Sundry Photography

Thesis

We highlighted in our pre-earnings update on leading endpoint cybersecurity company CrowdStrike Holdings, Inc. (NASDAQ:CRWD) that it could disappoint on guidance, leading to value compression, given its growth premium.

So, management did itself no favors by repeating macro risks several times. Wall Street analysts also did themselves no favor by being seemingly stunned by management’s mention of macro risks.

We had postulated in our previous article that weak guidance could have been anticipated in CrowdStrike’s previous estimates. However, management’s commentary suggests that CrowdStrike could face a more significant impact than anticipated, leading to a marked deceleration in annualized recurring revenue (ARR) growth for FY24 (year ending January 2024).

As such, the market de-risked CRWD further with a post-earnings selloff that took out the lows last seen in November 2020. However, we believe the selloff could also potentially set up an astute bear trap (not validated yet) over the next few weeks.

With CRWD already down markedly from its August highs heading into its Q3 earnings release, we believe a substantial level of pessimism has been priced in. Hence, investors are urged not to panic at the current levels, with CRWD’s price action already well oversold and re-testing a critical support level.

We maintain a Buy rating with a reduced price target (PT) of $170 (implying a potential upside of 44%).

CRWD: Macro Risks Not Surprising

With CRWD reporting its earnings after many of its SaaS peers, we believe the market has already gotten a first-hand insight into the state of the economy. Recent enterprise SaaS earnings highlighted elongated sales cycles with more scrutiny by senior management.

As such, CrowdStrike’s commentary in its Q3 release shouldn’t have surprised investors. But, the market was likely not satisfied with management attempting to de-risk its guidance, given CRWD’s embedded valuation premium against its SaaS peers.

Hence, we believe the de-rating is justified, as management’s guidance suggests that CrowdStrike could report markedly weaker ARR growth next FY.

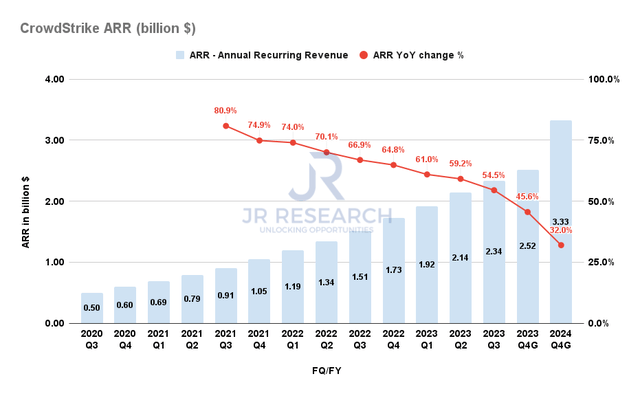

CrowdStrike ARR (Company filings)

CrowdStrike reported a 54.4% increase in ARR in FQ3, down from FQ2’s 59.2%. We highlighted previously that the trend would likely continue trending down in line with management’s FY26 model of $5B in ARR.

However, management’s commentary on its Q4 outlook suggests that its ARR uptick could fall to 45.6%. As such, it also marked a significant downtick in its revenue growth estimates, as analysts marked down from its previous projection of nearly 48% growth in Q4.

Moreover, its FY24 commentary demonstrated that the consensus estimates were too optimistic. Based on our analysis, CrowdStrike could report just 32% ARR growth in FY24, below the previous consensus of a nearly 38% uptick.

Hence, the macro headwinds have likely impacted CrowdStrike’s visibility into its SMB and enterprise segment, as companies have likely turned more cautious, given a weaker environment.

So, the question is whether these represented lost or delayed deals. Management quickly addressed investors’ concerns that it saw robust traction in its pipeline expansion. And it has also kept winning deals, but its customers have decided to allocate their spending to “multiphase subscriptions,” as CEO George Kurtz accentuated:

In Q3, these [enterprise] customers continued to prioritize their CrowdStrike investments, but some also had to manage timing issues related to OpEx budgets and cash flow amidst the rapidly evolving macro. To achieve this, some customers signed contracts that have multiphase subscription start dates, which pushes their expense and CrowdStrike’s ARR recognition into future quarters. (CrowdStrike FQ3’23 earnings call)

Is CRWD Stock A Buy, Sell, Or Hold?

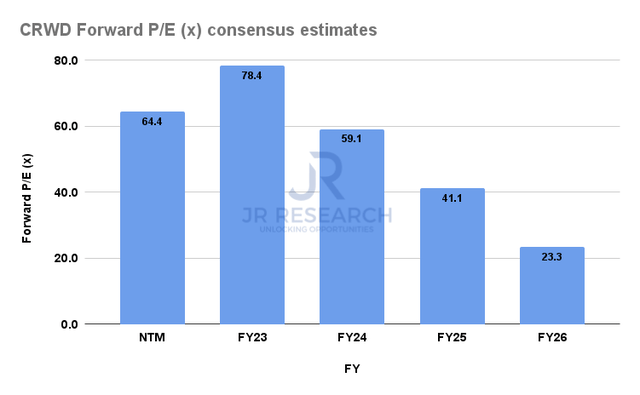

CRWD Forward normalized P/E (x) (S&P Cap IQ)

With the post-earnings selloff, CRWD’s NTM normalized P/E has been de-rated to 64.4x. Hence, it’s still well ahead of its SaaS peers’ median of 18.4x.

Hence, much depends on whether the market is confident in its execution through the cycle, as its FY25 earnings multiple of 41x suggests an embedded growth premium.

Therefore, the market will likely not welcome further guidance commentary that continues to suggest macro risks/delayed spending/more scrutiny on sales closing, etc.

CrowdStrike needs to deliver and outperform its peers because its valuation demands such. Nothing short of peers’ outperformance is justified and accepted in the current environment.

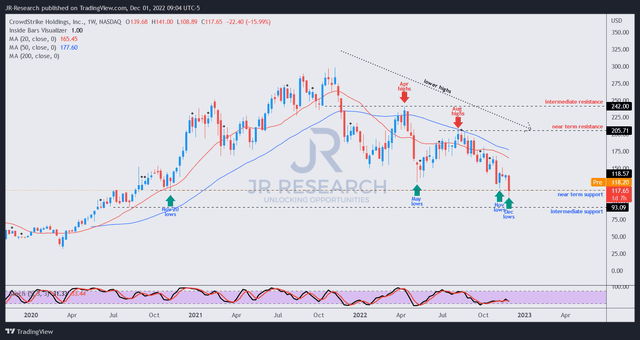

CRWD price chart (weekly) (TradingView)

CRWD re-tested its November 2020 lows with the post-earnings selloff. However, before any more bulls decide to join the holders who had decided to flee, CRWD could still potentially stage a mean-reversion rally from here.

As seen above, CRWD remains in a medium-term downtrend. Its previous bear trap in May was validated and led to a surge toward its August highs.

However, the market has astutely digested its recovery momentum, which seemed to have subsided in November (pre-earnings).

Therefore, we believe the stage is set for CRWD buyers to demonstrate conviction at the current levels. If they could hold the re-test lows and consolidate constructively, we see a positively skewed reward/risk mean reversion opportunity toward the $170 zone.

Maintain Buy.

Be the first to comment