Mohammed Haneefa Nizamudeen/iStock via Getty Images

Technical Analysis

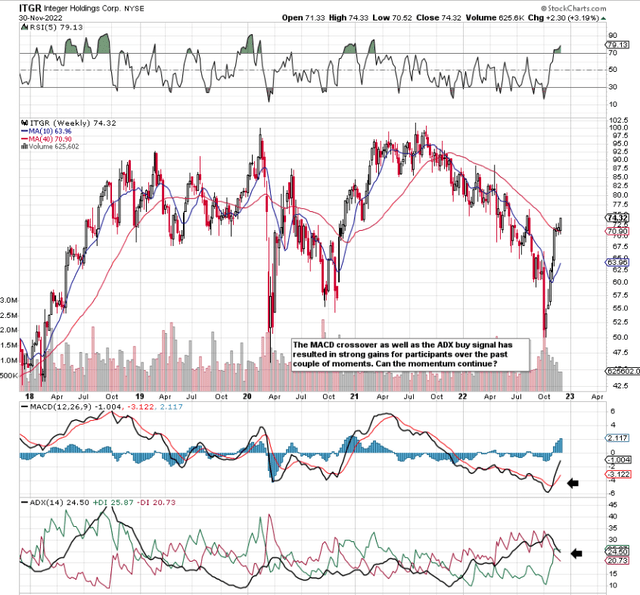

If we pull up a 5-year chart of Integer Holdings Corporation (NYSE:ITGR) (Medical Device Operator), we see that shares have had a very strong 7 weeks or so with shares gaining well over 40% in this time period. The spike in the share price has led to a crossing over of the popular MACD indicator which in turn has led to a subsequent buy signal by means of the ADX trend indicator. Whereas the MACD indicator is a solid read on when an underlying trend changes, the ADX weekly indicator is a lagging indicator in that it only gives signals when indeed a trend has been in motion for quite some time (Past 7 weeks).

Both of these buy technical buy signals (Especially the ADX crossover) should not be underestimated. We state this because the most robust moves actually take place from market highs (What we have at present) and not market lows which we had at the beginning of October. Suffice it to say, Integer’s present momentum and the fact that shares are now trading well above their respective 50-week moving average (Which corresponds to the pivotal 200-day moving average – of $71.43) should continue to bring trend-followers into the picture here. In fact, Integer’s rally is further evidence of the success of the “4-week rule” investment strategy where shares are bought if they make new highs for four weeks straight (More or less coincides with the ADX intermediate buy signal we see below)

Integer Technical Chart (Stockcharts.com)

Growth Worries

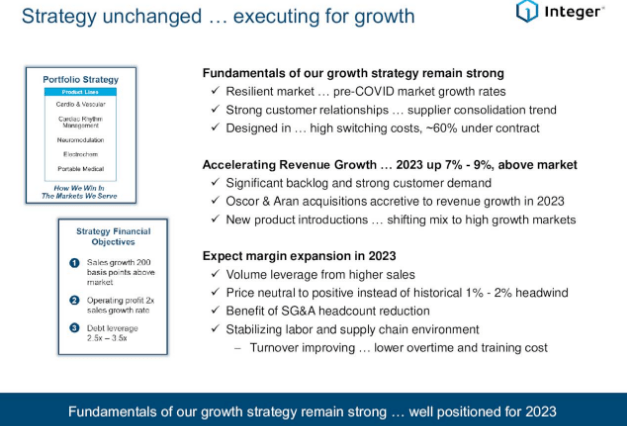

How long this present rally lasts is however another question entirely. Integer Holdings is just off the back of its third-quarter earnings report where management remained upbeat on the company’s growth strategy as we see below. Management announced an EPS beat of $0.95 on sales of $342.68 million (Missed the top-line estimate slightly despite growing by 12% compared to Q3 last year). Management was quick to point out how sales in the quarter were adversely affected by ongoing supply chain headwinds. In saying this, over 7% top-line growth is expected next year due to expected strong demand, new products, and improving performances from recent acquisitions. Management believes robust top-line growth along with lower SG&A costs will drive margins and earnings higher. 13% bottom-line growth is expected at this stage for fiscal 2023.

Integer Forward-Looking Strategy (Seeking Alpha)

In order for shares to keep rallying aggressively, this growth rate will be needed if not more. We state this because of the gross margin base Integer is currently working off. In the latest third quarter, the gross margin came in at 25.45% which is lower than the trailing 12-month average of 26.1%. No matter how much management can raise prices or how many costs can be eked out of the system, gross margin needs to increase meaningfully going forward and not go in the opposite direction like it did in Q3.

Balance Sheet

This needs to happen in order to protect the balance sheet which is key. Apart from the rising inventory which is par for the course in recent times across many industries, Integer reported $1.78 billion of combined goodwill and intangibles on its balance sheet at the end of Q3. Furthermore, long-term debt came in at $928 million for the quarter. The company’s reported equity of $1.35 billion means shares currently trade with a book multiple of 1.82.

A few things to take into account here. For one, since a large portion of the company’s debt is not fixed, interest payments in a rising interest-rate environment will increase especially if cash flow does not bring down the load fast enough. Secondly, if acquisitions do not live up to expectations, then this asset line item will ultimately be whittled down in due time. Furthermore, the intangible assets subtotal of $816 million seems very high for a company only realizing 26% gross margins. As mentioned, earnings growth (And also synergies that make up the various parts of this company) needs to come to essentially protect the balance sheet.

Declining Earnings Expectations

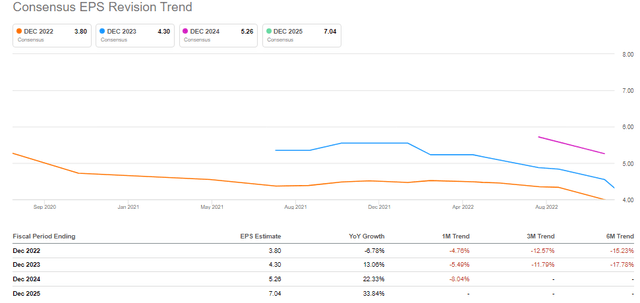

When pushed on giving some type of 2023 guidance for fiscal 2023, management refrained from doing so. Margin expansion seems to be a given but as already mentioned, Integer was already behind the eight ball in this area. Analysts though who cover this company have earmarked 13% growth (EPS of 4.30) for fiscal 2023. The worrying trend however here is how this estimate has declined in recent months; losing over 5% over the past 30 days alone. We need to see stability here if Integer’s present rally will have any longevity over time.

Integer EPS Revisions (Seeking Alpha)

Conclusion

Although shares of Integer Holdings Corporation have been in a bullish mode of late, the lack of forward-looking guidance for next year casts a cloud over how much upside is currently in this stock. Furthermore, the company’s debt load looks sizable, to say the least, compared to its net earnings. There is no doubt that Integer operates in a growth industry but margins and earnings trends need to improve for more gains to ensue. Let’s see what Q4 brings. We look forward to continued coverage.

Be the first to comment