Bryan Bedder

This article is part of a series that provides an ongoing analysis of the changes made to George Soros’s 13F stock portfolio on a quarterly basis. It is based on George Soros’s regulatory 13F Form filed on 8/12/2022. Please visit our Tracking Soros Fund Management Holdings article for an idea on his investment philosophy and our previous update for the fund’s moves during Q1 2022.

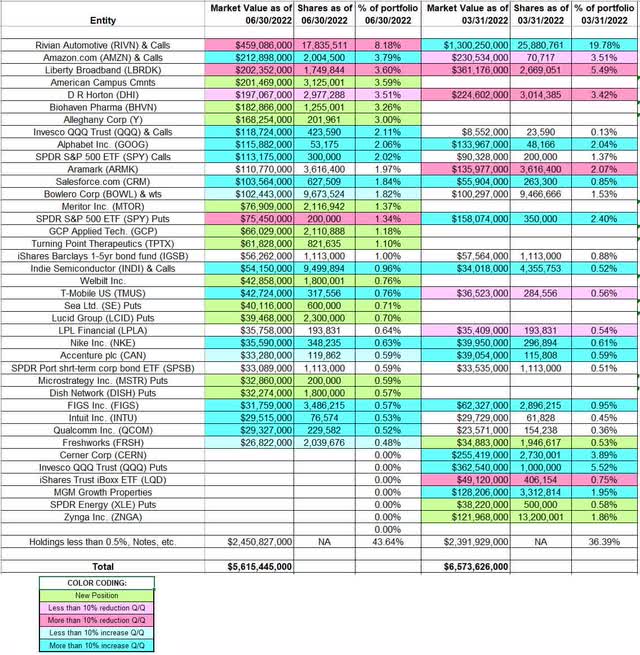

Soros Fund Management invests globally and the long positions in the US market reported in the 13F filings represent ~25% of the overall portfolio. The 13F portfolio value decreased ~15% this quarter from $6.57B to $5.62B. The number of positions decreased from 273 to 271. Very small stock positions and large debt holdings together account for ~44% of the 13F holdings. The investments are diversified with a large number of very small equity positions, a small number of large equity positions, and a few large debt holdings. The focus of this article is on the larger equity positions. The top three individual stocks held are Rivian Automotive (RIVN), Amazon.com (AMZN), and Liberty Broadband (LBRDK, LBRDA). To learn about Soros’ distinct trading style and philosophy, check out his “The Alchemy of Finance” and other works.

New stakes:

American Campus Communities, Alleghany Corp (Y), Biohaven Pharma (BHVN), GCP Applied Technologies (GCP), Meritor Inc., Turning Point Therapeutics (TPTX), and Welbilt Inc. : These are merger-arbitrage stakes established during the quarter. Combined they are at ~12% of the 13F portfolio.

Lucid Group (LCID) Puts, MicroStrategy (MSTR) Puts, and Sea Limited (SE) Puts: These are small (less than ~0.70% of the portfolio each) short positions through Puts established this quarter.

Stake Disposals:

Invesco QQQ Trust (QQQ) Puts: The 5.52% short position through QQQ Puts was established in Q4 2021 as the underlying traded between ~$353 and ~$404. Last quarter saw a ~40% stake increase as QQQ traded between ~$318 and ~$402. The disposal this quarter happened as the underlying traded between ~$271 and ~$369. It currently trades at ~$323.

Note 1: Soros is known to use ETFs to hedge other parts of his portfolio. As such, such positions do not indicate a clear market bias.

Note 2: A significant ~2% of the portfolio long stake in QQQ was built during the quarter.

Cerner Corporation, MGM Growth Properties (MGP), and Zynga: These merger-arbitrage stakes got eliminated as their corresponding merger deals closed during the quarter.

SPDR Energy (XLE) Puts: The 0.58% short position through SPDR Energy ETF Puts was established last quarter as the underlying traded between ~$57 and ~$79. It was eliminated this quarter as the underlying traded between ~$71 and ~$92. It currently trades at $79.46.

iShares Trust iBoxx ETF (LQD): The 0.75% LQD stake was purchased in Q1 2020 at prices between $105 and $134 and increased by ~600% next quarter at prices between $121 and $135. Q2 2021 saw a roughly two-thirds reduction at prices between ~$130 and ~$134. There was a ~30% selling last quarter at prices between ~$118 and ~$131. The disposal this quarter was at prices between ~$107 and ~$122. The stock currently trades at ~$112.

Stake Increases:

Amazon.com: AMZN is a 3.79% of the portfolio position primarily built in H1 2021 at prices between ~$148 and ~$176. H2 2021 had seen a roughly one-third selling at prices between ~$159 and ~$187. There was a ~40% stake increase this quarter at prices between ~$102 and ~$168. The stock currently trades at ~$138.

SPDR S&P 500 (SPY) Calls and Invesco QQQ Trust (QQQ) & Calls: The ~2% of the portfolio long position through SPY Calls was established in Q4 2021 as the underlying traded between ~$429 and ~$478. There was a ~50% stake increase this quarter as SPY traded between ~$366 and ~$457. It is now at ~$422. QQQ & Calls is a 2.11% stake primarily built this quarter at prices between ~$271 and ~$369. It is now at ~$323.

Alphabet Inc. (GOOG): GOOG is a ~2% of the portfolio position purchased in Q2 2019 at prices between ~$52 and ~$64 and reduced by ~50% in Q1 2020 at prices between ~$53 and ~$76. Q4 2020 saw another similar selling at prices between ~$71 and ~$86. There was a ~250% stake increase next quarter at prices between ~$86 and ~$107. H2 2021 had seen a ~50% reduction at prices between ~$133 and ~$151. Last quarter saw a one-third increase at prices between ~$127 and ~$148. The stock is now at ~$118. This quarter also saw a ~10% increase.

Note: Alphabet is a frequently traded stock in Soros’ portfolio.

Salesforce.com (CRM): The 1.84% of the portfolio CRM stake was built over the last four quarters at prices between ~$156 and ~$310 and the stock currently trades at ~$184.

Bowlero Corp (BOWL) & wts: BOWL is a 1.82% of the portfolio position purchased in Q4 2021 at prices between ~$8.80 and ~$10.15 and the stock currently trades at ~$12. There was a minor ~2% increase this quarter.

Note: Soros has a 5.4% ownership stake in the business.

indie Semiconductor (INDI): The ~1% INDI stake was built over the last three quarters at prices between ~$5.35 and ~$16 and the stock currently trades at $7.58.

Note: They have a ~8% ownership stake in indie Semiconductor.

FIGS, Inc. (FIGS): FIGS had an IPO last June. Shares started trading at ~$30 and currently go for $10.80. Soros’ stake is at 0.57% of the portfolio. There was a ~42% selling in Q4 2021 at prices between ~$23 and ~$43 while last quarter there was a ~60% stake increase at prices between ~$13.50 and ~$27. That was followed with a ~20% increase this quarter at prices between ~$7 and ~$23.

Accenture plc (ACN), Freshworks (FRSH), Intuit (INTU), NIKE Inc. (NKE), QUALCOMM (QCOM), and T-Mobile US (TMUS): These small (less than ~0.75% of the portfolio each) positions were increased during the quarter.

Stake Decreases:

Rivian Automotive & Calls: RIVN had an IPO last November. Shares started trading at ~$100 and currently go for $34.45. Soros established the stake at prices between ~$85 and ~$130. Last quarter saw a ~30% stake increase while this quarter saw a similar reduction. It is by far their largest position at ~8% of the portfolio.

Note: Rivian’s last funding round before the IPO was in early 2021 at a valuation of ~$28B. This is compared to current Enterprise Value of ~$18B. Rivian’s Enterprise Value is somewhat skewed as they have a huge net cash position of ~$15B and a lot of that would be consumed in Capex in the coming quarters.

Liberty Broadband: LBRDK is the third-largest individual stock position at 3.60% of the portfolio. The stake was established in Q2 2016 at prices between $55 and $60.50. Q4 2019 saw a ~20% selling at prices between $103 and $125. Q1 2021 saw a similar reduction at prices between ~$142 and ~$157. Last three quarters saw a ~55% selling at prices between ~$103 and ~$177. The stock currently trades at ~$114.

D.R. Horton (DHI): The large (top five) 3.51% DHI stake was established in Q1 2019 at prices between $35 and $47 and increased by ~70% next quarter at prices between $42 and $47. The position has wavered. Recent activity follows. There was a roughly one-third selling over the last two quarters at prices between ~$75 and ~$110. The stock currently trades at $74.28. This quarter also saw marginal trimming.

SPDR S&P 500 ETF (SPY) Puts: The 1.34% of the portfolio short position through SPY Puts was established over the last two quarters as the underlying traded between ~$416 and ~$478. The position was sold down by ~45% this quarter as the underlying traded between ~$366 and ~$457. SPY is now at ~$422.

Kept Steady:

Aramark (ARMK): The ~2% ARMK stake saw a ~200% increase last year at prices between ~$31.50 and ~$42.25. Last quarter saw a one-third reduction at prices between ~$33 and ~$38. The stock is now at $37.57.

LPL Financial (LPLA): The bulk of the original stake in LPLA was purchased in Q2 2018 at prices between $57 and $71. Q3 2020 saw a one-third selling at prices between ~$74 and ~$85. The three quarters through Q2 2021 had seen another ~35% selling at prices between ~$76 and ~$156. The stock currently trades at ~$224 and the stake is now very small at 0.64% of the portfolio.

iShares 1-5yr Bond Fund (IGSB) and SPDR Portfolio Short Term Corporate Bond ETF (SPSB): These very small (less than ~1% of the portfolio each) stakes were kept steady this quarter.

The spreadsheet below highlights Soros’s significantly large 13F positions as of Q2 2022:

George Soros – Soros Fund Management’s Q2 2022 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Soros Fund Management’s 13F filings for Q1 2022 and Q2 2022.

Be the first to comment