting a Q2 earnings miss, as analysts raised price targets due to the strength of the tailwind that the Act provides to the selling of PLUG’s products. Hydrogen fuel cells, hydrogen fuel, and electrolyzers that produce hydrogen are all likely to see growth in sales over time, and the Inflation Reduction Act should hasten the rate of adoption.

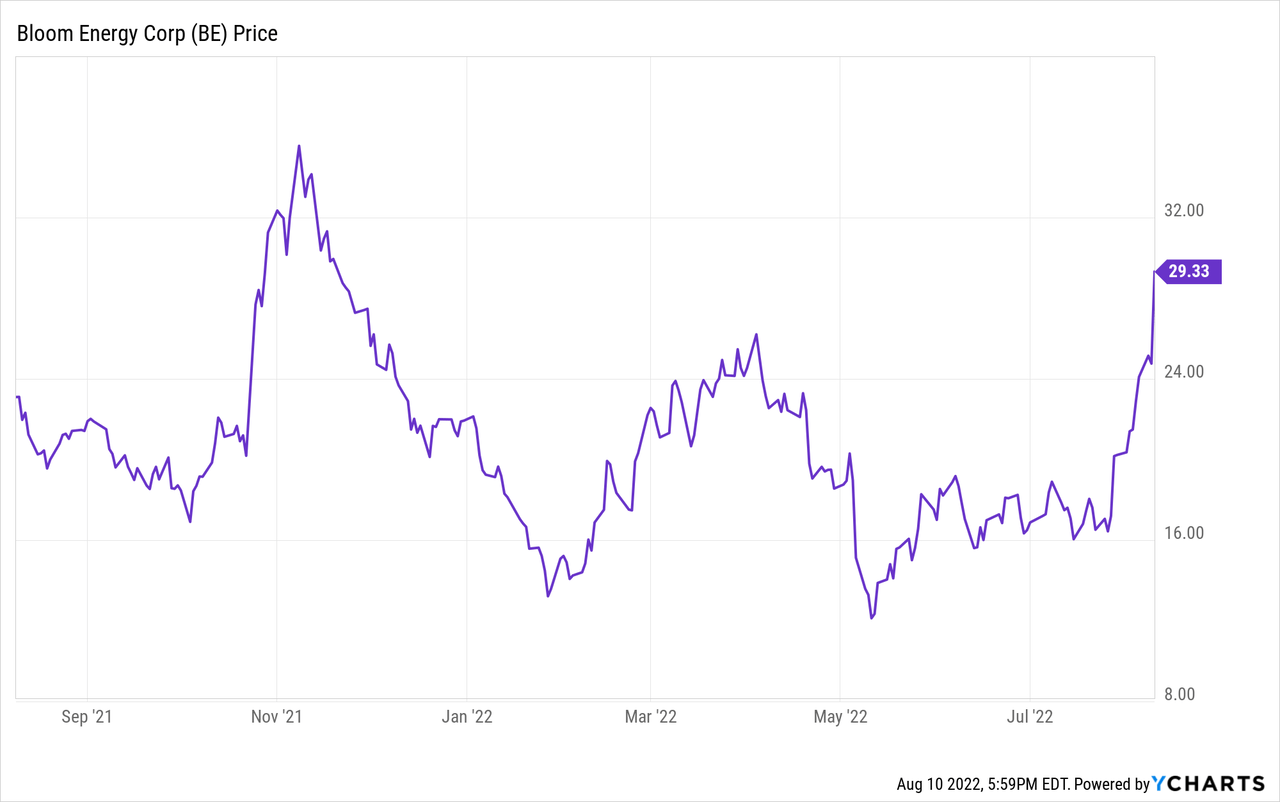

PLUG is the largest holding in the ETF, followed by Bloom Energy (BE), whose chart is eerily similar to Plug Power’s chart.

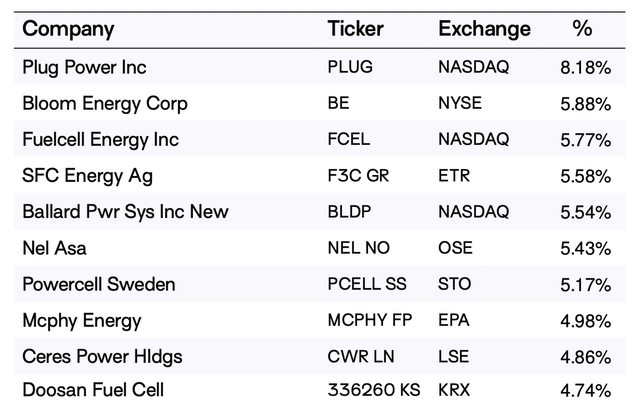

Many of the hydrogen energy related holdings in HDRO are not traded on the domestic markets. Below is a list of HDRO’s top ten holdings, and over half lack a domestic market ticker.

HDRO top holdings (HDRO fact sheet)

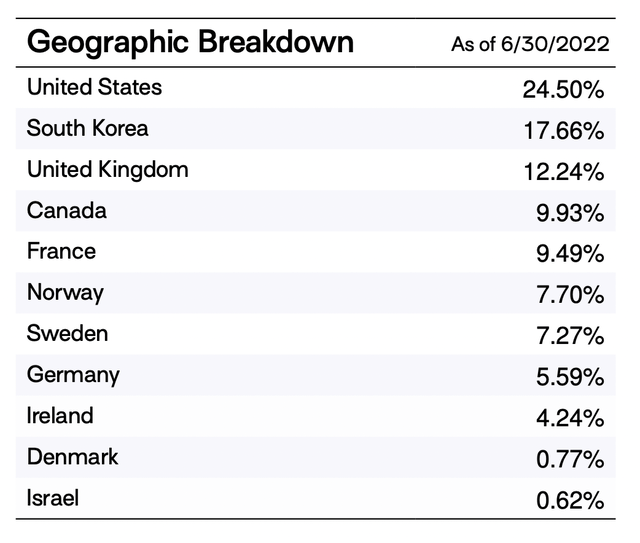

HDRO is highly diversified in terms of national breakdown. Less than 25% of the portfolio’s holdings are domiciled in the United States, with numerous other nations’ industrial might contributing to it. This is a measure of diversification, including being a potential beneficiary of a declining dollar.

HDRO Country Breakdown (HDRO fact sheet)

HDRO has been in a declining wedge since late November of 2021, and it looks like the ETF broke out of that wedge a few weeks ago. Since then, the ETF has outperformed the broader market. Today’s strong move in multiple of its largest constituents must be taken as tremendous flow through.

HDRO daily candlestick chart (Finviz.com)

While the trajectory of this recent move appears unlikely to sustain itself, it seems as though the industry is coming off of a capitulatory bottom. If that is the case, HDRO may continue to outperform in the coming quarters. And there is good reason to believe the hydrogen related companies should have a strong tailwind here. After all, there are significant benefits to the industry within the Inflation Reduction Act.

Conclusion

Hydrogen power related companies and the HDRO ETF were in a multi-quarter downtrend, but it appears that the group is breaking out of it. Beyond this technical move through the moving averages, hydrogen power is a key beneficiary of the Inflation Reduction Act. While it is unlikely for the industry to maintain its recent trajectory, since this apparent bottom, I believe it is likely that HDRO tests its first half of the year high around $19 within 2022.

Be the first to comment