gesrey

The dominant force of 2022 was the Federal Reserve

Markets have been driven by Inflation and the corresponding monetary policy changes by the Federal Reserve for the whole year of 2022. Changes to the potential Federal Reserve reaction function were discussed in great detail by the media, the live views of the FOMC meetings with Chairman Jerome Powell reached substantially more people than usual, and Twitter accounts of Macro Experts and/or Doomers had a surge in followership.

That’s for good reasons: Jerome Powell, formerly known as ‘Jay‘ (and in 2020/21 simply: ‘J’) managed to raise the effective Fed Funds from zero in January and started reducing the Federal Reserve balance sheet with Quantitative Tightening. Other Central Banks were less tight, and the Dollar (DXY) shot up in relative value, especially against the Euro and the Yen. Just recently, the Federal Reserve raised the target rate of the Fed Funds by another 50 Basis Points to 4.375%. Future Rate Hikes depend heavily on economic data, most importantly the unemployment numbers.

In my belief, it’s highly likely that the Federal Reserve will become less relevant in 2023 because markets heavily factor in rate-of-change instead of nominal levels. There may be another rate hike in February, but in general the Federal Reserve decisions will get less volatile because rates are already in highly restrictive territory. However, less volatility of the Federal Reserve decision-making isn’t necessarily bullish for stocks because real rates are in positive territory across the curve. This article aims at opening up a discussion about the probable driving forces of financial markets in 2023. After all, the market is forward-looking.

My thinking of recent economic trends

Before that, an important disclaimer and overview of my macroeconomic views of the last few years, as they materially influence how I think about the markets going into 2023.

To start off, I believe inflation is always and everywhere a monetary phenomenon, while the monetary policy of the Federal Reserve works with long and variable lags. I think that much of the inflation of late 2021 and 2022 had its origins in the massive monetary and fiscal stimulus following the Covid Crisis in March 2020. The fundamental difference of the monetary stimulus was a) the amount and b) the strong connection with fiscal stimulus, which acted as a transmitter for pushing money into the real economy and not only in assets. All the while, supply-chain issues, and fundamental supply/demand imbalances, especially in the energy sector, contributed to inflationary pressures. The extraordinary easing of monetary and fiscal policy, coupled with global covid restrictions led to the surge in consumer price inflation. Because of the mechanisms of credit provision, it took a little longer than a year for the monetary and fiscal stimulus to be reflected in the CPI numbers.

But the lag exists on both ends. With a good year of tightening monetary policy, much less fiscal stimulus, and substantial easing of supply-chain issues, I believe inflation will rapidly return below 3-4% in the next year. In 2022 the market experienced its sugar detox. In the first half of 2023, this will likely continue. Bad news will be bad news again.

However, the focus will probably shift from changes in the indirect liquidity provision from the central banks toward non-financial economic data. Throughout 2022, bad news was good news. The market discounted worse-than-expected economic data as tailwinds for stocks because of the Federal Reserve reaction function.

The faster the economy would decline toward a recession, the quicker the market expected the Federal Reserve to stop its tightening process, and global liquidity would be expected to improve. For example, the recent bear market rally from October 2022 to now started off with lower expectations of future inflation due to economic headwinds. Bad news was good news.

That short-term bear market rally is over, in my opinion.

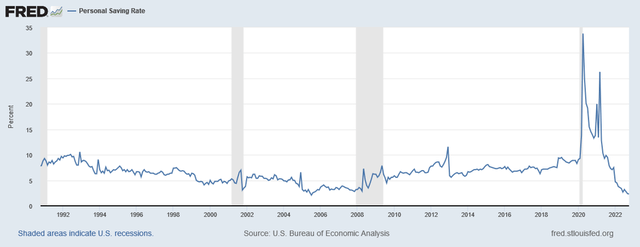

I believe the bear market will likely enter its last phase, the point at which corporate profits decline. Because of all the excess liquidity in the system, companies still earned record profits, even during times of monetary tightness and high inflation, because consumer demand was unaffected by the tightening. Margins rose and helped to offset the monetary tightening. That’s until now. The Personal Savings Rate just reached the previous lows of 2005 because of elevated average costs of living:

Personal Savings Rate (fred.stlouisfed.org)

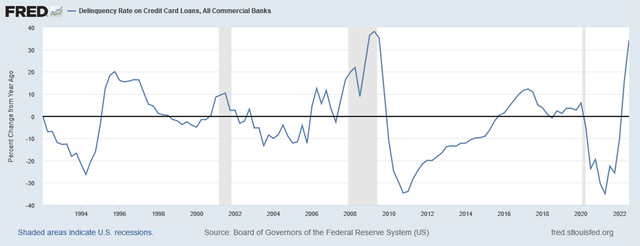

The Many are pushed into credit card debt, with elevated lending costs:

Delinquency Rate on Credit Card Loans (fred.stlouisfed.org)

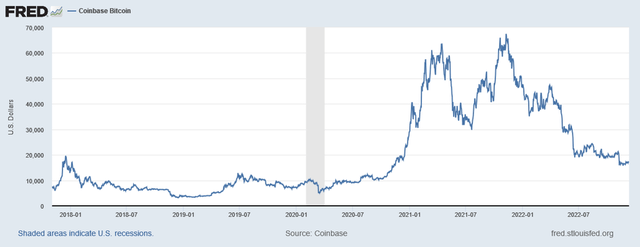

A good proxy for analyzing global liquidity conditions are Cryptocurrencies (BTC-USD, ETH-USD), as they represent assets that appreciate if money devalues (quite the opposite of an inflation hedge, contrary to popular belief). Bitcoin is down ~75% of its peak in late 2021. The peak corresponded perfectly with the change in Federal Reserve monetary policy:

Coinbase Bitcoin (fred.stlouisfed.org)

I expect profit margins to decline materially in the first half of 2023 because I think consumer demand won’t hold up as it did before. As bad news hits the market, I believe it’s highly probable that the market of the future also discounts it negatively. That’s because the Federal Reserve is unlikely to change its restrictive monetary policy throughout the first half of 2023 unless something material breaks the markets. Examples of breaking markets would be a sudden surge of unemployment or a credit event of a larger scale (doesn’t include bankrupt Crypto Exchanges and/or Lenders). I don’t believe the market will focus solely on the Federal Reserve’s reaction function but rather on the economic data.

The firefighters of the Federal Reserve won’t extinguish the fire before the markets sound the alarm in my view. In my opinion, it’s best to stay out of the way until then. I believe front-running a pivot is not possible, as the decision of the Federal Reserve depends on ex-post data.

A rise in Unemployment could shock the (housing) market

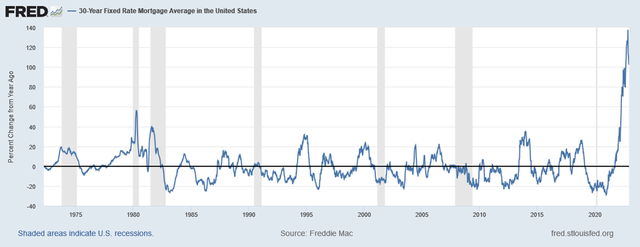

Everyone and their mother expects the housing market to come under pressure. It’s no secret that the sector is severely exposed to changes in the risk-free rate:

30Y Fixed Rate Mortgage Average in the US (fred.stlouisfed.org)

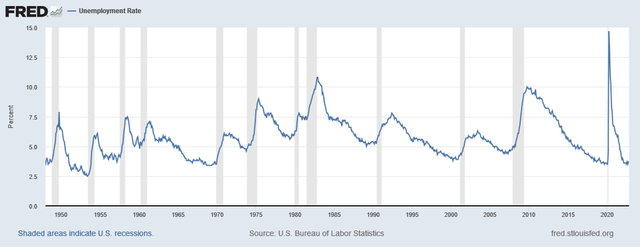

Currently, however, the majority of owners locked in fixed mortgage rates before the risk-free rates started to increase materially. In reality, the bulk of all lending costs will not increase as long as nobody sells their home. The incentives to start selling at lower prices are not there yet, as unemployment is still at a multi-decade low:

Unemployment Rate (fred.stlouisfed.org)

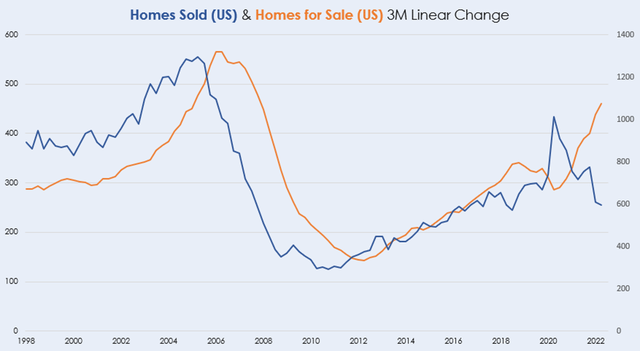

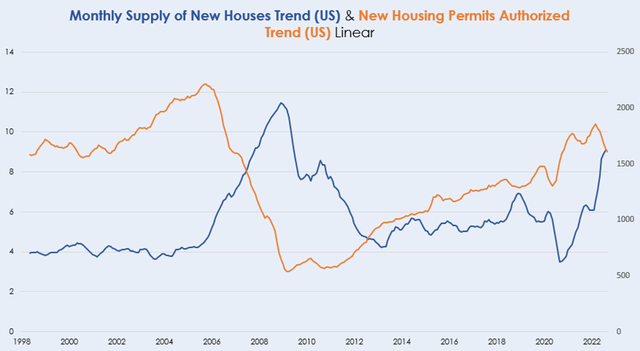

Just because most market participants expect housing to continue to deteriorate, that doesn’t mean it’s not happening. It’s a similar ex-post situation, as it is with the Federal Reserve reaction function: First, unemployment has to rise significantly for house owners to feel the heat. If owners are pressured to sell their homes, the housing market won’t stay illiquid, and prices eventually have to decline. Although I don’t want to make direct comparisons because I believe the underlying circumstances are materially different now, similarities to the 2008 financial crisis start to appear because of financial stress:

Homes Sold vs. Homes for Sale (Author – data from FRED) Supply of New Houses vs. New Housing Permits (Author – data from FRED)

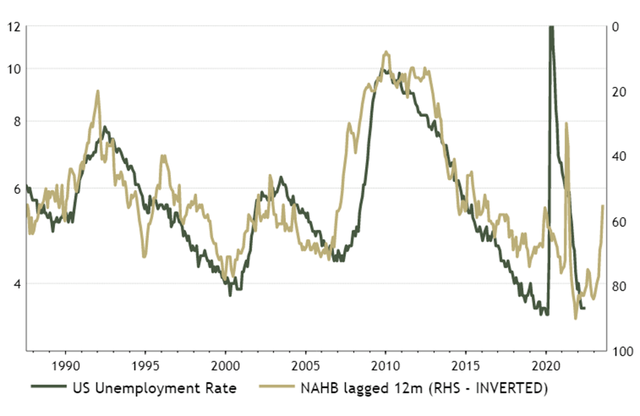

The housing sector dictates the US economy, as many jobs are on the line. In the end, no matter which way around it, unemployment numbers and the housing sector go hand in hand:

Unemployment & Inverted NAHB lagged 12M (twitter.com/IanRHarnett)

Retail still hasn’t capitulated

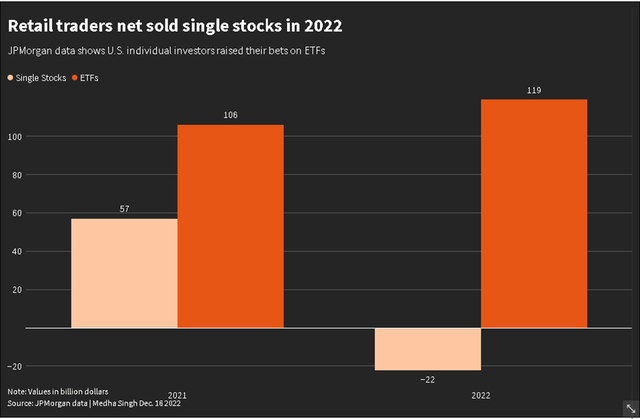

The rise of risk-free rates already destabilized some of the more speculative retail buying power. Retail traders net sold individual stocks in 2022, but they bought even more ETFs than in 2021 (!), betting on the long-term returns of the past 20 years.

Retail Trader Flows in 2021 & 2022 (reuters.com/markets/retail-investors-turn-etfs-recession-fears-knock-down-meme-stocks-2022-12-16/)

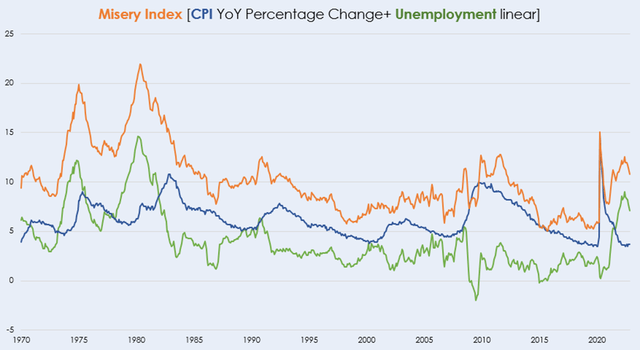

Generally, ETF buyers have a more passive approach to investing and only liquidate their investment if they have to. The misery index is a good estimate of pain for the average household. It combines CPI and unemployment numbers:

Misery Index (Author – data from FRED)

As of now, the misery index is quite elevated because of inflation. ETF inflows are likely to come under pressure if the (already stressed) financial conditions of the average household worsen because of rising unemployment. The savings rate has already come down significantly. I don’t believe much retail ETF buying power will be left if stocks continue to slide and unemployment rises.

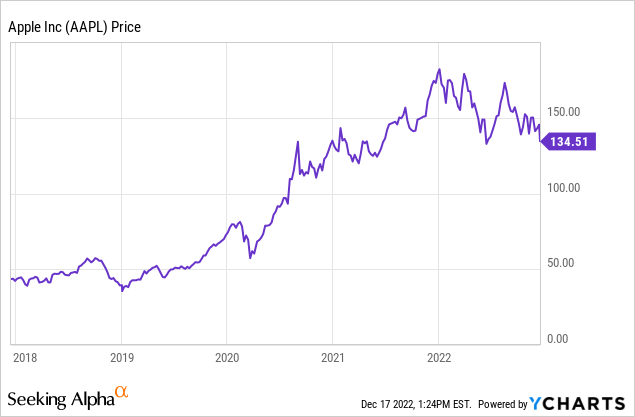

Apple (AAPL) seems very vulnerable in this kind of environment. The company sells luxury products with little innovation, for middle-class retail consumers that don’t have money to spend and for corporations that are likely to experience an earnings recession and a decline in margins. The company produces mainly in China, where political issues could pressure the supply chain. If they decide to produce domestically, margins will deteriorate further. However, the stock is still trading at $134, while the pre-covid high in 2020 was at $80.

I believe much of the resilience of these ‘pristine’ tech names has been due to the resilient ETF inflows and the switch by retail from tech names with low profitability to tech names with high profitability. Watch out for what happens when the margins of crowded ‘tech safe havens’ like Apple start to roll over, though.

Bonds as a potential ‘safe haven’ for 2023

The 2022 bear market was profoundly different from other bear markets in the last 40 years because the negative correlation between stocks and bonds broke down. Usually, when stocks sell off, the market expects the Federal Reserve to ease monetary policy and therefore, bonds rise. In 2022, stocks and bonds sold off simultaneously because inflation changed the Federal Reserve reaction function. Now, there wouldn’t be a pivot because of worsening financial conditions. On the contrary, worse financial conditions were the target of the Federal Reserve. During 2022, the long end of the curve (TLT) sold off by ~ 25%, while the S&P500 (SPX) only depreciated 20%.

My base case for 2023 is rapid disinflation or even deflation in the second half. If that happens, the negative correlation between stocks and bonds should reemerge – at least for the next year. Especially in times of spiking equity volatility, bonds should be a decent hedge if the current disinflationary trend continues. I don’t view a non-orderly decline of the market as my base case, but the possibility of a left tail risk event is still there if retail comes under pressure because of the above-listed reasons. Even in the case of a melt-up (left tail risk), bonds should outperform because that event would likely originate from a preemptive Federal Reserve pivot, which I view as unlikely as a market crash.

Nonetheless, the valuation of bonds vs. stocks seems favorable now. The forward earnings yield for the S&P 500 stands at ~ 5.8%, as analyst consensus for 2023 earnings remains fairly high at ~ $225. If earnings come down to ~ $200 in 2023, that’s an earnings yield of ~ 5.1%. Meanwhile, 10Y US Treasuries yield 3.5%, and the front-end of the curve remains above 4%. Comparing the relative risks of these investment options makes bonds seem like the superior choice, especially during times of great uncertainty and deflation.

The bigger picture

While I am bullish on bonds for 2023, my big-picture view remains bearish. I believe the long-term bull market in bonds found its peak in late 2021. But obviously, the market is probably not going to crash down to a 10% yield. A transition phase of relatively low-interest rates seems likely until the debt-to-GDP issue is resolved. I believe austerity would be a non-sustainable choice.

The easiest solution to the current macroeconomic environment is probably several years of financial repression, with average interest rates low enough (not zero!) to ensure that the average creditor receives a negative real return due to monetary devaluation, which at best doesn’t show up in traditional inflation data. This way, debt-to-GDP can decline over several years without the extreme pain which would be caused by austerity.

But you want to do that in a subtle and not in a kind of money-bazooka-shooting kind of way. I believe that was the mistake of the Federal Reserve during 2020/2021. However, inflation is likely to consolidate at a higher-trending baseline due to underlying and fundamental inflationary pressures because of destabilization.

Additionally, markets now face 5 long-lasting and important negative-turning macroeconomic factors, which I’ve discussed in a previous article:

| 1982-2021: | Going Forward: | |

| Average Inflation Rates | Falling |

Rising |

| Globalization | Spreading | Stagnating |

| Demographics | Young | Old |

| Relative Energy Costs | Low | High |

| Debt Levels | Low |

High |

Key Takeaways

I believe that the market will focus on the (presumably bad) economic data in 2023 instead of focusing on the Federal Reserve monetary policy. The Central Banks are probably going to hold their tight monetary policy stance for a while until something breaks. ‘Something breaking’ will likely be bearish for equities but not for bonds because of the disinflationary/deflationary force the economic downturn provides. In the very long term, bonds are still not a good place to be, however.

After the price shock of 2022, there is likely to be an earnings shock in 2023. The average consumer already got squeezed in 2022 by high transitory inflation, and he might get squeezed again in 2023 by rising unemployment. In 2022, the speculative tech assets got hit hard by interest rate hikes, but in 2023 the profitable tech names are likely to get hit by ETF outflows and broad-based margin compression.

Be the first to comment