DieterMeyrl/E+ via Getty Images

Investment Thesis

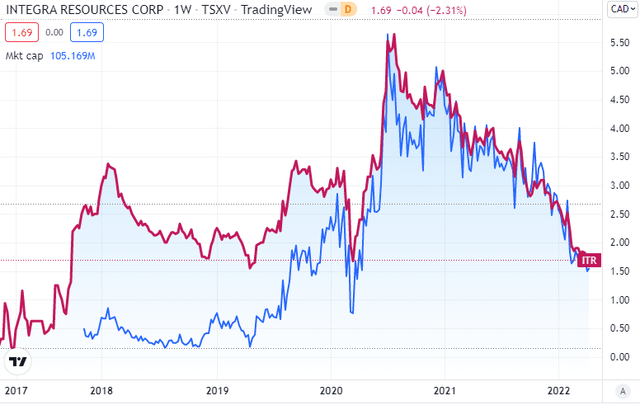

Integra Resources (NYSE:ITRG) is an extremely cheap gold and silver development company, with its asset in Idaho, United States. It is a stock which has gotten severely punished since the peak in August of 2020. The stock price has declined by as much as 70% from the high.

In this article, I will take a closer look at the valuation and review some of the potential risks for the company, which the market appears to be very concerned with presently.

Size & Valuation

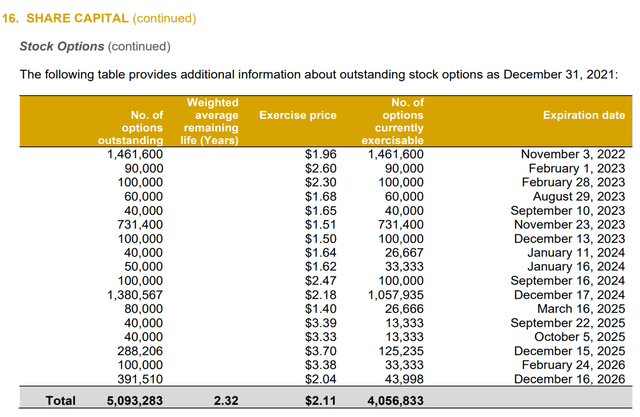

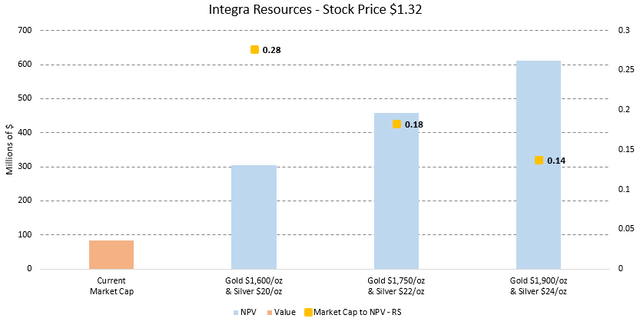

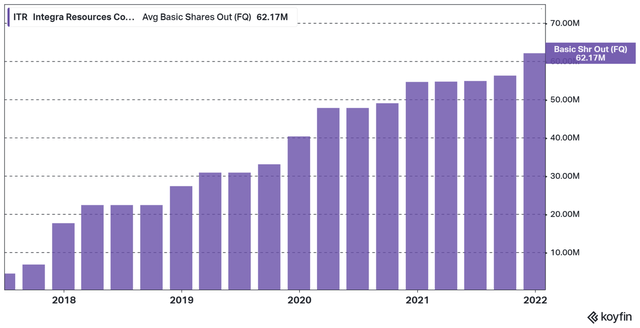

The latest stock price of Integra Resources is $1.32 and there were 62.6M shares outstanding as of Q1-22. Virtually all options are out of the money, we will consequently disregard them as they are anti-dilutive. The company does however have about 1.05M restricted and deferred share units. In total, we then get 63.64M diluted shares outstanding.

This in turn gives us a market cap of $84.0M. The company has no debt and $14.3M in cash as of Q4-21, but the cash will be used in the near future, so the enterprise value will be about the same as the market cap.

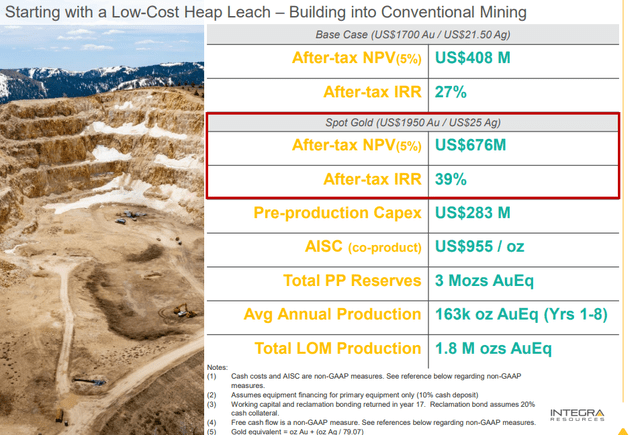

The core asset of Integra Resources is the DeLamar Project, which the company released the results from a pre-feasibility study in February of 2022. The asset presently has 3Moz in gold equivalent reserves, but the PFS does not contain any of the drill results from 2021. So, the asset will grow going forward.

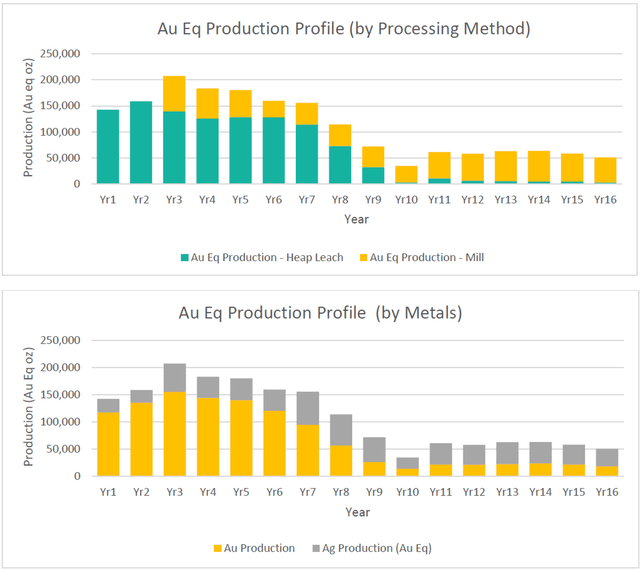

The project has an estimated average annual production of 110K AuEq ounces for 16 years, with 163Koz estimated during the first 8 years of the project. The AISC is estimated to be a respectable $955/oz.

Figure 3 – Q4-21 MDA Figure 4 – April 2022 Company Presentation

Using spot prices for gold and silver, the NPV of the project is multiples of the current market cap of the company. Even at slightly lower metal prices like $1,750/oz for gold and $22/oz for silver, we are talking about a market cap-to-NPV of 0.18x, which is extremely low when we also consider the tier 1 jurisdiction.

Risks To Consider

There is no doubt Integra Resources is cheap, but what potential risk factors are causing the stock to trade at such as discount to the NPV?

The pre-production capex is estimated to be $283M, which is a decent size increase from the initial estimate in the PEA. The amount is not that large though on an absolute basis when we consider the inflation in building materials lately. However, it is a very large amount in relation to the $84M market cap.

This means, it is unlikely that Integra Resources takes the asset to production by itself unless the sentiment changes drastically for the stock. It would be too much equity dilution for it to make sense and I doubt more than 35-50% of the capex could be debt-financed with an asset of this grade and internal rate of return. It is in my view not preferable for a development company to be so dependent on the external interest for a takeover or a joint venture to realize the potential of the company.

Another near-term concern is that the company will need to refinance in Q2 2022 based on communication from the CEO. So, we are likely looking at equity dilution at a very depressed share price. I do not think debt financing is relevant at this stage of the development cycle. While I am not a fan of royalties & streams in general, for a company trading at such a depressed level as Integra Resources, a stream or a joint venture would be preferable to equity financing. It is not always easy to get that sorted at favorable terms though.

There are already some royalties on the project from when it was acquired from Kinross, which is unfortunately quite common on legacy assets. The royalties primarily impact the margins as the royalty payments are naturally deducted in the NPV calculation.

Another concern is the massive share dilution over the last 5 years. When it comes to development projects, it is common to see extreme equity dilution from a very low level prior to the discovery. That is partly what we are seeing in the chart above, but Integra Resources is on the high side even compared to other exploration & development companies. We have seen the share price and market cap increase, up until August of 2020 at least, so there are worse examples, which continue to tap the equity market without delivering any value to shareholders.

Conclusion

There are certainly some risks to consider with Integra Resources, but do they explain the extremely depressed share price? There are a few other factors which have likely impacted the sentiment as well.

One aspect which has very likely played a part is the worsening characteristics of the PFS compared to the PEA. It has likely caused some long-suffering shareholders to throw in the towel and sell their shares. From a somewhat objective standpoint, this does not impact my reasoning though as I focus on risk-reward at this point in time.

Integra Resources does have some quite interesting growth potential over the next few years, but it will also be in a less exciting part of the Lassonde Curve going forward with permitting and working on a feasibility study. This period is often less invigorating for the share price.

There is also more inflation recently, where the sentiment appears to have hit the development companies the worst after a few significant cost overruns. I also think the market is overly conservative on the price of gold and silver in relation to inflation. We have seen some input costs increase by up to 50% over the last 3 years, which should be reflected in cost estimates. However, gold & silver prices have also increased by something similar over the last 3 years, but many insist on still relying on a $1,500/oz gold price, which does not make sense to me.

A $1,500/oz gold price might be a possibility, but I do not think other input costs will stay elevated if that is a reality. My view is that we are unlikely to see a $1,500/oz gold price unless we get a sharp deflationary impulse to most markets, which should also be reflected in input costs.

When it comes to an investment in Integra Resources, I think the risk-reward is very favorable for the stock at this level. So, I have recently taken a position in the stock. Waiting until after a likely Q2-22 financing might be a good strategy as well, but there is always a risk that the stock runs away to the upside when it is trading at these depressed levels from a change in sentiment.

Be the first to comment