ipopba/iStock via Getty Images

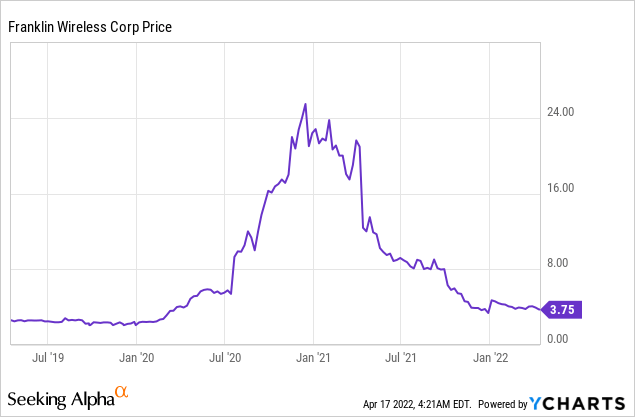

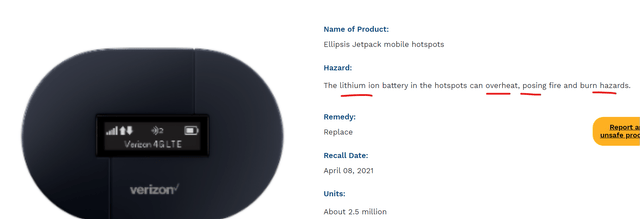

Franklin Wireless (NASDAQ:FKWL) had everything going for it, a small cap company founded in 1981 which finally got its big break with a major customer, Verizon (VZ). Franklin supplied Verizon with the popular 5G wireless hotspot, which was sold under the Verizon name as the (Ellipsis Jetpack). The stock price skyrocketed by over 810% in 2020 and reached highs of $21 per share. However, then there were allegations that 15 of the devices had “overheated” and had a “fire risk” in April 2021. This prompted Verizon to recall an eye watering 2.5 million units! This was an extreme move by Verizon, but was to save any further potential reputational damage. The share price has fallen off a cliff as a result, down by 81% since April 2021. However, it should be noted that Franklin was “unable to recreate any device failures of the type identified by Verizon”. Thus, this seems like an overreaction by Verizon and the stock market. Can the stock bounce back?

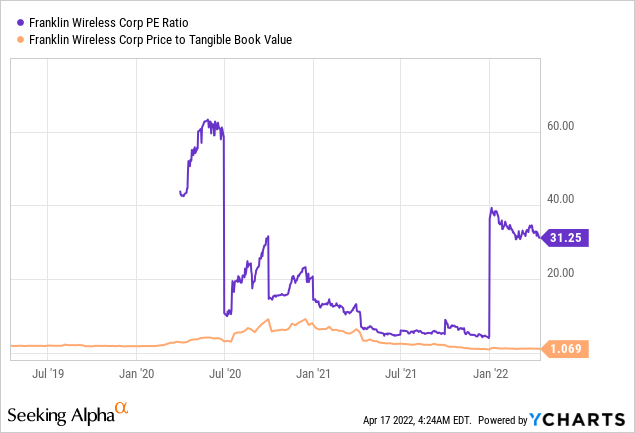

Franklin Wireless (ycharts)

Business Model

Franklin Wireless is a supplier of wireless products such as mobile hotspots and routers which support 5G technology. The company has the majority ownership position in Franklin Technology Inc. (“FTI”), a research and development company located in Seoul, South Korea. Franklin Wireless then gets devices manufactured by two independent factories in Asia (most likely in China). These are then sold to wireless operators, distributors and partners, such as Verizon and T-Mobile (Sprint). In the past Franklin Wireless had partnerships with other major players such as Qualcomm for a smart tracking solution. In addition, the company recently scored a partnership with C Spire to sell the “Jextream” 5G wireless hotspot, which in my opinion looks pretty cool.

Jexstream 5g Wireless Hotspot (Franklin Wireless)

According to one research study, The global Wi-Fi hotspot market is expected to be worth over $3 billion in 2022 and grow at a meteoric CAGR of 19.7% reaching $11 billion by 2027. This is a massive market opportunity for such a small company like Franklin Wireless ($45 million market cap) and partnerships with the major network players.

Franklin also recently announced they had surpassed 50,000 subscribers for its Mobile Device Management Service (MDM), a remote access service for schools and businesses.

This is all great news for Franklin Wireless, given the dark thunder cloud that is the “Verizon Recall”, which I will dive into in the next section.

Verizon Recall

Franklin supplied Verizon with the popular 5G wireless hotspot, which was sold under the Verizon name as the (Ellipsis Jetpack). Then on April 8, 2021 Verizon recalled a staggering 2.5 million units, due to alleged “Overheating and Fire” hazards . This was an extreme move by Verizon given only 15 devices were alleged to have overheated, just 0.0006% of 2.5 million devices. Ironically only two of the devices involved in the 15 incidents had been inspected by Verizon and Franklin was “unable to recreate any device failures of the type identified by Verizon”. However, this didn’t stop the stock market from selling the stock intensely and as the stock is a small cap, which trades at a $43 million market cap, sharp price moves are expected.

Franklin Wireless recall (Consumer Product Safety )

What will be the cost of the recall?

The key question on investors’ minds and the only truly rational way of valuing the company today is by estimating “What will be the cost of the recall?”. According to Franklin Wireless as per their latest earnings report one year later

“We are not currently able to estimate the financial impact of the recall on our future operations.”

The good news is the company has a strong balance sheet with $36 million in cash & cash equivalents and virtually no interest bearing debt with just $5 million in accounts payable and lease liabilities.

As an approximate estimate the Franklin Wireless T10 Hotspot 4G costs $90 and the Ellipsis Jetpack which was recalled costs similar, I believe. Just as a very rough estimate if Verizon paid $50/unit from Franklin, then a 2.5 million unit recall could be worth a whopping $125 million. However, Franklin doesn’t manufacture these devices but outsources the manufacturing thus they may be able to pass any recall costs on. In addition, this was a “Voluntary recall” by Verizon and Franklin “hasn’t been able to recreate the issue”, thus there may be litigation. In the best case scenario Verizon has a market capitalization of $226 billion and thus they may just write off this cost rather than battle in court with a supplier and lack of true evidence. For Verizon the cost of the recall is truly a drop in the ocean for them, they care more about reputation.

Fire Hazard

As a former electronic engineer I thought it would be a good idea to dive a little deeper into the “Fire Hazard” issue. In this case “overheating” in the 15 units was caused by the lithium ion battery but it doesn’t state how the product was being used at the time, it could have been in sunlight, under a bedsheet etc. With 2.5 million units odd’s are a couple of units will have issues, which is normal with most devices. Samsung had a much worse “fire/overheating” issue with their lithium-ion batteries for the Galaxy Note 7, this led to the global recall of millions of devices. A review of the Samsung share price in 2017, when this issue occurred show it actually went up! Even the golden company Apple had to recall their MacBook pro 15 in 2019, due to similar issues. This makes me believe that Franklin Wireless most likely doesn’t have any real issues with their devices, which confirms the company’s own statement that they “couldn’t recreate the fire issue”. However, this won’t stop Franklin Wireless from feeling the pain as they are a small cap company, who are at the mercy of the giant Verizon.

Volatile Financials

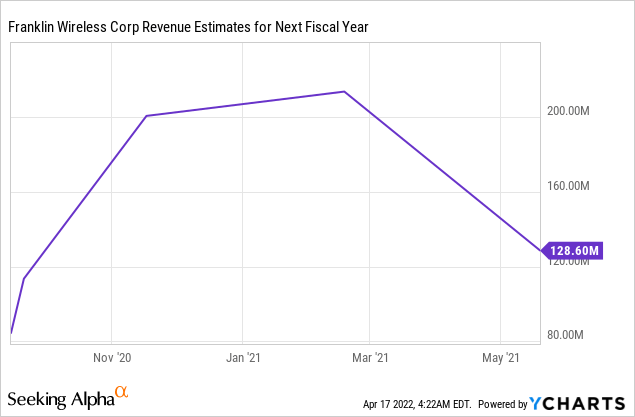

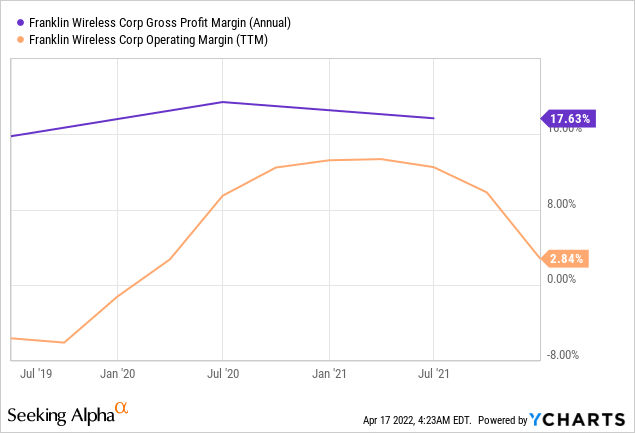

Franklin’s Q42021 financials aren’t great, Net sales decreased by an eye watering 96% or $123.6 million to just $5 million for the 6 months ended in December 2021. They stated this was driven by a “reduction in demand” from two major carrier customers. However, the company does caveat this by saying they had “unprecedented high demand in the prior period”. This is correct but doesn’t show the full story, which could be that networks such as Verizon and others don’t wish to buy any more products due to trust issues. The company seems fairly relaxed about this with minimal statements. Either they view this as part of the business cycle or are just holding their cards close to their chest.

Franklin Wireless Revenue (Y charts)

A review of the company’s online presence reveals they have revamped their website, released new products, scored new partnerships and are even hiring people, so I suspect things may be as bad as they seem.

Franklin Wireless Margin (created by author y charts)

The company’s net income has decline from $8.7 million in Q42020 to negative $1.7 million in Q42021. This is not a good sign as even if we minus the $1.1 million in R&D costs, the company is still operating at a loss.

In terms of valuation, the company is trading at a $45 million market cap, which is just 1.2 times their $36 million cash on the balance sheet. However, as the earnings have declined this quarter the P/E ratio has skyrocketed from ~3x to 31x.

Franklin Wireless Valuation (Created by author)

Insider Selling

When a small cap stock falls, ideally you want to see insiders swooping in to save the day, in this case the opposite occurred. The President (Kim OC) sold 50% of his shares prior to the large decline. This has led to many lawsuits which claim “insider trading occurred” it’s alleged that insiders were aware of the recall before this was reported publicly. Franklin denied these claims and stated “We believe these allegations are not supported by the facts and we will vigorously defend against such claims.” However, the director and 10% owner (Jyoung Joon Won) also sold ⅓ of his position, as did the COO which is not great to see.

Final Thoughts

On paper, Franklin Wireless has a lot going for them, they are an established player in the high growth wireless internet market, they have partners with major carriers (not just Verizon) and great technology which includes patents. However, the Verizon recall has caused a thunder cloud of uncertainty to hang over the company, as no estimates of the costs have been released. In addition, the insider selling is a red flag whether they were aware of the recall or not. Thus as I stated in the headline a speculative turnaround is possible, but still much uncertainty looms.

Be the first to comment