Fertnig/iStock Unreleased via Getty Images

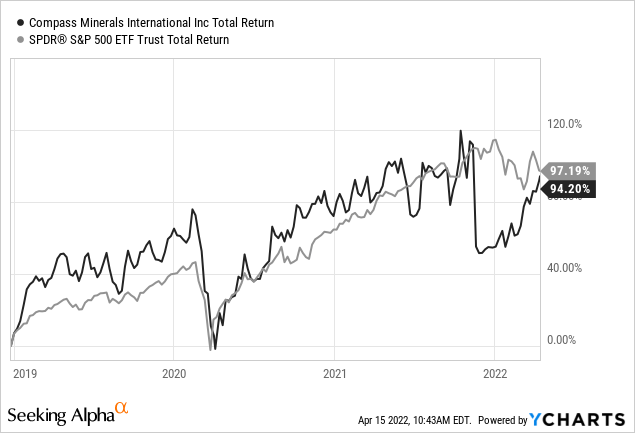

After being a shareholder in Compass Minerals International (NYSE:CMP) for about 3.5 years I actually sold my position recently. I am satisfied with my investment and although Compass Minerals slightly underperformed the S&P 500 (SPY) during that time, CMP still generated a CAGR of 22% (including dividends), which is not only a great return in my opinion but also above my targeted 10% yield on investment.

I am not really bearish about Compass Minerals right now and I am still convinced the company has a wide economic moat. But I am a bit annoyed by the mediocre performance, the still high debt levels and management not really taking the right steps. Over the long run, Compass Minerals will probably do fine, but I am convinced that I can invest my money better at this point. In the following article, I will explain my reasoning for selling the stock. Additionally, I will also explain why I still think Compass Minerals has a wide economic moat.

Struggling Business

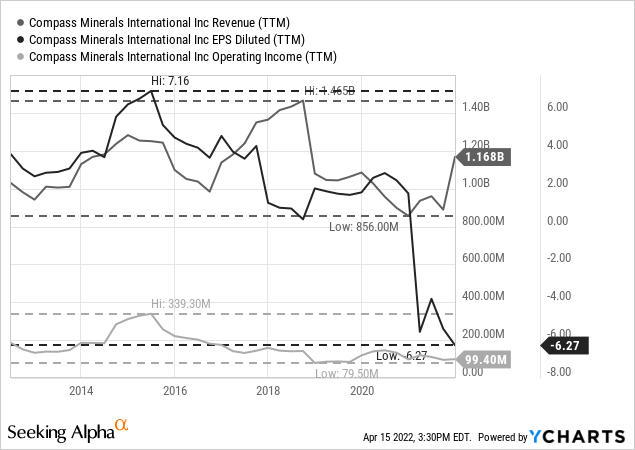

In my last article, I saw an improved picture due to the restructuring and the lithium resources. But I am actually not so optimistic anymore. And when looking at Compass Minerals in the last few years – and ignoring for a moment that we are dealing with a wide moat company – we rather see a struggling business. When looking at the income statement – revenue, operating income, or earnings per share – we see stagnating or declining numbers. Compass Minerals still has extremely high debt levels, and I am not really confident in the current management to take the right steps, but let’s look at the aspects in detail.

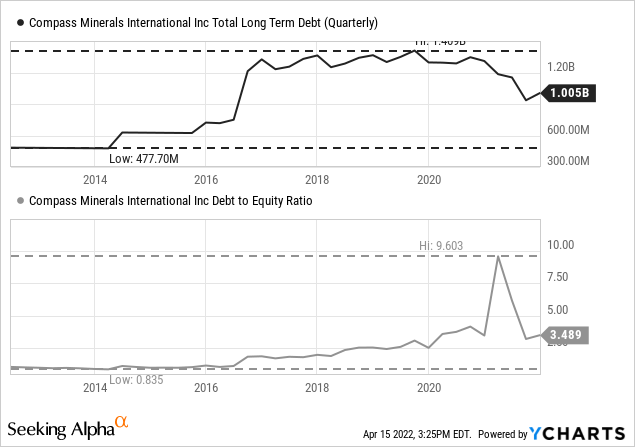

Debt

A problem that remains is the extremely high debt levels of Compass Minerals International. On December 31, 2021, Compass Minerals still had $1,004.9 million in long-term debt on its balance sheet and compared to a stockholder’s equity of $288 million this is resulting in a debt-equity ratio of 3.49. We can also compare the total debt to the operating income of the last four quarters, which was $153 million, and it would take about 6.5 years to repay the outstanding debt. And Compass Minerals has only $20.3 million in cash and cash equivalents on its balance sheet. We should not worry about CMP going bankrupt, but solvency as well as liquidity are both an issue for Compass Minerals (as they have been in the last few years).

We should also not ignore that the balance sheet improved. In July 2021, Compass Minerals has completed the sale of the company’s South America specialty plant nutrition business and received $325 million in cash and $107 million in debt was assumed by ICL (the acquirer of the business).

In the following quarter, CMP reduced the long-term about $220 million but in the last quarter, debt levels increased again. And recently, Compass Minerals International reported again, that it will receive about $18.5 million an earnout payment associated with the sale of the company’s South America specialty plant nutrition business. All in all, I hoped that Compass Minerals would be able to reduce the debt levels further: When comparing net debt before the sale was completed (June 2021) to right now, it was only reduced about $140 million although net debt could have been reduced (in theory) by more than $400 million.

Business Not Really Improving

Aside from the high debt levels, it is still problematic that the business does not really improve. And with the high debt levels it is also difficult for Compass Minerals to make huge investments for the future.

When looking at the last ten years, we see revenue fluctuating in a range between $850 million on the lower end and about $1.5 billion on the upper end. However, I see no clear path for improvement. And when looking at operating income as well as earnings per share since 2015 we can see a clear trend – and that trend is negative. Trailing twelve months earnings per share peaked at $7.16 in 2015 and has since then declined and in the last few quarters, earnings per share were even negative. In the last twelve months, the company reported a loss per share of $6.27. And operating income also peaked at $340 million in 2015 and the trailing twelve month amount is only $99 million and close to the lows of the last ten years.

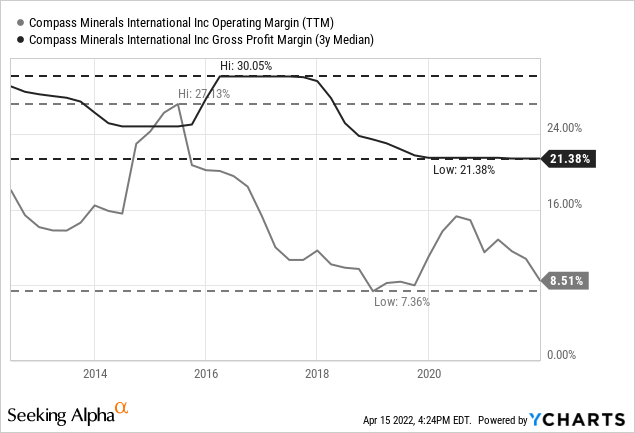

The business has the potential to improve again, but right now, I am lacking the imagination as to how CMP should really improve. We could be at a cyclical low right now as Compass Minerals clearly is a cyclical business, but the gross margin and operating margin are not affirming a bullish thesis.

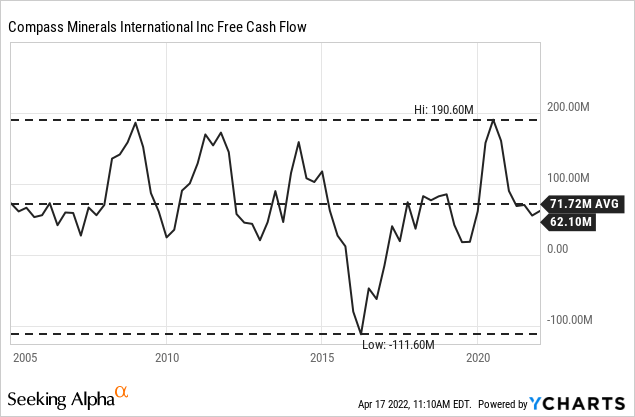

And when looking at the free cash flow since the IPO 18 years ago, I also see a cyclical business with fluctuations, but I don’t see many signs for a constantly higher free cash flow. It might actually seem like the current free cash flow is also in line with the long-term average and assuming extremely high growth rates might just be too optimistic.

Management And The Moat

Without any doubt, Compass Minerals has a wide economic moat, and that economic moat is difficult to destroy. The wide economic moat of Compass Minerals is based on cost advantages, that are difficult to match by other companies. In a past article, I described the economic moat in more detail:

The wide economic moat of Compass Minerals is mostly stemming from cost advantages and we can mention two different aspects. First, Compass Minerals is owning several precious mines with three mines standing out. These three mines will last at least 30 years and especially Goderich mine, which will probably last for another 85 years and Cote Blanche, which will last for even 100 years are worth mentioning. Those mines lasting for decades will be a source of revenue for a very long time. And it is not only cheaper to operate a mine, which is already up and running, but also Goderich’s unique geology features 100-foot-thick salt seams (being two to four times the size of other comparable mines), which leads to lower costs for Compass Minerals, and this is an advantage that will persist decades into the future as competitors simply can’t match or copy this advantage. And while management can lessen this advantage by bad decisions for some time, it certainly won’t destroy it.

And while management won’t be able to destroy the economic moat Compass Minerals has, it can still make the wrong decisions and a company might underperform due to mediocre management. The CEO Kevin S. Crutchfield is criticized quite often for not being shareholder friendly and not making the best decisions. Also the fact that he was chairman and CEO in 2015 when Alpha Natural Resources filed for chapter 11 bankruptcy is supporting that bad feeling. The last three years are also not making me confident about the current management.

Intrinsic Value Calculation

A final reason that is making me rather cautious about Compass Minerals is the valuation. While I remain optimistic that Compass Minerals could generate a higher free cash flow in the years to come (in theory), we also must acknowledge that the company is now struggling for several years and only generating mediocre results.

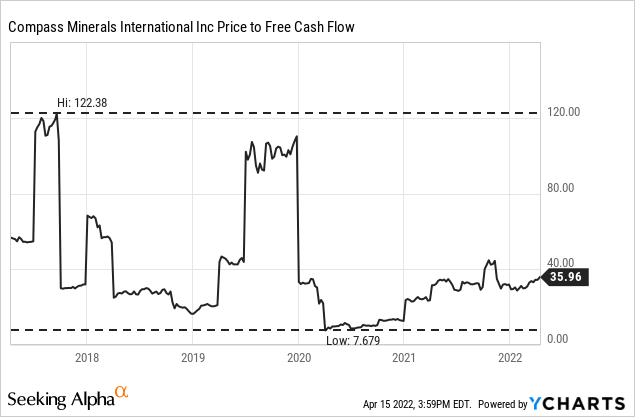

And when looking at the price-free-cash-flow ratio, Compass Minerals does not appear to be cheap. Right now, the stock is trading for 36 times free cash flow and although CMP was trading for a much higher ratio in the last few years, such a valuation multiple is not cheap, and CMP does not appear to be a bargain.

In my last article, I calculated an intrinsic value of $66 and the stock would be fairly valued right now. But in this calculation, I used a free cash flow of $90 million and the free cash flow in the last four quarters was only $71 million and the average free cash flow in the last five years was $52.6 million. When taking the free cash flow of the last four quarters, Compass Minerals must grow its free cash flow almost 10% for the next decade followed by 6% growth till perpetuity to be fairly valued right now (assuming 10% discount rate).

And as mentioned above, the average free cash flow since the IPO was also about $70 million without a clear growth path. Maybe $70 million in free cash flow is a realistic assumption and high growth rates for the years to come are just unrealistic. The wide economic moat is protecting the free cash flow CMP already has but does not necessarily generate high growth.

Dividend

And of course, management did not just make mistakes. Last year, management announced it will cut the dividend from $0.72 to only $0.15 per quarter. I actually feared a dividend cut for a long time – only in my last article I was quite optimistic that a dividend cut could be avoided as Compass Minerals might gain more financial flexibility due to the sale of the South America business. And I was proven wrong a few months later. During the November earnings call, management made the following statement:

As also announced yesterday, our board of directors has approved a reduction in the dividend for the third quarter, enabling us to leverage our operating cash flow for what we believe is a higher and better use of capital supporting strategic growth and ultimately creating long term and lasting shareholder value. Importantly, yesterday’s announced dividend level is also better aligned with the dividend yields of peers and the general market. Going forward, our board will continue to evaluate the company’s capital allocation needs on an ongoing basis in an attempt to strike a balance between supporting the investment needs of the business with returning cash to shareholders.

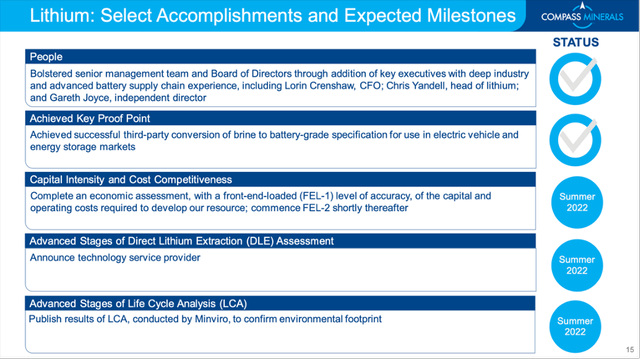

Right now, Compass Minerals has a dividend yield of 0.92% and it’s not really interesting for its dividend anymore. Considering the extremely high debt levels and mediocre results, a dividend cut was the right decision and management will use the $80 million it is saving annually to invest for a potential monetarization of the 2.4 million metric tons of lithium resources, which sound like a reasonable plan. The company also seems to have a clear lithium vision, which was presented during the Cowen Mobility Disruption Conference: To support the North America battery market by accelerating the development of sustainable, secure domestic lithium supply chain.

Compass Minerals International Cowen Mobility Disruption Conference

But it remains to be seen if the dividend cut will improve the balance sheet and the financial situation of Compass Minerals, and we also should not be too optimistic about the lithium resources as it could take years before this will add to EPS or free cash flow.

High Growth Expectations

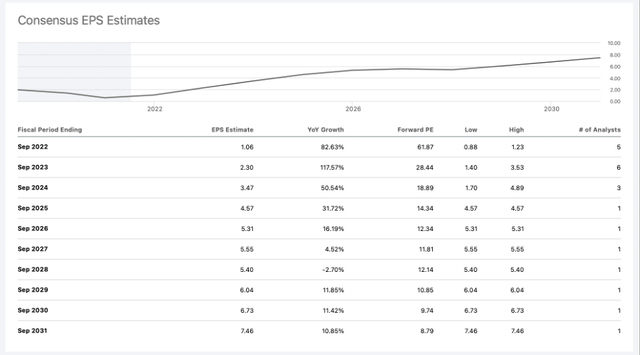

And maybe the lithium vision is also driving the high growth expectations that analysts have for the years to come. When looking at earnings per share estimates, analysts are expecting a rapid improvement and in fiscal 2031, analysts are expecting earnings per share of $7.46, which seems extremely optimistic when looking at past results. When considering the cyclical nature of CMP’s business, a constantly growing EPS also seems unlikely.

And when looking at the revenue surprise in the last few years, analysts might probably be too optimistic. In the last few quarters, revenue estimates were often too high, and CMP underperformed in the last few quarters and missed revenue expectations in 11 out of 16 quarters.

Compass Minerals certainly has the potential to report higher earnings per share again (it did already in the last decade), but after several years of mediocre results, I remain a skeptic and might need some hints (or proof), that Compass Minerals will actually improve again.

Conclusion

I am not saying that you should sell Compass Minerals International at this point. The company still has a wide economic moat around its business, which will ensure solid free cash flows in the years to come. But I don’t see a clear path for the stock to move much higher than it is trading now, and I don’t know if the stock will move higher than $75 right now (highs of the last few years). Before, the 7% dividend yield was actually a reason to hold the stock as the performance of the stock itself was not so great. But without the dividend and me not seeing a clear path for the stock moving higher, I made the decision to sell my position and use the cash otherwise.

And in case you are interested: I used the cash I gained from selling my CMP position to purchase shares of Starbucks (SBUX), as well as increasing my Walgreens Boots Alliance (WBA) position.

Be the first to comment